On Wednesday, the Dow and S&P 500 closed lower while the Nasdaq Composite finished in the green, with gains driven by strong tech earnings. The Nasdaq improved on tech earnings, while the broader market sold off, indicating a shift towards sector-specific performance. Results from Meta, Microsoft, and Alphabet set an upbeat tone for the tech sector, which is seeing strong growth amid the ongoing pandemic.

Microsoft’s stock rose by 7.2% as the tech giant’s cloud revenue beat Wall Street estimates, and guidance for the current quarter came in better than expected. Alphabet also beat expectations on sales and earnings, and announced an increase to its stock buyback program, which is already worth tens of billions annually. That initially sent the stock soaring in after-hours trading on Tuesday, although the shares have since lowered.

The ongoing tech earnings season is ramping up, with Meta Platforms reporting after the close on Wednesday, and Amazon due to release results after the bell on Thursday. However, investors remained wary of First Republic Bank after it reported a huge drop in deposits, leading to a 30% drop in its shares on Wednesday, following a 49% drop on Tuesday.

Looking ahead, the market will be paying close attention to the Personal Consumption Expenditures (PCE) data, which is set to release on Friday. Additionally, the latest Federal Open Market Committee (FOMC) meeting is scheduled for next week, which could have significant implications for the market.

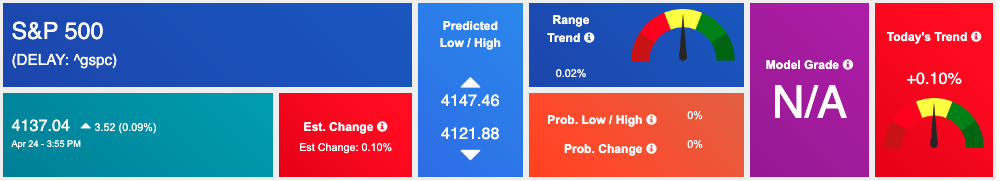

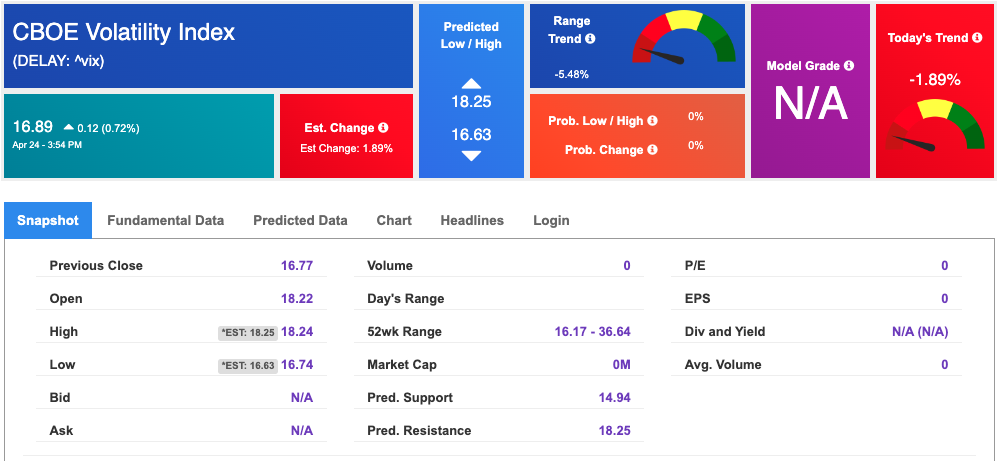

As we look over the current market conditions, we see that the $VIX is trading near the $17 level, indicating that volatility is relatively low at this time. However, the earnings of Microsoft, Alphabet, and General Electric this week, as well as GDP data, can influence the next move in the market.

