The impact of the recent Federal Reserve Jackson Hole symposium still lingers as investors prepare for a week filled with important financial events. The focus is on the U.S. labor market, earnings reports from big retailers, and the reveal of the latest inflation data, making this upcoming week a potential game-changer.

Following the global central bankers’ Jackson Hole gathering, the U.S. dollar made slight moves. It weakened a bit against the euro and pound, but gained against the yen, all within about 0.1%. The symposium went mostly as expected, which influenced these modest currency shifts.

Federal Reserve Chair Jerome Powell’s strong and cautious stance was a standout from the symposium. Powell emphasized the Fed’s determination to control inflation and hit the 2% target. The market got a bit shaky after his speech but soon stabilized, reflecting the dollar’s slight rise. Powell’s commitment to pursuing 2% inflation, even if it means higher interest rates, resonated, guiding the stock market’s responses.

In the corporate world, several retail earnings reports take the spotlight this week. Major players like Best Buy, Hewlett Packard Enterprise, HP, Salesforce, Broadcom, Dollar General, and Campbell Soup are set to reveal their financial performances, potentially offering insights into wider economic trends.

Shifting to economic indicators, the Bureau of Labor Statistics (BLS) will release the July Job Openings and Labor Turnover Survey results. Economists predict job openings will remain steady. Later in the week, the BLS will unveil August’s nonfarm payrolls data, with an expected gain of 175,000 jobs—a slight slowdown. The unemployment rate is likely to hold at 3.5%, and average hourly earnings are projected to rise by 0.4% compared to July.

In an interesting turn, 3M’s stock surged by 5.3% due to reports that it’s nearing a settlement to address allegations about faulty combat earplugs sold to the U.S. military. Negotiations are ongoing, and the final settlement amount isn’t confirmed yet.

