Following an encouraging start to the week, markets have declined as tech companies backtrack. Yesterday’s biggest market mover was Microsoft, the second-most capitalized U.S. business, which dampened market enthusiasm following their earnings report with a bleak outlook statement and saw clear losses the next morning as a result. All three major U.S. indices traded lower on Wednesday.

But tech earnings aren’t the only problem as Wednesday’s reports have been mixed at best. Boeing (BA) generated positive cash flow for the second consecutive quarter but reported a fourth-quarter loss when analysts expected a profit, sending the stock down 0.3%. Abbott Laboratories (ABT) fourth-quarter adjusted earnings beat Wall Street estimates, but sales fell 12% from a year earlier, and the stock has dropped 2.1%. Tesla’s (TSLA) earnings will be in the spotlight after Wednesday’s close.

Next week, the Federal Reserve will convene to reach a decisive conclusion on monetary policy and most likely raise interest rates by one-fourth of a percentage point as it continues its transition towards gradual loosening.

As investors become increasingly concerned that the Fed’s relentless rate hikes could cause an already slowing economy to plunge into recession, purchasing managers’ surveys revealed on Tuesday that U.S. manufacturing and services industries contracted for the seventh consecutive month in January, further solidifying the likelihood of a “hard landing.”

Next up, investors will be watching for the first reading on the fourth-quarter Gross Domestic Product (GDP) due Thursday to see if economic growth has slowed. Economists expect a 2.3% increase, lower than the 3.2% increase in the third quarter; however, this still points to a healthy economy. On Friday, we will receive the marquee report of the week when we get December Personal Consumption Expenditure (PCE) data.

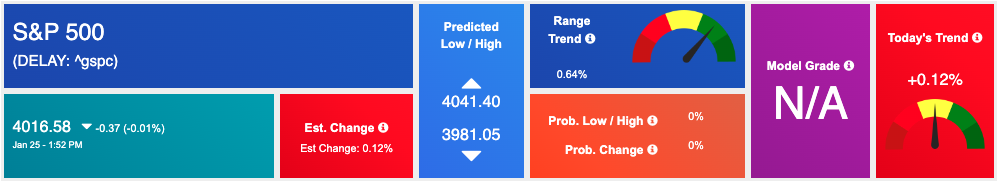

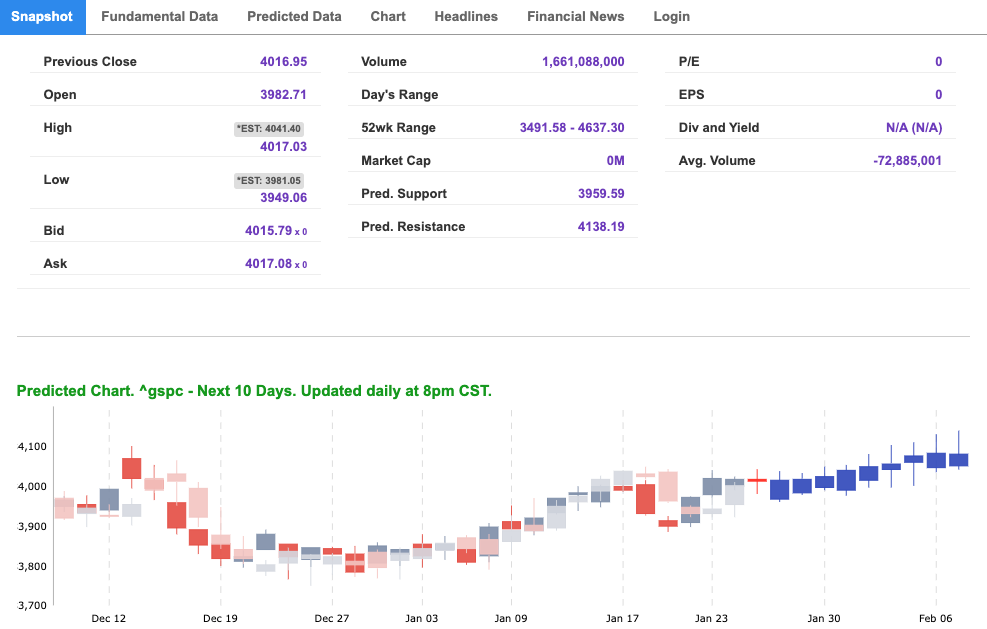

Market commentary readers should maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