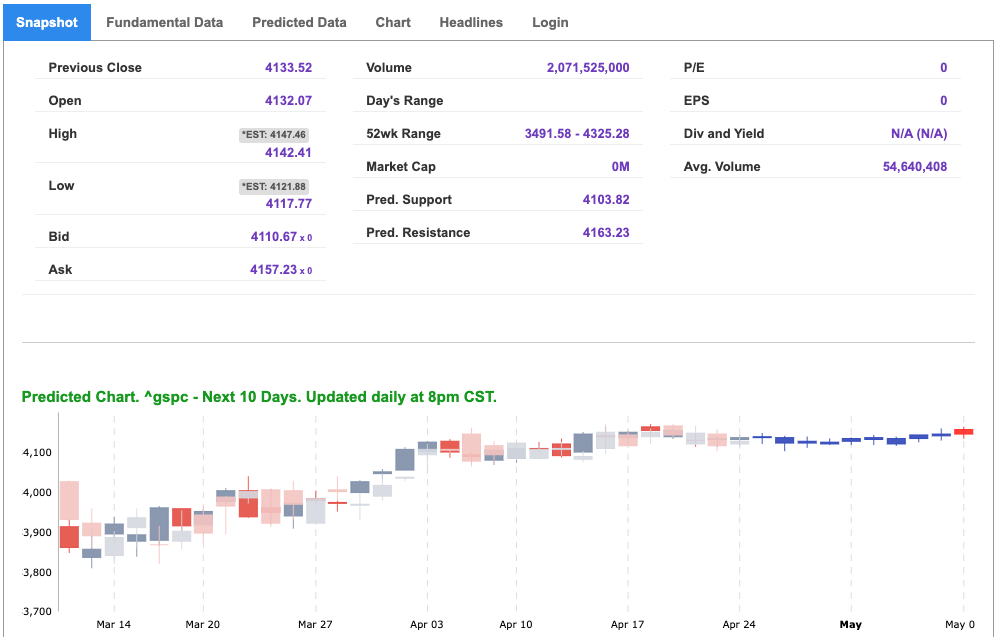

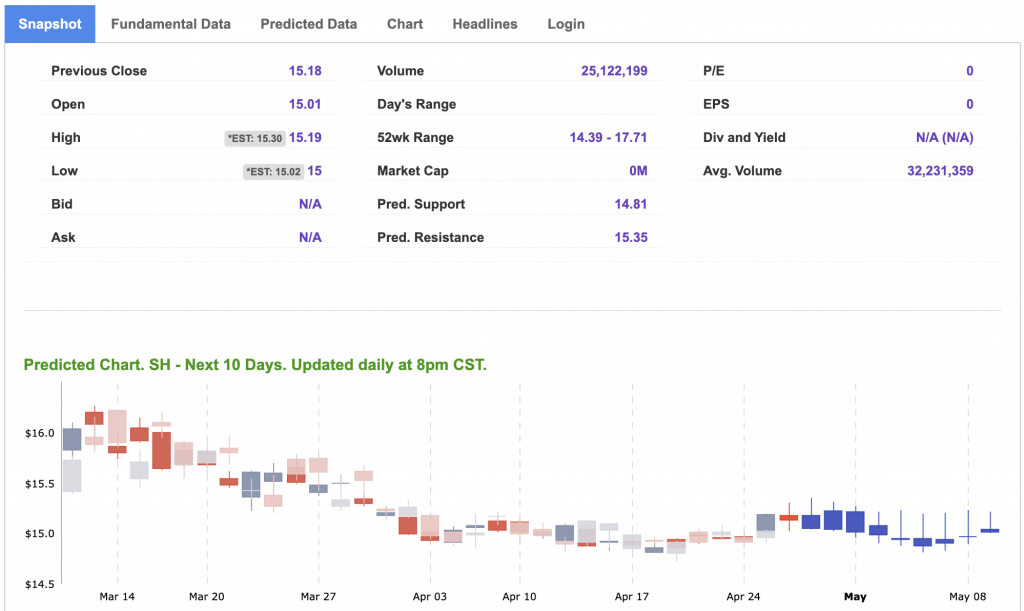

We are also watching for the overhead resistance levels in the SPDR S&P 500 ETF (SPY), which are presently at $414 and then $418. The support for the SPY is $406 and then $402. Overall, we expect the market to trade sideways for the next two to eight weeks, and we would recommend being market-neutral at this time, while also encouraging subscribers to hedge their positions to minimize risk. Globally, both Asian and European markets closed to mixed results. Market commentary readers should maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

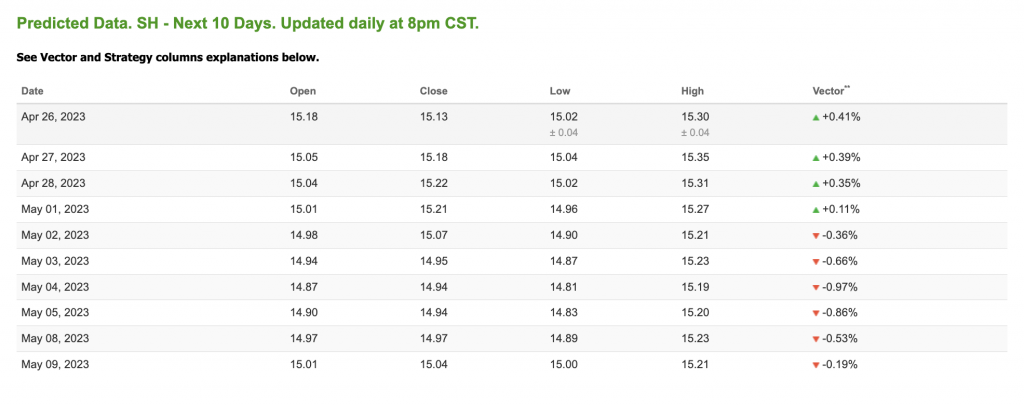

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, sh. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $74.35 per barrel, down 3.53%, at the time of publication.

