To kick off the week, markets dropped significantly in the first few days of trading after Federal Reserve officials made alarming, hawkish statements. This continued through the mid-week as stocks sold off on Thursday as well. Earnings remain in the spotlight while next week’s PPI data will serve as the marquee report.

Wednesday saw a particularly steep dip as all three major U.S. indices sold off. The S&P 500 experienced its most drastic dip of this calendar year due to some aggressive comments from Federal Reserve officials. The Dow Jones Industrial Average declined 1.8%, while the S&P 500 saw a noteworthy decrease of 1.6%. Furthermore, Nasdaq Composite didn’t fare any better; after an incredible seven-day run it terminated with a drop-off of 1.2%. This decline was extended on Thursday with another market-wide selloff.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This week, several Federal Reserve members have reinforced their opinion that the current inflation rate is still too high and necessitates a further increase in interest rates. Further adding to market stress were some of this week’s newly released economic data. This Wednesday saw the release of an unexpected Producer-Price Index decrease for December, and retail sales dropped by a staggering 1.1%. This data paints a picture of our current economic landscape and hints that this could be the start of an extended period of downward growth.

On Thursday, unemployment filings were announced at a multi-month low – an impressive record that was far exceeding what economists predicted. This suggests that the job market is still functioning strongly, making it difficult for investors wishing to see a less steady Federal Reserve approach. With inflation remaining consistent and high, the Fed has been trying to identify weakened employment; however, this news makes such an outcome increasingly unlikely.

Additionally, on Thursday, the United States reached its debt limit. In order to avert a default on our country’s obligations, Treasury Secretary Janet Yellen announced that “certain extraordinary measures” will be taken by her department. Last week she personally informed U.S legislators of these upcoming actions in response to this looming crisis.

However, not all reports were bad, as several earnings showed promise and saw shares rise. For example, despite the current economic climate, Netflix made a major positive impact on the market this week. After their fourth-quarter earnings report was released after-hours, it revealed that they had surpassed subscriber expectations, resulting in a surge in their shares!

It appears that the market pullback has resumed. We can expect more volatility during the first half of this year. CPI data and earnings continue to be the major catalysts, along with the start of the earnings season. Weak sales data, weak PPI data, weak manufacturing data, and weak job opening data all point to a downward slope in inflation, which at the same time sparks concerns about a looming recession. The Fed will speak on February 1st, but this week Fed committee members are pointing to maintaining their hawkish posture on rates.

It seems that everyone agrees that inflation is subsiding, and rates are going down, but will we have a recession or not? A soft landing or a hard landing? These are the key questions to monitor in the coming days. Following the reveal of stronger-than-predicted CPI/PPI data from both Europe and America, interest rates decreased while the US dollar remained flat. The yield on 10-year bonds is currently trading under 3.5%, a long-term support level, as sales figures turn out to be worse than projected.

With this in mind, I will be looking to make a move in one particular sector; but before we commit, let’s review the latest market conditions.

I am watching the overhead resistance levels in the SPY, which are presently at $402 and then $416. The $SPY support is at $391 and then $385. I expect the market to resume the bear market in the next 2-8 weeks. I would be BEARISH ON THE MARKET at this time and encourage subscribers to hedge their positions.

In light of the current market environment and possible future trends, the Volatility Index (VIX) has settled around $19. This week, the reports of $DFS, $NFLX, and $PG as well as PPI and Retail data have had a significant impact on the market. Further numbers are still being released and will impact the market in the coming days.

If markets are to remain down as earnings season wraps up, there is one symbol I will be looking to profit from in the coming days.

