In the unfolding chapters of this trading week, the market saw the Dow and S&P booking marginal declines, while the NASDAQ managed a subtle ascent. Initial attention on earnings swiftly pivoted to anticipation for Thursday’s release of the Federal Reserve’s core personal consumption expenditures (PCE) index for October—a pivotal instrument in the ongoing tussle against inflation.

October’s narrative unfolded with an unexpected twist—new home sales faced a dip, a subplot hinting at the impact of rising mortgage rates. In the corporate theater, Nvidia (NVDA) emerged as a protagonist, rebounding from a 3% Friday setback attributed to a delay in launching an artificial intelligence chip for China. Despite solid earnings, NVDA experienced a 4% decline, reflecting the current overbought conditions and injecting suspense into the storyline.

Midweek marked the unveiling of the Fed’s Beige Book—a literary masterpiece providing a panoramic view of economic conditions across the nation. The Beige Book’s narrative skillfully painted a picture of a broad softening in the labor market, with characters throughout the country reporting flat to modest employment growth. This nuanced storytelling illuminated the challenges faced by various sectors, offering readers a real-time perspective on the unfolding economic landscape.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Beige Book’s revelation of the economy cooling adds depth to the plot, supporting bets on softer monetary policy. The odds of a rate cut by March, equal to the odds of another hold, reveal the Fed’s cautious approach amid concerns about economic growth. Six of the 12 Fed regional banks reported slight declines in economic activity, while two were described as “flat to slightly down,” further emphasizing the nuanced challenges faced in different regions.

The economic slowdown, portrayed vividly in the Beige Book, extended its influence to hiring dynamics, indicating potential hurdles for employment growth. Slower economic growth and reduced demand for workers contributed to easing inflationary pressures—a complex narrative that the Beige Book described as “largely moderated” across the country. Yet, the lingering rate of inflation above 3% suggests a storyline demanding careful consideration.

The Beige Book, a literary exploration of economic conditions, unravels a nuanced narrative with implications for monetary policy and the broader economic landscape. As market participants immerse themselves in this literary masterpiece, it adds depth to the ongoing conversation about interest rates, inflation, and economic growth, shaping the market sentiment in the coming weeks.

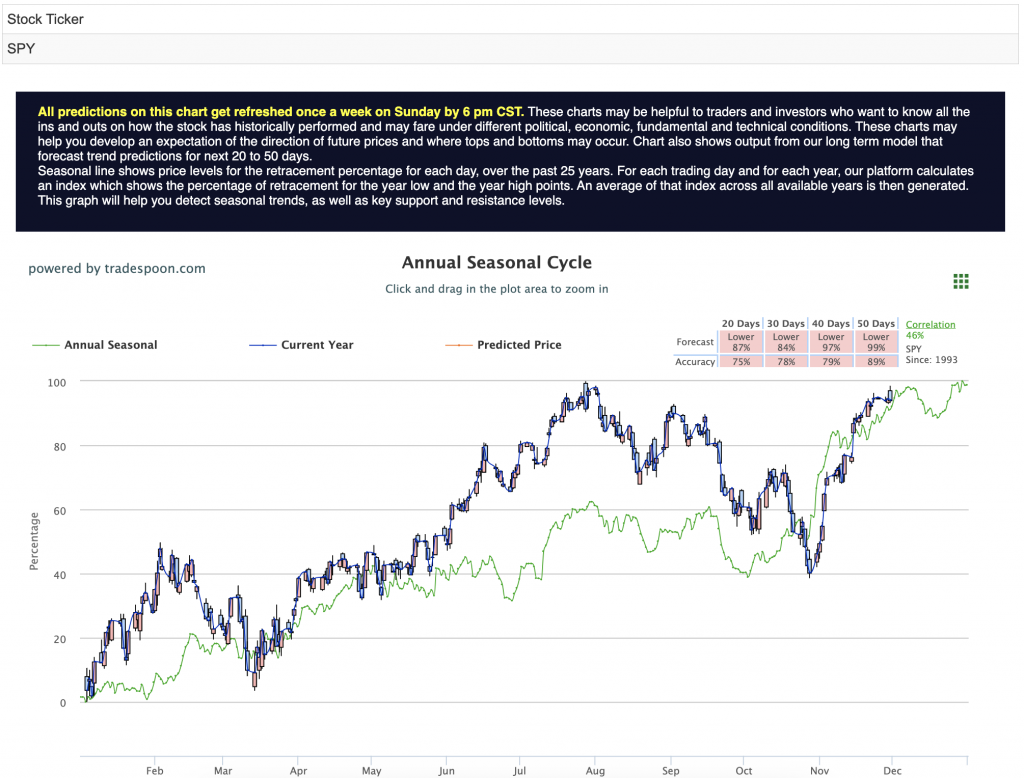

Approaching the SPY rally cautiously, there’s a noted cap at $450-470, with short-term support anticipated between 400-430 for the coming months. While expectations include patterns of higher highs and higher lows, there’s a prevailing sentiment that the rally’s peak may have passed. For reference, the SPY Seasonal Chart is shown below:

The energy sector takes a spotlight with a significant pullback, testing the 200-day moving average due to weakened global demand and reduced geopolitical risks—for now. This prompts questions about the duration and depth of the energy narrative shift.

In the search for a market catalyst, attention turns to individual stock movements like $NVDA and broader macroeconomic data. The first two weeks of December promise key economic indicators, including CPI, PPI, unemployment figures, and a significant Powell appearance—a storyline that may shape market trends. Short-term pullbacks are expected, but the narrative suggests a continuation of higher highs and higher lows into the next year.

The adoption of a market-neutral stance reflects nuanced economic data analysis. Each participant becomes a storyteller in the unfolding saga, contributing perspectives. Whether the markets continue upward or encounter new challenges remains an open question, awaiting insights from economic data and market reactions.

Amidst mixed earnings reports and economic challenges, market participants hold an optimistic outlook, driven by Fed signals of lower inflation and anticipation of a supportive macroeconomic environment. The Beige Book’s rich insights into the multifaceted nature of the economy contribute to the ongoing narrative shaping financial markets—a narrative that continues to evolve with each economic twist and turn. With this, I believe I discovered my next RoboStreet symbol, something I will be looking into for the upcoming week.

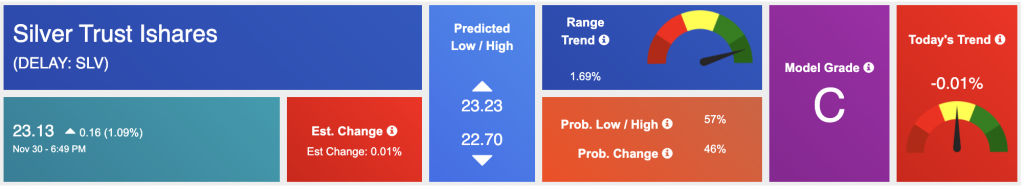

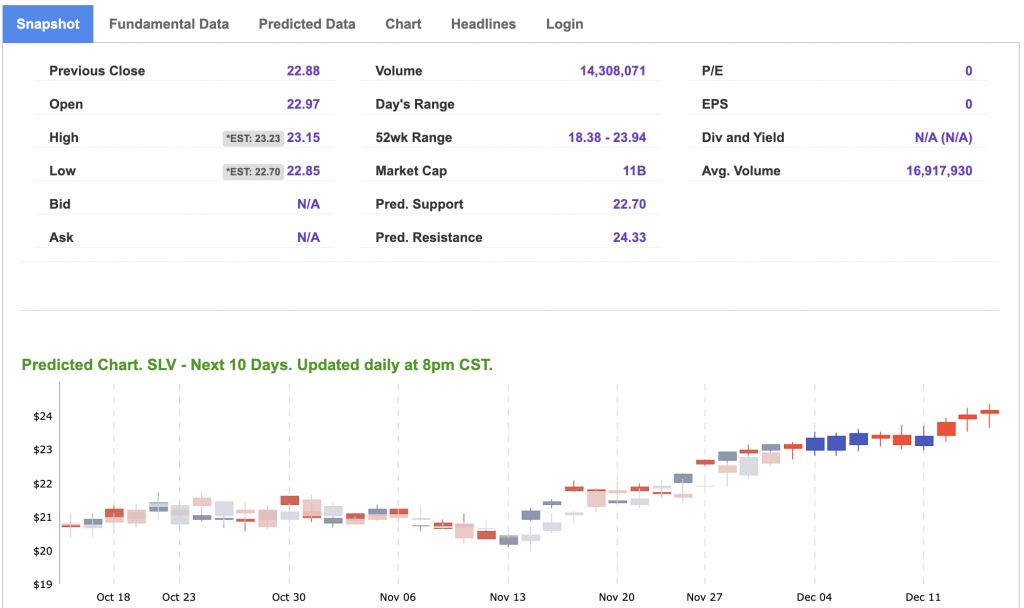

The iShares Silver Trust (SLV) provides a straightforward way to gain exposure to silver, reflecting the performance of the silver market.

