U.S. equities enjoyed a strong day on Wednesday as the Dow rose 900 points, following the conclusion of the Federal Open Market Committee meeting. Marking its best day since 2020, the Dow jumped 2.81% while the S&P rose 2.99% and the Nasdaq up 3.2%. Markets responded positively to the latest FOMC decision which was to raise rates by half a point, with its balance sheet shrinking in June. Following the meeting, Fed Chair Powell discussed the Fed’s next moves which would not include a 0.75 basis point increase in the upcoming meeting but would reduce its $9 trillion balance sheet. The planned reduction will cut the balance sheet by $47.5 billion a month starting in June, building up to a $95 billion cut monthly. U.S. Trade Deficit report showed a substantial jump, up 22%, while long-term notes retreated today. Earnings remain in focus with Uber and Lyft releasing their reports and seeing substantial drops in shares today, while Moderna saw a boost following their report. Starbucks, Airbnb, and Advanced Micro Devices were also recipients of shares trading higher today off impressive earnings. DoorDash, Dropbox, Kellogg, Shell, Shopify, and Wayfair are due to release earnings tomorrow; Friday will feature Adidas, DraftKings, and NRG Energy.

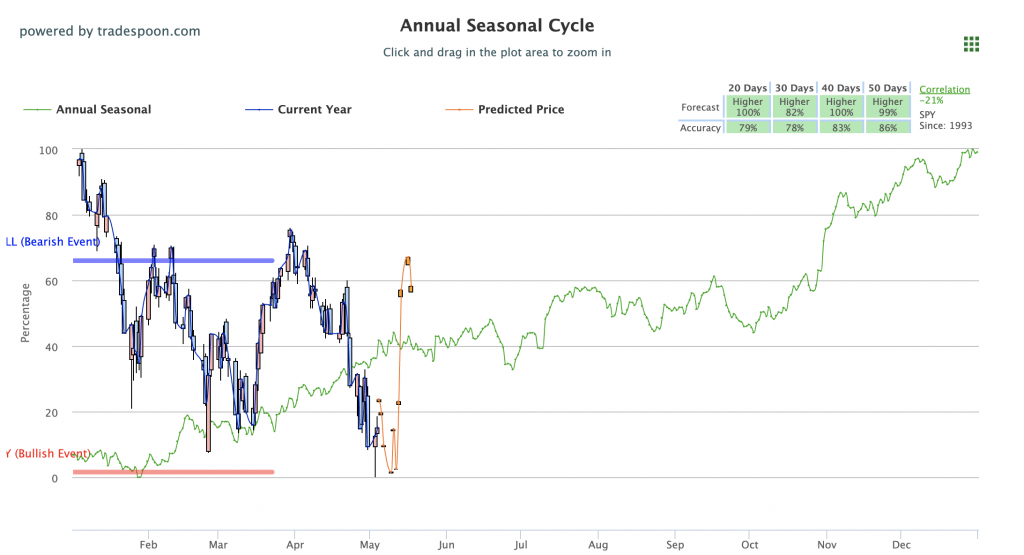

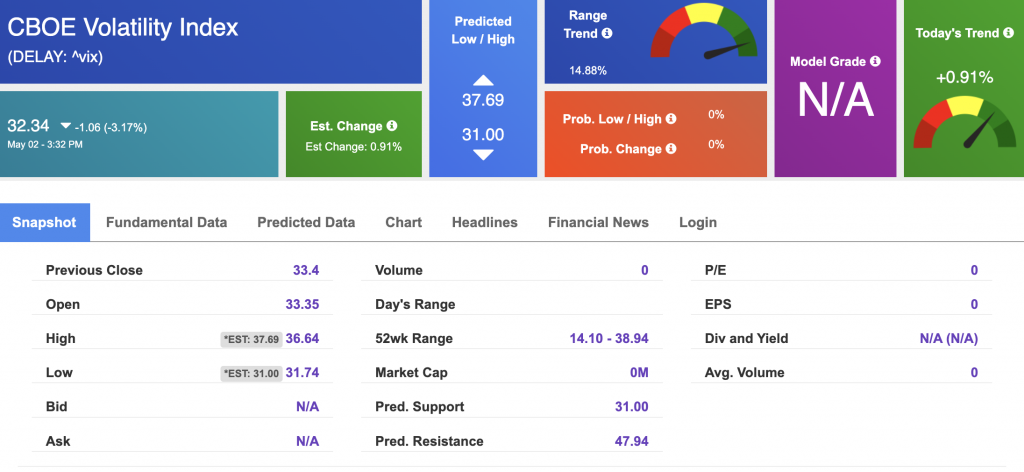

Focus remains on the $VIX, currently trading near the 30 level. The Geopolitical risks in Ukraine and today’s Fed decision can impact the next move in the market. We are watching the overhead resistance levels in the SPY, which are presently at $430 and then $435. The $SPY support is at $404 and then $380. We expect the market to continue the pattern of lower highs and lower lows for the next 2-6 weeks. In the short term, the market is oversold. Next week, earnings wind down with Disney, Toyota, Duke Energy, Tyson Foods, Sysco, Electronic Arts, and Alibaba. Globally, Asian markets closed to mixed results while European markets finished in the red. We encourage all market commentary readers to maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