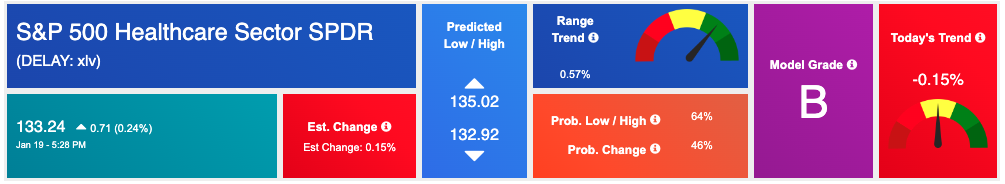

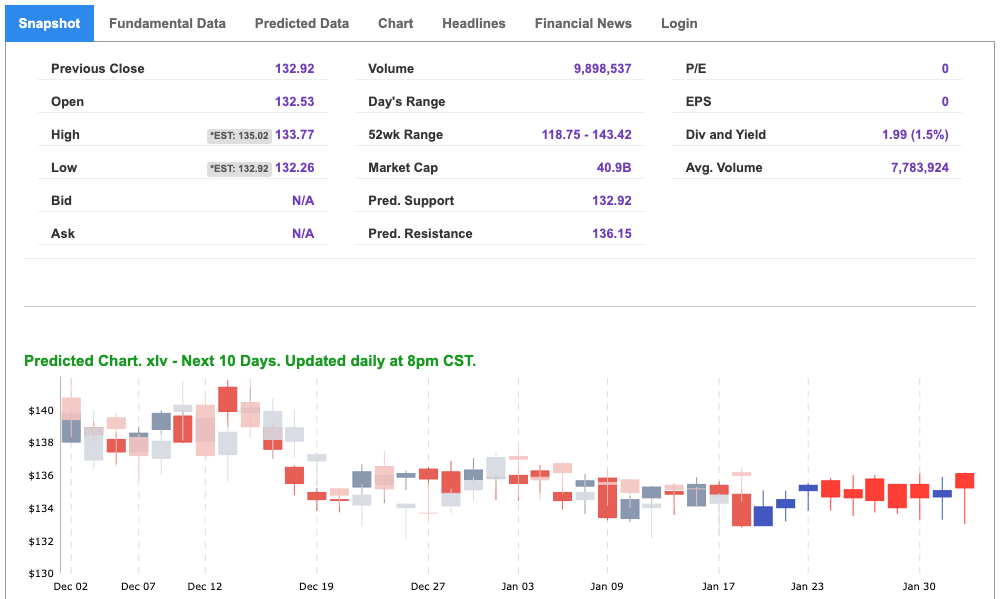

The Health Care Select Sector SPDR Fund (XLV) is undoubtedly your top pick for a U.S.-based healthcare ETF. If you’re looking to invest in anything health-related such as pharmaceuticals or medical equipment, this fund is an ideal choice due to its long history of success and large trading volume. Moreover, it has an overwhelming preference towards mega-cap stocks making it the most reliable option available!

Taking into consideration the current nature of the market and trading landscape, the health sector has historically outperformed during these times. With several factors bubbling up, this sector has the potential to make advances in the next few weeks. With nearly $40 billion of capital managed, XLV offers an invaluable chance to invest in the healthcare sector. Generally speaking, health stocks outperform during a bear market – and considering our current outlook on where this market is heading, now may be the optimal time to take advantage.

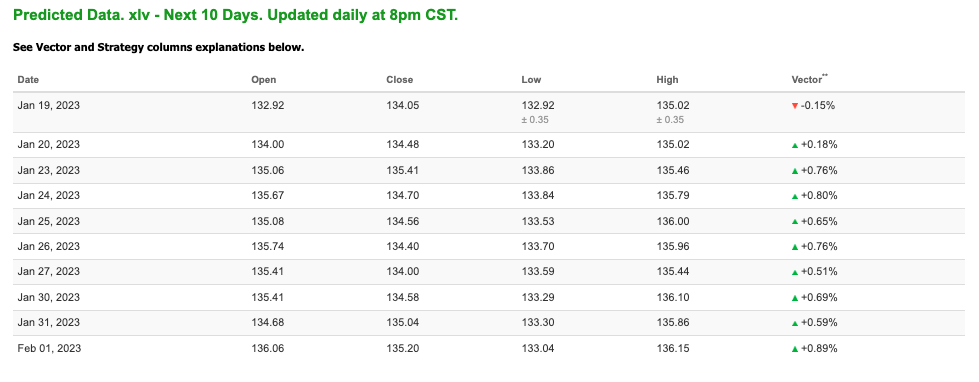

After reviewing the ten-day forecast for XLV, we have observed a positive trend that is both steady and continuous. This pattern indicates great potential in our prediction. Additionally, XLV has been given a “B” rating from the model which puts it among our highest accuracy symbols in the top 25%.

