In a day of mixed fortunes on Wall Street, the major U.S. indices closed with varied results. The Dow managed to defy early losses, finishing the day in positive territory. However, the S&P and Nasdaq experienced a sell-off, indicating a nuanced market sentiment.

The positive momentum in the Dow comes on the heels of two robust weeks of gains, although a closer look reveals a less optimistic picture. The S&P 500 Equal Weight Index, less influenced by the colossal moves of mega-cap tech stocks like Microsoft and Nvidia, recorded a 0.6% dip last week.

Investors brace themselves for a data-packed week, with key economic indicators and the looming threat of a government shutdown taking center stage. The release of the Consumer Price Index (CPI) for October on Tuesday is anticipated as the highlight, with a consensus estimate of a 3.3% increase from the previous year. Any surprises in these figures could significantly impact expectations regarding the Federal Reserve’s future stance on interest rates.

Adding to the week’s significance, retail giants Walmart, Target, and Macy’s are set to report earnings. Analysts and investors are keenly observing these reports for insights into consumer resilience against rising energy and borrowing costs, as well as gauging the industry’s response as the holiday shopping season approaches.

Amidst the economic data, the specter of a U.S. government shutdown looms if lawmakers fail to reach a funding agreement by Friday midnight when the current 45-day funding measure expires.

Last week, stocks saw an uptick following economic reports that reinforced the belief that the Federal Reserve may maintain the status quo on interest rates. Futures currently suggest a 71.7% probability that the central bank will keep rates steady through the next two Federal Open Market Committee meetings.

In individual stock movements, Boeing soared 4% on reports that the Chinese government might lift a commercial freeze for the company’s 737 MAX jet during the APEC Summit. Meanwhile, Tyson Foods experienced a 2.8% dip after missing analysts’ expectations for fourth-quarter sales and offering a less-than-optimistic outlook for fiscal 2024.

Tech giants also made waves in the market, with Illumina (ILMN) falling 5.7% due to revenue projections for 2023 falling short, while Nvidia (NVDA) rose 0.6% after unveiling its latest artificial intelligence chip, the H200 Tensor Core GPU.

Looking beyond stocks, the dollar remains steady, awaiting cues from Tuesday’s U.S. inflation data. Oil prices edged higher after OPEC raised its demand forecast for 2023, countering earlier negative market sentiment and emphasizing the resilience of the global economy.

