Unleashing the potential of options trading can be a rewarding way to invest your finances; however, it is critical to understand the basics before doing so. In this piece, we will provide valuable insight into how you can trade options competently and safely while maximizing profits. At Tradespoon, we offer a unique trading experience and provide a range of resources to help you learn and advance your trading skills.

Options are contracts that give buyers the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a specific date. The underlying asset can be anything from stocks, commodities, currencies, or indices. Buyers of options pay a premium to sellers for this right. There are two types of options available: call options and put options.

Call options give buyers the right to buy the underlying asset at a specific price, known as the strike price, on or before the expiration date. Put options, on the other hand, give buyers the right to sell the underlying asset at a specific price on or before the expiration date.

Two types of options contracts are available: American style and European style. American options can be exercised anytime before the expiration date, while European options can only be exercised on the expiration date.

Options can also be classified as in-the-money, at-the-money, or out-of-the-money. In-the-money options have intrinsic value, meaning the option has immediate value if it were to expire today. At-the-money options have no intrinsic value but may still have value if the underlying asset price moves before expiration. Out-of-the-money options have no intrinsic value and will expire worthless if the underlying asset price does not move before expiration.

Options work by providing buyers with the right to buy or sell the underlying asset at a specific price. Buyers of options pay premiums to sellers, who are obligated to fulfill the terms of the contract should buyers choose to exercise their options. If the option expires worthless, then the seller keeps the premium and the buyer loses their investment.

Options trading can offer high rewards for investors, but it also carries significant risks. The potential reward of options trading is that one can make large profits with a relatively small investment. However, the risk is that options trading can also result in significant losses.

The biggest risk of options trading is the possibility of losing your entire investment. If the underlying asset price does not move in the direction you predicted, your option may expire worthless, and you will lose your investment. Another risk is the potential for significant price fluctuations, which can cause the option’s value to increase or decrease rapidly.

Studying and practicing are the best ways to learn how to trade options. At Tradespoon, we offer a wide range of online resources to help you learn about options trading, including guides, videos, and live webinars.

Before buying or selling options, it’s important to:

In conclusion, at Tradespoon, we provide a unique trading experience designed to help you learn and advance your trading skills. We offer a range of resources, including our AI trading program and experienced traders’ insights, to help you become a successful options trader.

Comments Off on

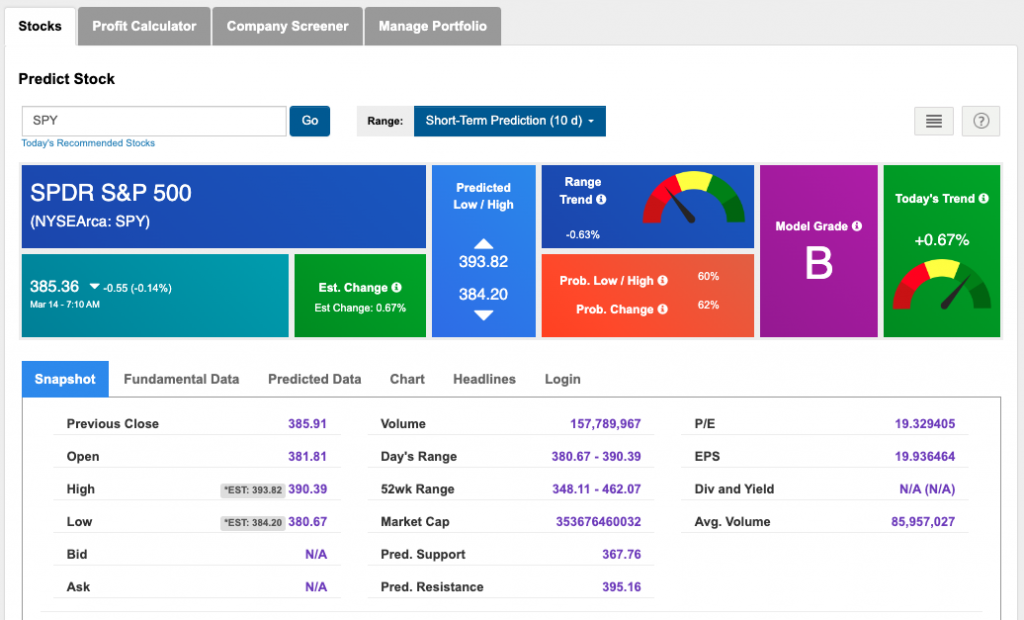

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!