As the financial world settles into the new week, it’s clear that optimism and positive market sentiment continue to prevail. All three major U.S. indices showed remarkable resilience, closing in the green on Monday, following an action-packed previous week. The previous week had witnessed a whirlwind of earnings releases, economic data, and a Federal Open Market Committee meeting. With the dust now settled, traders are bracing for a potentially quieter week ahead.

Last week was especially significant as it saw a confluence of events that fueled market positivity. Bond yields experienced a welcome dip, providing a boost to equities, while a softer jobs report on Friday further solidified the belief that the Federal Reserve might be putting a hold on any further interest rate hikes. This notion has been gaining momentum in the market, prompting investors to exhibit newfound confidence.

Stocks managed to eke out gains on Monday, building on the momentum from the previous week when Wall Street celebrated its best week of the year. The prevailing sentiment seems to suggest that the Federal Reserve is now stepping back from its tightening policies concerning interest rates, offering a more favorable environment for equities.

Bond markets also made notable moves, with the 10-year Treasury yield ticking higher on Monday but still hovering at 4.614%. This is a far cry from the 5% level it was trading at in October, which had weighed on rate-sensitive stocks.

Last week’s surge in the market was primarily driven by the Federal Open Market Committee meeting and economic data that suggested the Federal Reserve has likely put an end to its interest rate hikes. In fact, Fed funds futures now indicate a mere 9.8% chance of a rate hike at the December meeting, which is a significant drop from the 24.6% probability observed the previous week. Furthermore, the likelihood of no rate hikes through the January meeting has increased to 84.6%, up from 66.8% just a week ago. On the flip side, the chances of a rate cut at the March meeting have climbed to 23.7%, compared to the 11.4% probability from the prior week.

Turning our attention to the current week, the economic calendar is notably less packed than the preceding one. However, public appearances by Federal Reserve officials could still introduce volatility into the markets.

In the currency realm, the dollar indexes have largely stabilized after last week’s selloff, triggered by the somewhat dovish Fed stance and softer U.S. employment data. While the greenback weakened slightly against the euro and the pound, it strengthened against the yen. Anticipated lower U.S. interest rates are expected to bring some relief to the currency, although they are projected to remain higher than in other developed markets. This scenario should provide ongoing support to the dollar, especially as Treasury yields rebound following last week’s decline.

As the week unfolds, market participants will keep a close eye on Chair Powell’s speech scheduled for Thursday, where the focus will likely return to the notion that tight financial conditions limit the necessity for further interest rate hikes, especially in light of limited fresh macro data.

Simultaneously, the energy sector is witnessing early gains in oil prices on Monday. This surge follows the announcements by two of the world’s largest oil exporters, Russia and Saudi Arabia, committing to extended voluntary production cuts until the end of the year. This development is reinforcing market optimism and contributing to the prevailing positive sentiment.