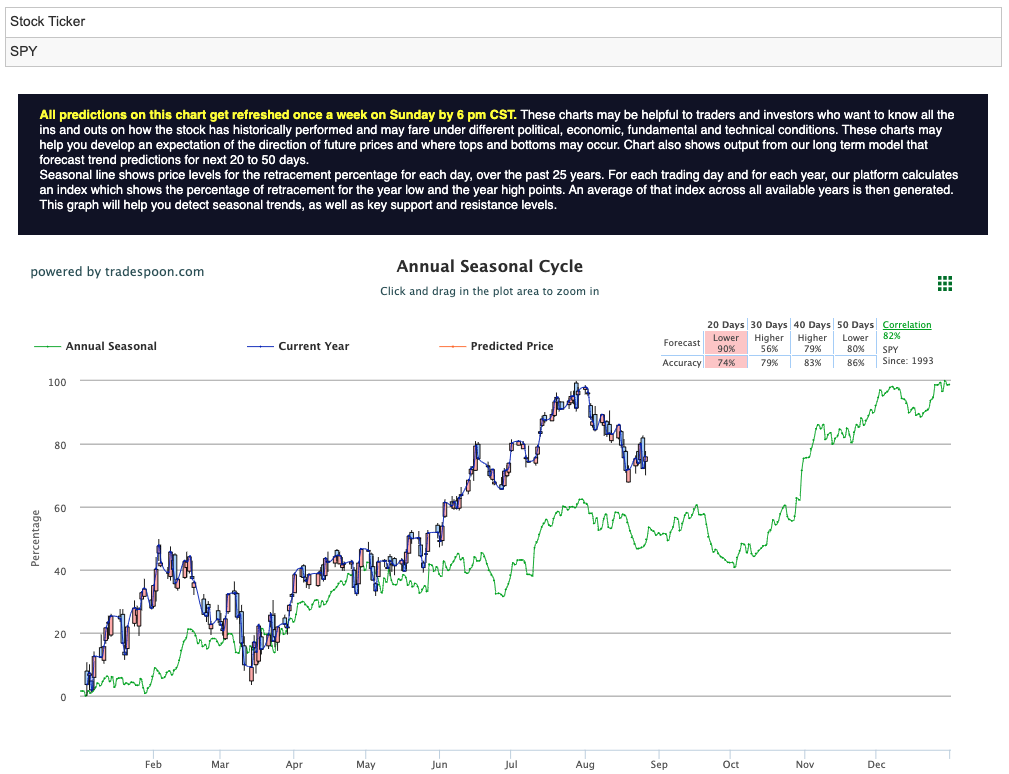

As we step into the second half of 2023, a sense of cautious optimism prevails amid growing market volatility. The SPY rally threshold, ranging from $450 to $470, becomes a crucial gauge of investor sentiment. Support levels between 400 and 430 offer guidance for navigating this complex financial landscape. With a diverse range of events ahead, investors are gearing up for a potentially impactful week that could shape the path ahead. For reference, the SPY Seasonal Chart is shown below:

