A turbulent day in the stock market left investors grappling with uncertainty as stocks took a tumble and ended in the red on Thursday. The primary culprit behind this downward spiral was the relentless climb of bond yields, casting a shadow over the market’s performance. Notably, the 10-year Treasury yield continues rising and is on the cusp of hitting record levels, adding to the apprehension among traders and investors.

Shifting our focus to the economic landscape, mortgage rates climbed to a two-decade peak, sending ripples of concern through the housing market. On the flip side, the unexpected decline in initial jobless claims underscored the ongoing tightness in the U.S. labor market. What initially appeared to be a promising day for stocks ultimately succumbed to the gravitational pull of rising bond yields. As these Treasury yields continue to surge, fundamental assumptions held by both bullish and bearish camps are being questioned, from the economy’s trajectory to the next moves by the Federal Reserve.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The new week ushered in a mixed bag of performances, as stocks retraced some gains achieved during the prior week’s surge, triggered by promising U.S. labor report data. The week’s opening displayed a blend of ups and downs, as investors navigated the aftermath of Friday’s robust market rally. As the week unfolds, market participants brace for a series of pivotal events, including the release of U.S. inflation figures and the commencement of the fourth-quarter earnings season.

While the most impactful triggers are slated for later in the week, Monday had its own share of economic revelations. Investors closely scrutinized the New York Federal Reserve’s inflation expectations for signs of abatement. Additionally, the speeches by Atlanta Federal Reserve President Raphael Bostic and San Francisco Federal Reserve President Mary Daly were subject to keen observation.

Going back to Wednesday, market watchers saw the market lose its momentum as investors meticulously dissected the minutes from the Federal Reserve’s July meeting. This scrutiny was accompanied by unease stemming from China’s economic landscape, further contributing to the market’s jitters. Intriguingly, a couple of members of the Federal Open Market Committee advocated for maintaining the benchmark interest rate at its present level during the last policy-setting meeting. This dissenting view contrasted with the prevailing sentiment, which acknowledged the “significant” inflation risks.

Delving deeper into July’s pivotal meeting, the unanimous decision to raise rates by a quarter-point was notable. Yet, this unity concealed a nuanced division within the committee. At least two members voiced reservations about the timing of the rate hike, shedding light on the deliberative nature of the decision-making process. The ensuing discussions highlighted differing opinions, with some advocating for a more measured rate stance to better gauge the effects of past increases on inflation.

This brings us to Thursday where, the healthcare sector bore the brunt of the day’s turmoil, with CVS Health leading the way with an 8.1% decline. The catalyst behind this slump was Blue Shield of California’s decision to sever ties with CVS’s Caremark, its pharmacy-benefit manager. This seismic shift paved the way for a consortium of other players to step in, with Amazon.com emerging as a contender for at-home drug delivery services. The aftershocks were felt throughout the sector, as CVS emerged as the weakest performer in the S&P 500. Cigna and UnitedHealth, both major players in the pharmacy-benefit management arena, also faced losses of 6.4% and 1.9%, respectively.

