The financial markets remain on a rollercoaster ride as investors grapple with uncertainty. The past week has seen a series of ups and downs across various sectors, promising more volatility in the coming months.

Last week, stocks closed lower as weekly jobless claims increased, albeit less than expected. Investors eagerly awaited Friday’s payroll data, hoping for signs of a stabilizing job market. This comes amid ongoing concerns about the Federal Reserve’s strategy for interest rates in the face of persistently high inflation.

The bond market remains a focal point of attention. Treasury yields fell for the second consecutive session, and some experts are starting to consider the idea of “higher for longer” interest rates. This scenario would imply that interest rates may not see a significant reduction until the latter half of 2025 if the expected decline in yields during the first half of 2024 does not materialize. Such a situation could exacerbate the challenges posed by prolonged high inflation.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Certain sectors, including technology, small caps, and regional banks, continue to experience weakness. Technology stocks have begun to show signs of strain, with the S&P 500 ETF ($SPY) battling to maintain its 50-day moving average. Meanwhile, the U.S. Dollar Index ($DXY) continues its multi-month rally, impacting various asset classes.

Jobless claims data, although slightly softer than expected, indicates a degree of resilience in the labor market. All eyes are on the upcoming release of September’s employment summary, with expectations of nonfarm payrolls increasing by 163,000. Investors hope for signs of a softer labor market, which could influence the Federal Reserve’s stance on interest rates.

Crude oil prices have been on a rollercoaster, dropping 7.3% over two days. This trend is raising concerns about the stability of the oil market. Simultaneously, mortgage rates have surged to 7.49%, potentially nearing 8% by month-end, impacting the housing market.

In the corporate sphere, Rivian Automotive is projecting third-quarter sales in line with estimates and plans to offer convertible notes worth $1.5 billion. Lucid Group, a competitor in the electric vehicle market, has introduced a more affordable version of its luxury Air sedan.

Tesla faced a minor setback despite a recent rally, stemming from lower-than-expected third-quarter deliveries. General Motors grapples with concerns related to potentially dangerous airbag components in some of its vehicles.

Constellation Brands raised earnings expectations after reporting strong second-quarter results, primarily attributed to the success of the Modelo brand. On the flip side, BlackBerry announced plans to split into two separate businesses, with an initial public offering for its Internet-of-Things division in the pipeline.

Exxon Mobil expects an earnings boost in the third quarter due to rising crude oil prices, although thinner margins in its chemicals business may offset some gains.

In Europe, markets experienced mixed results. The pan-European Stoxx Europe 600 ended up 0.3%, while Germany’s DAX index closed lower, reflecting caution ahead of crucial U.S. jobs data.

The market remains cautious as strikes spread across various industries, including the automotive sector in Michigan. Extended strikes could contribute to rising inflation pressures and potentially impact interest rates.

The IPO market has seen a resurgence, with companies like $CART and $ARM going public. Both stocks surged by up to 30% on their debut days but subsequently retreated to IPO prices. This development is closely monitored as a gauge of risk appetite, considering the IPO market’s dormancy over the past two years.

Tech giant Apple ($AAPL) has been under scrutiny, breaking below August lows and nearing its 200-day moving average. Historically, this moving average has been a key support level for the market.

