This week’s market narrative has been one of cautious optimism tempered by economic uncertainty. Following a sharp downturn driven by inflation fears, Thursday’s market rebound offered a reprieve as wholesale prices defied expectations. However, with inflation persisting above target levels, the Federal Reserve faces a challenging path forward.

Wednesday’s release of the Consumer Price Index (CPI) data painted a picture of mounting price pressures, with March’s year-over-year increase reaching 3.5%, surpassing economists’ forecasts. Core inflation remained elevated at 3.8%, driven by surges in housing and gasoline costs. These figures underscore the difficulty in achieving the Fed’s 2% inflation target, potentially delaying anticipated interest rate cuts.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

On Thursday, attention shifted to the Producer Price Index (PPI), which showed a modest 0.2% increase in March, falling below expectations. This contrasted with the previous day’s alarming CPI report, prompting a sigh of relief among investors. However, doubts persist regarding the timing of potential rate adjustments, contributing to market volatility.

While the European Central Bank maintained interest rates, speculation mounts regarding a potential cut in June, diverging from the uncertain stance of its U.S. counterpart. The discrepancy in monetary policies adds complexity to global market dynamics, influencing investor sentiment and asset allocation strategies.

As earnings season commences, Delta Air Lines (DAL) reported robust results, setting a positive tone for the market. All eyes are now on major banks like JPMorgan Chase (JPM), poised to unveil its earnings performance. Despite challenges faced by tech giants like Apple (AAPL), Tesla (TSLA), and Nvidia (NVDA), investors pivot towards sectors showing resilience, such as energy, banks, materials, and industrials.

Against a backdrop of volatile treasury markets, investor sentiment remains cautiously optimistic. Most anticipate the Fed to maintain its current stance, potentially initiating rate cuts in the first half of 2024, aligning with a bullish market outlook. However, the risk of delayed rate adjustments poses a potential headwind, warranting a vigilant approach to investment decisions.

The rising popularity of former President Trump and impending elections add another layer of uncertainty to market dynamics. Market participants closely monitor political developments, acknowledging their potential impact on market sentiment and investment strategies.

