On Thursday, all three major US indices showed a positive trend as the shares of regional banks stabilized after a week of tumultuous trading following the collapse of Silicon Valley Bank. The Dow Jones Industrial Average rose by 0.4%, the S&P 500 was up by 0.9%, and the Nasdaq Composite jumped by 1.6%. However, concerns about the impact of higher interest rates on the banking sector have market watchers adjusting their expectations for the future path of monetary policy. Also today, the European Central Bank raised interest rates by half a point to 3.5% at its monetary-policy meeting, following a half-point lift in February.

Looking at major banks, JP Morgan Chase (JPM) and Morgan Stanley (MS) are said to be in talks about a possible deal with struggling bank First Republic (FRC) that may involve an influx of capital. This comes after First Republic shares were down 28% on Thursday, falling 21% in Wednesday’s session. Credit Suisse (CS) announced that it will borrow up to 50 billion Swiss francs from the Swiss central bank after plunging to all-time lows on Wednesday when its top shareholder said it would not invest more money. Credit Suisse’s stock gained 17.5% in Switzerland, while its American depositary receipts rose by 2.1%. Likewise, Goldman Sachs lowered its U.S. annual growth forecast for the fourth quarter of 2023 by 0.3 percentage points to 1.2%. This was attributed to a likely tightening of lending by small and medium-sized banks.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Key economic reports continue to dictate the market this week. The Labor Department disclosed that initial jobless claims fell to 192,000 for the week ended March 11, a downturn from the revised 212,000 reported the previous week, while economists surveyed by FactSet had expected claims to fall to 206,500. Housing starts rose 9.8% to a seasonally adjusted annual rate of about 1.45 million in February from a month earlier, exceeding economists’ anticipated 0.45% lift.

Retail sales tumbled in February, falling by 0.4% compared to expectations of a 0.1% decline. The pullbacks in spending were seen across various categories, including a 4% decline in department store sales, a 2.5% fall in furniture store sales, a 2.2% decrease in food services, and a 1.8% decline in motor vehicle and parts dealers.

Overall, the developments have major implications for the Federal Reserve, which has lifted interest rates eight times in an effort to slow down the economy and battle historically high inflation. Concerns surrounding the banking sector and a fall in retail sales indicate a potential slowdown in the economy and the potential for a recession, which would likely prompt the Federal Reserve to pause its increasing interest rates.

The recent movements in the financial markets have been quite volatile and unpredictable. In the past few sessions, the DXY has been strengthening, while the 2-year yield has been dropping at an unprecedented rate, comparable only to Black Monday in Oct 1987. There is still a disconnect between the bond market, currency market, and equity market, and it remains to be seen whether the stock market will follow the precipitous drop in the 2-year yield or vice versa.

With this in mind, I have identified a symbol that I believe has a good path forward; however, before we commit, let’s further break down the latest market conditions.

My current outlook remains bearish with potential for a relief rally as we’ve seen today. I’m in the hard landing camp, the market will likely not fight against the high-interest rates set by the Fed and the historically high US Dollar. While it is expected for bulls to hold on to December lows in the next few weeks, there is a high probability that we will test and break 52-week lows in the coming months, especially as we approach earnings season.

The SPY rally is expected to be capped at $404-424 levels, and short support is likely to be $375-$350 for the next few months. The $VIX is trading near the $30 level. The $FDX, and $LEN earnings this week – as well as liquidity issues in regional and global banks and PPI data – have influenced the next move in the market.

