U.S. stocks rebounded on Thursday, recovering from a slump earlier in the week, as the House of Representatives passed a deal on the US debt ceiling. The positive sentiment in the market allowed investors to shift their focus to the upcoming Federal Reserve meeting and the release of the jobs report on Friday. However, concerns loomed over the health of the consumer sector, highlighted by grim outlooks from Macy’s and Dollar General. Additionally, the Chinese manufacturing industry contracted, setting a cautious tone for the day.

After closing the previous month in the red, US stocks opened June on a positive note following the passage of a deal on the US debt ceiling. This development alleviated concerns about a potential default and allowed investors to redirect their attention to other market-moving events, such as the Federal Reserve meeting. The passing of the deal also lifted uncertainty surrounding the political landscape, as it faced opposition from both sides of the aisle.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

With the immediate debt ceiling issue resolved investors turned their focus towards the Federal Reserve’s next meeting. The central bank’s decision on interest rates is eagerly anticipated, and Friday’s jobs report will provide valuable insights into the likelihood of another rate hike. Traders are currently pricing in a higher probability of the headline interest rate remaining unchanged, reflecting a shift in expectations following comments from Federal Reserve officials.

Several earning reports are making waves this week. Macy’s and Dollar General offered a somber outlook on consumer health, signaling potential challenges for the sector. Tech earnings were also in focus, with post-market reports from Broadcom and Dell. These developments will provide further insights into the performance and growth prospects of the technology industry.

Early indications of a contraction in Chinese manufacturing had a negative impact on market sentiment. Futures declined in response, setting the tone for the day. While official PMI data suggested a contraction in manufacturing activity, a private gauge offered a slightly more positive outlook, leading to mixed reactions in Asian markets.

The Bureau of Labor Statistics Job Openings and Labor Turnover Survey showed an increase in job openings, defying economists’ expectations of a decline. However, the manufacturing sector in the US continued to contract, at a slightly faster rate compared to the previous month. The Institute for Supply Management’s May industrial PMI fell below economists’ projections, indicating a decrease in new orders but a rise in employment.

European stock markets saw a rise, propelled by data indicating a drop in eurozone inflation. The consumer price index in the eurozone increased at a slower pace compared to the previous month. Meanwhile, US earnings reports revealed mixed performance, with C3.ai and Salesforce experiencing declines, while Chewy and Nordstrom surpassed expectations.

As U.S. stocks experienced a rebound following the passing of the US debt ceiling deal, which eased concerns about a potential default, the focus now turns to the upcoming Fed meetings. With investors now turning their attention to the Federal Reserve meeting and the release of the jobs report, seeking further guidance on the future direction of interest rates, I have identified my next move in the market. While markets continue to trade sideways and volatility is expected to persist in the coming months, there is one type of trade I feel fairly confident about.