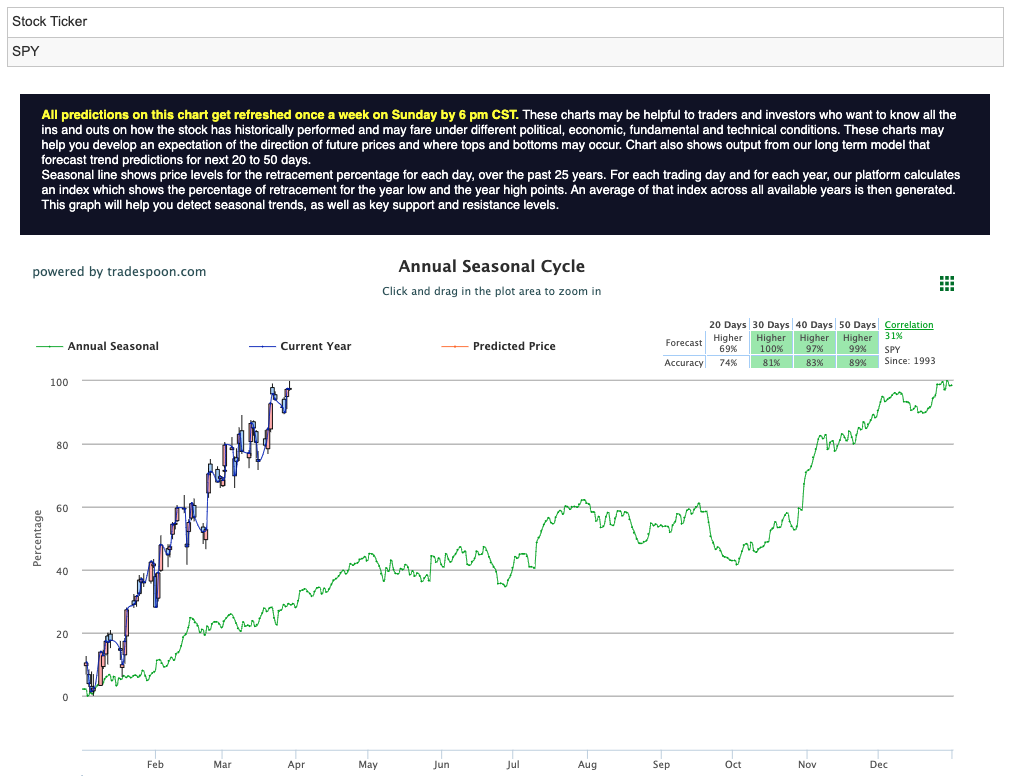

Despite recent turbulence, the market demonstrates resilience, supported by broadening participation and favorable seasonal trends. Investors navigate the evolving economic landscape, awaiting guidance from the Federal Reserve. While challenges persist, strategic opportunities emerge amidst market fluctuations. Projected levels for the SPDR S&P 500 ETF (SPY) remain within the range of $530-$540, with support anticipated at $490-$500 in the coming months, reflecting ongoing market volatility and investor caution. For reference, the SPY Seasonal Chart is shown below:

