After falling in back-to-back sessions to open the week, all three major U.S. indicies rebounded impressively on Wednesday with gains of nearly 2%. Volatility appeared to ease as the VIX lowered from its $33 high and is currently trading in the $34 range. U.S. indices neared their 2022 lows in the latest selloff before today’s rebound rally. The Federal Reserve’s rate hike earlier this year triggered an U.S.-led dollar bull run that helped propel equities to new highs, but it also sent bond yields higher in the United States and prompted a Bank of England intervention in the UK government bond market which boosted risk appetite. The Bank of England stated that it would be buy continue buying bonds with long expiration dates until it can steady markets after United Kingdom’s budget announcement last Friday resulted in gilt yields spiking and the sterling plummeting to an all-time low. Globally, European markets traded higher across the board while Asian markets sold off sharply.

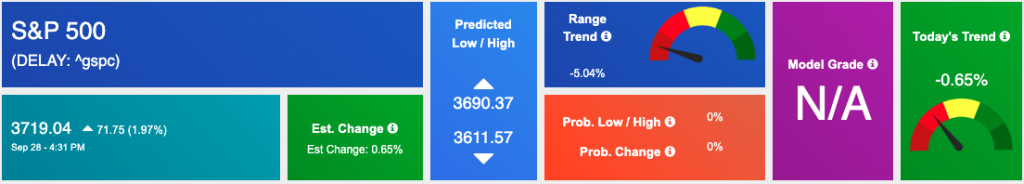

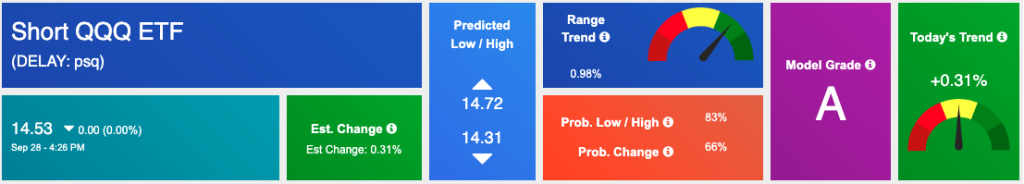

With earnings season rapidly approaching, several big names are set to release their results this week and in the weeks ahead. Three major companies–CarMax, Rite Aid, and Micron Tech–will report tomorrow while Carnival’s results will be released on Friday. Be on the lookout for vital inflation data to release later this week, with PCE information releasing Friday and GDP revisions for Q2 coming out Thursday. We’re keeping an eye on the SPY’s overhead resistance levels, which are presently at $380 and $390. The $SPY support level is $360 and then $350. We encourage all market commentary readers to maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

