On a rather somber note, the U.S. stock market retreated on Thursday, closing with all three major indices in the red. This reversal followed a four-day winning streak and was fueled by a notable surge in Treasury yields. Investors were keeping a close eye on economic indicators, particularly the latest consumer price index (CPI) report, to gain insights into the state of the market.

According to the government’s most recent consumer price index report, consumer prices in the United States increased at a 3.7% annual pace in September, echoing the rate set in August. This persistent climb was primarily driven by robust pricing in shelter and other services. On a month-over-month basis, the headline index rose 0.4%, slightly surpassing expectations but falling short of August’s remarkable 0.6% surge.

For the core index, which strips out volatile food and energy prices, the story was more reassuring. Core prices in September maintained a steady pace, climbing 0.3%, the same as the previous month, and slowing down to a 4.1% annual rate from August’s 4.3%. This may come as welcome news to the Federal Reserve, signaling that their efforts to curb inflation through measures like raising the federal funds rate are having a noticeable impact. Rising bond yields and tightening financial conditions have further contributed to this slowdown.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

As earnings season takes center stage, one of the standout performers in the Dow was Walgreens Boots Alliance, despite releasing a somewhat disappointing report. Delta Air Lines also provided a positive outlook, although it failed to lift the stock’s performance. The spotlight now shifts to major banks, with Citigroup, Wells Fargo, and JPMorgan Chase set to report earnings, along with UnitedHealth Group. These reports will undoubtedly influence market sentiment.

The spike in Treasury yields has put considerable pressure on stock markets. The 10-year Treasury yield surged to 4.7%, while the 30-year note rose to 4.858%. These rising yields have kept investors on their toes, raising concerns about their implications on equities.

In the energy sector, U.S. crude futures experienced a third consecutive session of decline, finishing down 0.7% at $82.91. The drop followed a weekly report from the Energy Information Administration (EIA), which indicated increased U.S. exports, production, fuel demand, and refinery activity. These signs collectively point towards a loosening of the previously tight and price-supportive U.S. oil market.

Continuing strikes across various industries, particularly those edging closer to the Big Three automakers in Michigan, are raising concerns about their potential to increase inflation pressures. Moreover, this situation could impact political dynamics, possibly leading to changes in leadership, such as the ousting of the Speaker of the House.

Interest rates remain in the spotlight, with a growing concern that they might overshoot their anticipated levels. Weak demand for U.S. Treasuries, especially from Japan and China, could result in interest rates continuing to rise. Insufficient demand for treasuries has the potential to drive prices down, pushing yields higher and placing added pressure on equity valuations.

The DXY (U.S. Dollar Index) continues its rally, with longer-dated treasuries experiencing a vertical surge as they retest October highs in yield. The 10-year yield has reached levels not seen since the Global Financial Crisis (GFC), leading to speculations in the market. Most market participants expect lower yields in the first half of 2024, but if this scenario doesn’t materialize, it could mean that inflation remains elevated for an extended period, and interest rates might not see a decline until the second half of 2025. These factors are currently not fully factored into the market evaluations.

