The financial landscape this week resembled a turbulent ride, with stocks initially soaring before plummeting in a swift and unexpected selloff. The excitement was palpable, especially in the technology sector, driven by Nvidia’s stellar earnings report. However, the enthusiasm was short-lived as a sudden downturn left investors on edge.

Taking center stage was the 10-year Treasury yield, which showcased an upward trajectory. Concurrently, robust economic indicators pushed mortgage rates to their highest point in more than twenty years, igniting discussions on potential implications for borrowing costs and the housing market.

The financial world’s attention pivoted to the Federal Reserve’s prestigious Jackson Hole symposium, where anticipation swirled around Chairman Jerome Powell’s upcoming address. Analysts, traders, and investors eagerly awaited any subtle hints or explicit indications about the central bank’s potential strategies.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This latter part of the year has indeed ushered in heightened volatility, casting a spotlight on consumer staples, particularly the $XLP sector, which experienced a noticeable pullback amid the ongoing market turbulence.

The week’s highlights included the significant downgrade of regional banks, the repercussions of Nvidia’s earnings revelation, the highly anticipated Jackson Hole symposium, and the unveiling of retail data. The imminent Jackson Hole symposium is set to take the stage, spotlighting Federal Reserve Chair Jerome Powell’s address. His commitment to data-driven decisions and insights into potential interest rate trajectories and future monetary policies were highly anticipated.

Moreover, concerns about China’s economic stability, coupled with default instances by major lenders, intensified market unease. A resurgent U.S. Dollar Index (DXY) and a dramatic surge in longer-dated treasuries drew eerie parallels to the tumultuous times of the 2008 financial crisis.

The latest market sentiment was woven with declines across various sectors, spanning from the European markets and small-cap stocks to technology shares, regional banks, and cyclicals. Tech’s flag bearer, represented by $SPY, relinquished its positive trajectory, slipping below the crucial 50-day moving average. Strikingly, the yields on the 10-year and 30-year Treasuries mirrored their 2008 crisis levels, reverberating with concerns about inflation’s impact and the pace of economic recovery.

Earnings announcements stole the limelight, with the spotlight shining on Nvidia ($NVDA) and Macy’s ($M). Nvidia’s remarkable projection of a 170% sales increase highlighted its stranglehold on the AI chip market. Nevertheless, its success cast shadows over rivals AMD and Intel, both witnessing declines as Nvidia’s dominance in high-powered chips for AI applications became evident.

Nvidia’s triumph also signaled a profound shift in the data center chip landscape. Prominent tech giants, including Alphabet, Amazon, Meta, and Microsoft, embraced Nvidia’s cutting-edge processors, resulting in a noteworthy surge in the company’s adjusted gross margin.

The economic front also offered insights, with U.S. economic growth gaining momentum in July, as indicated by the Chicago Fed National Activity Index. Initial positivity faded, culminating in the Dow Jones Industrial Average tumbling 373 points. The S&P 500 and Nasdaq Composite also dipped, falling 1.4% and 1.9%, respectively.

Bond yields played an influential role, with the 10-year Treasury yield hovering around 4.2%, reflecting concerns about inflation and the potential for sustained high interest rates.

The fluctuations in bond yields reverberated across equities, particularly within the tech sector, as the 10-year Treasury yield stabilized near 4.3%, prompting discussions of potential corrections. Additionally, Chinese economic data and central bank actions sparked uncertainty and market chatter.

Across the Atlantic, European stock markets echoed their American counterparts, with energy firms emerging as leaders due to surges in oil prices and heightened awareness of the ongoing hurricane season.

