The stock market witnessed an impressive rally for the fourth consecutive day, driving the S&P 500 and Nasdaq to intraday 52-week highs. The surge in stock prices was fueled by encouraging developments, including the producer-price index report, which revealed slower-than-expected growth in U.S. wholesale prices during June. Additionally, market sentiment was bolstered by robust earnings reports from major companies such as Delta and Pepsi. Technology stocks spearheaded the rally, capitalizing on the positive economic data. As earnings season commences, market participants eagerly await reports from financial institutions, with JPMorgan Chase being closely watched as a bellwether for economic health.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Thursday’s release of the producer-price index provided further evidence of disinflation, as wholesale prices rose less than anticipated. This follows the previous day’s consumer-price index report, which indicated a deceleration in price growth. The combination of these reports allayed concerns over rapidly rising inflation, instilling confidence in the market.

Earnings season officially kicked off this week. Delta Air Lines and PepsiCo reported impressive second-quarter earnings, delivering positive news and providing valuable insights into the overall health of the economy. Delta achieved record revenue and profitability, driven by strong demand and favorable fuel costs. The company exceeded both analyst expectations and its own guidance.

PepsiCo also outperformed expectations, maintaining its consistent success in the consumer staple sector, with an impressive performance in both the second quarter and previous quarters demonstrating its ability to surpass expectations and reinforce positive market sentiment.

Overall, Delta Air Lines and PepsiCo’s robust performances contribute to positive market sentiment, providing insights into the overall health of the economy. Delta’s raised guidance for the full year indicates confidence in continued strong demand and favorable cost dynamics. PepsiCo’s consistent outperformance solidifies its position in the consumer staple sector. However, the impact of price hikes on demand emphasizes the importance for consumer product companies to carefully manage inflationary pressures. Monitoring companies’ strategies in navigating these challenges are crucial for investors seeking to understand the ever-changing economic landscape.

Apart from earnings, this week also included key economic reports reflecting on the latest inflation levels and the overall health of the U.S. economy.

Released Wednesday, June’s larger-than-expected slowdown in inflation brings positive news for the Federal Reserve’s efforts to achieve price stability. However, the central bank still faces significant challenges ahead. Consumer prices rose at a 3% annual pace, a notable deceleration from May’s 4% pace and below economists’ expectations. The growth in core prices, which excludes volatile food and energy categories, also slowed more than anticipated. While these developments provide some relief, the central bank must continue its work in navigating the economy toward stability.

The headline consumer price index increased by 0.2% in June compared to a 0.1% climb in May, reflecting a broader slowdown. Core prices also rose by 0.2% for the month, down from a 0.4% jump in May. Notably, core CPI climbed only 0.2% in June, the smallest one-month increase since August 2021. Various categories, including airfares, alcohol, rental cars, and health insurance, experienced declines, while grocery costs remained flat. The deceleration in core services, excluding housing, also indicated progress. Medical care and recreation services remained unchanged, transportation services saw a slight increase of 0.1%, and education services declined by 0.3%.

The latest Beige Book survey of regional business contacts reveals an overall increase in economic activity since late May, though most regions anticipate a weakening pace of expansion. Employment modestly increased, yet employers continue to struggle to find workers. Inflation remained at a modest pace, but the rate of growth slowed in several districts. Price expectations were generally stable or lower for the upcoming months. The survey also indicates a mixed picture of consumer spending, with growth primarily observed in consumer services but a shift away from discretionary spending noted by some retailers. Nevertheless, tourism and travel activity remain robust, with a busy summer season anticipated. Manufacturing activity continues to face challenges and remains subdued, while banking conditions remain flat and lending activity continues to soften.

Friday’s earnings reports from banks, including JPMorgan Chase, are eagerly anticipated by market analysts. JPMorgan Chase’s projected 44% rise in profit compared to the previous year, with estimated earnings per share of $3.97 for the second quarter, will provide crucial insights into the financial sector’s performance. These results will serve as an important indicator for the broader market’s direction.

Amidst the market rally, the industrials sector has shown promising strength. Investors are witnessing a rotation into cyclicals, as Europe, China, regional banks, and other cyclical industries continue their upward trajectory. This shift indicates a broader market sentiment that favors sectors more closely tied to economic recovery and growth.

Given the positive market sentiment and the current rotation into cyclical, Caterpillar Inc. ($CAT) presents an interesting investment opportunity. As a leading industrial company, Caterpillar stands to benefit from the ongoing economic recovery and increased infrastructure spending. The company’s strong position in the global construction and mining sectors, coupled with its solid financial performance, make it a compelling choice for investors seeking exposure to industrials.

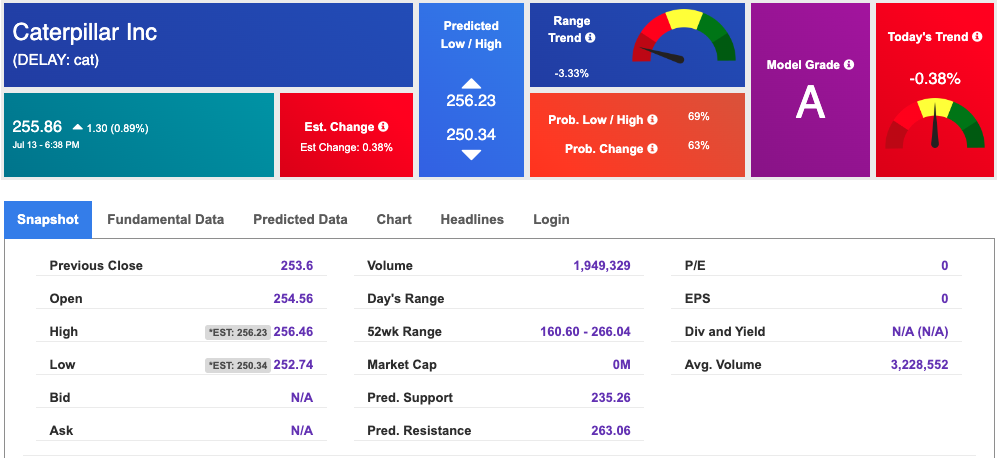

Looking at my A.I.’s reading of CAT I am seeing similar, encouraging signals!