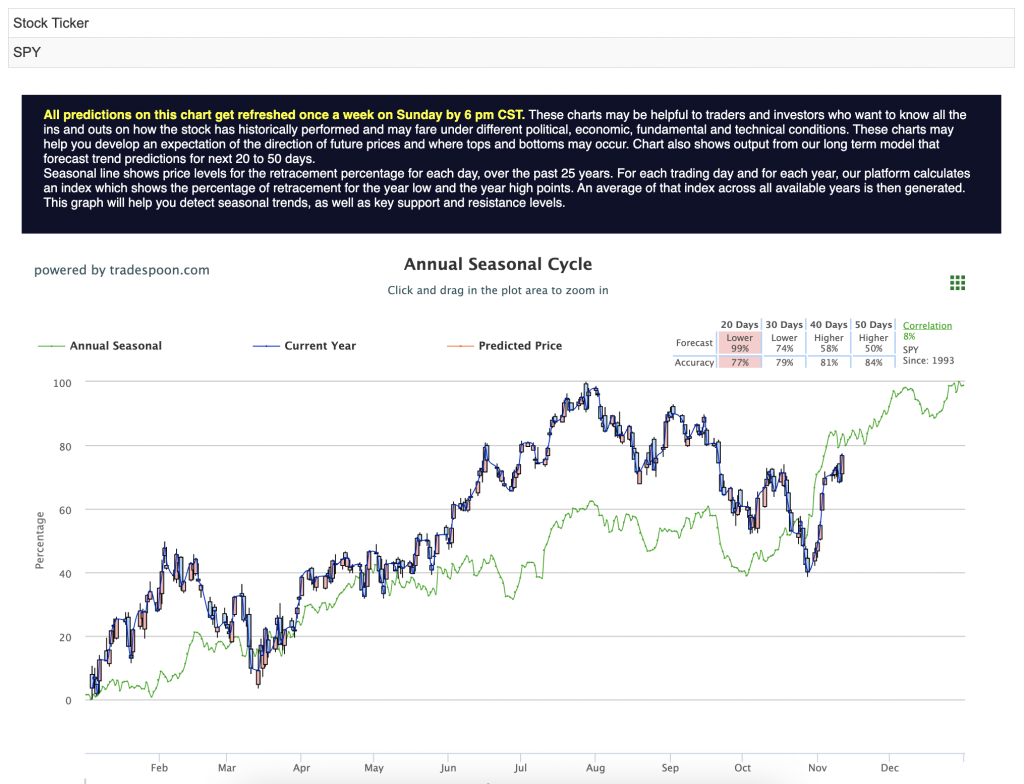

As conflicting expectations persist, a significant portion of market participants anticipates lower yields in the first half of 2024. However, uncertainties remain, and a shift to a market-neutral stance is advisable. With a capped SPY rally predicted at $450-$470 levels and short support at $400-$430, navigating the coming months requires a cautious approach. Additionally, the energy sector faces headwinds due to weak global demand and a temporary decrease in geopolitical risks. For reference, the SPY Seasonal Chart is shown below:

In the midst of this financial intricacy, market participants brace themselves for a week of pivotal economic data releases and corporate earnings reports, all of which may influence the trajectory of the markets in the coming months.