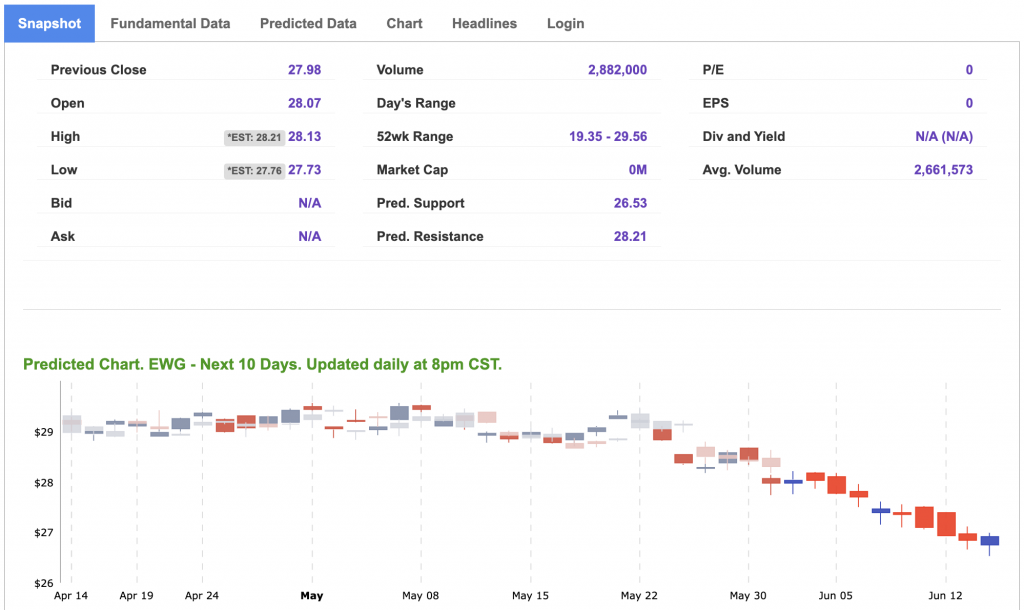

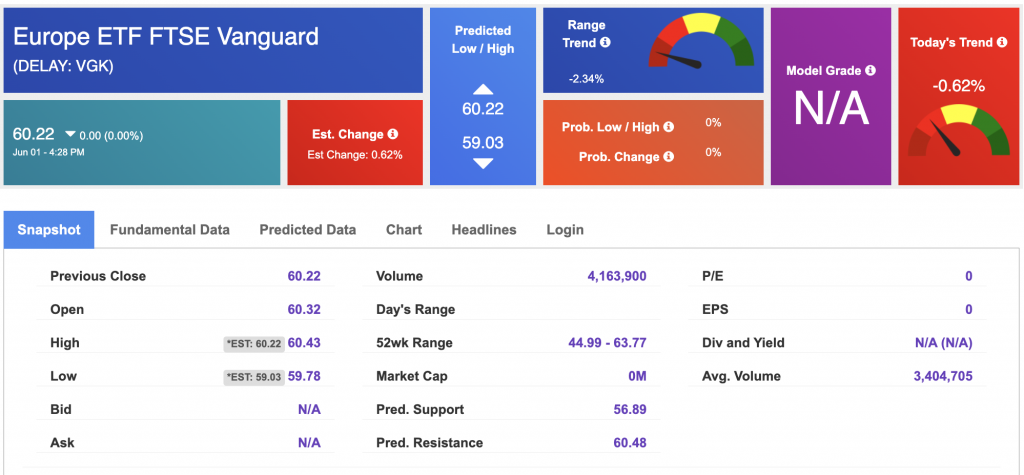

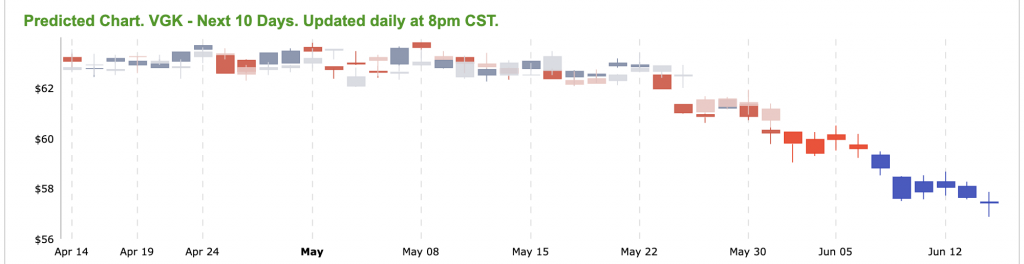

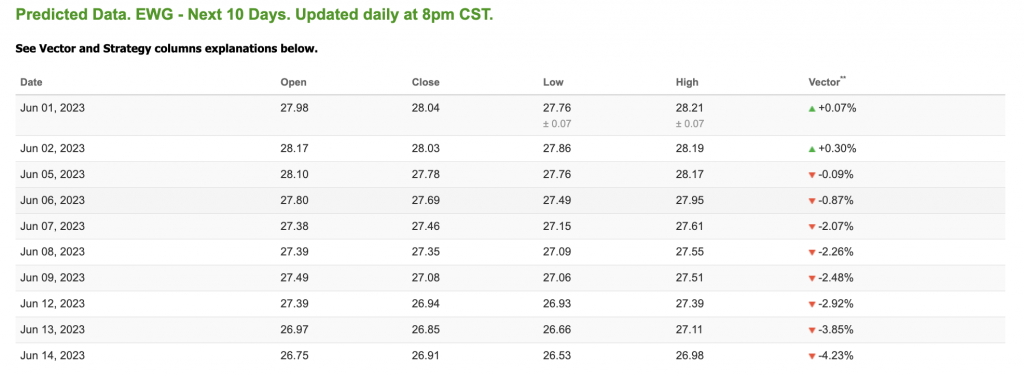

Our A.I. system has spotted an opportunity to short European markets specifically referring to taking bearish positions on European ETFs like EWG (iShares MSCI Germany ETF) and VGK (Vanguard FTSE Europe ETF).

The symbol EWG represents the iShares MSCI Germany ETF, which is an exchange-traded fund that tracks the performance of the German equity market. It provides investors with exposure to a diverse range of German companies across various sectors. The fund’s holdings include large, well-established German corporations, making it a popular choice for investors seeking exposure to the German economy.

