RoboStreet – October 13, 2022

Earnings Season Due To Dictate Upcoming Market

On Thursday, after the U.S. consumer-price index for September came in higher than economists had predicted, stocks initially sold off sharply. However, they later recovered and turned sharply higher during the final hour of trading. The latest movement does not deter market sentiment that the Federal Reserve will continue with large interest rate increases in coming meetings. The $VIX saw an up-and-down week, trading as high as $34 before edging below $32 ahead of Friday. This week’s key economic release was the CPI data released on Friday which further illuminated inflation and the overall health of the U.S. economy as of late.

Diving into the data, we see that the cost of living in the United States rose by 0.4% in September, signaling unrelenting high inflation levels continuing into the end of the year. Yearly inflation moved from 8.2% to 8.4% and when reviewing the data excluding gas and food inflation showed a 0.6% increase. Forecasts had initially predicted a 0.3% increase. Keeping this in mind, it looks like the Federal Reserve will be strongly inclined to continue hiking rates. With key tenets of the economy such as rent and medical on the move higher, many are predicting additional 75 basis point hikes in the November and December FOMC.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Also making waves this week was the latest announcement from the Organization of Petroleum Exporting Countries which will likely push gas prices higher in the weeks to come. OPEC had announced a major scaleback of production – cutting its oil production by 2 million barrels per day. Although the CPI report showed a decrease in oil prices last month, oil rates spiked higher to start October following the OPEC news. Although not as high as they were in mid-summer, shares are facing significant trouble from both OPEC and the unrest in Ukraine.

Next week, the latest earning season is set to be in full stride following this week’s major bank releases. JPMorgan Chase, Citigroup, Morgan Stanley, and Wells Fargo earnings are due Friday. Then, we will see marquee earnings data from Bank of America, Charles Schwab, Netflix, Johnson & Johnson, Tesla, AT&T, and Verizon next week. Additionally, the latest Beige Book will also be released.

Reviewing the latest levels in the market, we are watching overhead resistance levels in the SPY which are presently at $376 and then $390. The $SPY support is at $355 and then $340.

We expect the market to continue the bottoming process for the next 2-8 weeks. The short-term market is oversold and can stage a multiple sessions rally. He would be a buyer into any further sell-offs and encourages readers not to chase the market to the downside. See SPY Seasonal Chart below:

As previously stated, we believe the bottoming process will continue. PPI data along with earnings will be key for the upcoming market direction following today’s CPI data. Rent, food, airline prices, and gas continue to show signs of high inflation as reports continue to come above estimates. Although there has been a repeat of the July-August rally, fueled by the hope of a change in Fed sentiment, the market remains oversold and can rally for a couple of weeks. We had just broken below the June-July low, setting up the latest minor rally in the market. Still, the bear market remains dominant and as long as SPY remains above recent lows, the bottoming process will continue.

With a handful of earnings being released before key banking data, it is clear there is some resilience in the market. PepsiCo and Delta airlines showed just that with their reports, as did $TSM. This brings me to one particular sector and one particular symbol ahead of the major bulk of earnings being released.

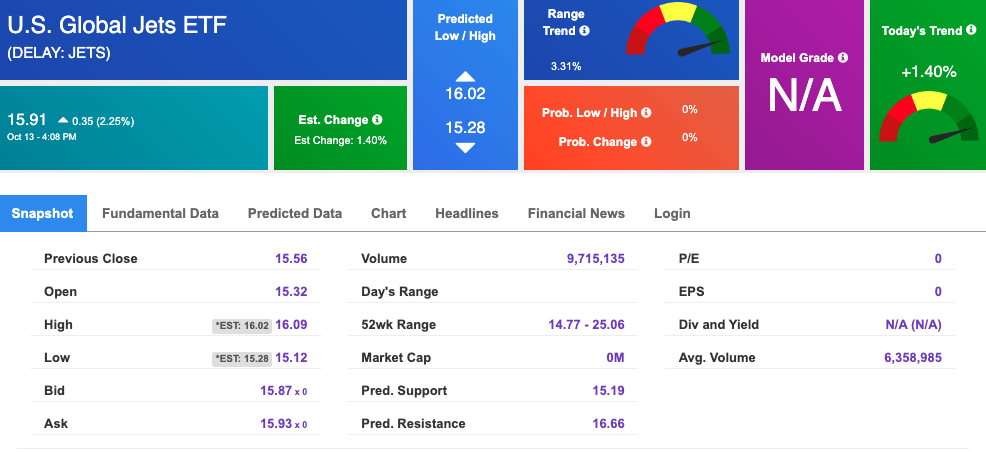

U.S. Global Jets ETF (JETS) is my go-to airline ETF which provides sector-wide exposure to airlines and the like. At $15 the ETF is trading far below its 52-week high of $25 and just above its 52-week low of $14.77. This provides a great opportunity in the airline sector as it appears the easiest path forward is up. This is a fantastic opportunity and one that I’d want to take advantage of as long as my A.I. data agrees. Let’s check:

