Stocks rallied on Thursday as new data showed that inflation is cooling down, leading investors to hope that the Federal Reserve will stop raising interest rates. Earnings season is set to kick off on Friday with JPMorgan Chase, Wells Fargo, and other banks reporting earnings. Forward-looking guidance from banks and other companies could set the tone for the market’s performance in the coming quarters.

On Thursday, we saw the release of the producer price index (PPI) showed that companies’ costs rose by 2.7% year over year, which is below expectations of 3%, and the largest drop in three years. The PPI data follow Wednesday’s cooler-than-expected reading on consumer prices. Investors are optimistic that the slowdown in inflation could result in rebounding profit margins, which would support earnings.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Federal Reserve has been raising interest rates to lower inflation by reducing economic demand. However, the slowdown in inflation has led investors to hope that the Federal Reserve will stop raising interest rates. The possibility of a recession this year has caused concern among investors and has contributed to the stock market’s struggles.

On Wednesday, the latest CPI report showed prices rose by 5% for the 12 months ending in March, a slowdown from February’s 6%. The core CPI, which excludes volatile food and energy prices, rose by 5.6% annually. Monthly CPI showed some cooling, ticking up by 0.1% from February, compared to a previous 0.4% increase. On a monthly basis, core CPI grew 0.4%, resulting in a 5.6% annual growth rate. In February, core CPI accelerated 0.5% month over month and 5.5% year over year. The cooling of inflation has been attributed to year-over-year comparisons to a period when food and energy prices spiked amid Russia’s invasion of Ukraine.

The cooling of inflation has led to increased confidence that the Federal Reserve may soon pause its rate-hiking campaign. However, the flip side of falling inflation and interest rates is a weakening of economic demand, which the Fed highlighted in its meeting minutes released later in the day.

The VIX is trading near the $19 level, and upcoming earnings reports from companies such as Delta Air Lines, and UnitedHealth Group, as well as retail and PPI data, could influence the market’s next move. The market is expected to trade sideways for the next two to eight weeks, leading many to adopt a market-neutral stance and hedge their positions.

While the inflation narrative may not have a significant impact on equity price action, the upcoming earnings season is set to provide important insight into the market’s performance in the coming quarters. We will be keeping an eye on earnings data next week as an indicator of where the market could go. However, with these levels in mind, we have identified a sector we believe should prosper and furthermore a symbol within it to highlight.

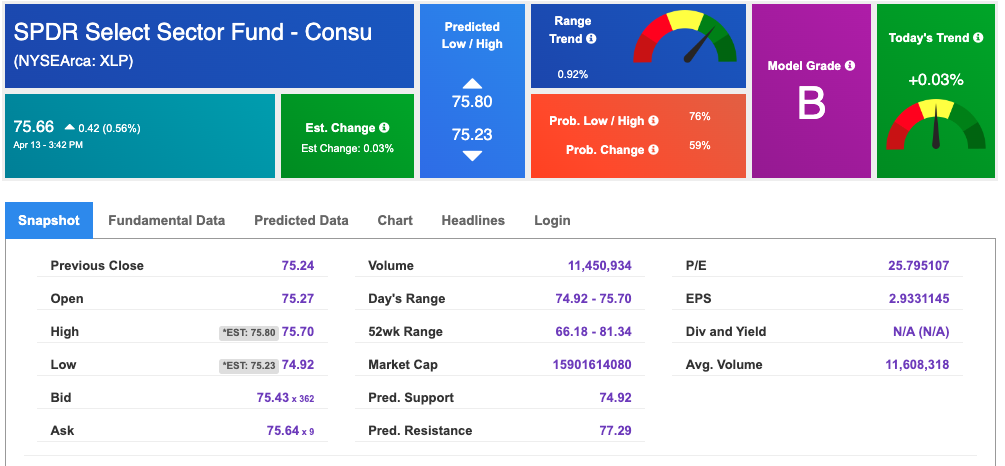

The Consumer Staples Select Sector SPDR Fund (XLP) is a well-known exchange-traded fund (ETF) that tracks the performance of companies in the consumer staples sector of the S&P 500 Index. The fund seeks to provide investors with exposure to companies that produce and distribute consumer goods such as food, beverages, household and personal care products, tobacco, and other essential items that tend to be in demand regardless of economic conditions. XLP is one of the largest and most popular ETFs in the consumer staples sector and is widely used by investors seeking to add defensive exposure to their portfolios. Some of the top holdings in XLP include companies such as Procter & Gamble, Coca-Cola, and Walmart.

Within XLP, there is one company that is trading at an opportune level and offering a great entry price. With earnings coming up, there could be plenty of growth in consumer symbols, especially this one!

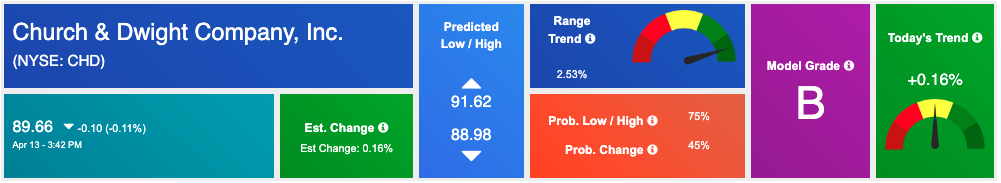

Church & Dwight Co., Inc. (CHD) is an American multinational consumer goods company known for its portfolio of household brands, including Arm & Hammer, OxiClean, Trojan condoms, First Response pregnancy tests, and more. Church & Dwight’s products are sold in various categories, such as personal care, laundry, cleaning, and oral care. The company has a strong presence in North America and international markets with a focus on innovation and sustainable practices.