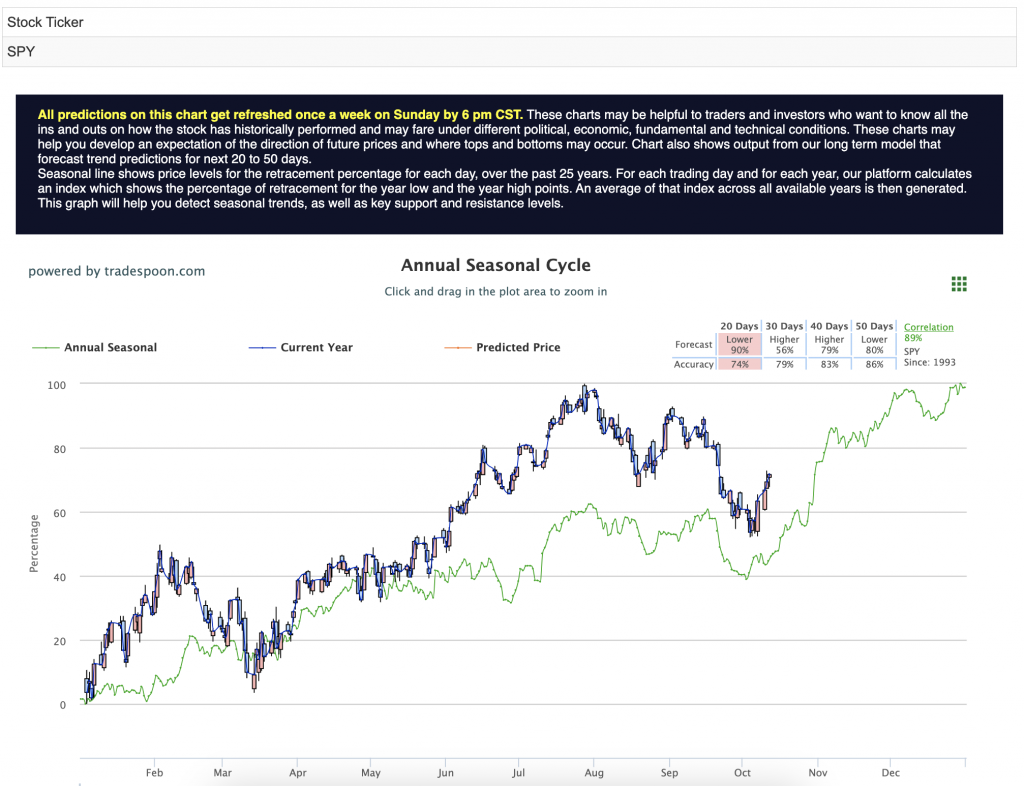

In terms of sectoral performance, Europe, small-cap stocks, technology, cyclicals, and regional banks continue to exhibit weakness. The technology sector and the S&P 500 ($SPY) have started to show signs of breaking down as they contend for the 50-day moving average. This comes amid the backdrop of a multi-month rally for the U.S. Dollar Index ($DXY), highlighting the ongoing market challenges and the need for a careful approach to investment decisions. For reference, the SPY Seasonal Chart is shown below:

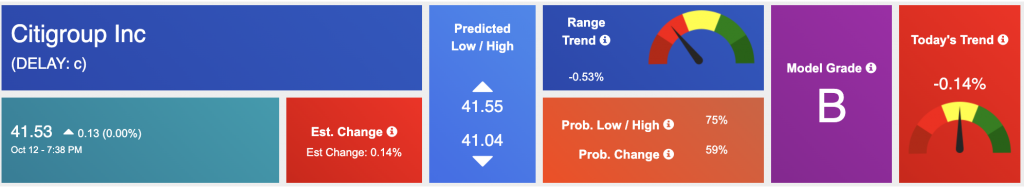

In the midst of shifting market dynamics, the banking sector has found itself at a critical juncture. Two major players that deserve close attention are Citigroup Inc. ($C) and JPMorgan Chase & Co. ($JPM). As we await their upcoming earnings results, it’s worth diving into these financial giants to understand why it may be a promising time to consider investments in the banking industry.

Citigroup Inc. ($C) is no stranger to the complexities of the global financial landscape. In the face of rising Treasury yields and inflationary concerns, Citigroup stands as a well-established financial institution with a rich history spanning more than two centuries. Its global presence and diversified range of services make it a significant player in the banking arena.

As we approach Citigroup’s earnings report, the financial community will be keen to see how the bank has weathered recent economic turbulence. In the context of the ongoing push-pull between inflation and rate hikes, Citigroup’s performance could provide valuable insights into how banks are adapting to this evolving environment.

