As the second-quarter earnings season gains momentum, investors are eagerly assessing corporate performances, along with the latest released economic indicators, including retail sales data and updates on the U.S. housing market. The stock market experienced a robust start to the week, driven by technology stocks, while bond yields declined, reflecting market enthusiasm over the possibility of the Federal Reserve wrapping up its interest rate hikes.

On Tuesday, stocks rallied as corporations reported their earnings. Bank of America reaped the benefits of higher rates, while Morgan Stanley exceeded expectations despite a slowdown in deal-making. Charles Schwab also impressed with second-quarter adjusted earnings that surpassed estimates, leading to a notable 13% surge in the company’s stock. Citigroup rose 1.7%, in line with other banks.

Among regional banks, notable performers included Bank of New York Mellon, which posted better-than-expected second-quarter earnings, driven by an impressive 33% increase in net interest revenue. Despite missing Wall Street’s revenue forecast, PNC Financial’s stock still managed to rise by 2.6%.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Elsewhere, on Tuesday, Microsoft reached an all-time high, fueled by its latest artificial intelligence capabilities and announcement. The stock surged 4% after unveiling an aggressive pricing plan for its latest AI products. This propelled the company’s market capitalization by an impressive $102.3 billion, making it one of the largest one-day gains for a U.S. firm. Analysts raised earnings estimates as the AI-driven software market expanded. With inflation declining, markets anticipate the Federal Reserve will pause interest rate hikes, benefiting Microsoft’s future profits and anticipated substantial growth.

Looking at Tuesday’s other key economic report, June retail sales fell short of expectations, with a year-over-year increase of 1.49%, lower than estimates, and May’s gain of 1.96%. Households exercised caution and selective spending, resulting in flat retail sales volumes when adjusted for inflation. This resilience in consumer spending has puzzled experts as the Federal Reserve continues its efforts to control inflation by curbing demand for goods and services.

Nevertheless, the overall positive sign indicates that the economy is growing, but at a moderate pace, easing concerns about stubbornly high inflation. The prospect of the Federal Reserve halting interest rate hikes brings the potential for economic relief.

Wednesday saw the stock market open higher, with the Dow Jones Industrial Average on track for its eighth consecutive day of gains. The optimism stems from inflation trends, as rates have consistently declined throughout the year, signaling the possibility of the Federal Reserve winding down its interest rate hikes. This, in turn, is expected to stabilize economic growth, fostering corporate earnings growth.

Carvana made headlines by surging 40% after reporting its best-ever quarter for profit and announcing a debt reduction agreement. The company’s decision to move up the release of its earnings report by two weeks further fueled market interest. While, AT&T and Verizon Communications experienced considerable gains, rising by 8.5% and 5.3%, respectively.

On Thursday, the Dow Jones Industrial Average continued its ascent, heading for its ninth consecutive day of gains, with a boost from IBM and Johnson & Johnson. Meanwhile, the S&P 500 and Nasdaq faced declines due to disappointing reports from Netflix and Tesla. Weekly jobless claims came in lower than expected, signaling continued strength in the U.S. labor market.

Tesla’s second-quarter earnings topped analysts’ expectations, with a 47% revenue increase from the previous year. However, the electric-vehicle maker’s gross profit margins slipped to 18.1%, slightly below Wall Street’s 18%-19% expectations. Tesla’s CEO, Elon Musk, added that third-quarter production would be slightly lower due to planned equipment upgrades during the normal summer shutdown. As a result, Tesla shares experienced an 8.8% decline, closing at $265.50.

Similarly, Netflix’s stock fell by 8.7% after reporting a surprise 5.89 million increase in subscribers for the second quarter but falling short on revenue forecasts. The company’s sales guidance for the third quarter was also disappointing, with Netflix expecting revenue of $8.52 billion, below analysts’ forecasts of $8.67 billion.

Shares of Johnson & Johnson, however, surged on Thursday, driven by positive earnings and increased financial guidance, despite renewed concerns about talc litigation. The company’s adjusted earnings of $2.80 per share for the quarter ended June, along with revenue of $25.5 billion, both exceeded analysts’ expectations.