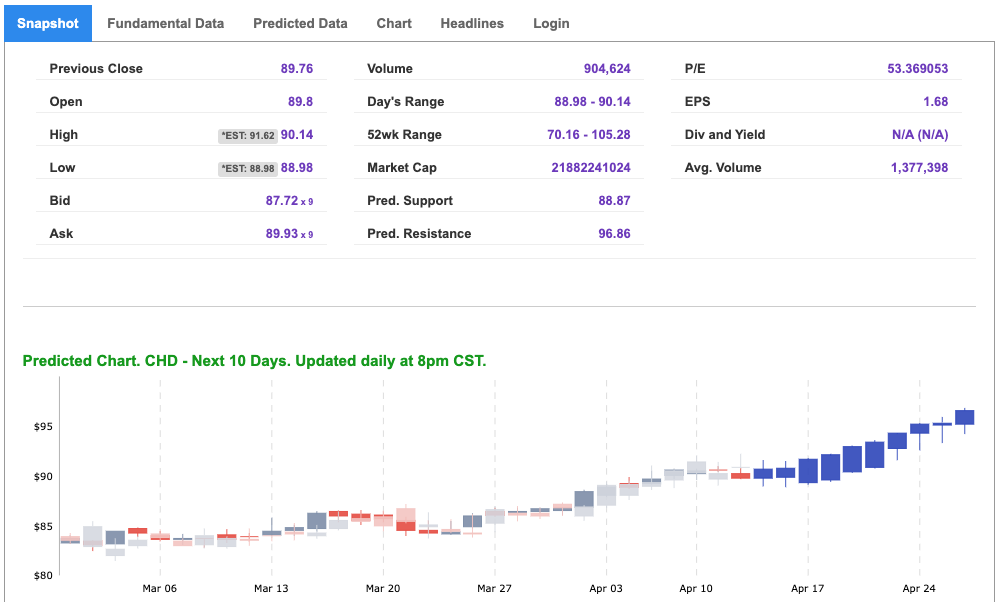

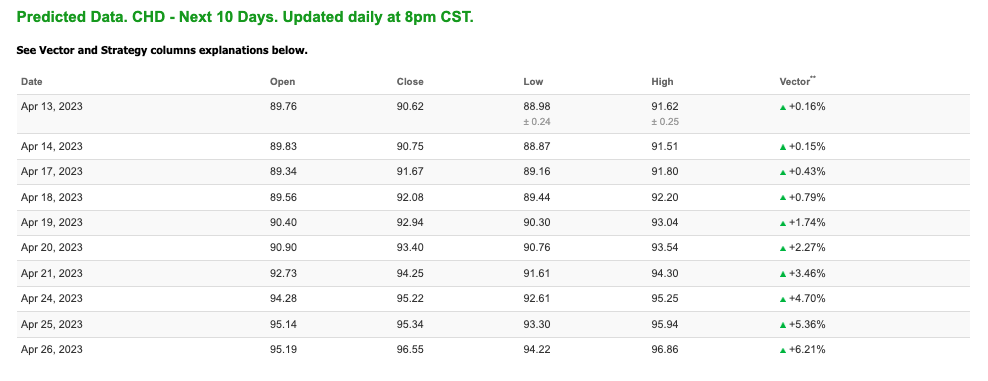

CHD currently sports a grade of “B,” putting it in the top 25% of accuracy within our data universe and is trading between its 52-week range of $70-$106, currently at $89. Most importantly, our predicted data shows upward momentum for CHD with growing vector scores in a one-directional, steady fashion. See 10-day $CHD Predicted Data:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

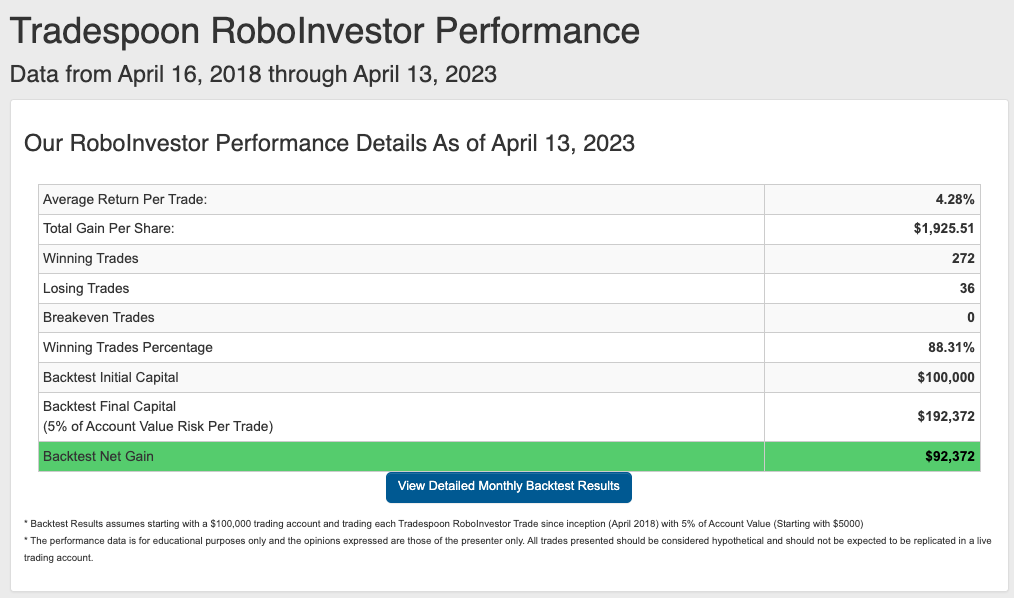

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!