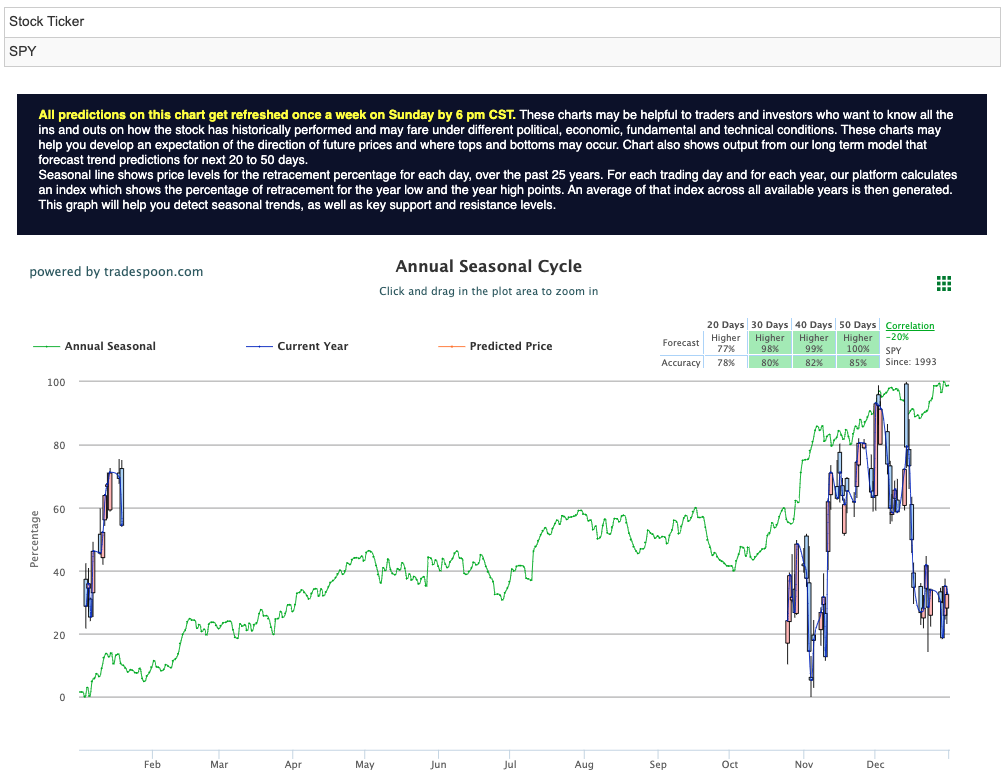

Our A.I. platform, using the Seasonal Charts tool for long-term data, is now giving you a strong ‘buy’ signal, and the chart pattern shows clear potential for success. Of the four time frames we’ve studied– 20 days, 30 days, 40 days, and 50 days – Seasonal Chart readings paint an especially promising picture in three of them. See XLV seasonal chart below:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

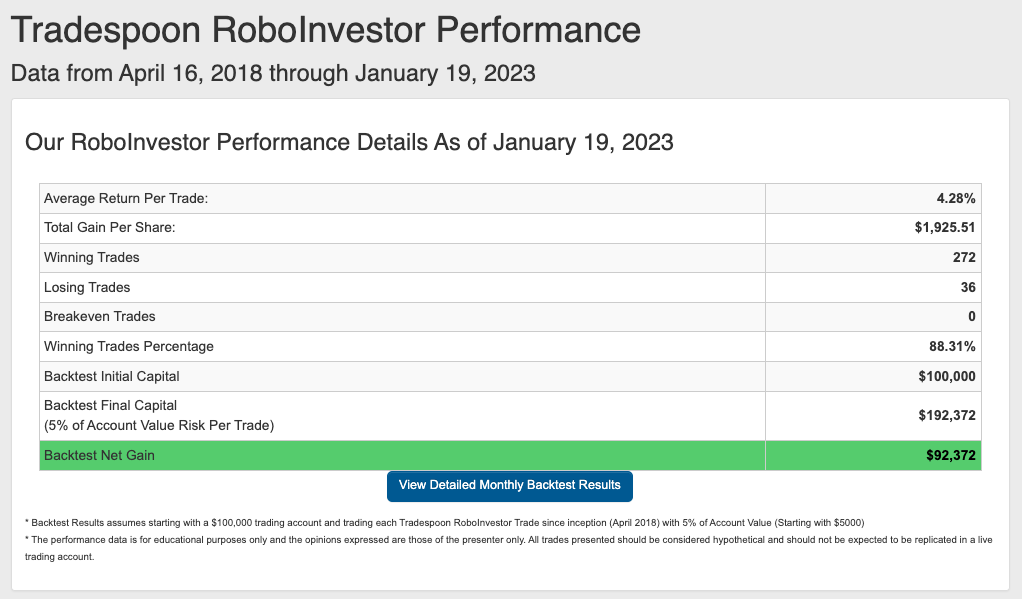

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!