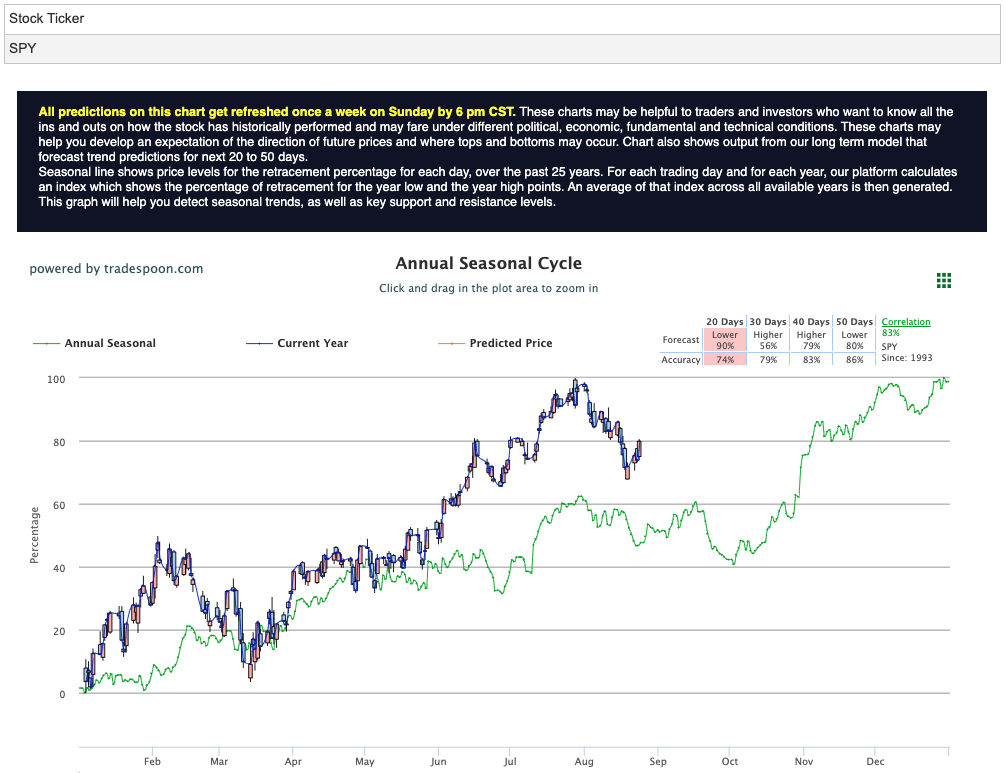

As we step into the latter half of 2023, a sense of careful optimism prevails amid the looming surge of market volatility. Projections for the SPY rally threshold, a pivotal gauge of investor sentiment, extend across the spectrum from $450 to $470. Additionally, the bedrock of support levels, ranging between 400 and 430, serves as a compass for investors navigating the tumultuous waters of the financial realm. For reference, the SPY Seasonal Chart is shown below:

As the financial markets continue their whirlwind dance of volatility, an intriguing subplot has emerged in the form of consumer staples, drawing attention to the XLP sector. Consumer staples often considered the bedrock of stable portfolios, have cast a steady light amidst the market’s tumultuous terrain.

The Consumer Staples Select Sector SPDR Fund (XLP) offers investors exposure to a range of essential goods companies, including those involved in food and beverages, household products, personal care, and retail. Known for their resilience, these companies tend to weather economic storms better than their more cyclical counterparts.

In the face of recent market turbulence, the XLP sector has captured the spotlight for several compelling reasons:

Stability in Volatile Times: Consumer staples are known for their stability during periods of market uncertainty. As the market experiences sudden shifts and unpredictable swings, these companies tend to maintain consistent demand due to their nature as essential goods providers.

Defensive Play: In times of economic downturns or heightened volatility, investors often seek refuge in defensive sectors. Consumer staples, being a staple of everyday life, fall into this category, making XLP an attractive option for investors looking to hedge against market swings.

Resilience in Economic Cycles: Regardless of economic cycles, people continue to buy everyday necessities. This steadiness provides consumer staples companies with a level of predictability that can serve as an anchor for portfolios.

Dividend Potential: Many consumer staples companies are known for their consistent dividends. These dividends can offer investors a source of income even in uncertain market conditions.

Portfolio Diversification: Diversification is a key strategy for managing risk. Incorporating XLP into a portfolio that might be heavily weighted in more volatile sectors could help balance risk exposure.