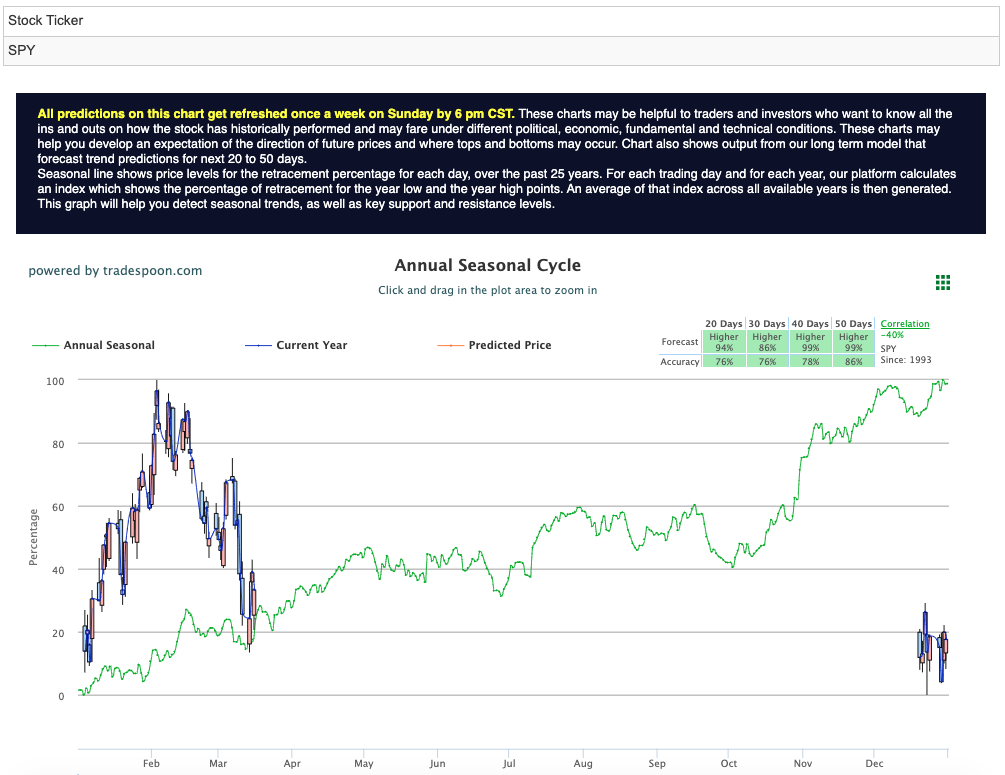

I am watching the overhead resistance levels in the SPY, which are presently at $392 and then $402. The $SPY support is at $380 and then $372. Vlad expects the market to trade sideways for the next 2-8 weeks. He would be BEARISH ON THE MARKET at this time and encourages subscribers to hedge their positions. See $SPY Seasonal Chart:

The ECB and Fed are expected to speak next week, which will set the tone for the rest of the year. The current economic landscape has made Jerome Powell’s job one of the hardest in the world, as he is stuck between stubborn inflation, CPI data, and unemployment on one hand, and the possibility of another financial collapse similar to 2008 on the other.

It is worth giving credit to the current administration for quickly stepping in and bailing out depositors of banks despite the levels of deposits. However, Powell will need to provide a safety zone by coming to the markets and saying that the Fed is ready to provide any type of liquidity and start aggressive quantitative easing. If there are no buyers for the banks, who are holding billions of assets and uncertainty will push the market down. As of right now, there is still a 70% chance that the Fed will raise 25 bp next week, and if it does, the market is likely to sell off on this news.

Futures data already points to a high probability of a 50 bp rate drop in Europe and the US, and markets are not factoring this in yet. There is still a disconnect between the bond market and equity market, where the 2-year yield and 10-year bond yield (Germany) are breaking to a decade high, while semiconductors are trading at a 52-week high.

Going into summer, it would be best to be market bearish until the next earnings season starts at the end of April and May. Equity markets are likely to be volatile, and the best-case scenario is that the market reaches the bottom in the first half of the year. This is because SP500 revenue numbers are most likely going to be revised down, which is not yet factored into the current market levels.