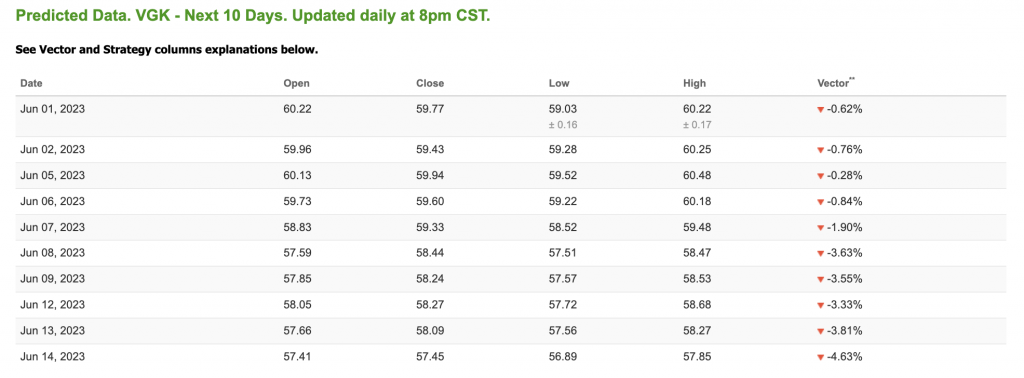

The Vanguard FTSE Europe (VGK) is an exchange-traded fund designed to track the performance of European stocks. The fund offers investors broad exposure to companies located in developed European markets, including countries like the United Kingdom, France, Germany, and others. VGK is widely regarded as a benchmark for European equity performance and is considered a reliable option for investors looking for diversified exposure to European markets.

As discussed above, we’ve seen selective market pullbacks across all assets and regions during the current volatile year. When a market pullback occurs across different asset classes and regions, it suggests a broader and more widespread trend of negative sentiment and selling pressure. As U.S. markets found good footing following the debt ceiling agreement, pressure could spill over to Europe while several geopolitical concerns continue to impact global markets. Likewise, the current situation in China appears to carry a larger fallout than anticipated.

When reviewing A.I. data we see a steep trend towards the downside for these symbols. See 10-day Predicted Data:

Shorting EWG and VGK provides investors with an opportunity to hedge against potential losses in the European market during times of uncertainty. By taking short positions on EWG (iShares MSCI Germany ETF) and VGK (Vanguard FTSE Europe ETF), investors can potentially offset losses or profit from a bearish outlook on European markets. When reviewing our reading of the market alongside the A.I. forecasts for these European staples it is clear there is profit to be had with shorting European markets in the coming weeks.

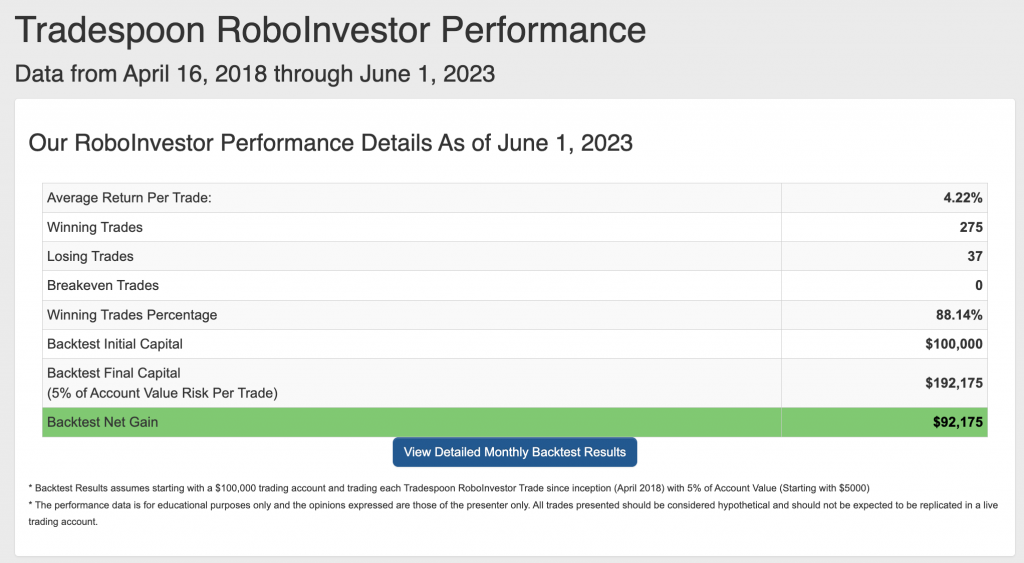

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.14% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!