In contrast, Discover Financial Services faced a challenging day, with its stock plunging by 16%. The company’s second-quarter earnings dropped by 18%, and the disclosure of an internal review of certain card product misclassifications led to a decision to pause stock buybacks during the review process. This made Discover the leading decliner in the S&P 500 on Thursday.

Internationally, the UK’s inflation rate dropped more than anticipated, hitting a 15-month low of 7.9% in June, down from 8.7% in May. Despite the decline, the UK still holds the highest inflation rate among the G7 economies and is grappling with sluggish economic growth. Market reactions included a fall in the pound against the dollar, with UK housebuilder shares rising as the market priced in lower expectations for interest rates. The FTSE 100 stock index surged by 1.6%. The next Bank of England decision is set for August 3, with a quarter-point hike expected.

In other global markets, Germany saw markets move higher while the Hang Seng in Hong Kong closed down 0.3%, driven by concerns over the weakening of the world’s second-largest economy. Conversely, Japan’s Nikkei index finished 1.2% higher.

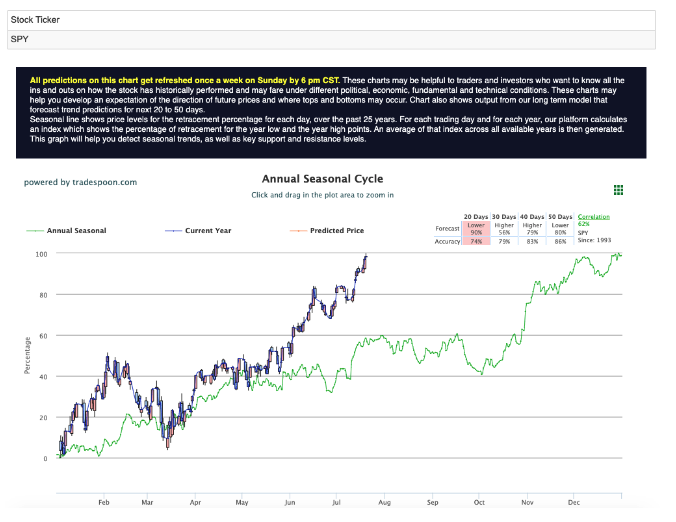

As the market continues to trade higher, investors should anticipate more volatility during the second half of the year. Better-than-expected earnings data has fueled optimism, and all eyes are on the Federal Reserve and European Central Bank decisions in the coming week. With the latest rally in mind, I still believe the SPY rally capped at $450-470 levels and short support is $400-430 for the next few months. See $SPY Seasonal Chart:

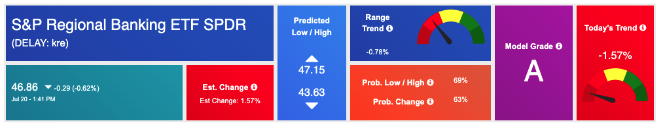

Additionally, the better-than-expected CPI data from the UK and Europe may impact rates in those regions, potentially influencing the performance of the $DXY currency index, which is currently extremely oversold. While the market remains overbought, certain sectors, such as technology, are still showing signs of uptrends. Investors should closely monitor the performance of regional banks, small caps, and cyclicals, which continue to rally, while keeping an eye on the potential make-or-break scenario for the stock market and currency markets.