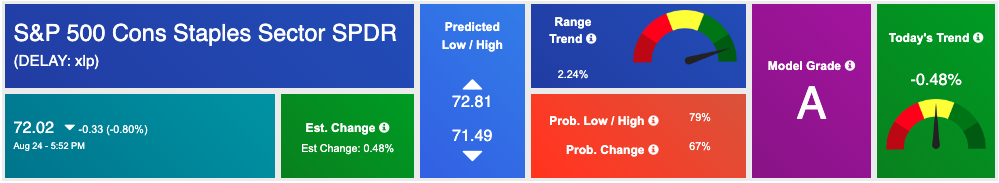

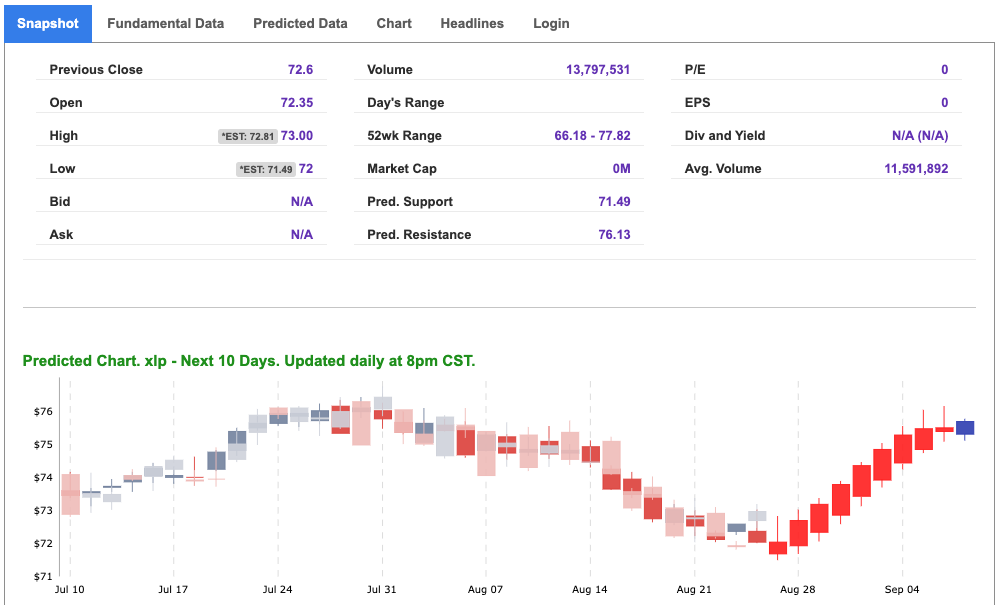

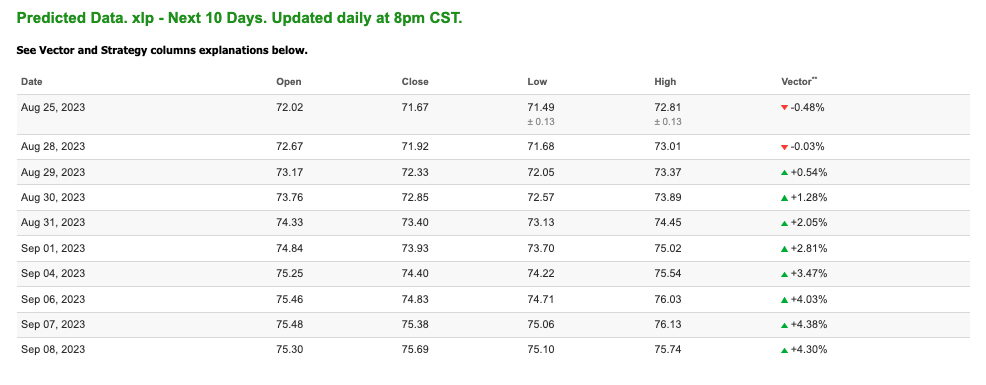

Given these factors, many investors view XLP as an attractive option for inclusion in their portfolios, particularly when the broader market is experiencing heightened volatility and uncertainty. And our A.I. models agree! See 10-Day Predicted Data for XLP:

As we navigate the second half of 2023, the spotlight on consumer staples and XLP highlights the importance of stability and resilience amidst market turbulence. While the market’s twists and turns remain a focal point, the enduring appeal of essential goods offers investors a steadying influence in an unpredictable financial landscape.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

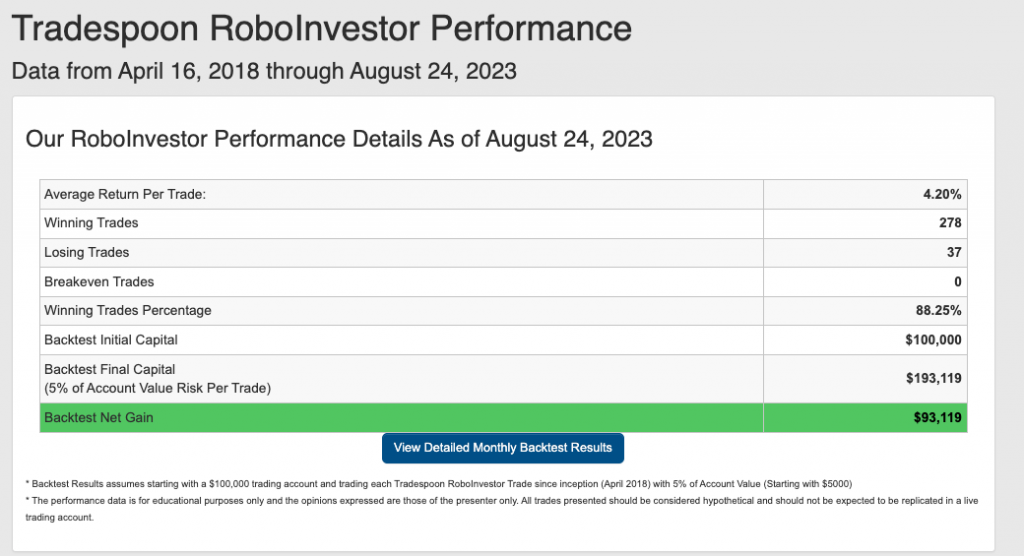

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we continue onto the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!