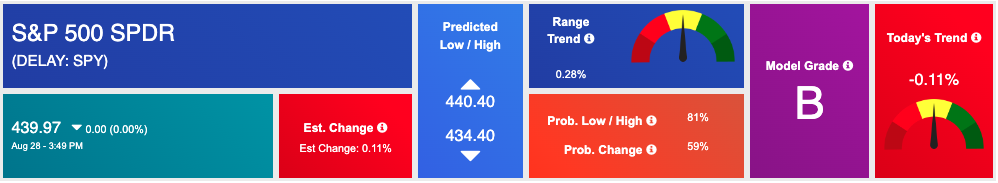

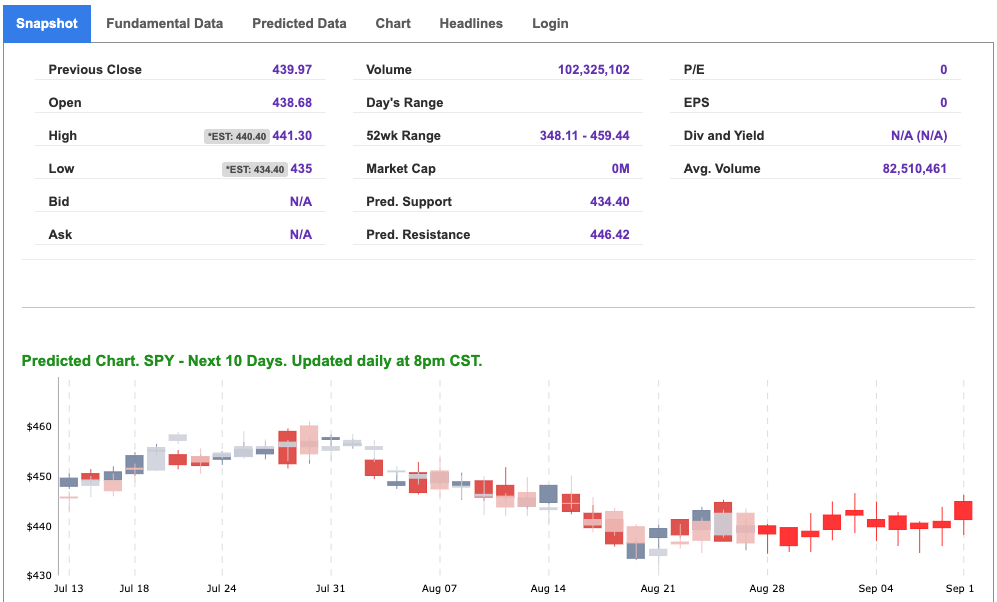

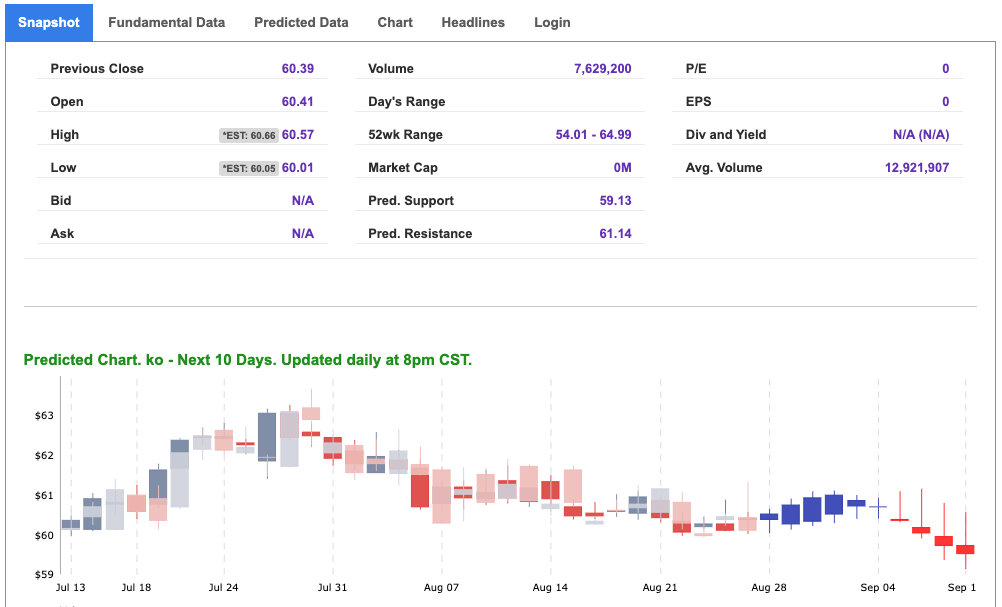

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

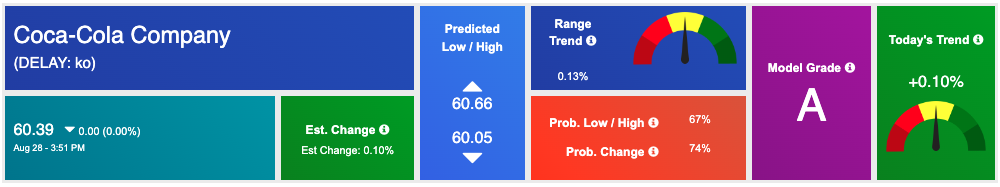

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, ko. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

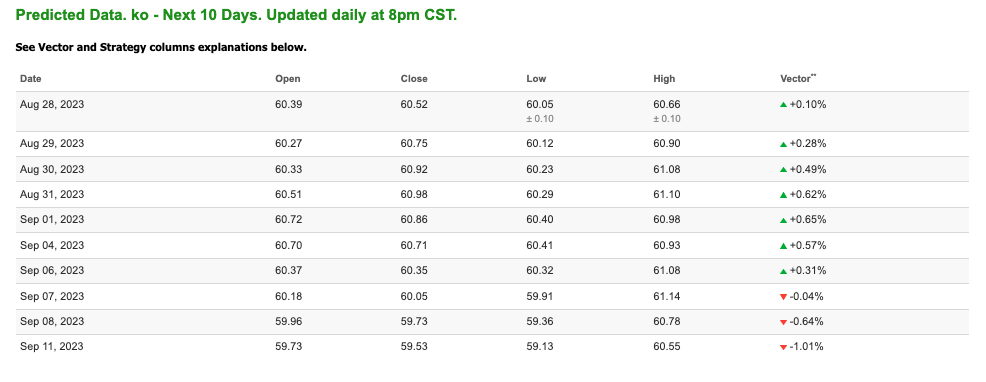

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $79.98 per barrel, up 0.19%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $72.45 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