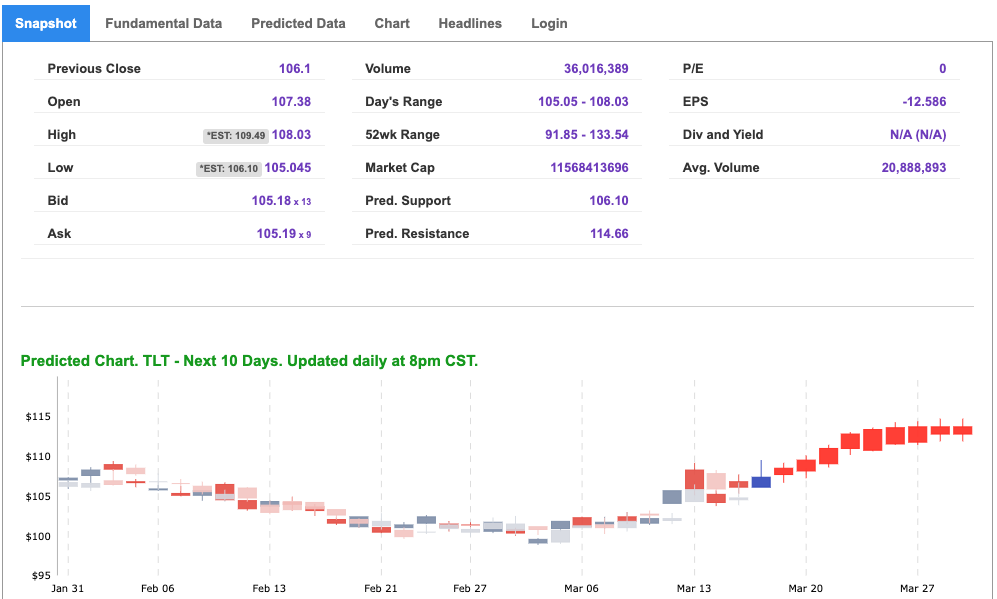

Keeping this in mind, I believe treasuries could see some bounce back in the coming days.

iShares 20+ Year Treasury Bond ETF (TLT) is an exchange-traded fund that tracks the investment results of an index made up of U.S. Treasury bonds with remaining maturities of 20 years or more. The fund seeks to provide investors with exposure to the longer-term segment of the U.S. Treasury bond market, which is typically less volatile than shorter-term Treasury bonds. TLT is managed by BlackRock, which is one of the largest asset management firms in the world. As of September 2021, TLT had total assets of over $17 billion and a dividend yield of approximately 1.5%.