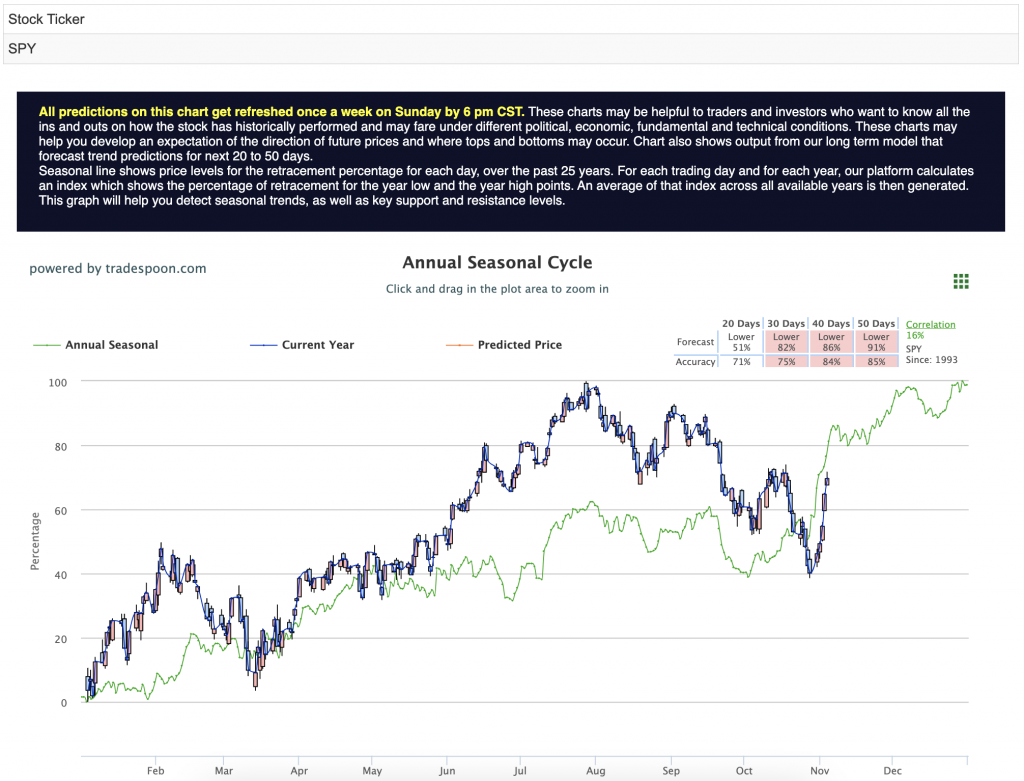

With the latest market happenings in mind, I still believe the SPY rally capped at $450-470 levels and short support is $400-430 for the next few weeks. For reference, the SPY Seasonal Chart is shown below:

In conclusion, the trajectory of “higher highs and higher lows” appears to be intact, with the Christmas rally seemingly underway. DXY and yields have experienced a significant pullback and are currently approaching the 50-day moving average. Despite potential volatility in the upcoming quarter, expectations of better-than-expected earnings and end-of-year seasonality should serve as a market stabilizer within the 200-day moving average.