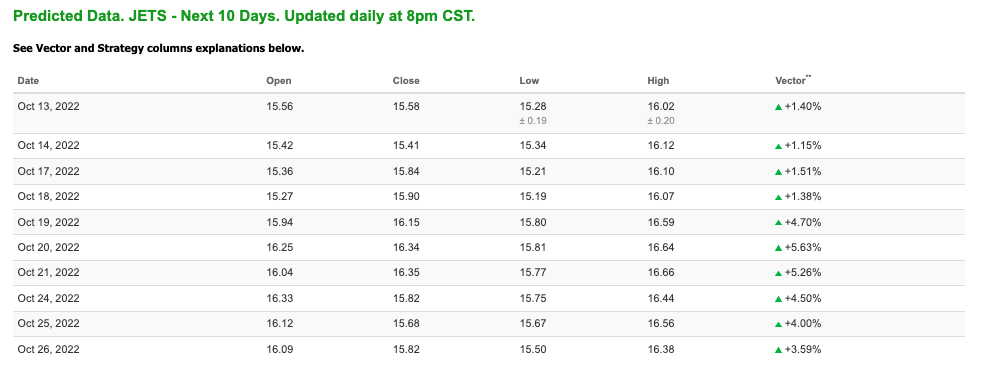

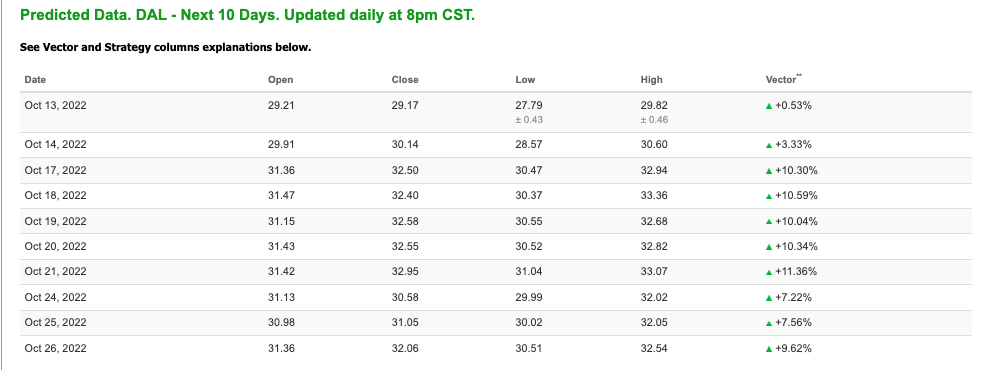

Reviewing the $JETS Stock Forecast Toolbox 10-day prediction above, we see that the data agrees – trend signals point to an upswing for the airline ETF. Not only are the technical levels of this ETF showing support towards higher momentum, but our key trend indicator, vector, presents an escalating vector search that often predicts shares to move in tandem. See the 10-day breakdown below:

If airlines are to profit on a wide scale, it would be prudent to identify a symbol that could also rise and offer a solid shot at profits. Having just released their earnings, I am eyeing one symbol that not only showed resilience through the selloff but also strong technical support going into the final quarter of 2022.

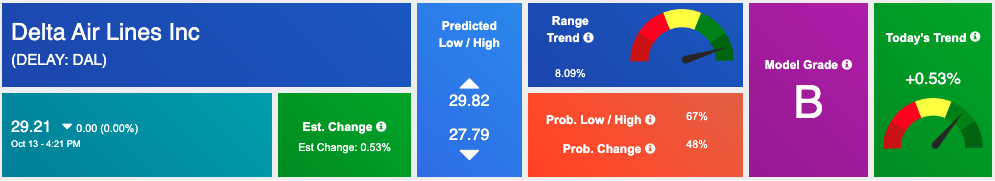

Delta Air Lines, Inc. (DAL) is one of the premier U.S. airlines with a nearly $20 billion market cap. DAL is trading just above its 52-week high of $27, currently at $30, and still has room to grow to hit its 52-week high of $46. Looking at our A.I. toolset we are seeing several encouraging signals for shares of Delta to push higher.