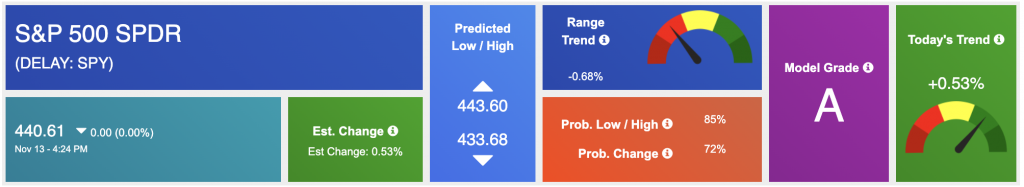

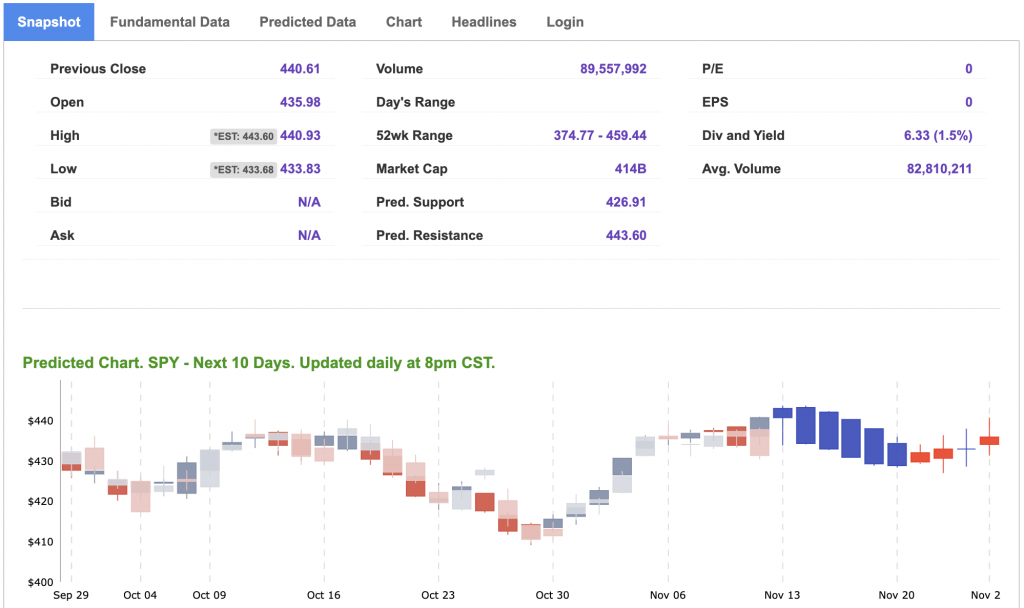

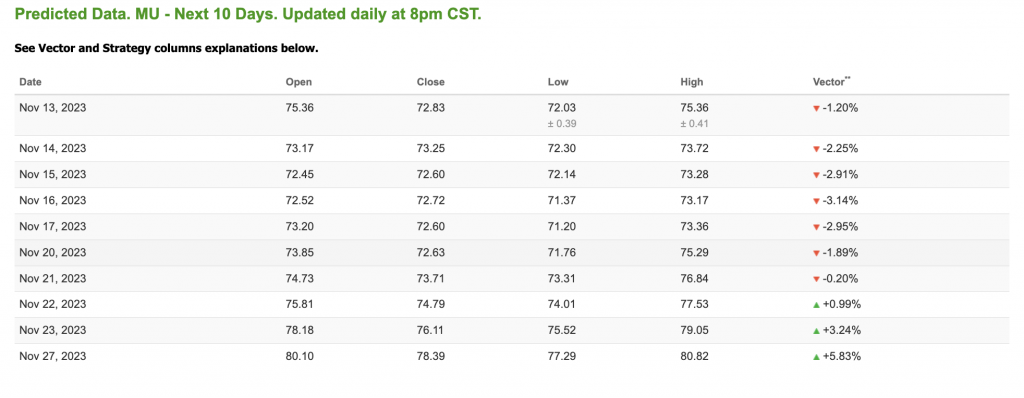

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

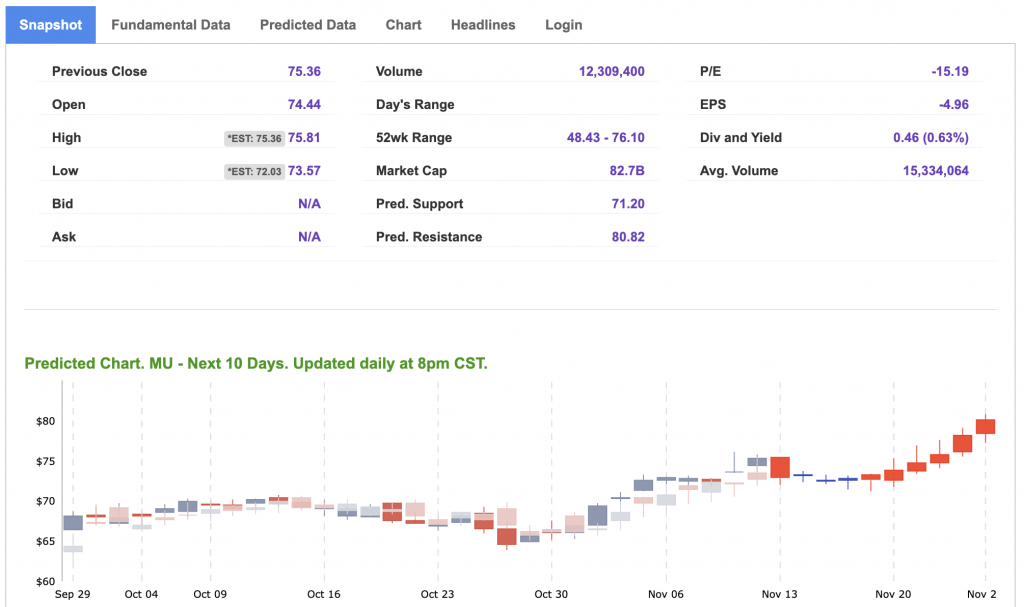

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, MU. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

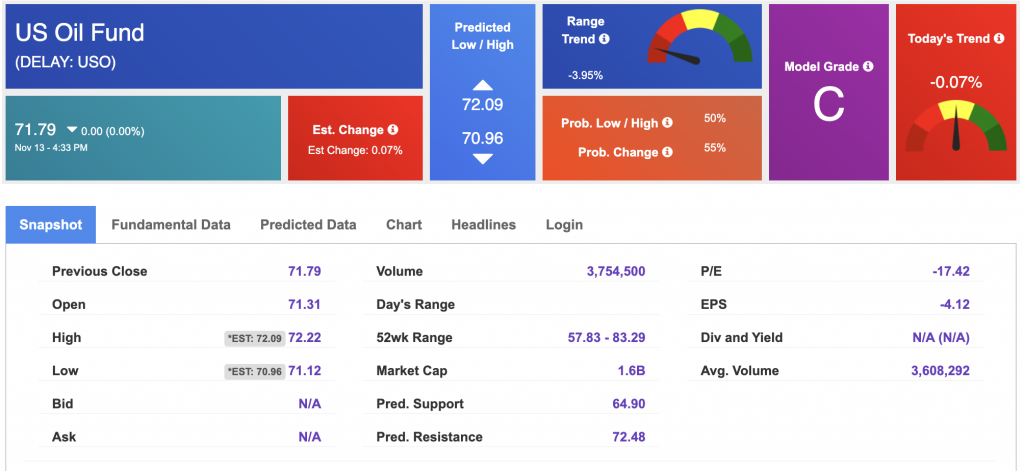

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $78.51 per barrel, up 1.74%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.79 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