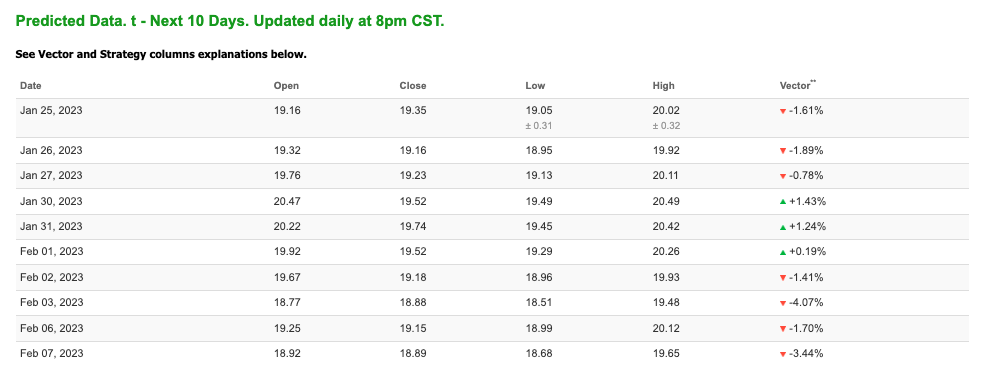

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

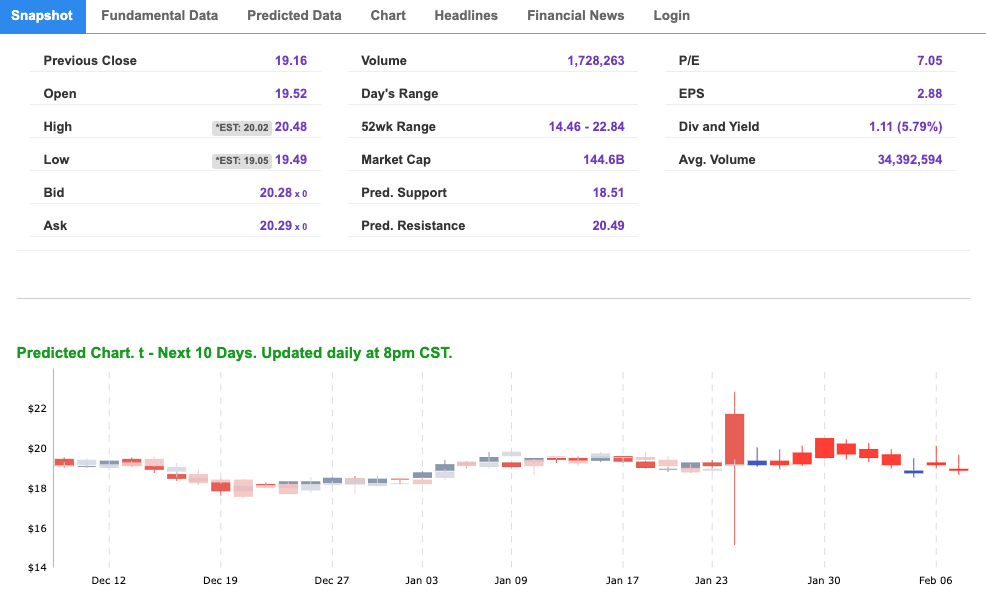

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, T. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $80.38 per barrel, up 0.37%, at the time of publication.

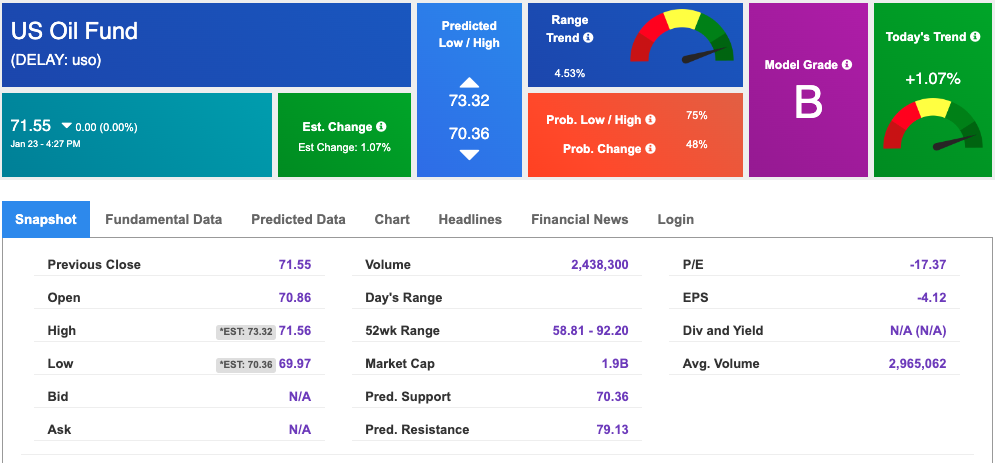

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.55 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The price for the Gold Continuous Contract (GC00) is up 0.41% at $1943.40 at the time of publication.