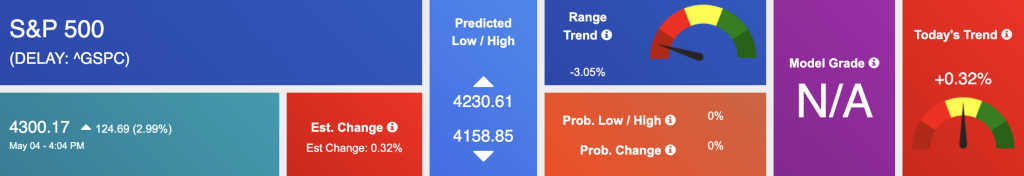

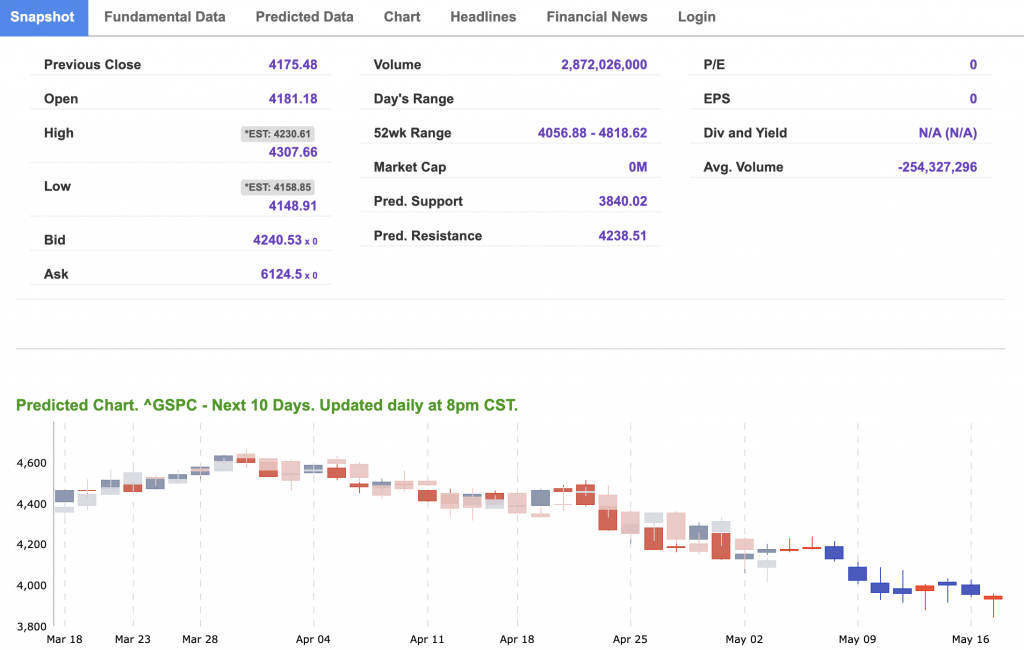

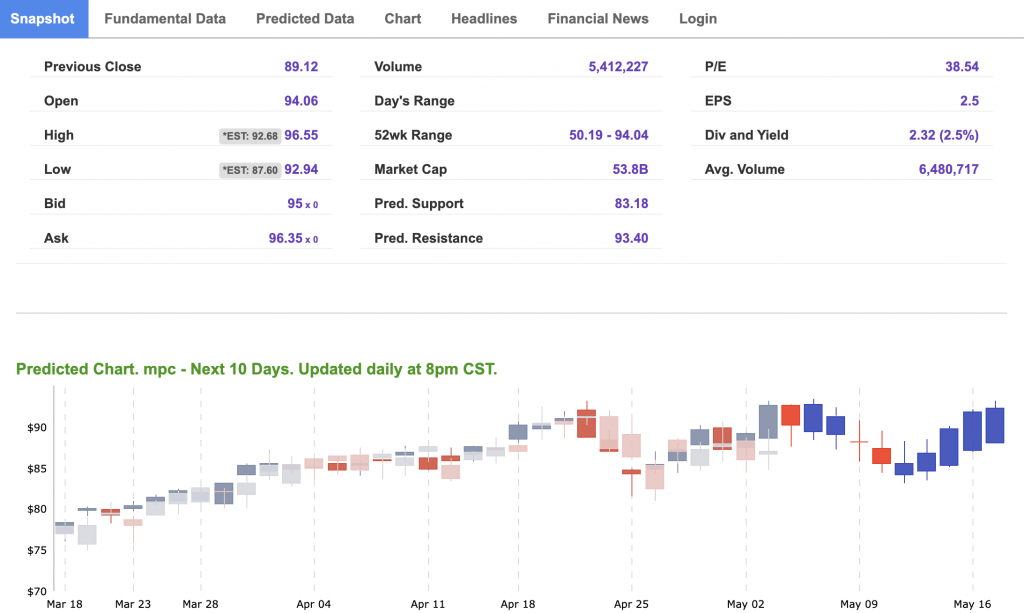

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term mixed outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

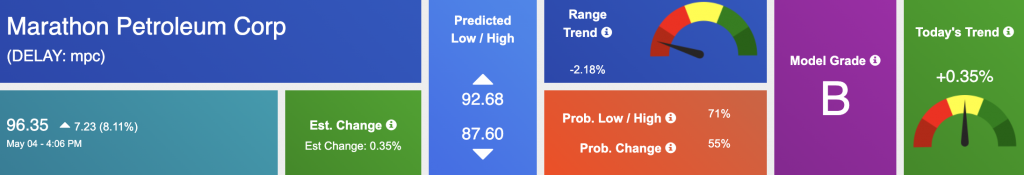

The symbol is trading at $96.35 with a vector of +0.35% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, sh. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $107.55 per barrel, up 5.02%, at the time of publication.

