RoboStreet – November 3, 2022

Market Selloff Following FOMC Rate Hike

This week, markets responded to the latest Fed policy update ahead of key employment data as well as the continuation of the latest earnings season. Markets continued to sell off on Thursday after starting the week in the red and lowering even further following the Fed decision. Following this week’s Federal Open Market Committee meeting decision, the next major event to impact markets will be the upcoming midterm elections.

On Wednesday, Fed Chair Powell announced the fourth consecutive interest rate hike, bringing interest rates to multi-year highs. The Fed hiked its rate by 0.75 percentage points to a range of 3.75% to 4%, signaling that it would watch closely for any potential damage caused by this rapid pace of hikes. Powell hinted that there could be more interest rate hikes on the horizon, although the Fed may ease up on the frequency of increases after ramping up over the past year to combat inflation.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

At his press conference, Powell stated that it would be “very premature” to consider pausing the rise in rates. However, he also said the target for increases in policy rate might differ from what was previously expected which sent shares lower throughout the market. Markets continued to sell off on Thursday and look to finish the week in the red. On Friday, monthly employment reports will be released for the month of October which will include the unemployment rate, average hourly earnings, payrolls, and labor-force participation.

Also this week, the ADP employment data for October revealed that the private sector added 239,000 jobs, exceeding expectations. Even though the report states that pay growth is decreasing, the labor market still seems to be thriving after impressing in two months consecutively.

While the Fed’s decision triggered a pullback on the market following fears of recession due to over-tightening, there are hopeful prospects for market relief. First of all, earnings have shown resilience in several sectors and we still have several reports set to release in the coming days. Following the initial batch of strong earnings, markets staged a decent rally before falling in the lead-up to and after the latest Fed interest rate hike.

Looking past the upcoming employment and earnings data, which are still due, next week will mark the latest midterm election which can offer market support. Political clarity traditionally supports the market and it appears this election will have a decisive swing toward majority control.

With this in mind, there is potential for the market to rally for several weeks. Having hit the latest lows, the easiest path for the market, as long as it trades above its annual low, is toward the upside. Just as we saw in July and August, following inflation pressures the market was able to rebound into a multi-week rally. As long as SPY trades above recent lows, the market can continue to go higher.

Right now, I am monitoring the SPY’s overhead resistance levels. They are currently at $390 and $400. The $SPY support is currently at $374 and then projected to be at $367.

Based on current market trends, I anticipate a potential rally to continue for 4-8 weeks. Still, the short-term market appears to be overbought and could experience some pullbacks. I would be a buyer into any further sell-offs and encourage subscribers not to chase the market to the downside or upside.

With the market focus shifted from the Fed decision to the upcoming midterm election, several sectors are looking to break out. CPI data is also on the horizon which could pressure markets, however, there is one sector I believe could be pullback-proof.

Healthcare is one sector that should be resilient to any market pressure formed in the upcoming weeks. Rather, this sector has been shown to trade higher even amidst inflation and recession pressures. With a handful of supportive events on the horizon, including the midterm election and holiday rally, I am looking into the sector for the remainder of 2022.

Within this sector, there is one symbol that has a unique occupancy in both healthcare and a notable retail brand: CVS Pharmacy.