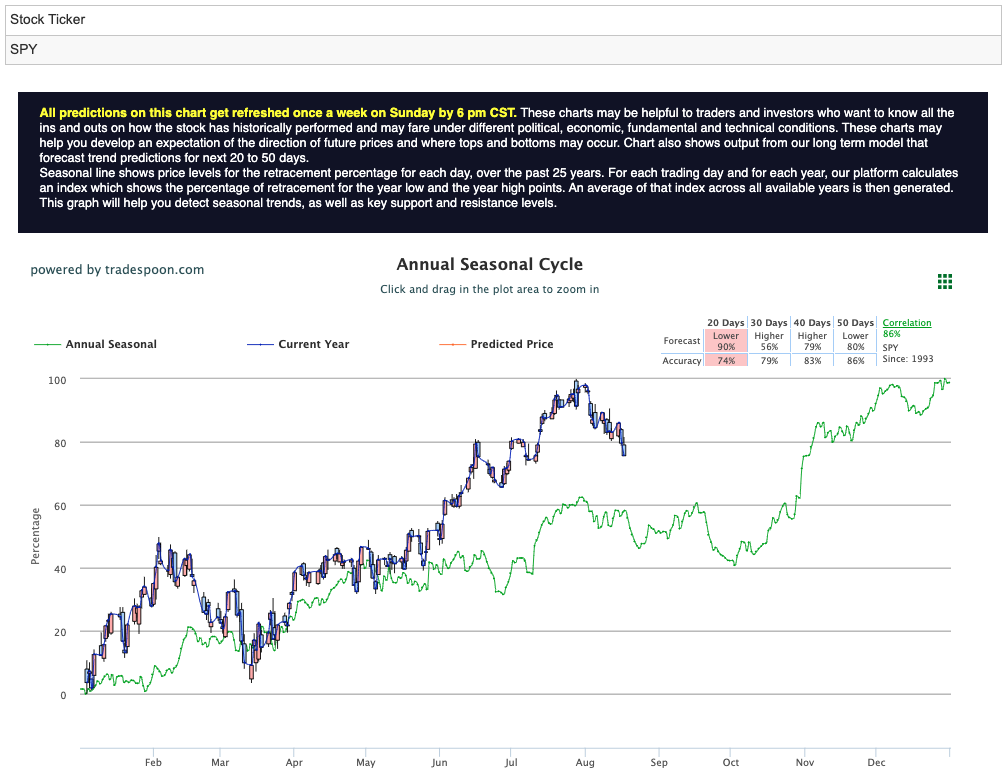

In a landscape characterized by reduced recession risks and a declining U.S. Dollar Index ($DXY), market experts maintain a cautiously optimistic outlook for the future trajectory. Following a shift in sentiment during the mid-summer period, expectations of heightened market volatility persist as the year progresses. Despite this caution, analysts project a potential SPY rally boundary ranging from $450 to $470, reflecting optimism amid the uncertainty. Furthermore, they pinpoint short-term support levels within the 400-430 range in the coming months. For readers of market commentary, the advice is clear: establish well-defined stop levels for all positions to navigate this dynamic terrain with confidence. For reference, the SPY Seasonal Chart is shown below:

