The stock market experienced a tumultuous day as stocks fell due to an unexpected jobs report and heightened tensions between the United States and China. In contrast, bond yields and the dollar saw an increase. Several market players, including Newmont, Catalent, Tesla, Tyson, and others, moved the market. Despite the uncertain circumstances, the stock market remains poised for a rally, despite potentially defying logic. Meanwhile, Bitcoin has seen a slight downturn as both gold and oil trade higher.

The January jobs report delivered a surprising increase of 517,000 new positions added to the U.S. economy, far surpassing the projected 185,000. This boost has led to a historically low unemployment rate of 3.4%, which hasn’t been seen since 1969. The positive news suggests a potential decline in inflation, however, the Federal Reserve has taken proactive measures by continuously raising interest rates in order to curb inflation and control economic activity. This move has caused some apprehension on Wall Street about the possibility of a coming recession. In turn, the two-year Treasury yield, which serves as an indicator for the federal funds rate, has risen to 4.42% from Friday’s close and from its previous level of 4.1% prior to the jobs report. This increase is driving up the 10-year yield, which has closely followed the trajectory of short-term yields, to above 3.6% from its previous level of below 3.4% earlier in the week.

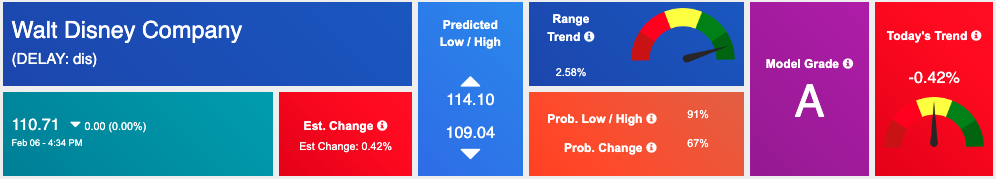

Following last Thursday’s Big Tech earnings that failed to satisfy investors, the next set of prominent company reports is slated for this week. On Monday, Take-Two Interactive Software and Tyson Foods will kick off these announcements, followed by BP, Chipotle Mexican Grill, and DuPont on Tuesday. Wednesday marks Walt Disney’s turn with CVS Health and Uber Technologies also delivering their financials on the same day. Don’t miss out – be sure to stay tuned!