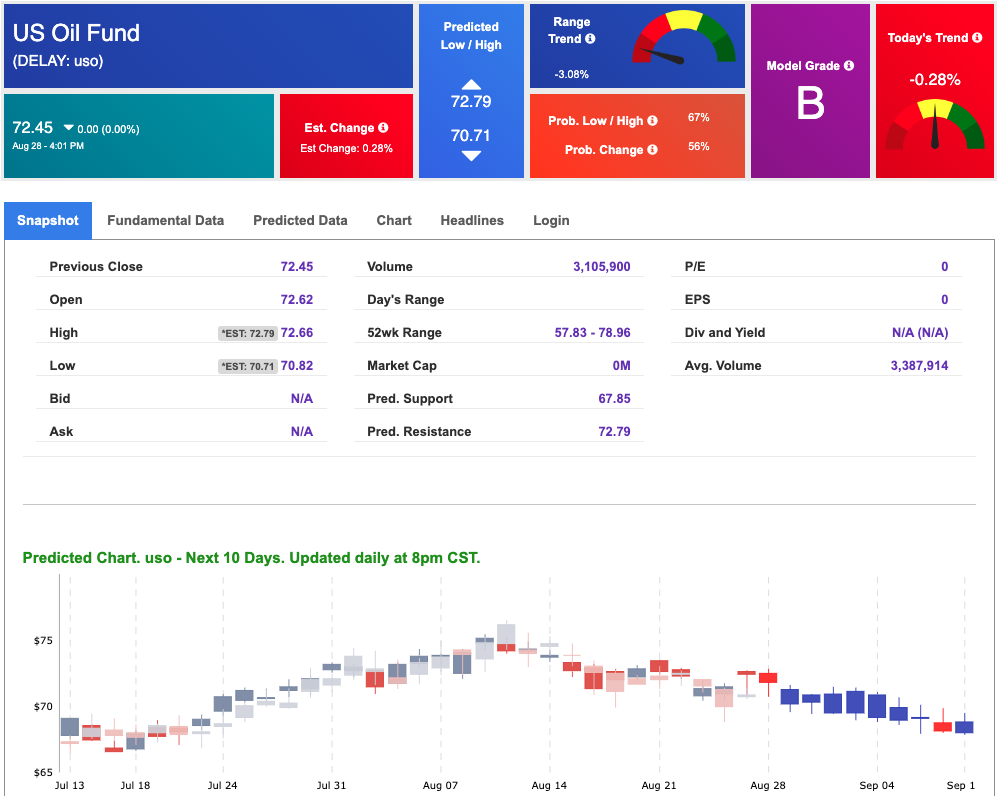

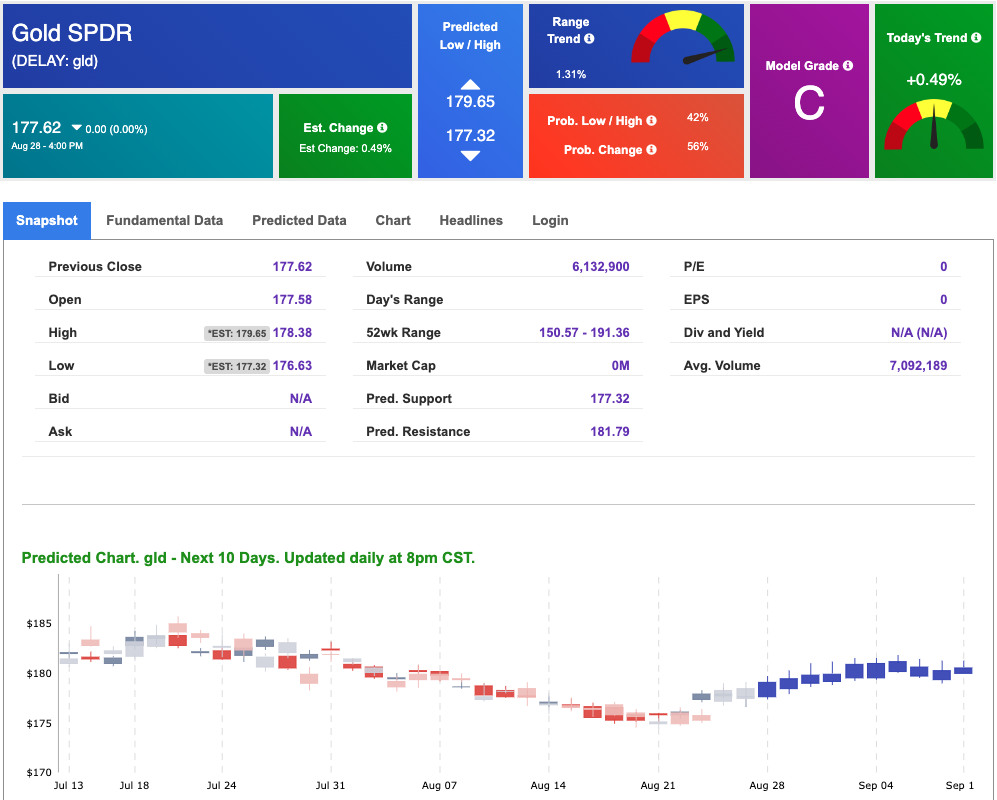

The price for the Gold Continuous Contract (GC00) is up 0.42% at $1948.00 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $177.62 at the time of publication. Vector signals show +0.49% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is