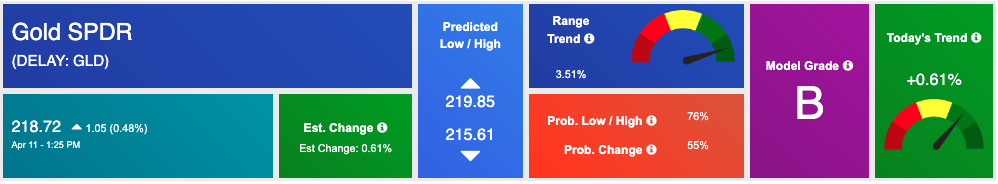

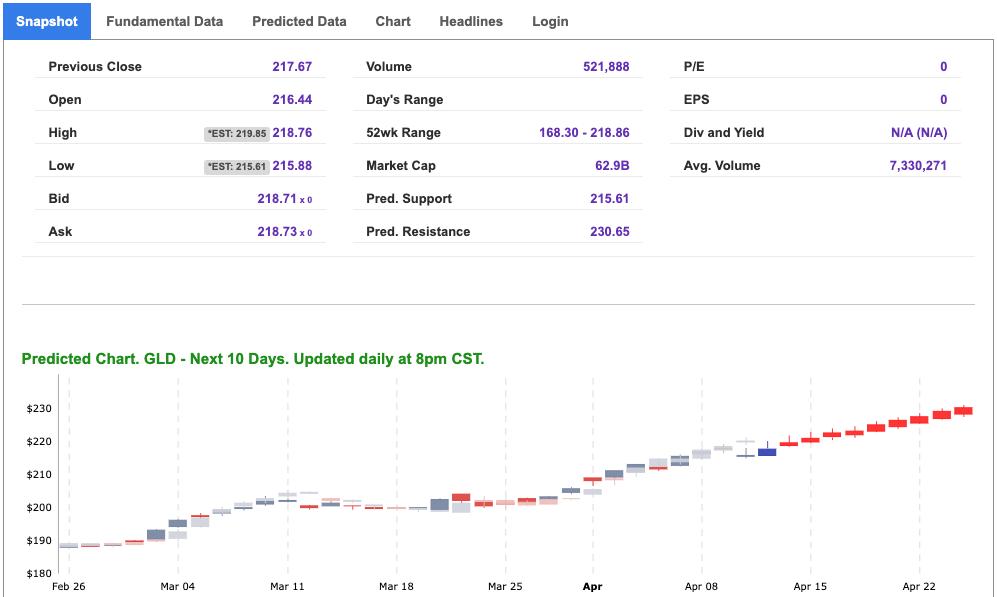

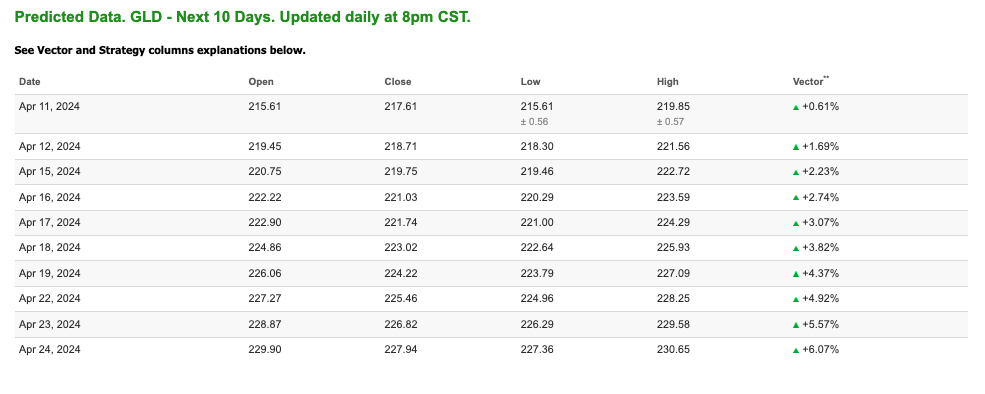

In the current market landscape, characterized by inflationary concerns and uncertainty surrounding interest rate adjustments, gold emerges as a compelling asset for investors seeking a hedge against volatility. GLD, or the SPDR Gold Shares ETF, is one of the world’s largest exchange-traded funds backed by physical gold bullion. Introduced in 2004, GLD offers investors a convenient and cost-effective way to gain exposure to the price of gold without the need for direct ownership of physical gold. With its transparent and liquid structure, GLD has become a popular choice for investors seeking to diversify their portfolios and hedge against inflation, currency fluctuations, and geopolitical risks.

With inflation persisting above target levels and the Federal Reserve navigating the delicate balance between price stability and economic growth, the outlook for traditional assets remains uncertain. Gold, historically considered a safe haven during times of economic uncertainty, offers diversification benefits and serves as a store of value in turbulent times.

Furthermore, as treasury markets experience volatility amidst speculation surrounding interest rate adjustments, gold gains traction as an attractive alternative investment. Unlike bonds, which face downward pressure in a rising interest rate environment, gold tends to retain its value or even appreciate, making it an appealing option for risk-averse investors seeking capital preservation.

Additionally, the recent breakout in gold prices despite higher interest rates underscores investors’ appetite for assets that protect against inflationary pressures. As market participants reprice the likelihood of rate cuts and navigate shifting monetary policies, allocating a portion of the portfolio to gold can enhance diversification and mitigate downside risks.

In conclusion, amidst ongoing market volatility and uncertainty, gold stands out as a prudent addition to investment portfolios. GLD, as a liquid and easily accessible vehicle for gold exposure, presents an opportunity for investors to hedge against inflation and market turbulence while preserving capital in a challenging economic environment.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

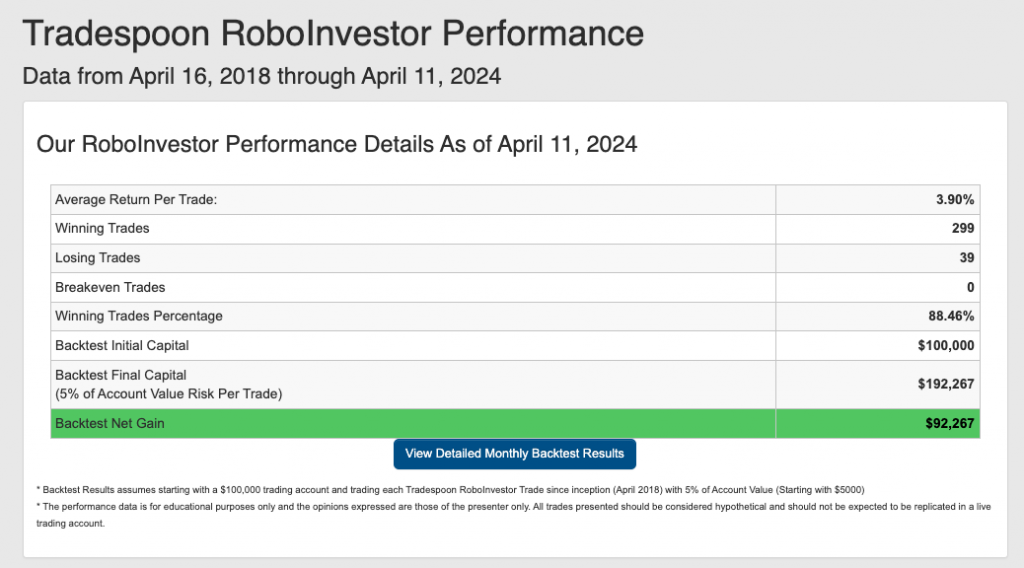

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.46% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!