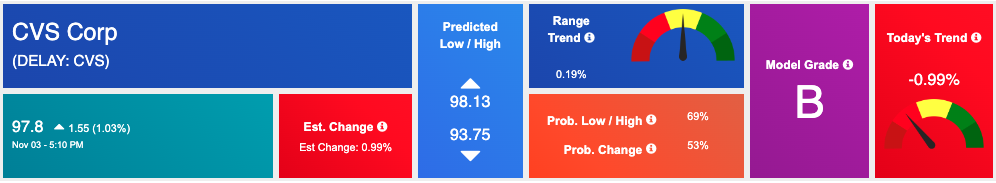

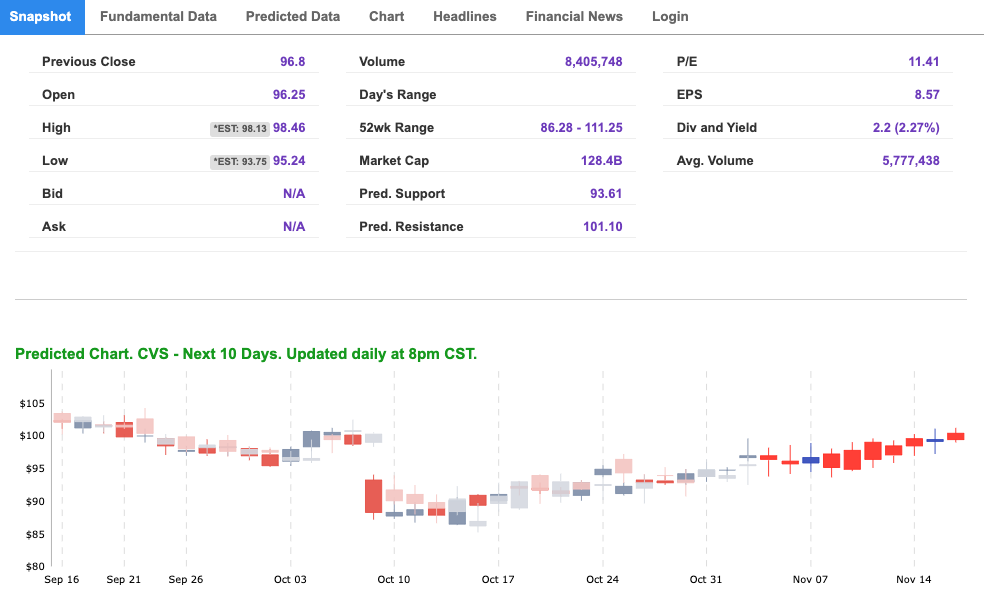

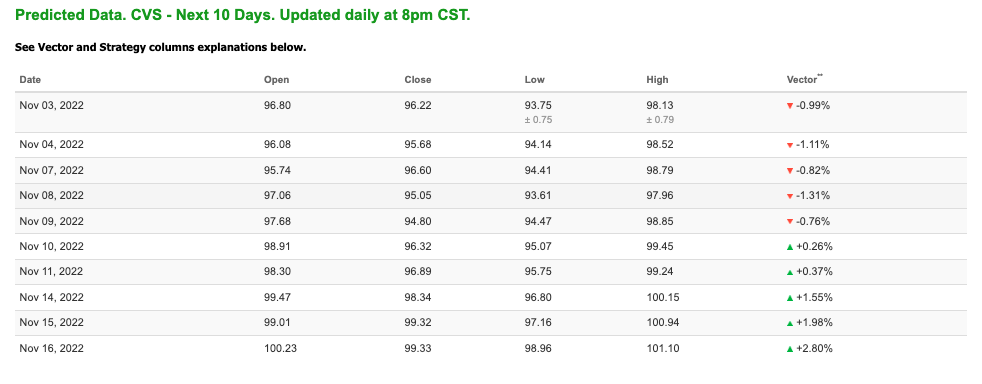

CVS Corp. (CVS) is currently trading in the $97 range and currently sporting a nice 5% rise in the last 5 days. Still, the symbol is trading closer to its 52-week low and offers plenty of room to the upside. With a 52-week range of $86-$111, CVS is down over 6% for the year. When reviewing our Stock Forecast Toolbox 10-day predicted data, CVS is showing a promising model grade “B” indicating it is in the top 25% for accuracy in our data universe.

Similarly, CVS is showing a solid vector trend toward the upside after a few losing sessions. The symbol’s trend coupled with its current levels offers a good entry price for the name-brand health symbol. When reviewing vectors, we look for steady trends in one direction and CVS appears to be showing just that.

