In today’s dynamic financial realm, the fusion of artificial intelligence (AI) has reshaped trading methodologies. Tradespoon’s innovative AI algorithmic trading platform, driven by sophisticated algorithms and cutting-edge machine learning methods, stands as a beacon of modern trading strategies. Join us as we explore the multifaceted world of AI algorithmic trading, unraveling the diverse array of trading algorithms, and assessing their profound impact on contemporary trading landscapes.

The integration of artificial intelligence (AI) has ushered in a revolutionary era in algorithmic trading, reshaping the very fabric of how financial markets operate. Unlike traditional trading methods, which relied heavily on human intuition and manual analysis, AI-driven algorithms have introduced a paradigm shift by leveraging advanced computational techniques to process vast amounts of data, discern complex patterns, and execute trades with unprecedented speed and accuracy.

At the heart of this transformation lies the concept of algorithmic trading, where AI algorithms play a pivotal role in automating the decision-making process. By harnessing the power of machine learning, natural language processing, and other AI technologies, these algorithms can analyze market data in real-time, identify subtle signals, and execute trades at lightning-fast speeds, all without human intervention.

The evolution of algorithmic trading through AI can be traced back to the early days of electronic trading, where the advent of computers paved the way for automated trading strategies. Initially, these strategies were simple rule-based systems that executed trades based on predefined conditions. However, with the advancement of AI technologies, algorithmic trading has evolved into a sophisticated ecosystem, encompassing a diverse array of algorithms tailored to address specific trading objectives.

Today, AI algorithms power a wide range of trading strategies, from high-frequency trading (HFT) algorithms that exploit microsecond price differentials to sentiment analysis-based algorithms that gauge market sentiment from social media feeds and news articles. These algorithms continuously learn from historical data, adapt to changing market conditions, and optimize trading performance over time, enabling traders to stay ahead of the curve in an increasingly competitive landscape. Moreover, the democratization of AI technology has democratized access to algorithmic trading, leveling the playing field for traders of all levels with the rise of AI-powered trading platforms and educational resources, providing individual traders access to cutting-edge tools and insights once reserved for institutional investors.

AI algorithmic trading encompasses a spectrum of algorithms, each tailored to address specific trading needs:

The integration of AI algorithmic trading yields a spectrum of advantages that redefine trading dynamics:

However, amidst the myriad benefits, AI algorithmic trading presents a host of challenges that require vigilant navigation:

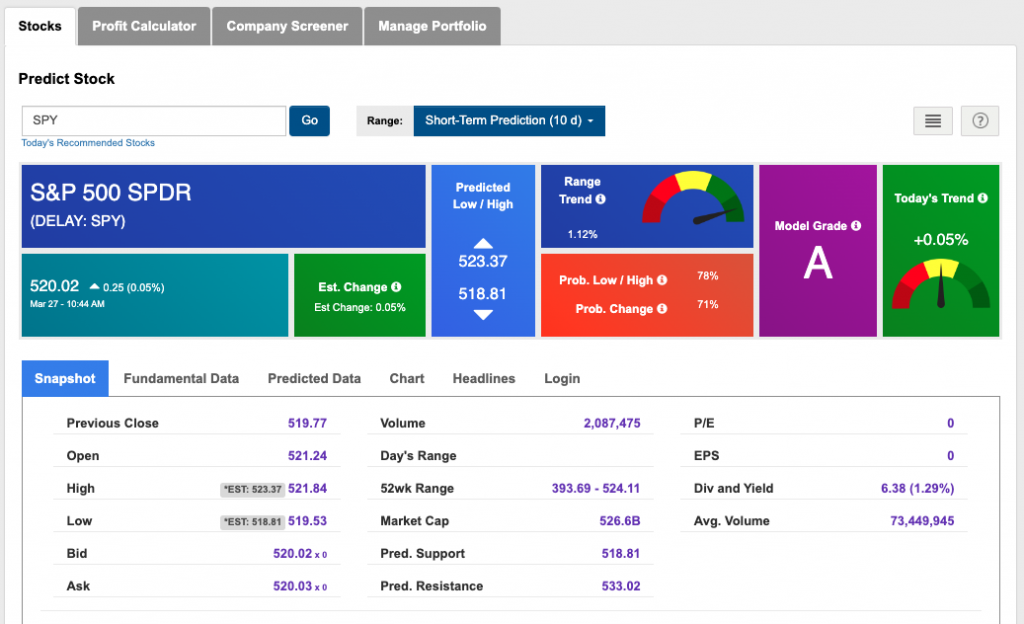

Tradespoon offers a comprehensive suite of AI trading tools and resources designed to empower traders with the latest advancements in AI algorithmic trading. From predictive analytics to risk management solutions, Tradespoon equips traders with the knowledge and technology needed to navigate today’s dynamic markets effectively.

AI algorithmic trading marks a paradigm shift in the evolution of financial markets, offering unparalleled opportunities for traders to capitalize on market inefficiencies and generate alpha. Embracing AI algorithmic trading is essential for staying ahead of the curve and achieving long-term success in trading.

The future outlook for AI algorithmic trading is promising, with continued advancements expected to enhance trading strategies and performance. As AI algorithms become more sophisticated and accessible, broader adoption among traders is anticipated.

Traders can stay informed by following reputable sources such as industry publications, research papers, and conferences focused on AI and finance. Additionally, leveraging educational resources and networking with experts can provide valuable insights.

AI algorithmic trading is increasingly accessible to both individual traders and institutional investors. With platforms like Tradespoon democratizing access to AI technology, traders of all levels can leverage its benefits in their trading strategies.

Beginners can start by gaining a foundational understanding of trading principles and AI concepts. Educational platforms like Tradespoon offer comprehensive learning materials tailored to beginners, enabling them to gradually build knowledge and skills through practical application.

By embracing Tradespoon’s AI algorithmic trading platform, traders can embark on a transformative journey, equipped with the tools and insights needed to thrive in today’s ever-evolving financial markets.

Becoming a member of the Tradespoon trading community can significantly support your trading endeavors. Our carefully crafted community offers an unparalleled trading experience, enabling you to leverage our impartial AI trading program and gain valuable knowledge from accomplished traders. By joining us, you will immerse yourself in a supportive environment that fosters growth and provides access to a wealth of expertise.

With the market’s unpredictable nature and the uncertainty that lies ahead, we cannot stress enough the importance for our readers and members of the Tradespoon community to refer to our Live Trading Room. By doing so, you can stay updated on how our AI platform navigates select trades and gain valuable insights throughout the trading day. Our Live Trading Room is available for free, and we highly encourage everyone to sign up and check in regularly.

For more information on Tradespoon’s tools and our trading community, we recommend reviewing our latest Strategy Roundtable, held weekly on Tradespoon.

Being part of our Tradespoon trading community is immensely advantageous; here, you can exchange multiple tactics with fellow traders. During my recent Strategy Roundtable session (which is held weekly on Tradespoon), we did just that! This opportunity to collaborate and learn from others in the world of trading should not be passed up. I recommend checking out our latest Roundtable webinar in its entirety below:

Tradespoon Strategy Roundtable

Join us and unlock your trading potential with Tradespoon today!

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!