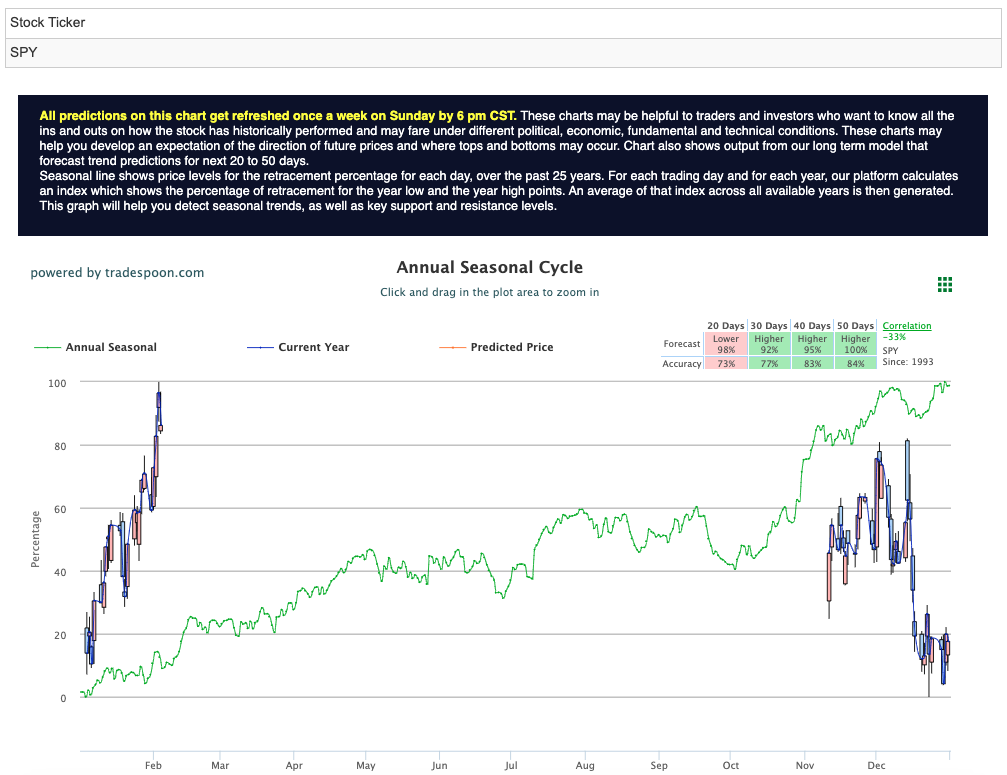

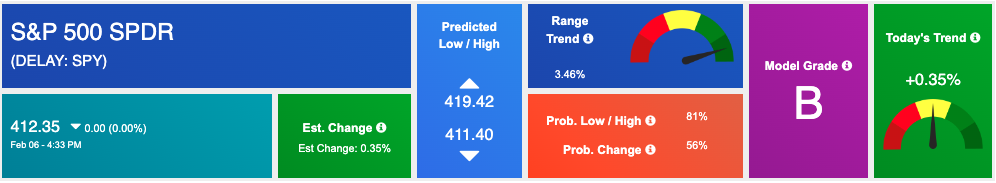

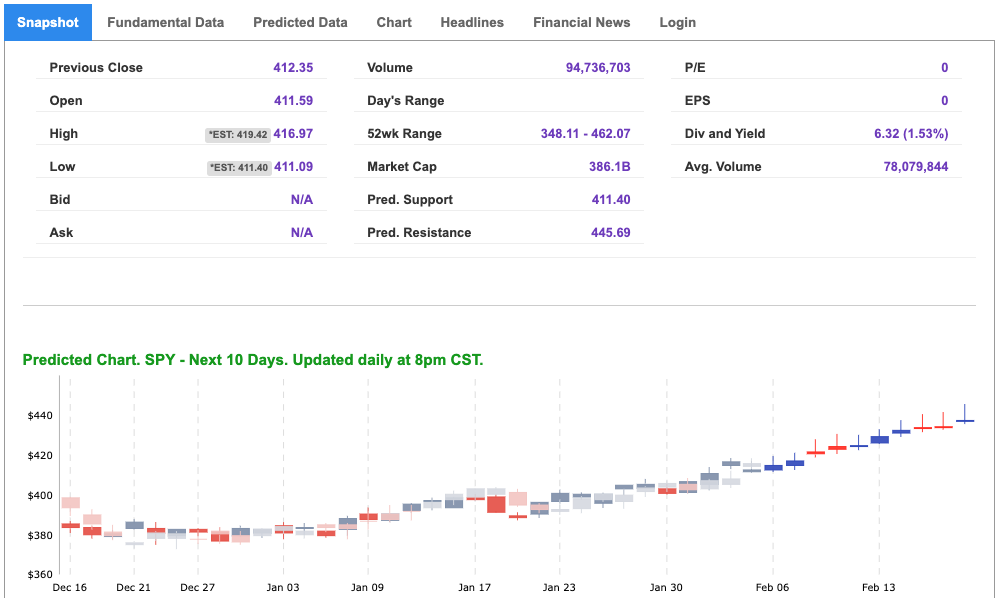

Globally, Asian markets traded with mixed results while European markets finished in the red. We are watching the overhead resistance levels in the SPY, which are presently at $420 and then $430. The $SPY support is at $410 and then $402. We expect the market to trade sideways for the next 2-8 weeks. We would be MARKET NEUTRAL ON THE MARKET at this time and encourage subscribers to hedge their positions. Market commentary readers should maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