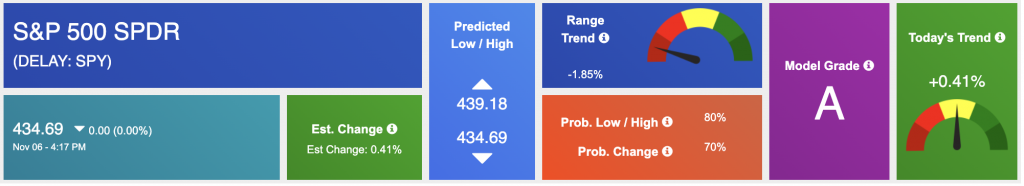

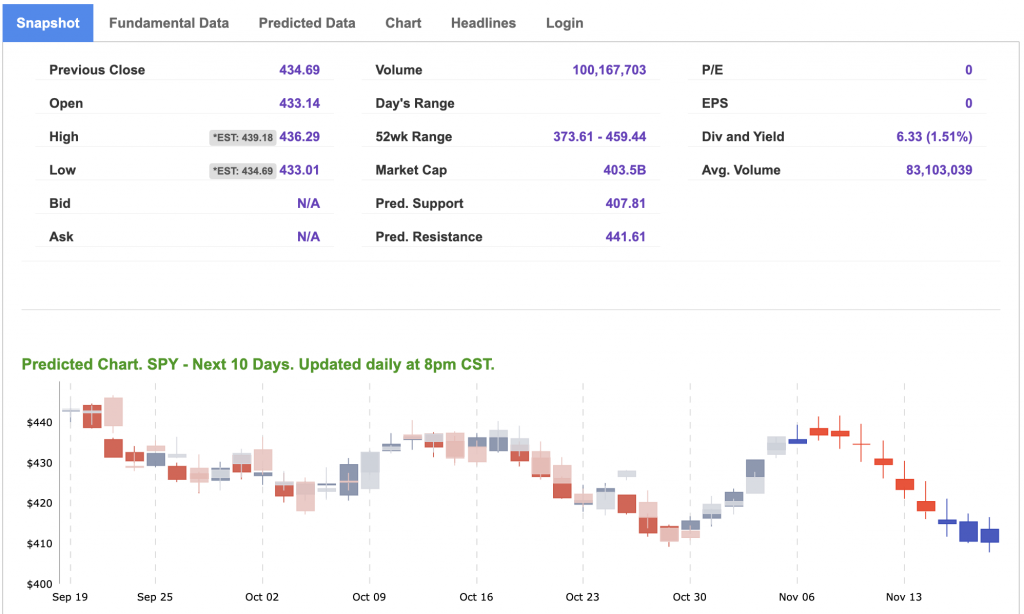

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

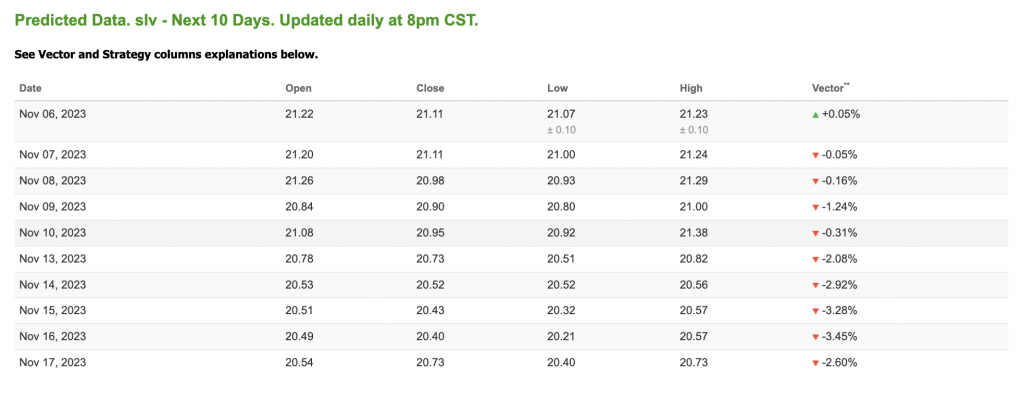

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

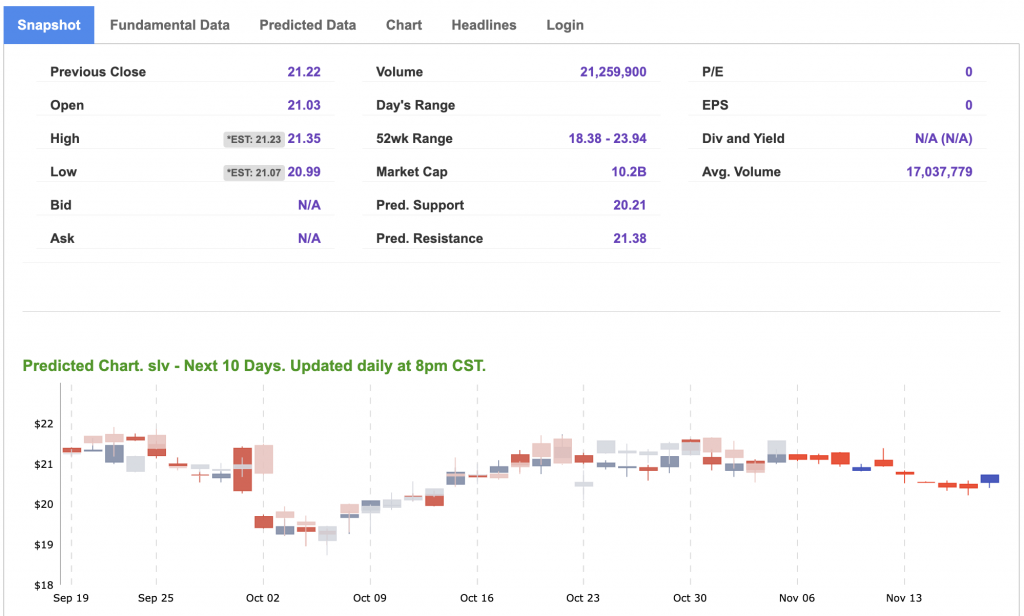

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, SLV. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

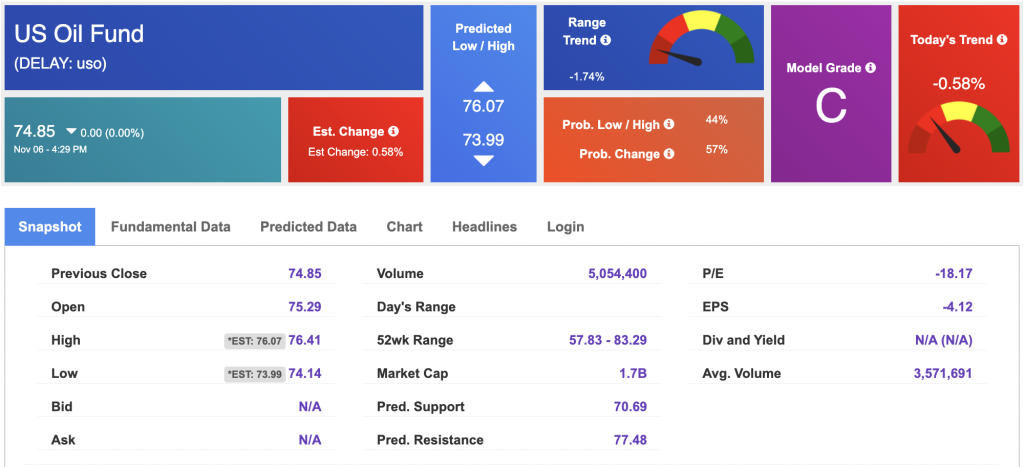

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $80.92 per barrel, up 0.51%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $74.85 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