down at 4.204% at the time of publication.

The yield on the 30-year Treasury note is down at 4.280% at the time of publication.

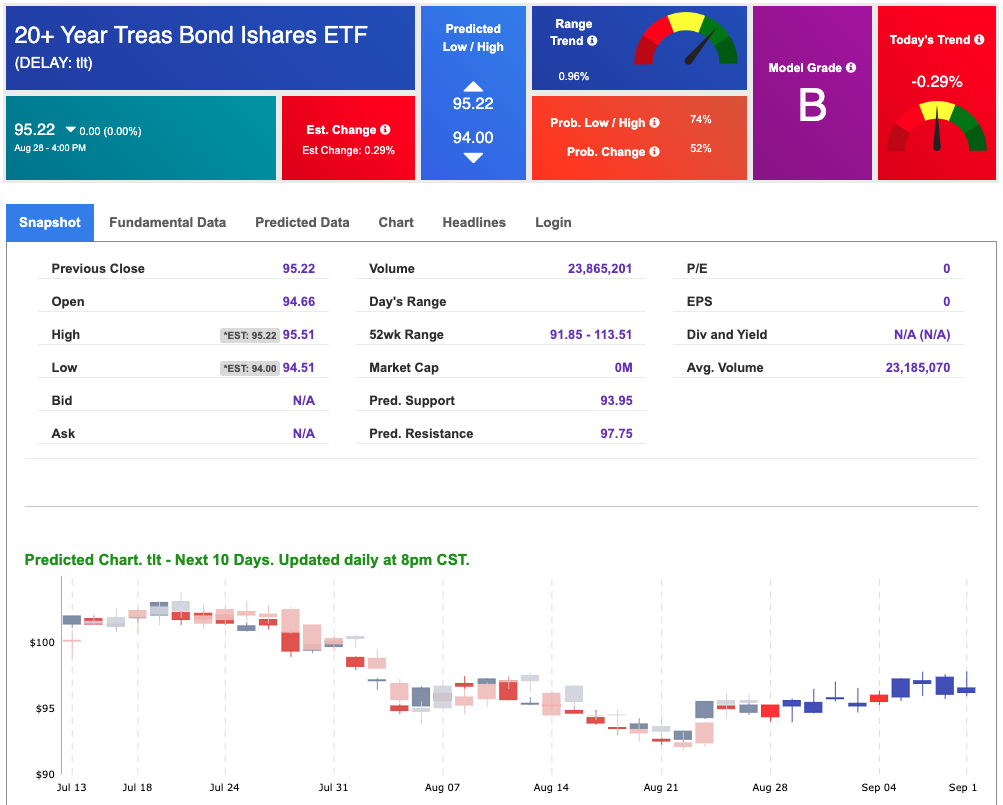

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $15.08, down 3.83% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!