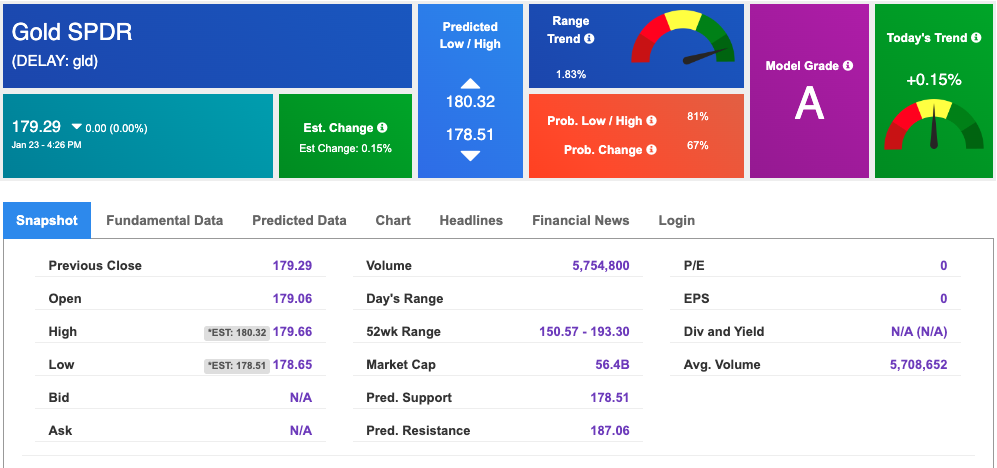

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $179.29 at the time of publication. Vector signals show +0.15% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

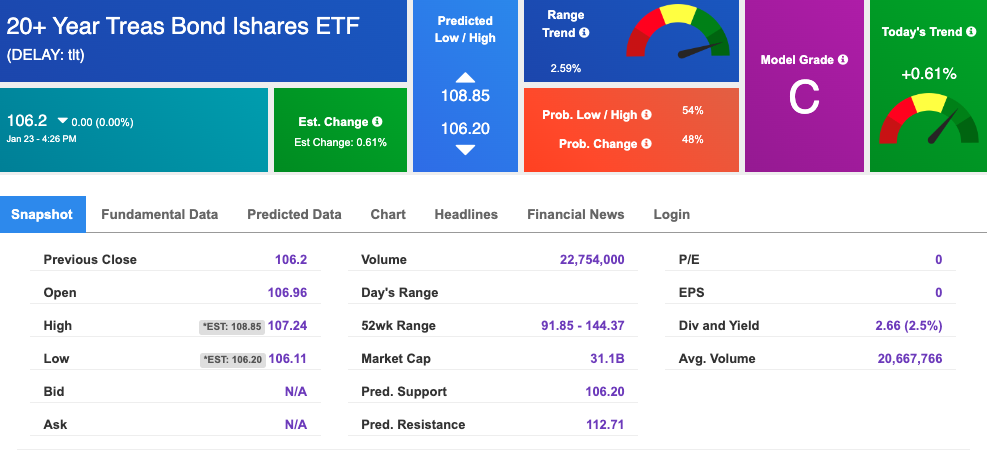

The yield on the 10-year Treasury note is down at 3.458% at the time of publication.

The yield on the 30-year Treasury note is down at 3.621% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

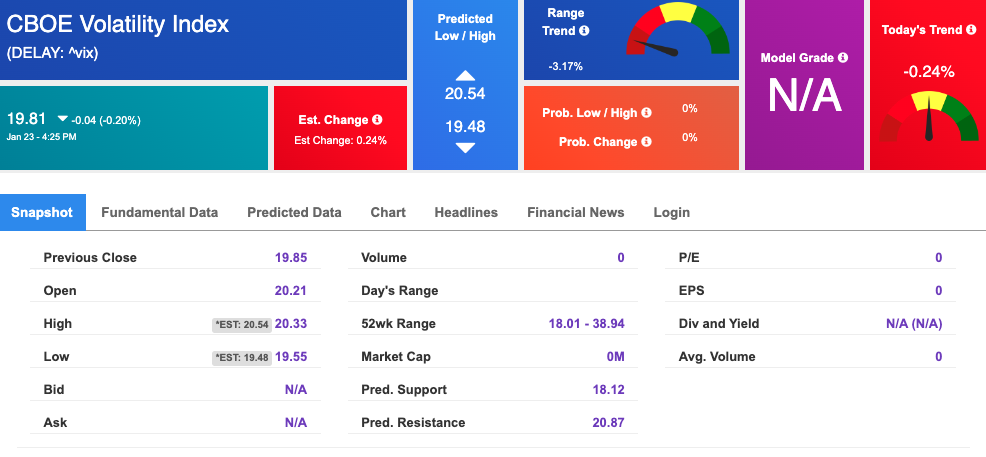

The CBOE Volatility Index (^VIX) is $19.81 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!