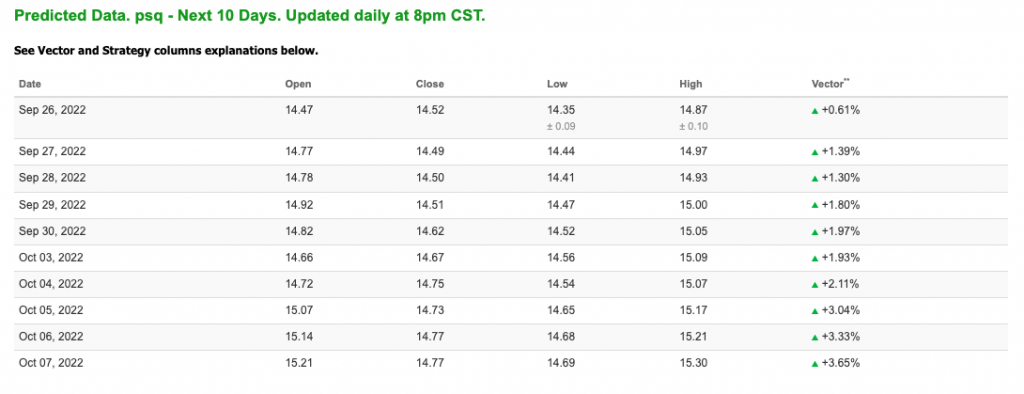

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

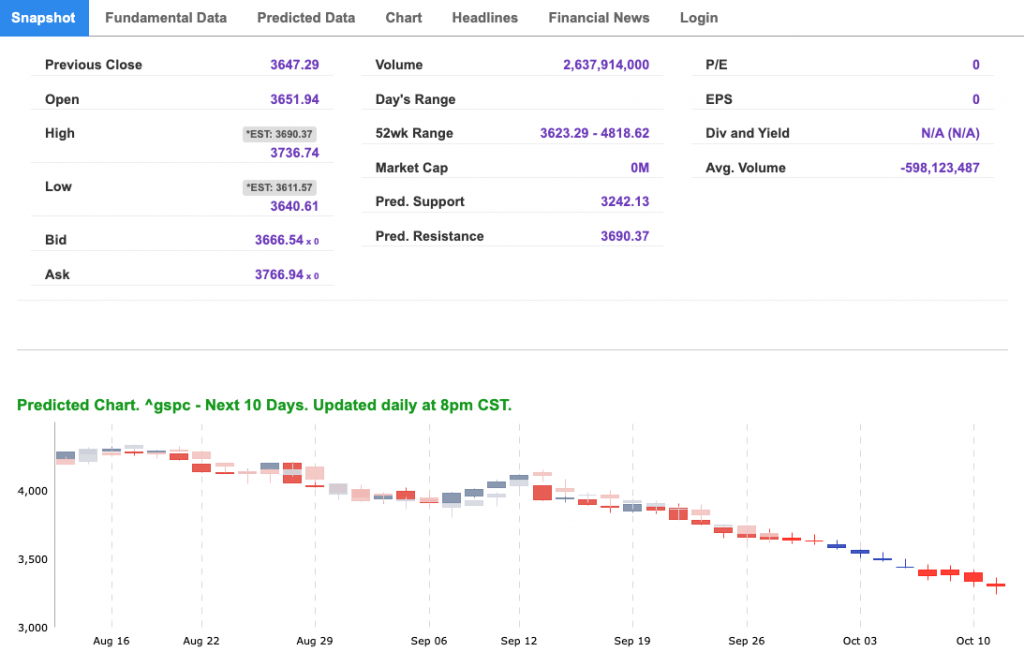

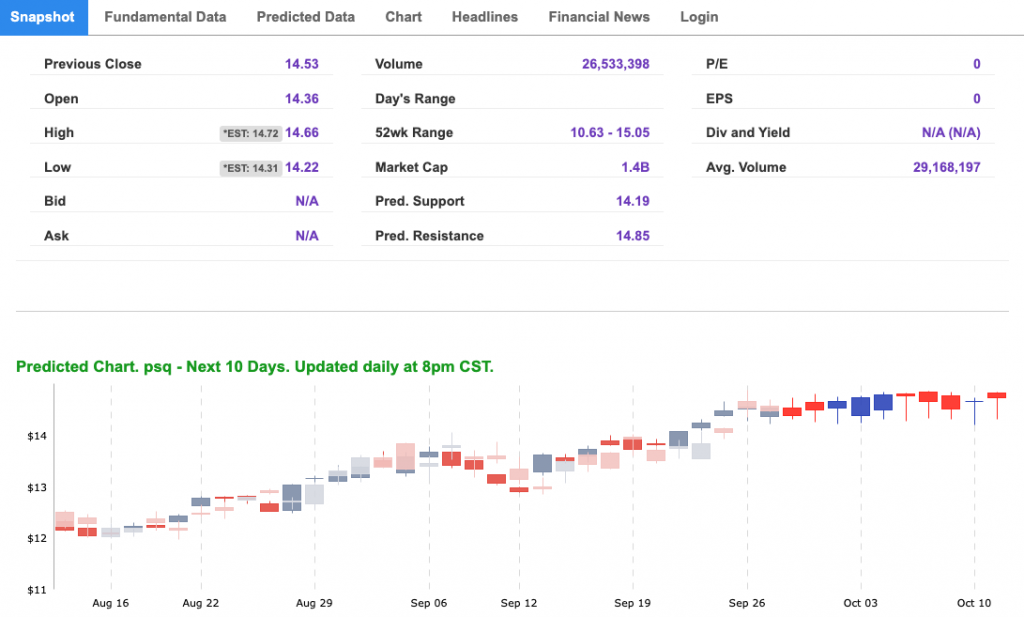

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, PSQ. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

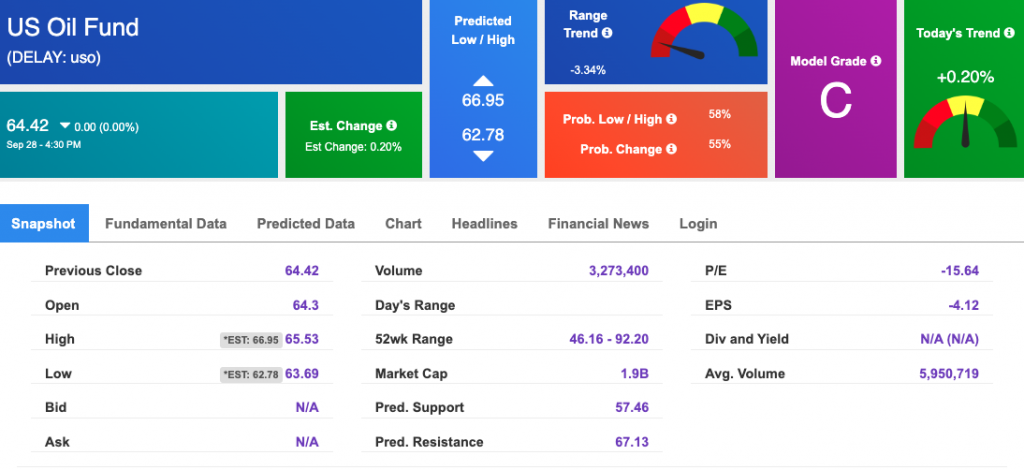

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $81.88 per barrel, down 4.31%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $64.42 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