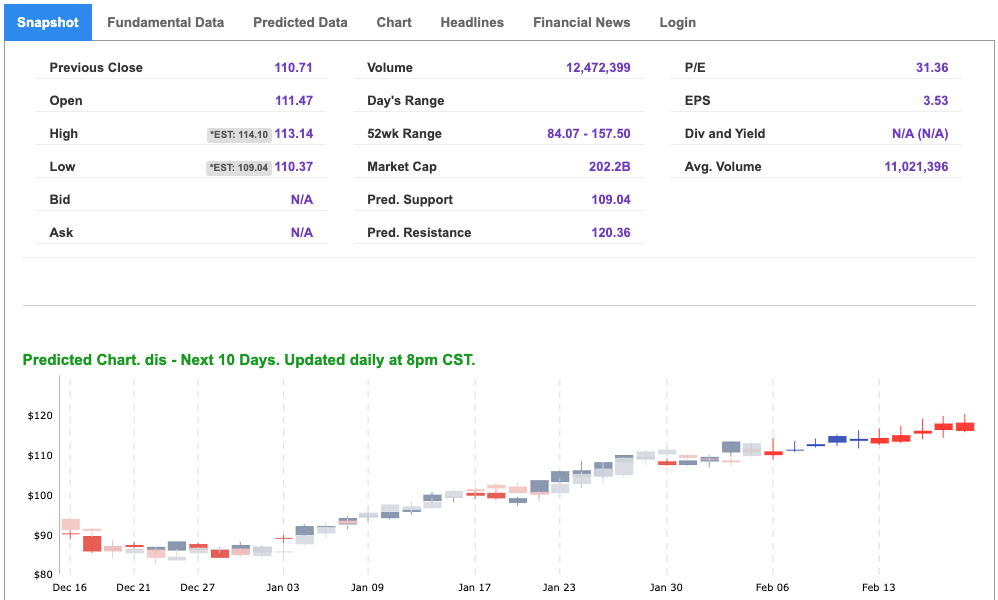

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, dis. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $74.45 per barrel, up 1.44%, at the time of publication.

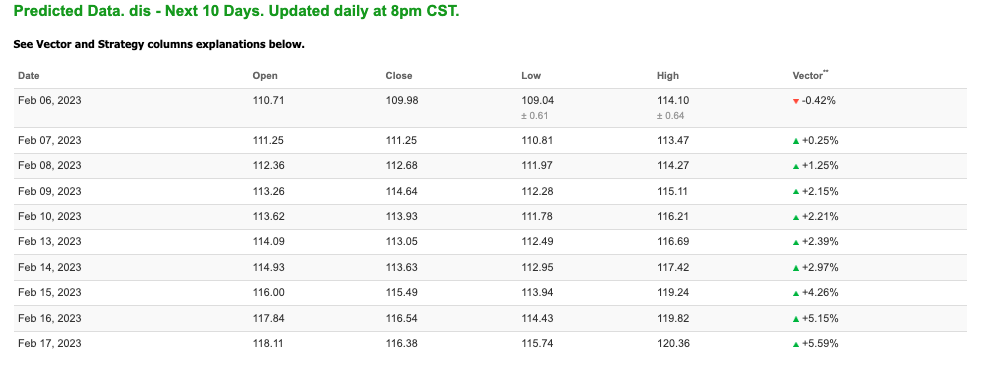

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $64.4 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The price for the Gold Continuous Contract (GC00) is up 0.19% at $1880.20 at the time of publication.

