Inflation is an economic phenomenon characterized by a rise in the overall price level of goods and services over time, resulting in a decrease in the purchasing power of currency and increased living costs. The stock market is significantly impacted by inflation, necessitating investors’ ability to navigate through it for optimal investment outcomes. In this article, we will delve into the effects of inflation on the stock market and discuss the best types of stocks to invest in during inflationary periods.

During inflation, the prices of goods and services increase, which can lead to higher costs for companies. This, in turn, can impact their profit margins, resulting in reduced earnings per share (EPS) and lower stock prices. However, not all stocks are affected equally by inflation. Some stocks thrive and even benefit from inflationary periods. For instance, companies in the commodities sector, such as oil and gas enterprises, tend to profit from rising prices as they can sell their products at higher rates, leading to increased profits.

Investing during inflationary periods can be challenging but also presents opportunities for significant gains. Investors must be aware of stock types that tend to perform well during inflation and develop sound investment strategies to capitalize on these opportunities. This article will discuss the best stock types to invest in during inflation, provide tips and tricks for identifying inflation-proof stocks, and offer a list of the top stocks to consider in 2023 during inflationary periods.

Inflation, a persistent increase in the price of goods and services over time, can impact the stock market in various ways. Firstly, inflation can result in higher interest rates, making stocks less attractive to investors. Bonds and other fixed-income investments become more appealing due to the higher interest rates, as they offer guaranteed returns.

Secondly, inflation diminishes the purchasing power of money, leading to lower corporate profits. As production costs increase, companies may need to raise prices for their goods and services to maintain profit margins. This can result in decreased demand and profits, ultimately leading to lower stock prices.

Lastly, inflation can cause market volatility. As investors attempt to forecast the future direction of the economy, uncertainty and nervousness may increase, leading to heightened selling activity and market instability.

While inflation may concern investors, certain stocks tend to perform well during inflationary periods. These stocks are often referred to as inflation-resistant or inflation-proof stocks.

One way to identify these stocks is by seeking companies with pricing power. These are companies capable of passing increased costs to their customers, either through price increases or by reducing costs elsewhere in their operations. Examples of companies with pricing power include utilities, healthcare providers, and consumer staples companies.

Another approach is to identify inflation-resistant stocks by analyzing companies’ strong balance sheets. These are companies with low debt levels and substantial cash reserves, enabling them to weather economic downturns and sustain dividends during periods of high inflation. Large-cap technology companies and financial institutions often demonstrate strong balance sheets.

Additionally, investors may consider adding commodity-related stocks to their portfolios during high inflation periods. Commodity prices tend to rise during inflation, benefiting companies involved in their production or sale. Examples of commodity-related stocks include oil and gas companies, mining companies, and agricultural companies.

Overall, investors concerned about inflation should consider diversifying their portfolios with a mix of inflation-resistant stocks. Identifying companies with pricing power, strong balance sheets, and exposure to commodities can help protect portfolios from the negative effects of inflation.

Certain types of stocks tend to outperform others during inflationary periods. These stocks benefit from rising prices, as their revenue and earnings increase along with inflation. Here are some of the best types of stocks to consider for investment during inflation:

Investing in stocks resistant to inflation requires research and analysis. Consider the following tips to identify inflation-proof stocks:

In conclusion, investing during inflation presents challenges but also opportunities for smart investments. By understanding the impact of inflation on the stock market and selecting the appropriate stock types, investors can safeguard their portfolios and achieve favorable returns during inflationary periods.

It is important to note that no investment is completely immune to inflation. However, certain stocks historically perform better during inflation. Consumer staples, real estate, and healthcare stocks are examples of inflation-proof options for investors seeking to protect their portfolios against inflation.

Combining fundamental and technical analysis can assist in identifying stocks likely to benefit from inflation. Additionally, diversification and a long-term investment horizon should be considered.

Overall, investing in stocks during inflation requires diligence. By following the tips and tricks outlined in this article, conducting thorough research, and making informed decisions, investors can safeguard their portfolios, pursue financial goals, and navigate inflationary periods successfully.