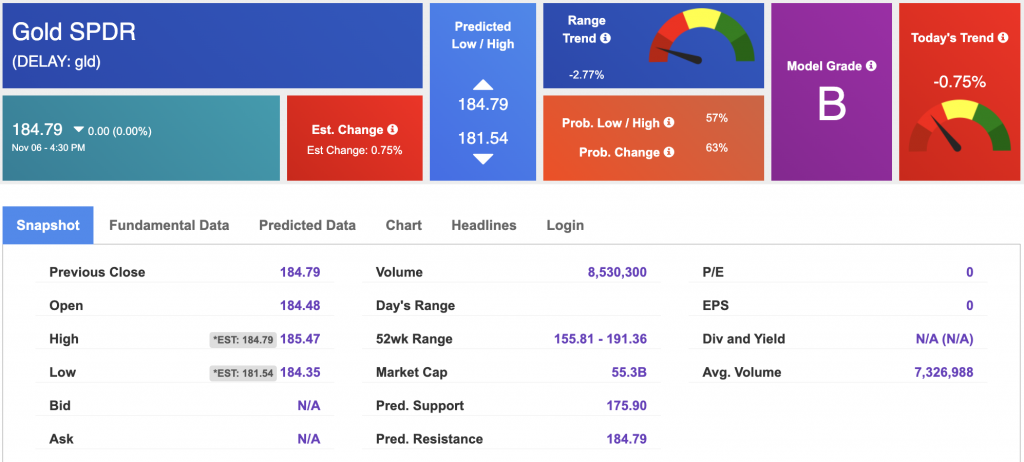

The price for the Gold Continuous Contract (GC00) is down 0.73% at $1984.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $184.79 at the time of publication. Vector signals show -0.75% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

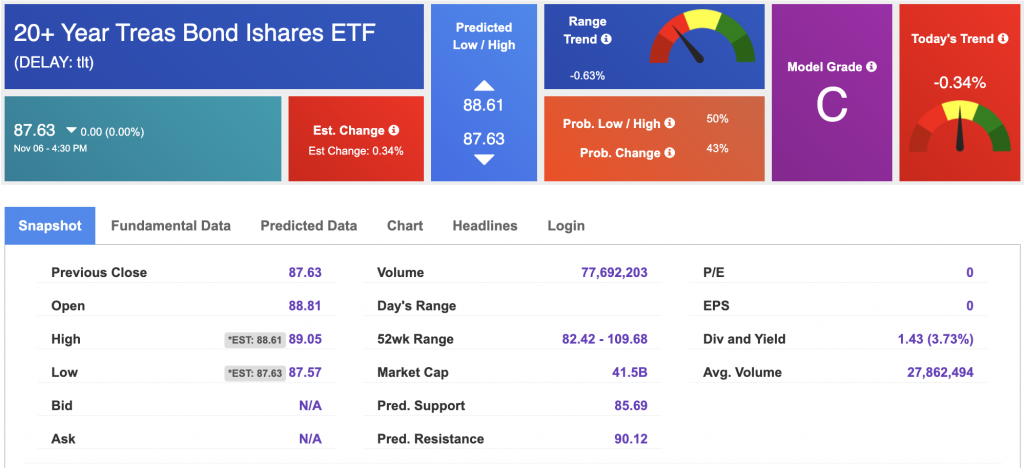

The yield on the 10-year Treasury note is up at 4.649% at the time of publication.

The yield on the 30-year Treasury note is up at 4.810% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

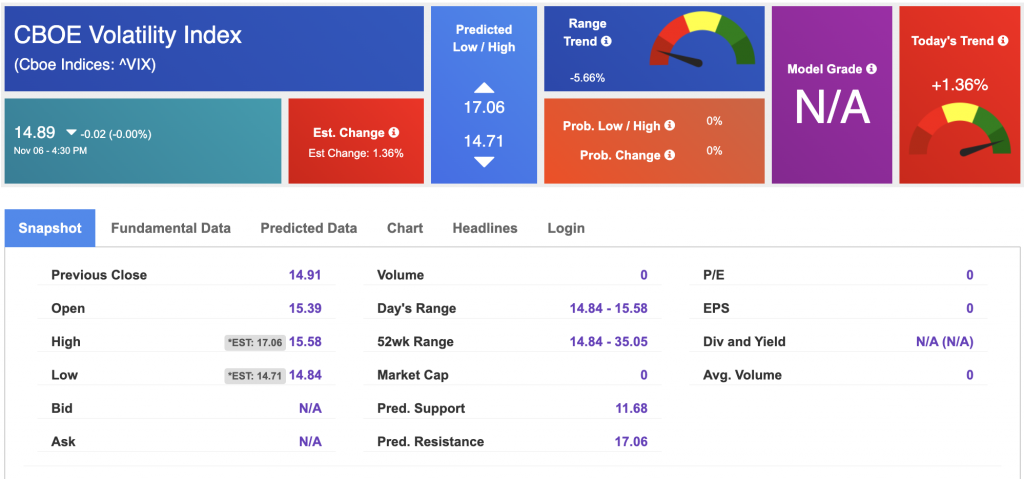

The CBOE Volatility Index (^VIX) is priced at $14.89 down 0.13% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!