Trading below its 52-week high, CAT has room to the upside and with earnings approaching the market could see a boost to this sector specifically.

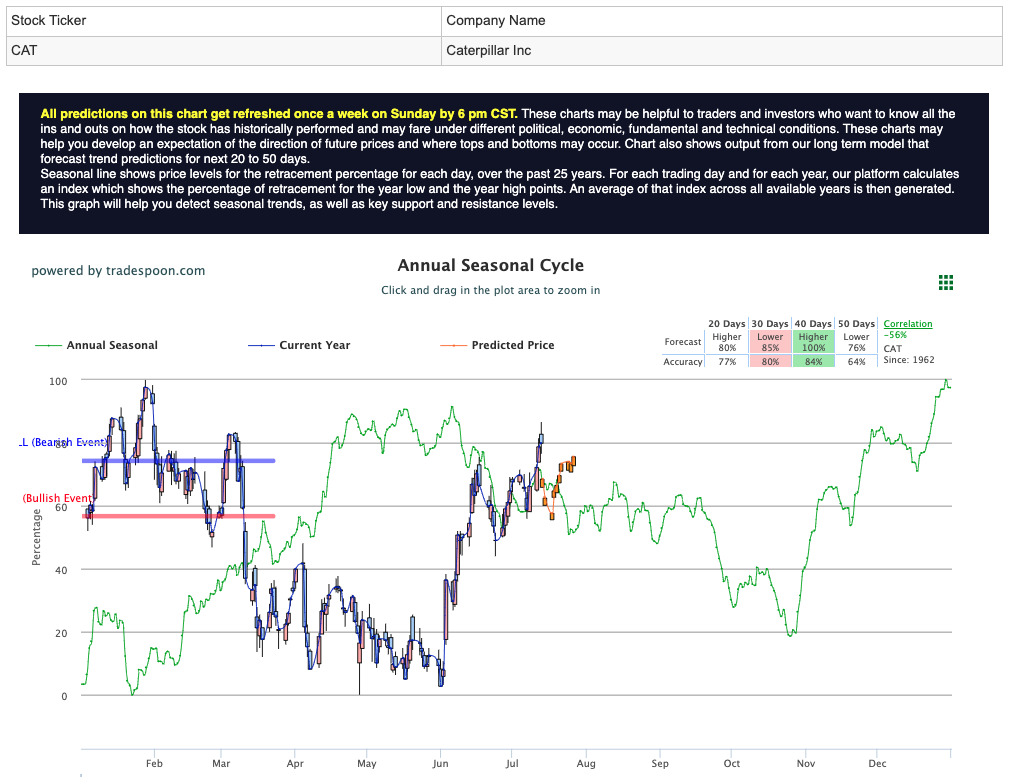

Similarly, the Seasonal Chart tool shows an uptick in the first 20 days for CAT as well as additional higher signals in the coming weeks. Seasonal Chart is primed for long-term forecasts and sees good reason to believe CAT should move higher. See CAT Seasonal Chart:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

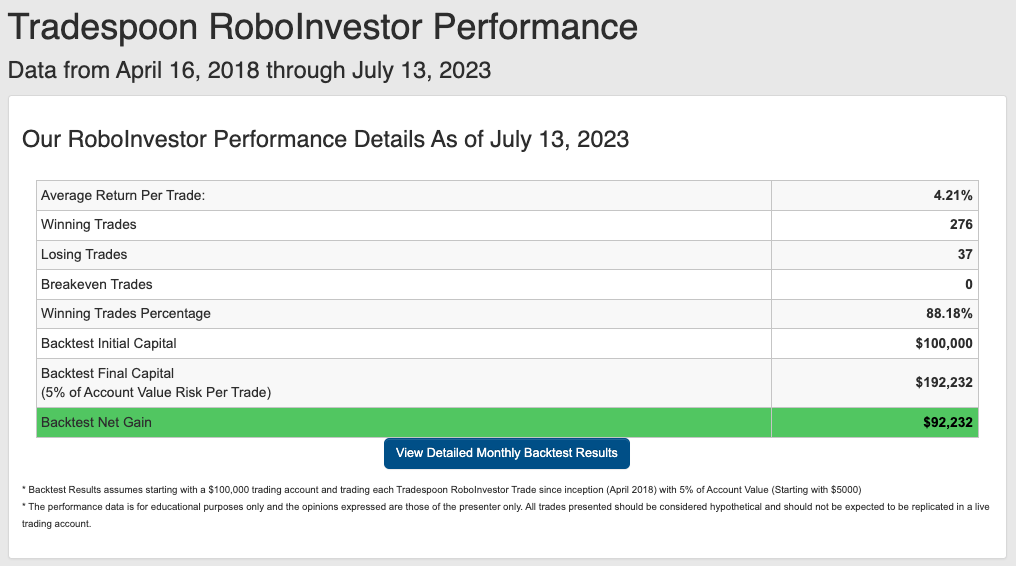

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.18% going back to April 2018.

As we enter the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!