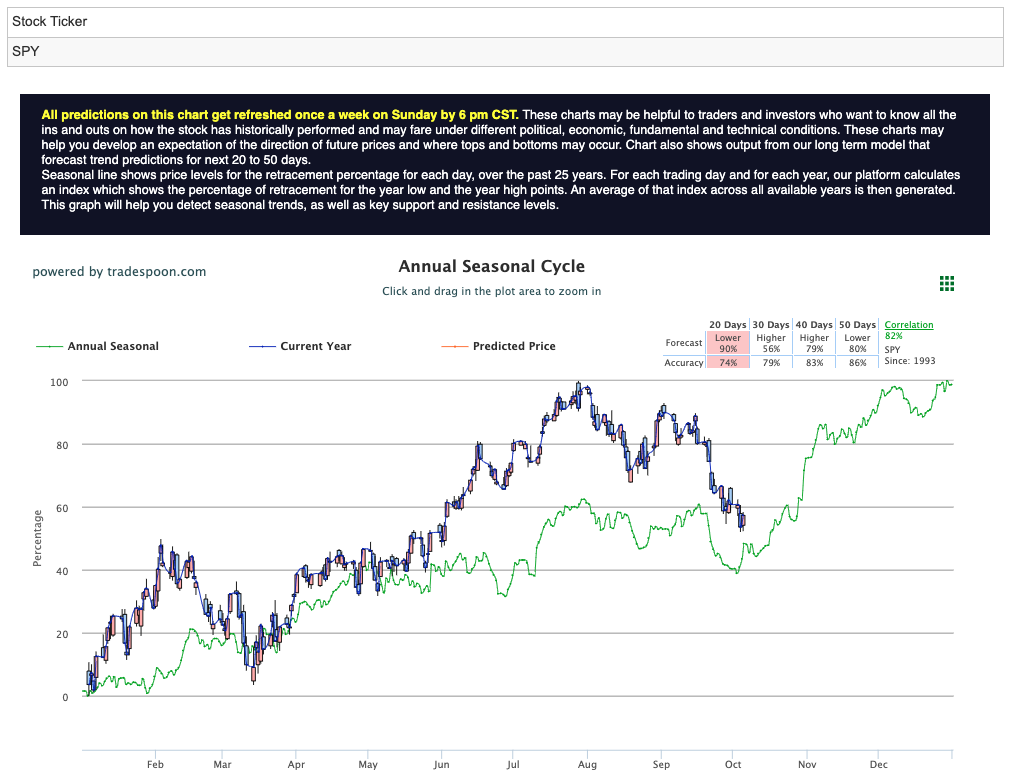

Amid all these developments, some investors are adopting a market-neutral stance, driven by data suggesting a low probability of a recession. However, many believe that the S&P 500 ($SPY) rally is capped at levels between $450 and $470, with support levels in the range of $400 to $430 in the coming months. For reference, the SPY Seasonal Chart is shown below:

Cyclicals, in particular, are expected to test their August lows, making October a potentially volatile month. However, expectations of better-than-anticipated earnings and end-of-year seasonality may help establish a market floor near the 200-day moving average.

Amid the market’s recent turbulence, one sector that is showing resilience and attracting the attention of investors is the banking industry. Several factors suggest that it might be a good time to consider investing in banks.

As discussed earlier, the trajectory of interest rates has been a point of concern for investors. However, for banks, rising interest rates can be beneficial. When interest rates increase, banks can charge higher interest on loans, improving their net interest margins and profitability. This dynamic can significantly boost the earnings of banking institutions.

Banks often serve as a barometer for the overall health of the economy. An improving economic environment typically leads to increased demand for loans, mortgages, and financial services. As the global economy continues its recovery from the pandemic, banks are expected to benefit from increased lending and economic activity.

Many banks have bolstered their balance sheets in recent years, enhancing their ability to weather economic downturns. Regulatory changes and stress tests have made banks more resilient, reducing the risk of another financial crisis. This improved financial stability is attractive to investors seeking a safe haven during volatile market conditions.