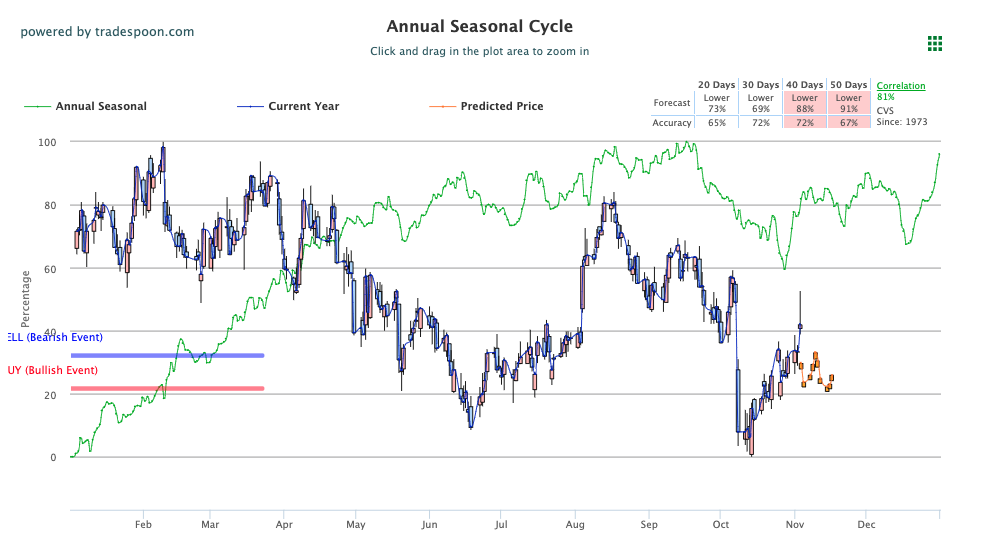

Looking into the Seasonal Chart of $CVS, our model for longer-range forecasts, we see several additional positive indicators. Specifically, the symbol has developed a sizable gap between the annual seasonal price and its current price, which could push the symbol higher in the coming weeks. See CVS Seasonal Chart below:

After reviewing the latest levels in the market, I feel confident about CVS’s path toward the upside. Midterm elections should offer market-wide support. Following them, we are likely in store for the seasonal holiday rally. I believe the market should rally toward the end of the year, although a short-lived rally as the bear market could resume next year. If so, that means CVS is currently trading in a great spot for any upcoming rallies.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

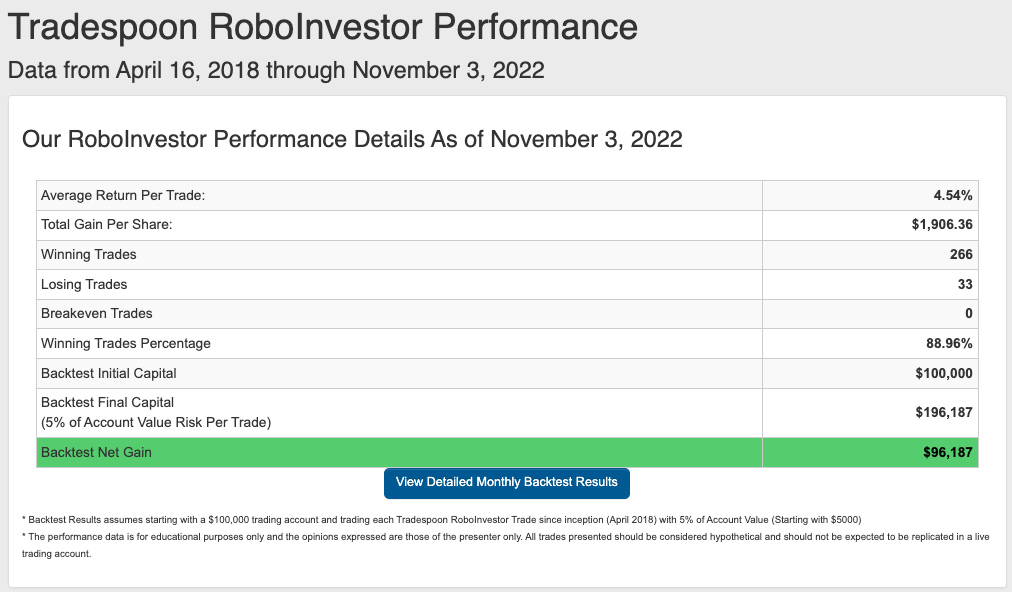

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.96% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we just started Q4! Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!