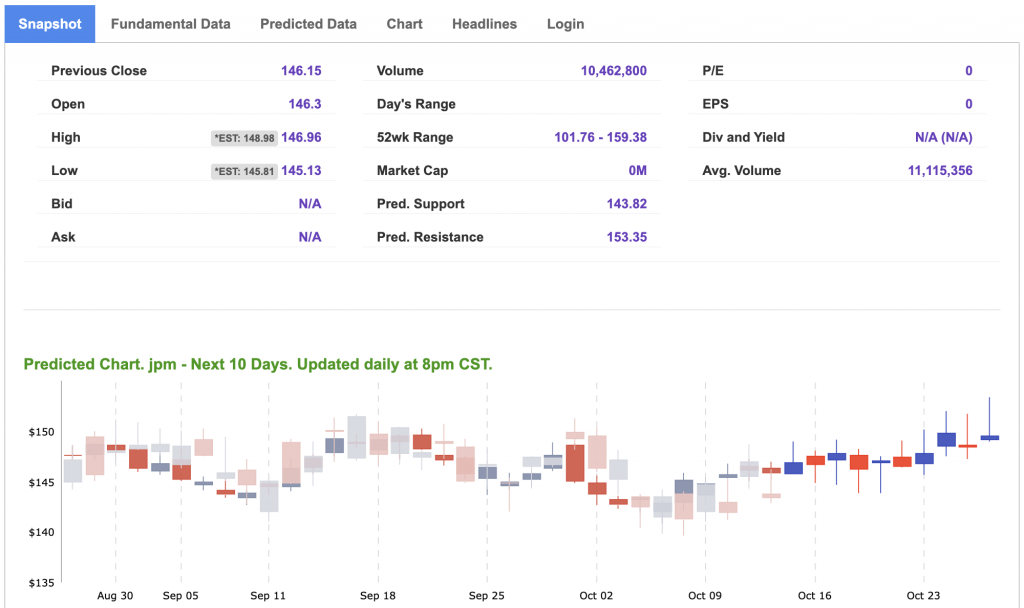

JPMorgan Chase & Co. ($JPM) stands as one of the largest and most influential banks globally. With a strong focus on innovation and adaptability, this banking behemoth has consistently demonstrated resilience in navigating economic fluctuations.

The forthcoming earnings release from JPMorgan Chase is sure to capture the attention of investors. The results may shed light on how well a banking giant can maneuver amid rising interest rates and concerns about inflation. It will also provide a glimpse into the broader economic landscape, as the bank’s diversified portfolio gives it an extensive view of various sectors and industries.

Amid the market uncertainties outlined in the preceding sections, investing in banks could be an astute decision – and as seen above our A.I. agrees! Likewise, there are several factors that fall in line with our A.I. forecast:

While market conditions remain fluid and challenges persist, it’s important for investors to consider the stability and adaptability of major banking institutions when making investment decisions. The earnings reports from Citigroup Inc. and JPMorgan Chase & Co. could provide valuable insights into the banking sector’s ability to endure and thrive in the current financial landscape.

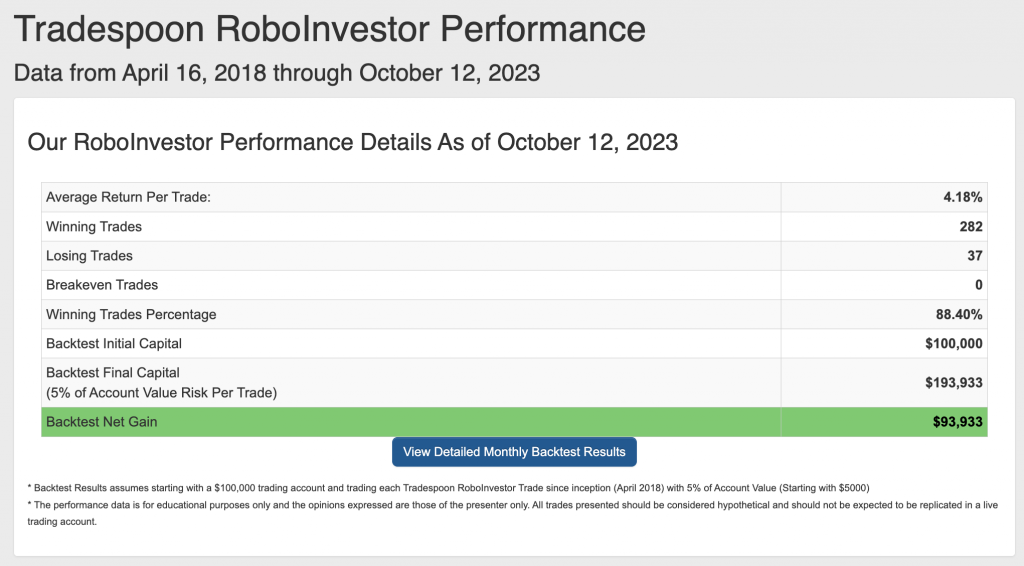

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.40% going back to April 2018.

As we enter Q4, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!