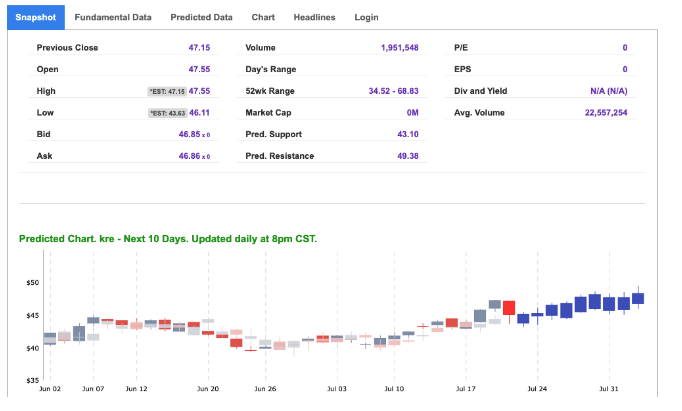

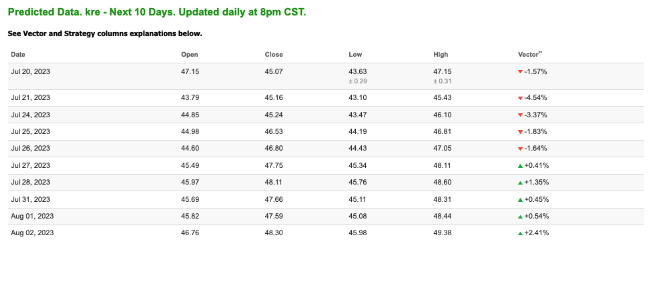

As the stock market continues its upward trajectory, one sector that has been gaining attention is regional banks, and the SPDR S&P Regional Banking ETF ($KRE) stands out as an appealing option for those looking to capitalize on this trend.

The SPDR S&P Regional Banking ETF ($KRE) is an exchange-traded fund that tracks the performance of regional banking companies in the S&P Total Market Index. With assets under management of over $5 billion, $KRE offers a diversified portfolio of small and mid-sized regional banks, providing exposure to the potential growth and stability of these financial institutions.

Investing in small regional bank stocks through $KRE can be a prudent move for several reasons. Firstly, these banks tend to have a strong focus on local communities, allowing them to better understand and cater to the specific needs of their customers. As the economy rebounds and consumer spending rises, regional banks may benefit from increased lending and improved credit quality. Additionally, they may have lower exposure to complex financial products, reducing the risk of potential market volatility.

As interest rates stabilize, regional banks can benefit from an improved interest rate environment, positively impacting their net interest margins and profitability. Considering the current market conditions and the overall positive outlook for the financial sector, investing in small regional bank stocks through $KRE may offer investors an opportunity to participate in the potential growth of these institutions while diversifying their investment portfolios.

In summary, the second-quarter earnings season has delivered promising results, instilling optimism in the markets. Economic indicators and central bank decisions will be key drivers of market sentiment. Employment gains in the U.S. have been robust, indicating strength in the labor market. However, global markets are witnessing mixed performances, with Europe and Asia experiencing both gains and challenges. As the market navigates the potential impacts of central bank decisions and economic data, investors are advised to stay vigilant and adaptive in the ever-changing financial landscape.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

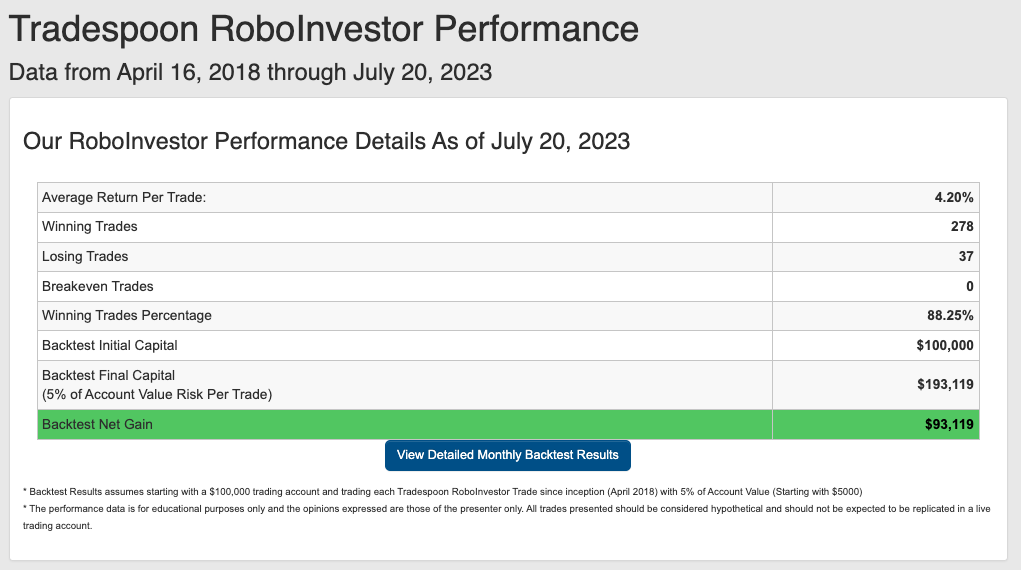

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we enter the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!