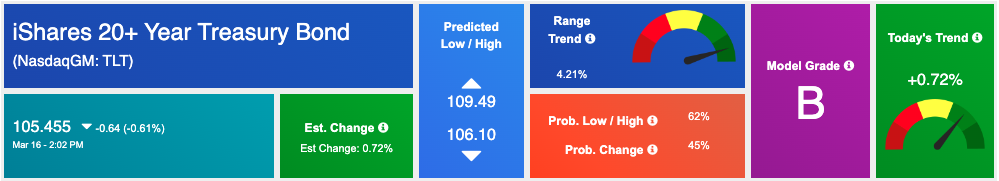

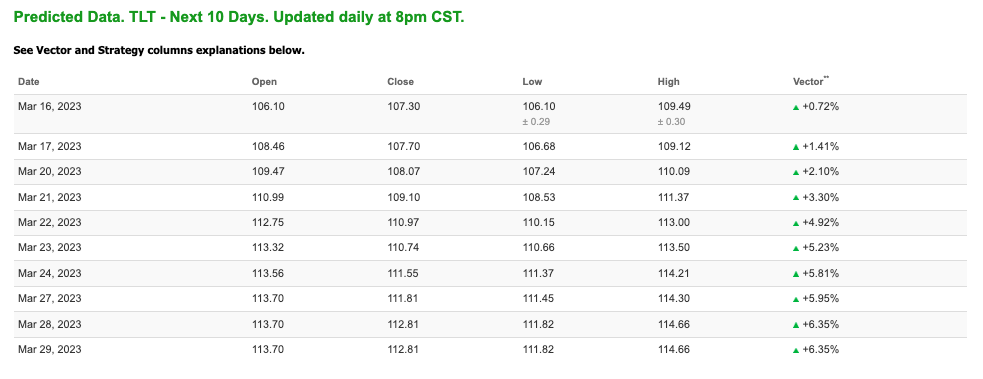

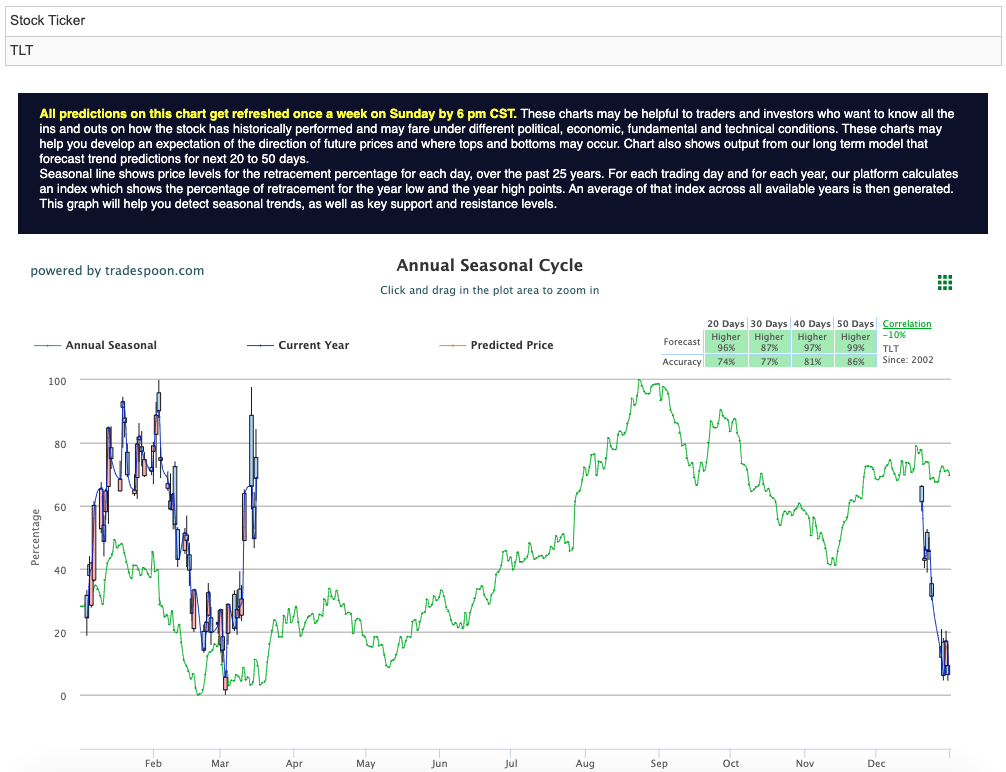

Looking at the 10-day forecast, TLT is showing an impressive vector score as well as trends and sports a model grade of “B” – indicating it is in the top 25% of accuracy within our data universe. Likewise, the one-directional trend towards the upside is what I look for in symbols that I believe have a good path up with an accurate forecast.

Furthermore, there is one additional strong forecast providing confidence in the symbol. Looking at the seasonal chart — our premier tool for long-term forecasts — TLT is showing a strong forecast for the symbol to trade higher. All four-time frames are pointing toward the upside, with strong accuracy scores for each time period. See $TLT Seasonal Chart:

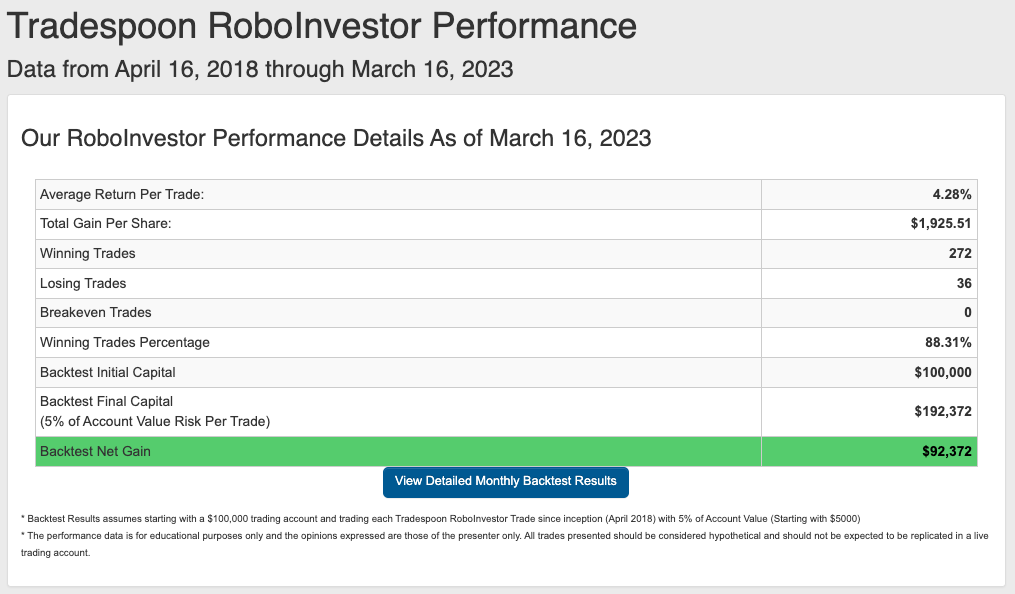

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!