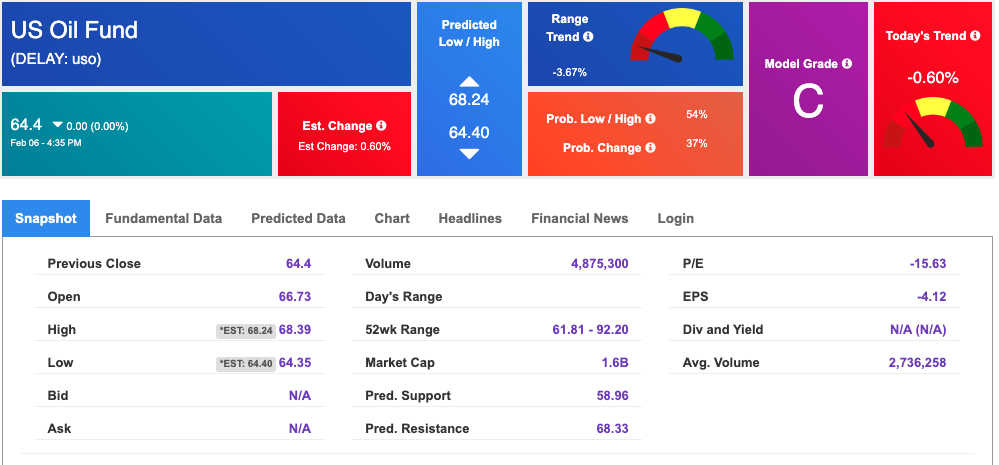

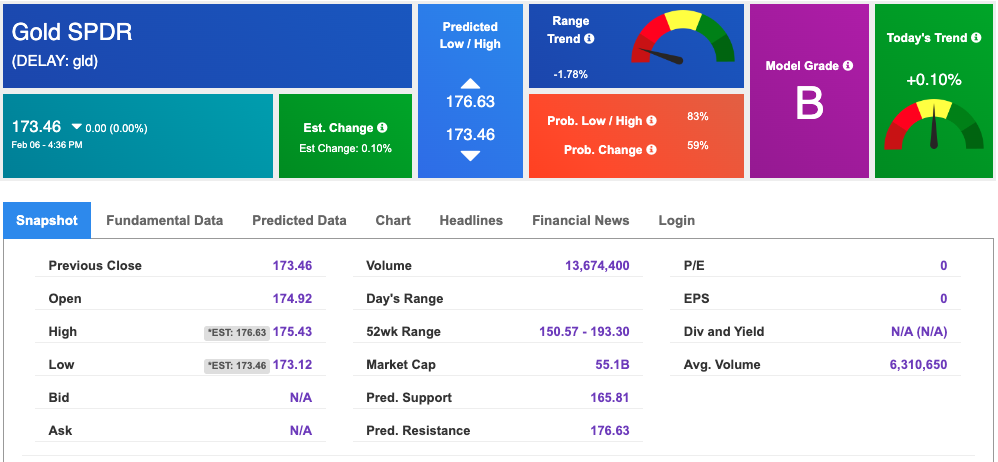

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $173.46 at the time of publication. Vector signals show +0.10% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is up at 3.645% at the time of publication.

The yield on the 30-year Treasury note is up at 3.677% at the time of publication.

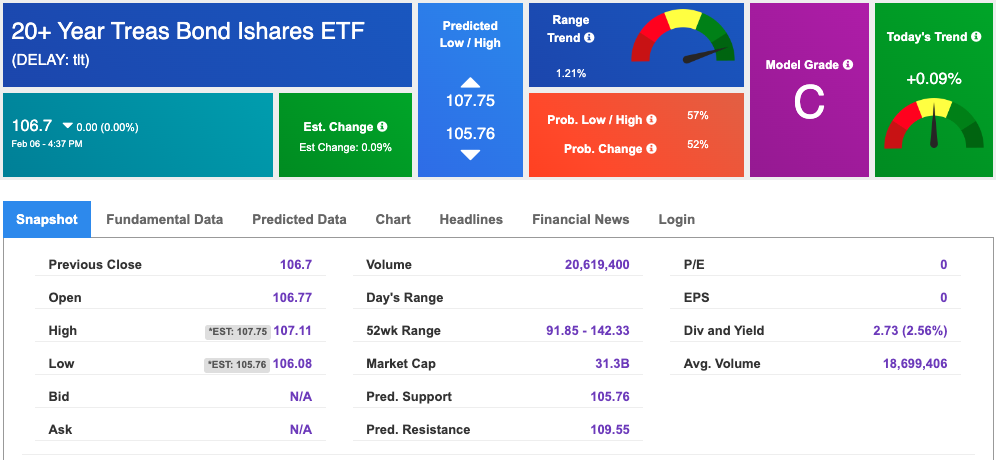

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

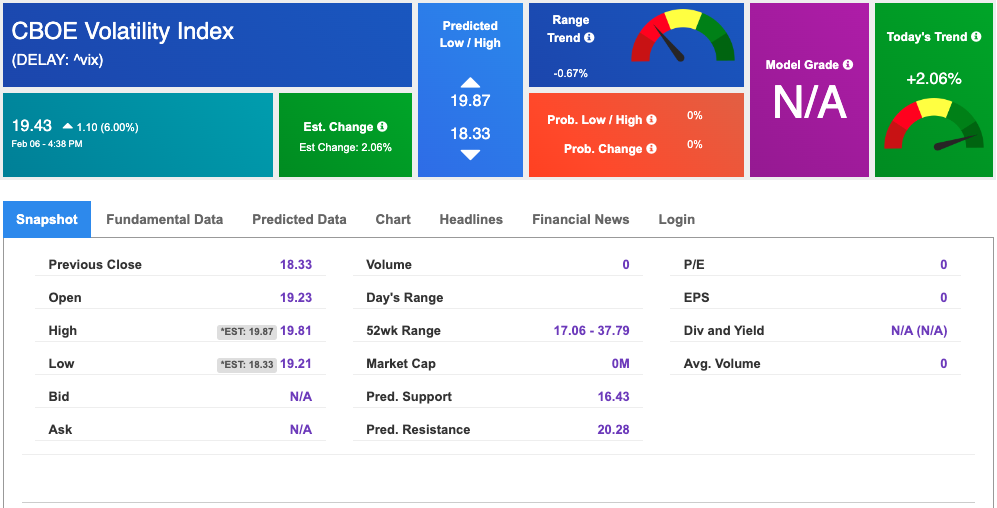

The CBOE Volatility Index (^VIX) is $19.43 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!