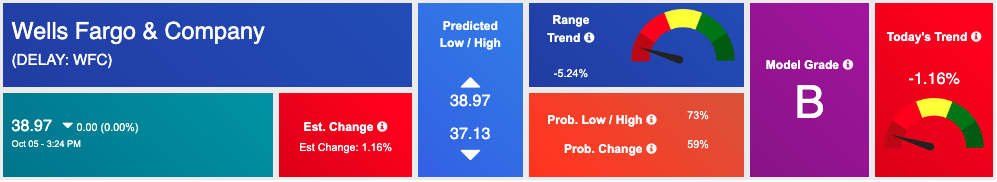

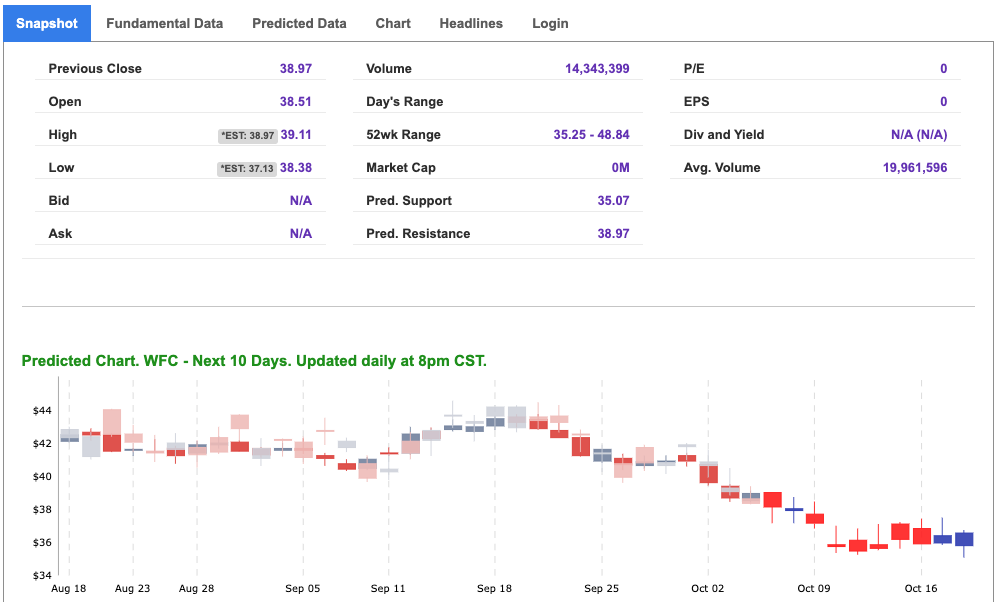

Wells Fargo & Company (WFC) commonly known as Wells Fargo, is one of the prominent players in the banking sector and merits a closer look for potential investors. Here’s a brief overview of the company and why it might be a good time to consider investing in $WFC:

Wells Fargo is a multinational financial services company headquartered in San Francisco, California. It is one of the largest banks in the United States, with a history dating back to 1852. The company provides a wide range of banking, mortgage, and investment services to individuals, businesses, and institutions.

Why Consider Investing in $WFC:

It’s important to note that investing in individual stocks carries inherent risks, and it’s advisable to conduct thorough research or consult with a financial advisor before making investment decisions. Nevertheless, Wells Fargo’s position in the banking sector, coupled with current market conditions, suggests that it may be an opportune time to consider $WFC as part of a diversified investment portfolio.

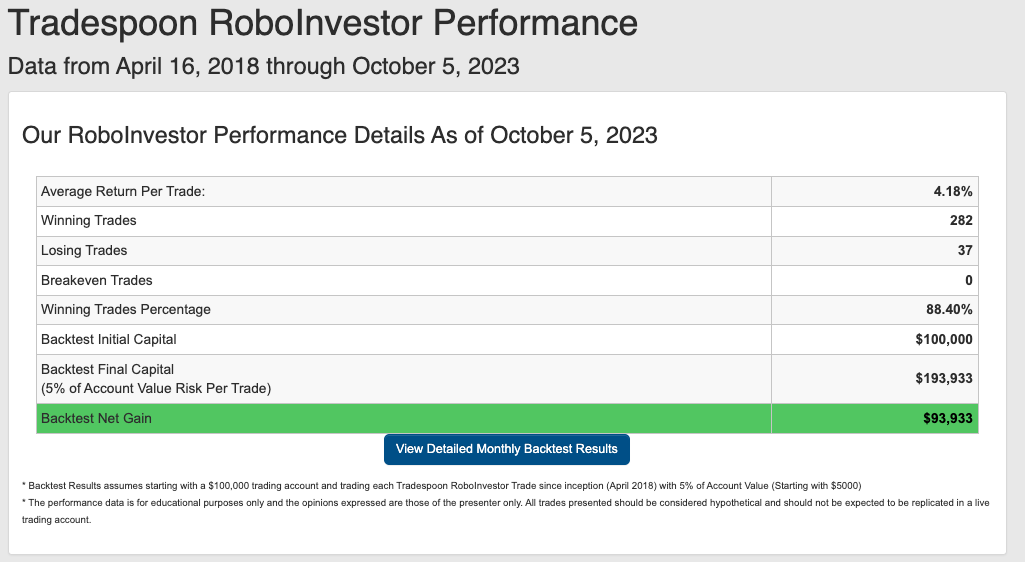

That is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.40% going back to April 2018.

As we inch closer to Q4 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!