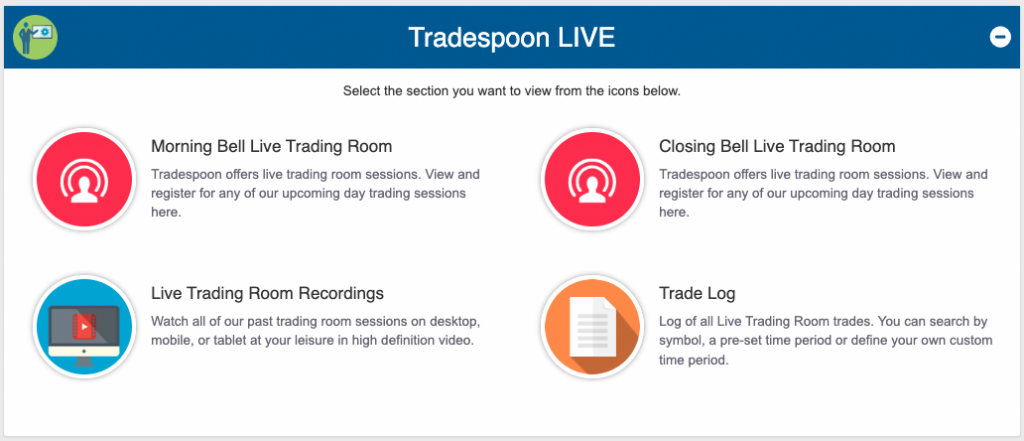

Every week, I review various trading and market aspects in my weekly videos, which include Market Briefs, Strategy Roundtables, and daily Live Trading Rooms, as well as in my Market Commentary and RoboStreet articles.

As the market remains volatile, I would like to make sure our readers understand how vital it is for them to connect with us through our Live Trading Room. Our AI platform will provide you with guidance when entering and exiting trades in the most optimal way possible. Don’t forget that signing up for this service comes at no cost! Therefore, I encourage everyone from Tradespoon’s community to join today and stay updated as they trade each day.

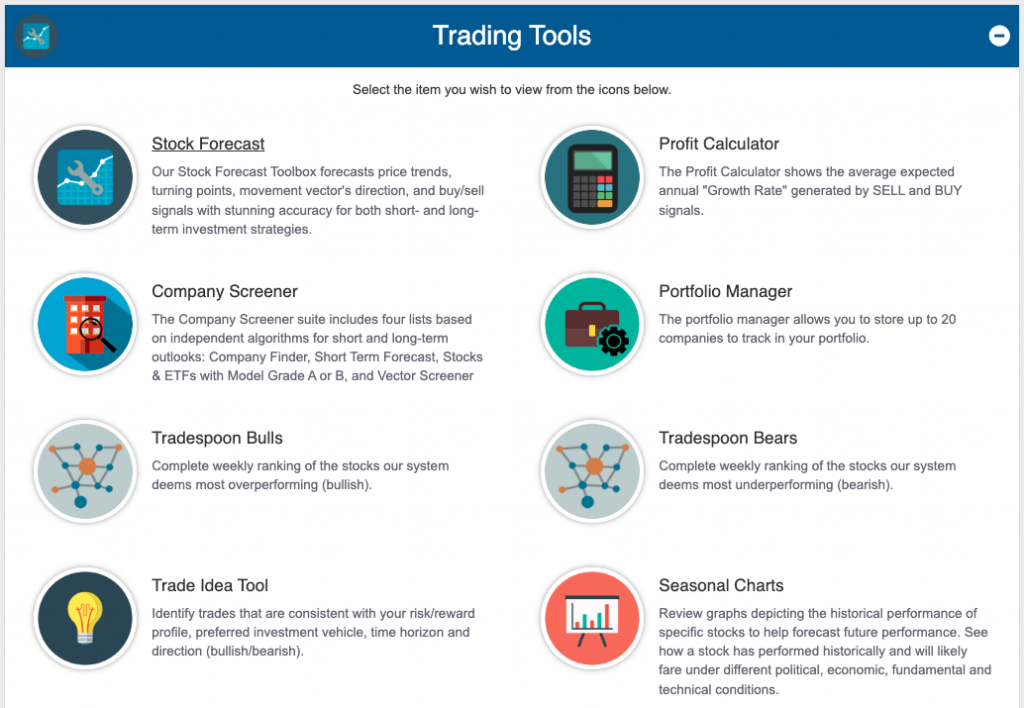

At Tradespoon, we take immense pride in our community and resources. We strive to provide retail traders with the necessary tools and guidance they need to succeed in their trading. One key feature of Tradespoon is its models and neural networks, which use artificial intelligence (A.I.) self-learning technology to power the platform. Traditional platforms base their trading decisions on historical data and mathematical formulas, but Tradespoon uses its algorithms to spot profitable trends. And the Tradespoon community comes together to take advantage of them, create a discourse, and provide analysis.

Being part of our Tradespoon trading community is immensely advantageous; here, you can exchange multiple tactics with fellow traders. During my recent Strategy Roundtable session (which is held weekly on Tradespoon), we did just that! This opportunity to collaborate and learn from others in the world of trading should not be passed up. I recommend checking out our latest Roundtable webinar in its entirety below:

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!