RoboStreet – May 15, 2025

Markets staged a notable comeback this week, lifted by a wave of optimism following the announcement of a temporary trade truce between the United States and China. Over the weekend, both nations agreed to reduce tariffs for 90 days, lowering U.S. tariffs on Chinese goods to 30% and Chinese tariffs on U.S. imports to 10%. This de-escalation, while short-term in nature, injected renewed confidence into equities and helped erase year-to-date losses for the S&P 500. The Dow Jones Industrial Average jumped more than 1,100 points on Monday, and the S&P 500 surged to its highest level since early March.

Technology stocks, particularly those tied to global supply chains and semiconductors, led the rally. Nvidia, AMD, Tesla, Super Micro Computer, and Meta all posted substantial gains, with AI-related optimism and easing chip restrictions further supporting the sector. The Trump administration’s move to replace Biden-era AI export rules with a streamlined global licensing system provided an added boost to chip stocks and helped the Nasdaq outperform for much of the week.

At the same time, investor appetite for risk sent bond prices lower and yields higher. The 10-year Treasury yield, which has been volatile for months, continued trading within a wide band between 3.6% and 4.8%. It ticked higher after the trade announcement, as demand for safe-haven assets faded and traders braced for the potential inflationary effects of restructured tariffs. Although the CBOE Volatility Index (VIX) fell below 20, indicating a return to relative calm, that calm may be deceiving as deeper macro risks remain unresolved.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Midweek, the rally showed signs of fatigue. While headline inflation appeared to cool—April’s Consumer Price Index (CPI) came in at a 2.3% annual increase, the lowest since early 2021—investors were quick to reevaluate. Core CPI remained sticky at 2.8%, and the Producer Price Index (PPI) revealed a 0.5% monthly increase for April. Compounding this were revised figures from March, which showed prices remained flat rather than falling, suggesting that the disinflationary trend may be temporary or overstated. The early optimism around inflation was quickly replaced by caution, as it became clear that new tariffs could apply renewed pressure to both wholesale and consumer prices.

Adding to the mixed picture were earnings from retail and healthcare giants. Walmart posted a strong quarter and beat earnings expectations, but warned of “substantial uncertainty” in the months ahead due to the changing tariff landscape. Executives noted that import costs are already rising and that those increases will likely be passed on to consumers. UnitedHealth shook the healthcare sector by suspending its 2025 forecast and announcing the abrupt resignation of CEO Andrew Witty, which led to a steep decline in its stock price and dragged down related names like CVS and Humana. Meanwhile, American Eagle withdrew its financial outlook and posted a $75 million inventory write-down, triggering a sharp drop in its share price and contributing to overall weakness in retail sentiment.

Coinbase was a rare standout outside of tech, rallying over 9% after news broke that the cryptocurrency platform would be added to the S&P 500 index later this month. While its inclusion marked a milestone for digital assets, the broader market remained largely split across sectors. Tech and communication services buoyed the indexes, while healthcare, materials, and utilities all struggled. Out of the 500 stocks in the S&P, fewer than 120 were in the green on Thursday—a reminder that recent gains have been narrow and momentum-driven.

Crude oil also took a step back after four straight sessions of gains. A surprise 3.5 million barrel build in U.S. inventories, paired with OPEC’s decision to keep its demand forecast unchanged while increasing output, led to a modest pullback in energy names. As with other sectors, commodity markets remain sensitive to shifting global demand expectations and policy developments.

Despite this week’s bullish tone, I remain in the market-neutral camp. We are trading in a sideways pattern, and I believe the market will continue to do so over the coming months. While the SPY may attempt to test the $600–620 range if optimism holds and tech remains strong, the near-term support remains between $540 and $550. Economic uncertainty has not disappeared—it has simply taken a backseat to short-term catalysts. Unemployment is beginning to tick higher, and recession odds are rising. If interest rates remain elevated for longer, as I expect they will, these pressures will resurface and weigh on sentiment. For reference, the SPY Seasonal Chart is shown below:

For now, the probability of a Federal Reserve rate cut in June has fallen to just above 8%, with the odds of a cut by July declining to just over 40%. Traders are still pricing in an 80% chance of a cut by September, but that expectation is highly sensitive to upcoming inflation and labor data. With recent inflation readings soft but not definitive, and with new tariff impacts likely to ripple through the economy in Q2 and Q3, the Fed may be forced to delay action further than many investors currently expect.

In the coming weeks, markets will have plenty to digest: a new round of corporate earnings, key consumer spending data, and another wave of inflation reports. While the recent rally may continue if sentiment holds, the long-term outlook remains uncertain. This is still not a market built on broad participation or solid fundamentals—it’s a market fueled by relief rallies and short bursts of momentum.

Navigating this landscape requires more than just optimism. A well-balanced, diversified strategy is essential. Agility is your edge—identify emerging opportunities while staying protected from sudden downturns. Staying informed throughout earnings season and tracking macroeconomic shifts will position you to act decisively and with confidence.

Despite the headwinds, this environment still offers meaningful opportunities for growth. With discipline and a focus on key indicators, investors can adapt to changing conditions and position themselves for long-term success.

That’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

Click Here To Subscribe To Our YouTube channel, Don’t Miss Out!

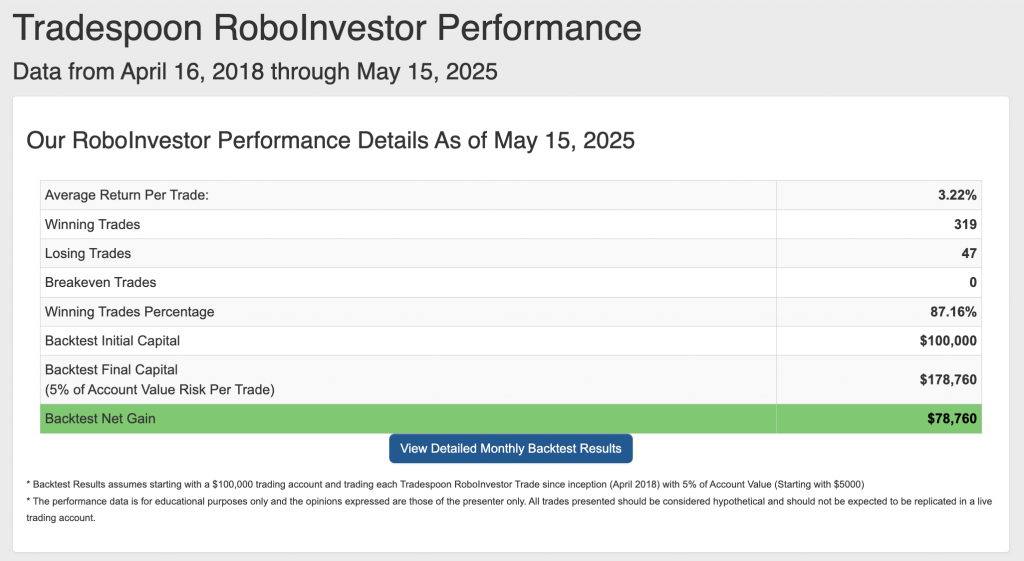

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.09% going back to April 2018.

As we progress through Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!