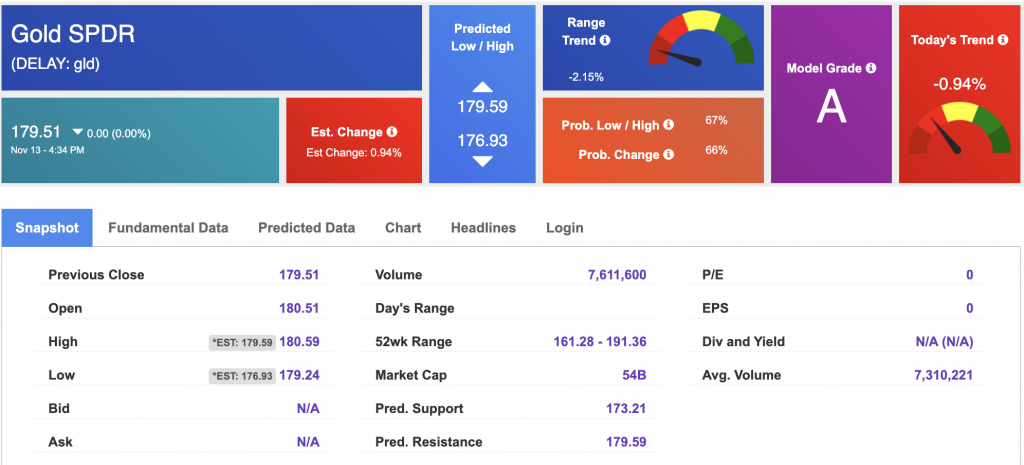

The price for the Gold Continuous Contract (GC00) is up 0.65% at $1950.20 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $184.79 at the time of publication. Vector signals show -0.75% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

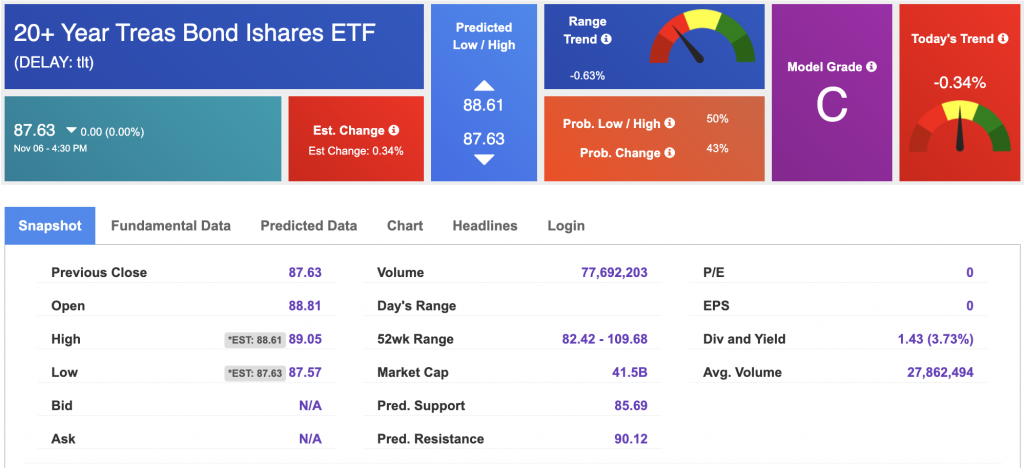

The yield on the 10-year Treasury note is down at 4.636% at the time of publication.

The yield on the 30-year Treasury note is down at 4.758% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

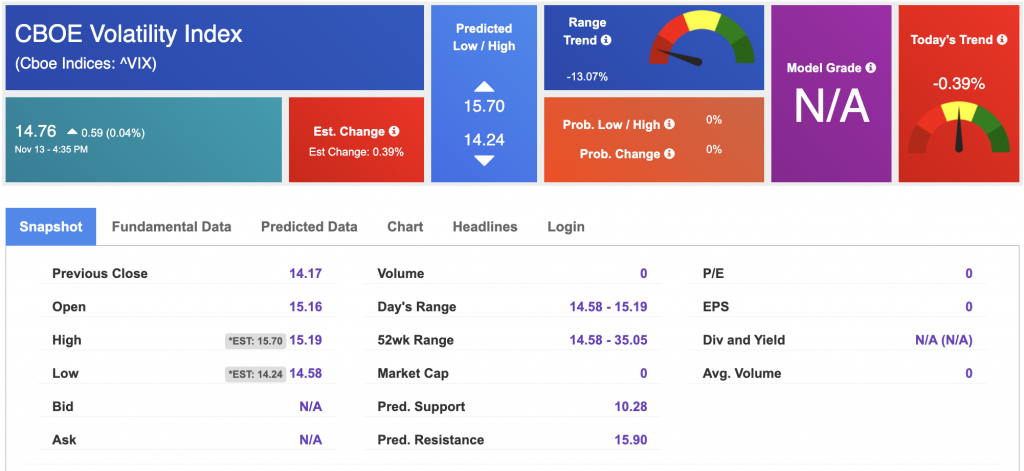

The CBOE Volatility Index (^VIX) is priced at $14.76 up 0.04% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!