On Thursday, markets traded to mixed results as the S&P 500 and Nasdaq Composite found themselves in the red, while the Dow Jones Industrial Average made modest gains. The Nasdaq Composite, in particular, suffered its fourth consecutive day of declines, largely due to the ongoing tech stock slump. Investors are growing increasingly anxious about signs of a potential economic slowdown in China and concerns that the Federal Reserve may keep interest rates elevated for an extended period.

The tech sector, once a market darling, continued to face headwinds. A new wave of restrictions on iPhone use by Chinese government officials sent tech stocks tumbling. This development raised concerns that further limitations on other tech companies could follow suit, further stifling the industry’s growth.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The specter of future interest rate hikes by the Federal Reserve loomed large over investors’ minds. Fears persist that the central bank might continue its aggressive monetary policy stance, especially in the wake of robust economic data, including a decline in jobless claims. The uncertainty surrounding these potential hikes cast a shadow over market sentiment.

Amid this uncertainty, stock markets presented a mixed picture. Apple shares struggled for a second consecutive day, while healthcare stocks, including industry giant Johnson & Johnson, bolstered the Dow’s performance. Furthermore, labor strikes have continued to disrupt various industries and are now inching closer to impacting the big three automakers in Michigan.

In the bond market, Treasury yields dipped, though they remained close to this year’s highs. This trend followed persistent signs of tightness in U.S. labor markets. The 10-year yield slipped 0.029 percentage points to 4.260%, while the two-year yield shed 0.069 percentage points to 4.953%, both snapping three-day winning streaks.

The U.S. dollar index continued its impressive rally, heading for its longest winning streak in years. It posted a 0.1% gain, reaching $104.97 and on pace for its highest close since March 9. Remarkably, the index was set to secure gains for the eighth consecutive week.

Better-than-expected services ISM data sparked a market pullback, with all eyes now on next week’s CPI data release. The Dollar Index’s continued rally and surging yields on longer-dated Treasury bonds signal investor sentiment.

China’s recent stimulus measures, such as cutting mortgage interest rates and reducing taxes, have raised questions about whether inflation can reach the desired 2% level without triggering a recession and a spike in unemployment. Historical data suggest that this outcome is rare.

In the global market landscape, certain sectors, including European stocks, small caps, technology, cyclicals (including energy), and regional banks, have displayed weakness. The battle for the 50-day moving average between technology stocks and the S&P 500 ($SPY) is an area of concern.

Reviewing specific companies’ earnings performance, Oracle ($ORCL), Zscaler ($ZS), and AI-related stocks ($AI) provide valuable insights. Oracle received a boost from Barclays, which raised its rating and target price. Meanwhile, market performance was mixed, with the Dow Jones Industrial Average rising while the S&P 500 fell.

On the commodities front, oil prices experienced a dip after a nine-day winning streak, with Saudi Arabia’s efforts to limit supply playing a key role. As crude oil’s upward momentum loses steam, caution is advised against chasing oil prices. Saudi Arabia’s efforts to control supply have played a role in this shift.

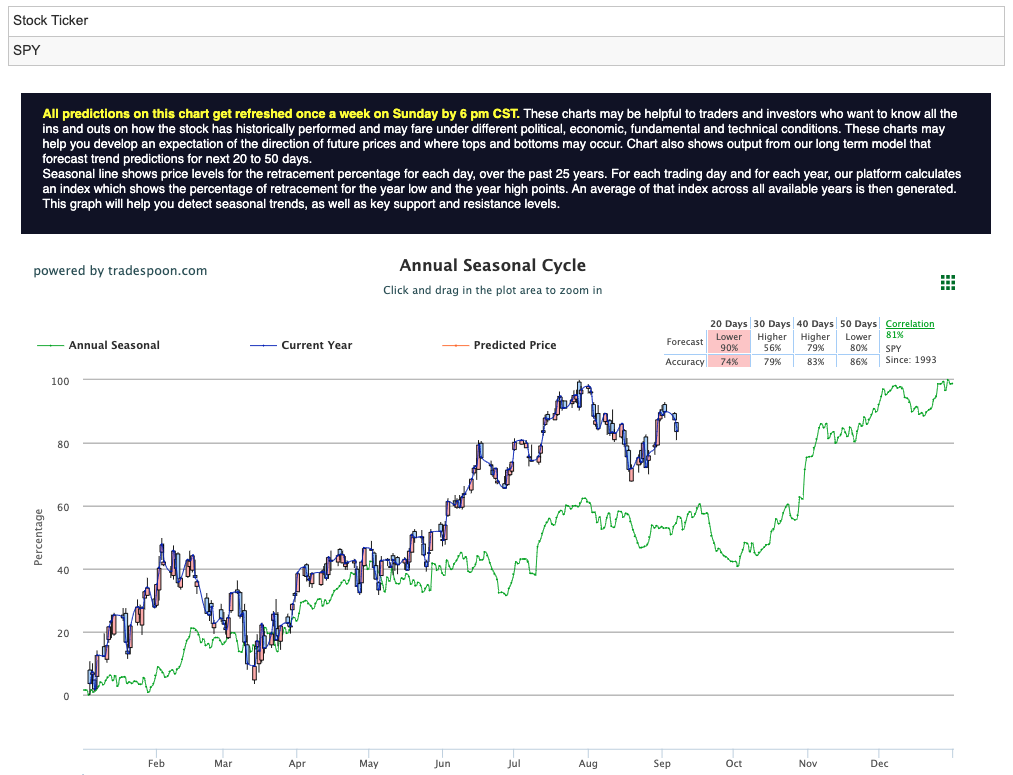

In light of economic data pointing to a low probability of recession, some investors are shifting to a market-neutral stance. However, many still believe that the S&P 500’s rally may be capped in the $450-470 range, with short-term support levels at 400-430. Currently, there seems to be more room for downside movement, and a retest of August lows may already be underway. Keep an eye on charts for IWM, KRE, and XRT, as cyclicals may potentially break August lows in the near future. For reference, the SPY Seasonal Chart is shown below:

As the markets remain in flux, investors will be closely monitoring upcoming economic data releases and central bank decisions for clues on how the landscape may evolve in the coming months. With this in mind, there is one type of trade I will be certainly looking to make in the coming days.

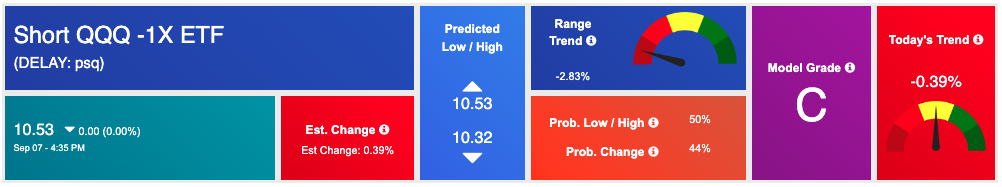

Amid the turbulence in the tech sector and concerns over the Federal Reserve’s monetary policy, investors are seeking opportunities to navigate the market’s shifting dynamics. One intriguing option to explore is ProShares Short QQQ (PSQ), an inverse exchange-traded fund (ETF) that aims to provide the opposite return of the Nasdaq-100 Index, which is tracked by the popular Invesco QQQ ETF (QQQ). Here’s why it might be a favorable time to consider PSQ and potentially short QQQ.

Apple’s Pullback and Tech Sector Struggles

As we’ve observed, Apple, a tech giant, has been on a downward trajectory for two consecutive days. This decline is not an isolated incident but part of a broader trend of tech stocks struggling. Concerns about China’s restrictions on iPhone use by government officials and the potential for more restrictions on other tech companies have rattled the tech sector. These headwinds have put pressure on QQQ, which is heavily weighted toward tech stocks.

Federal Reserve’s Uncertain Path

Investors are also grappling with uncertainty surrounding the Federal Reserve’s stance on interest rates. The possibility of further rate hikes has cast a shadow on the tech sector, which is particularly sensitive to interest rate movements. If the Fed decides to keep interest rates higher for an extended period, it could exacerbate the challenges faced by tech stocks.

The Case for PSQ

In light of these developments, ProShares Short QQQ (PSQ) emerges as a strategic option. PSQ is designed to benefit from declines in the Nasdaq-100 Index, which makes it a potential hedge against further tech sector woes. When the Nasdaq-100 declines, PSQ aims to rise, providing inverse returns. This can be an effective tool for investors looking to offset potential losses in their tech-heavy portfolios.

In conclusion, the current market environment presents unique challenges and opportunities. As tech stocks face headwinds and the Federal Reserve’s actions remain uncertain, ProShares Short QQQ (PSQ) can be a strategic addition to your investment toolkit. However, always conduct thorough research and consider seeking professional guidance to make informed investment decisions.

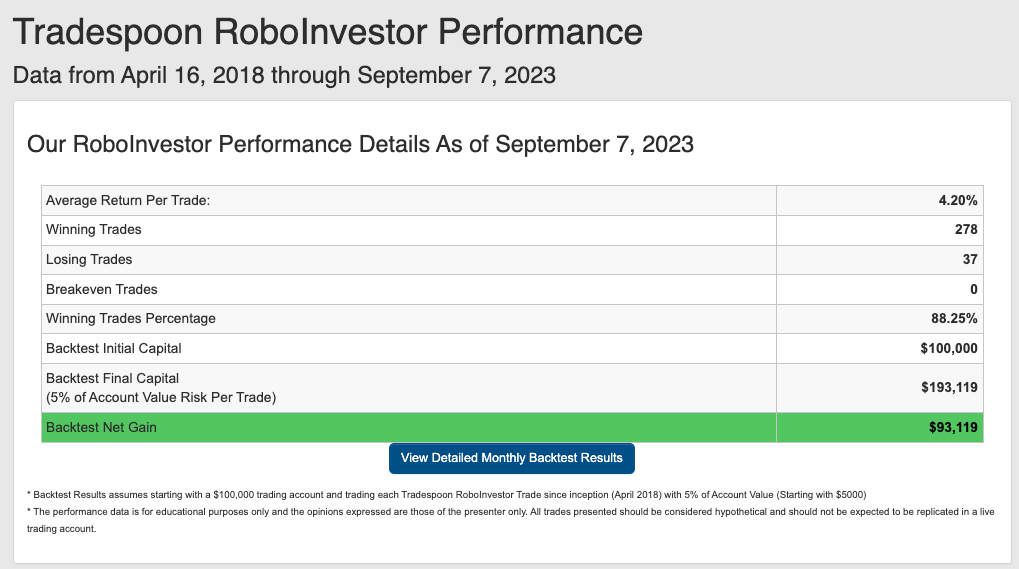

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we inch closer to Q4 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!