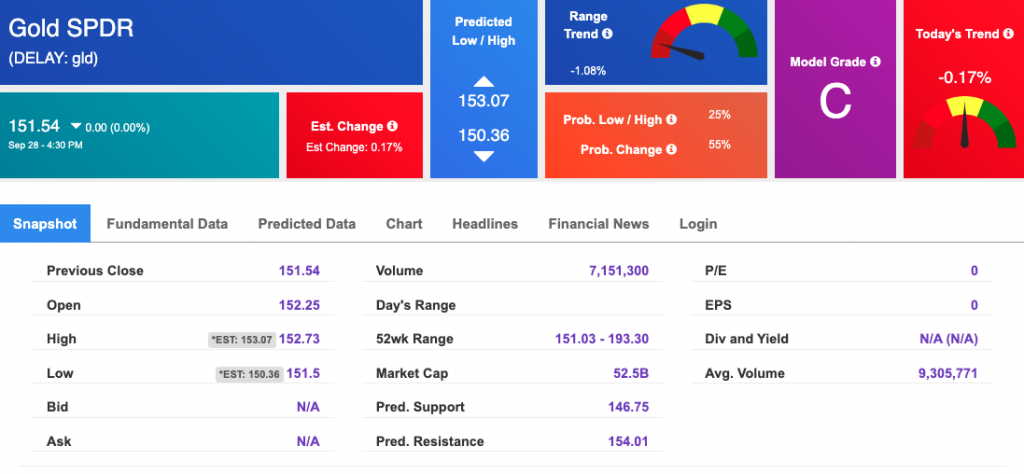

The price for the Gold Continuous Contract (GC00) is up 1.97% at $1668.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $151.54 at the time of publication. Vector signals show -0.17% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

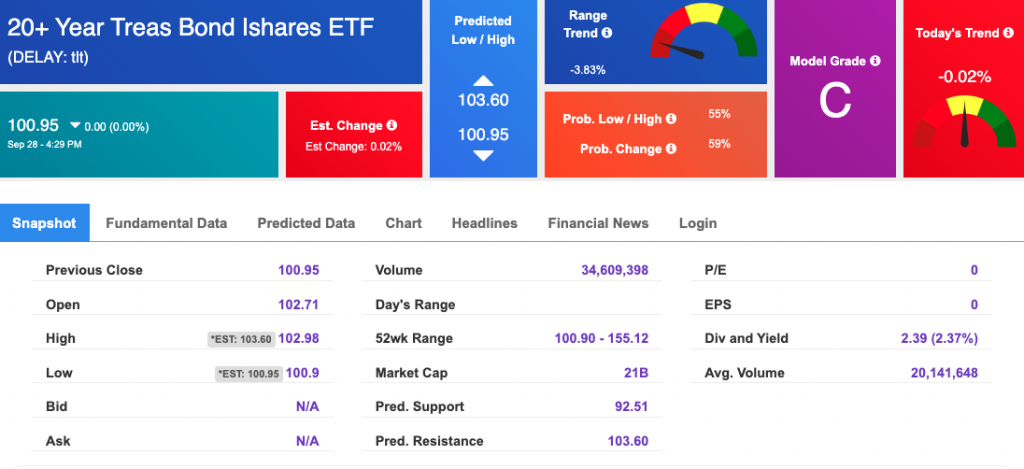

The yield on the 10-year Treasury note is down, at 3.736% at the time of publication.

The yield on the 30-year Treasury note is down, at 3.702% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

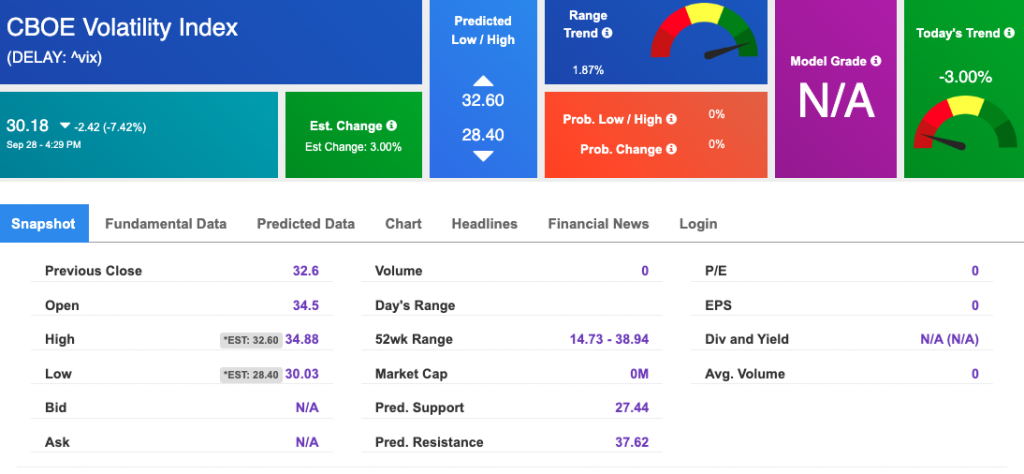

The CBOE Volatility Index (^VIX) is $30.18 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!