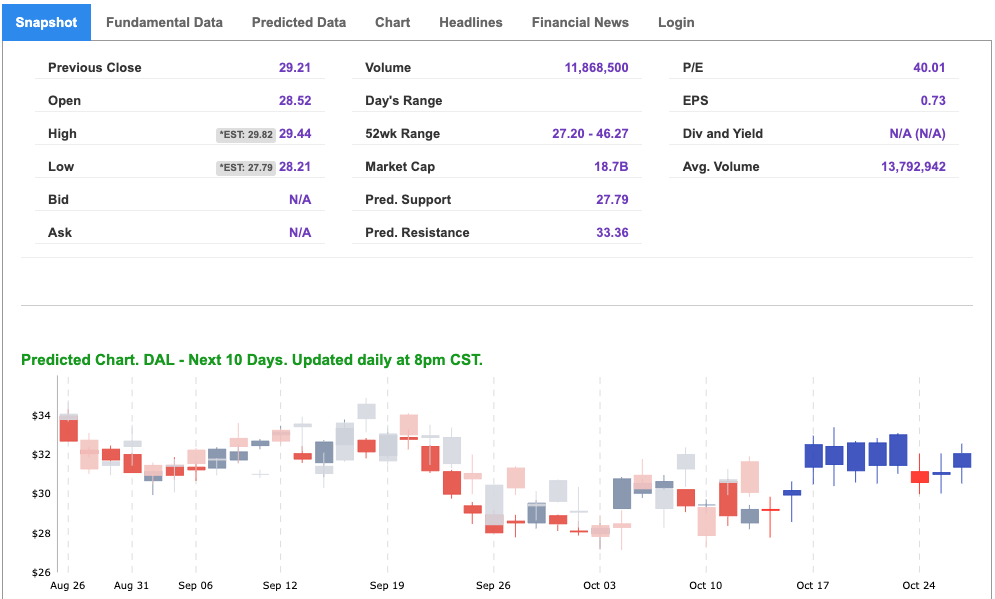

Presenting a model grade of “B” the symbol ranks at the top of the accuracy rating for the Tradespoon Stock Forecast data universe. Likewise, the SFT model shows a strong signal that shares could trade higher and furthermore, after pressing up against its predicted high, could balloon even further. The forecast also shows a strong probability to lend between the forecasted low and high as well as an escalating vector trend.

Vector scores offer insight into the model’s forecasted trend for the symbol. We look for strong vector scores moving in tandem in one direction. This is exactly the case with Delta. As earnings line up and more clarity on the market is offered, I am going to be looking at investing in Delta following the technical and forecasted support I spot within the airline sector.

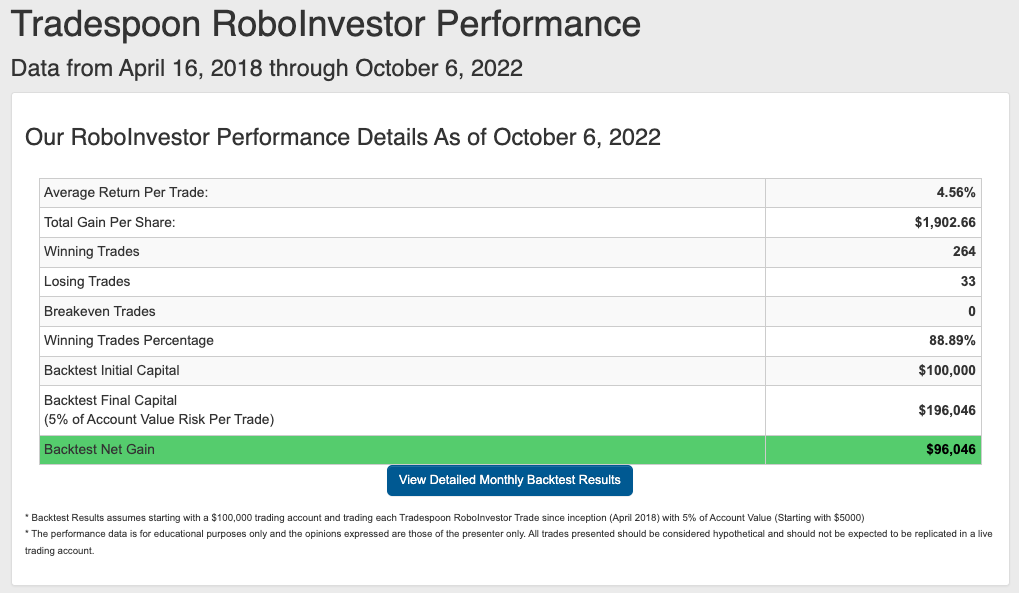

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.89% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we just started Q4! Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!