Silver, often referred to as the “poor man’s gold,” has historically been a valuable asset, appreciated for both its industrial applications and its status as a precious metal. As geopolitical and economic uncertainties cast shadows on traditional investment avenues, silver becomes a beacon of opportunity.

Amid a market-neutral stance and cautious optimism, silver stands out for its dual role as a precious metal and an industrial commodity. The metal often thrives during economic recoveries, benefitting from increased industrial demand while maintaining its allure as a safe-haven asset in times of uncertainty.

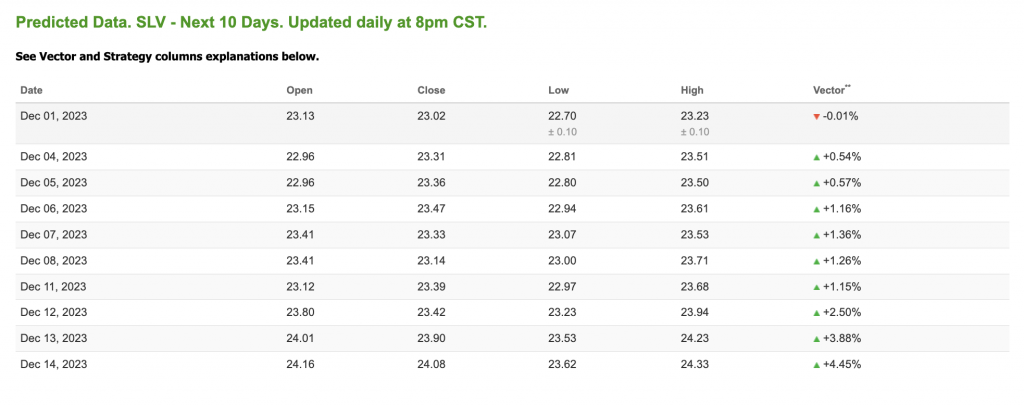

In this context, my Stock Forecast Toolbox is revealing positive signs for SLV, underlining a potential opportunity for investors. The toolbox, equipped with data-driven insights, indicates favorable conditions for silver investments, aligning with the current market narrative. Just take a look at the 10-day predicted data for SLV:

The forecast toolbox’s analysis, combined with the cautious optimism in the market-neutral stance, suggests that silver, represented by SLV, could be an attractive addition to investment portfolios. As investors navigate the intricate market landscape, the allure of silver as a diversification tool and a potential hedge against market uncertainties becomes increasingly apparent.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

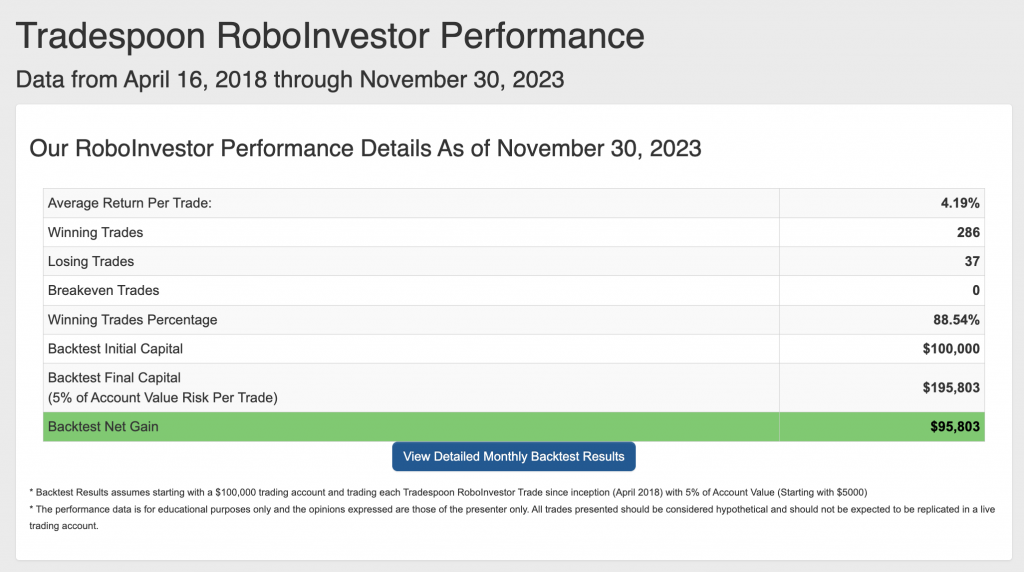

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.40% going back to April 2018.

As we enter Q4 comes to a close, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!