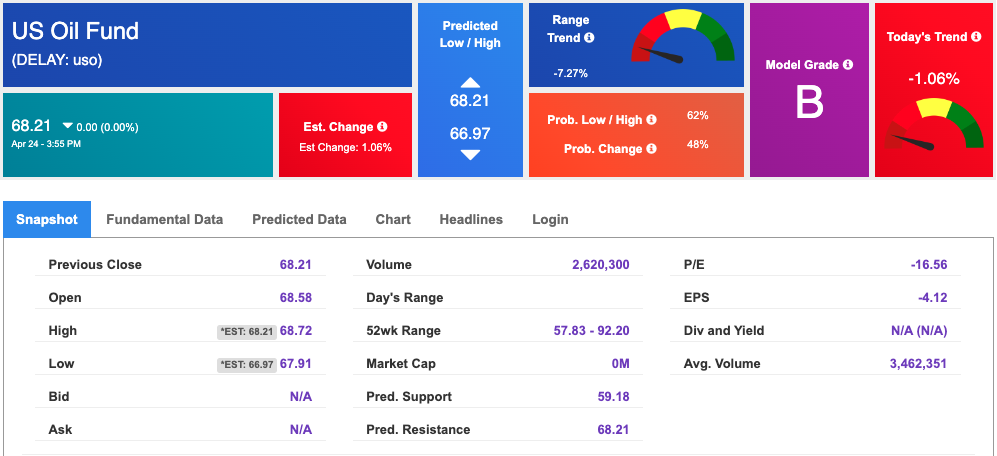

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $68.21 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The price for the Gold Continuous Contract (GC00) is down 0.28% at $1998.80 at the time of publication.

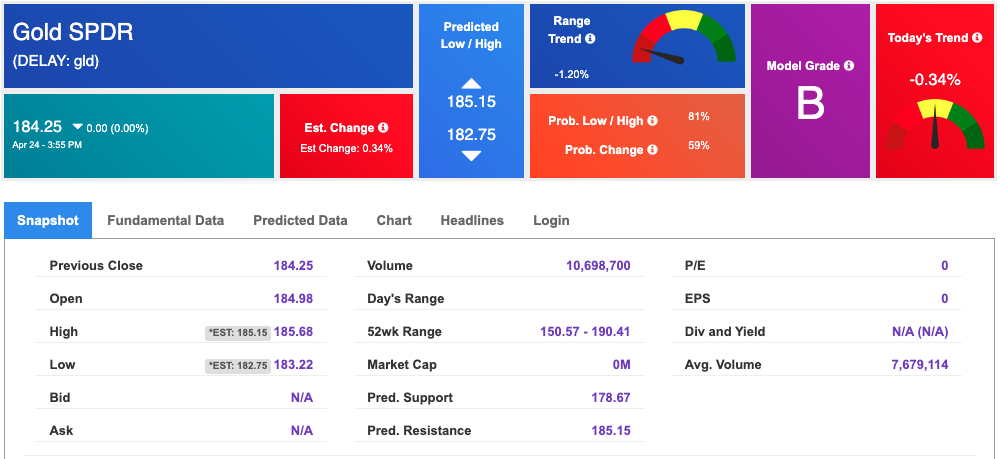

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $184.25 at the time of publication. Vector signals show -0.34% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is up at 3.450% at the time of publication.

The yield on the 30-year Treasury note is up at 3.709% at the time of publication.

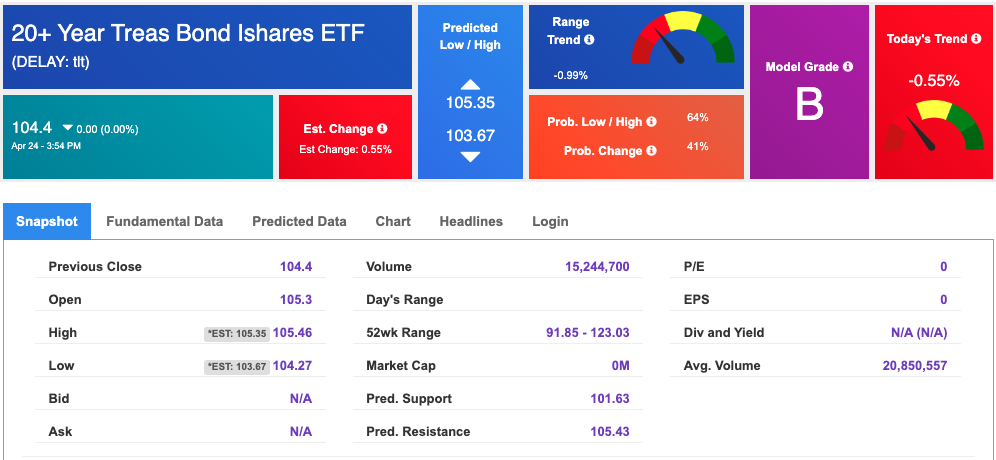

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is $16.89 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!