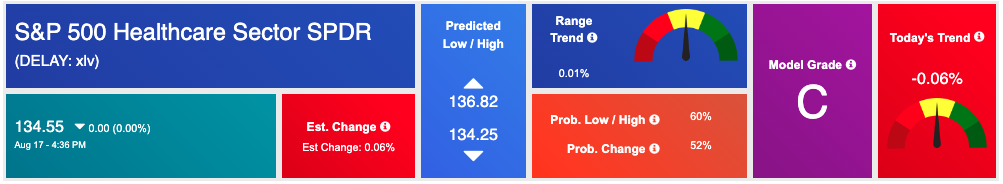

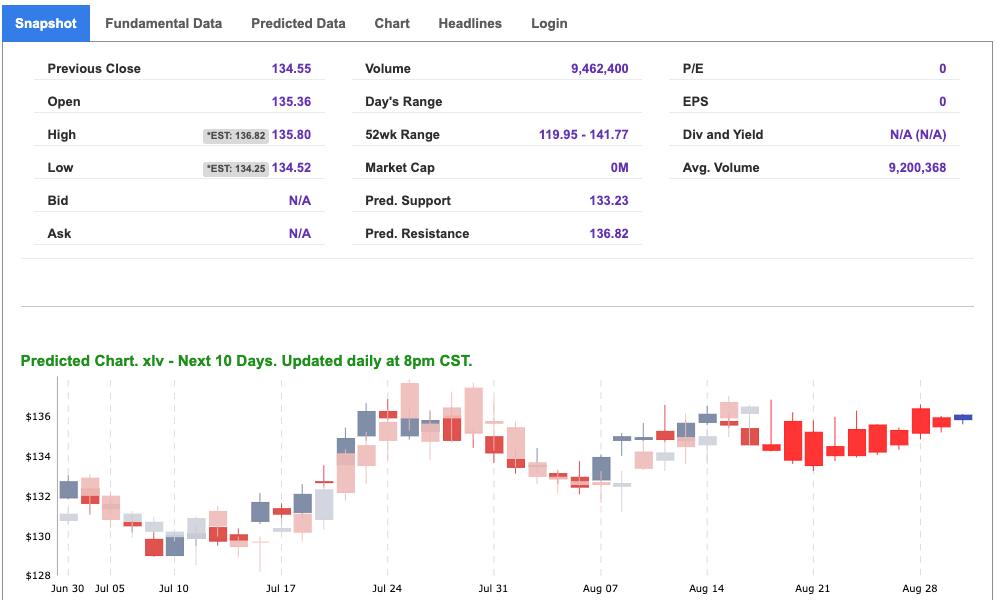

In the midst of the market’s recent fluctuations, the healthcare sector has stood at the forefront of challenges. The sector’s performance took a hit, with CVS Health notably experiencing an 8.1% decline due to changes in its pharmacy-benefit management dynamics. The decision by Blue Shield of California to drop CVS’s Caremark in favor of other companies, including Amazon.com for at-home drug delivery, stirred waves of uncertainty. The ripple effects were palpable, with Cigna and UnitedHealth, major players in the pharmacy-benefit management landscape, also facing declines.

Beyond these specific company developments, the healthcare sector’s trajectory is being influenced by broader economic factors. The rising bond yields, which have cast a shadow over the overall market, are impacting healthcare stocks as well. Furthermore, discussions surrounding the Federal Reserve’s decisions and their implications for interest rates are likely to ripple through the sector, affecting investor sentiment.

Spotlight on $XLV: Healthcare Select Sector SPDR Fund

One key instrument that provides exposure to the healthcare sector is the Healthcare Select Sector SPDR Fund ($XLV). This exchange-traded fund (ETF) is designed to track the performance of the healthcare sector within the S&P 500 Index. Comprising a diverse range of healthcare-related companies, $XLV offers investors an opportunity to gain broad exposure to the sector without having to cherry-pick individual stocks.

With its portfolio comprising a variety of healthcare companies, $XLV provides diversification within the sector. This can help mitigate the risks associated with investing in individual stocks, especially during times of heightened market volatility. Healthcare is often considered a defensive sector, meaning it tends to perform relatively well even during economic downturns. As investors seek stability in uncertain times, $XLV’s defensive characteristics could come into play.

The healthcare industry is underpinned by long-term demographic and societal trends. Despite recent challenges, the healthcare sector could benefit from potential catalysts, such as ongoing innovation, drug development, and healthcare infrastructure investments. Market turbulence often presents opportunities to invest in quality assets at potentially more attractive valuations. If the recent dips in healthcare stocks are viewed as temporary setbacks, investors might find value in the sector.

While investing always carries inherent risks, considering the strategic role of healthcare and the potential benefits of diversification, $XLV could be an appealing option for investors looking to position themselves for potential future growth and stability within the sector.

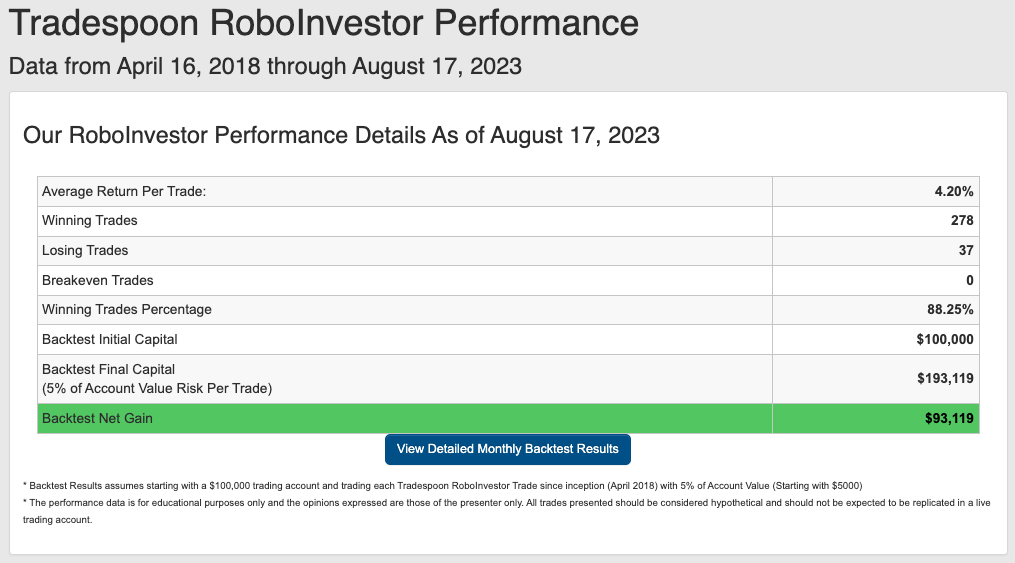

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we continue onto the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!