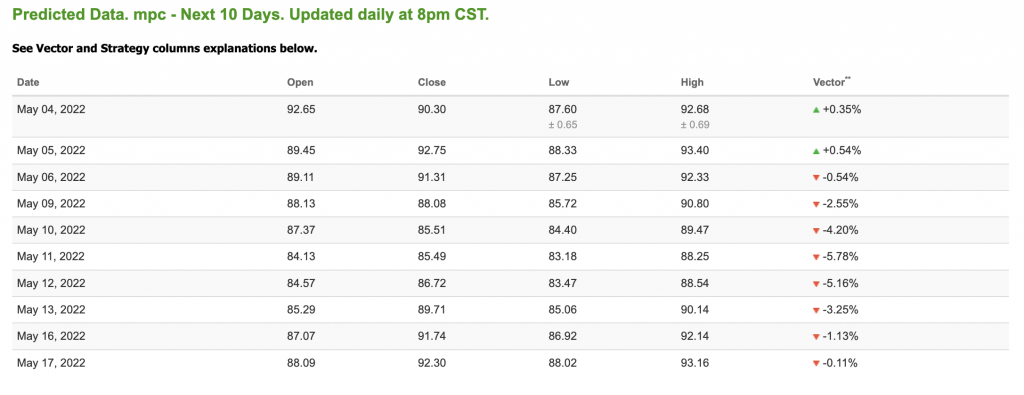

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $78.38 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

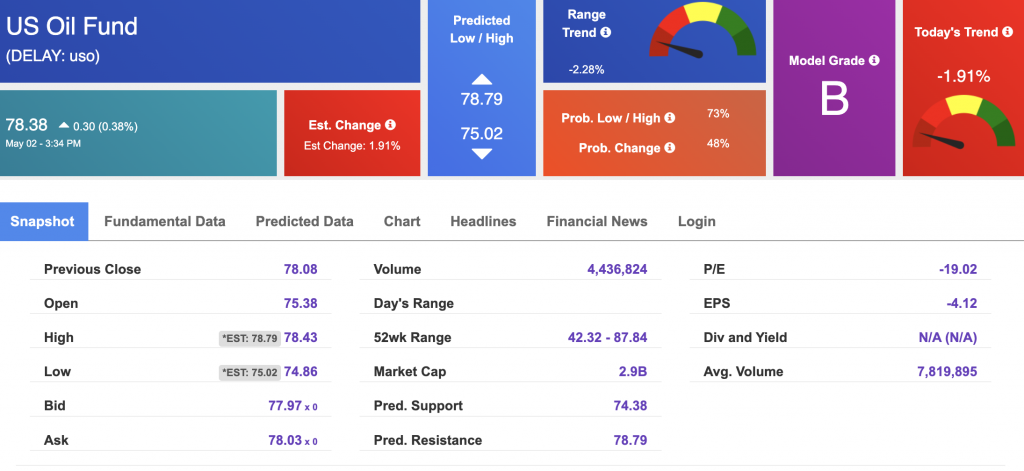

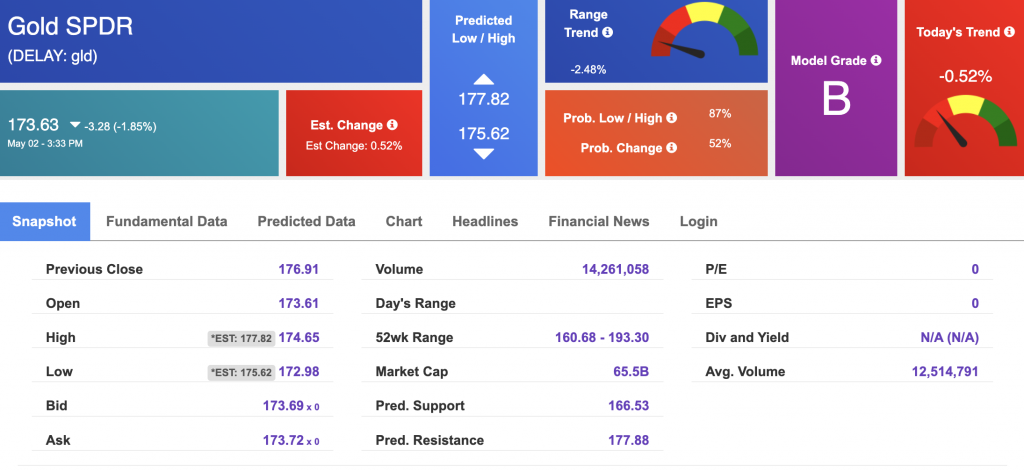

The price for the Gold Continuous Contract (GC00) is up 0.63% at $1882.30 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $173.63 at the time of publication. Vector signals show -0.52% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

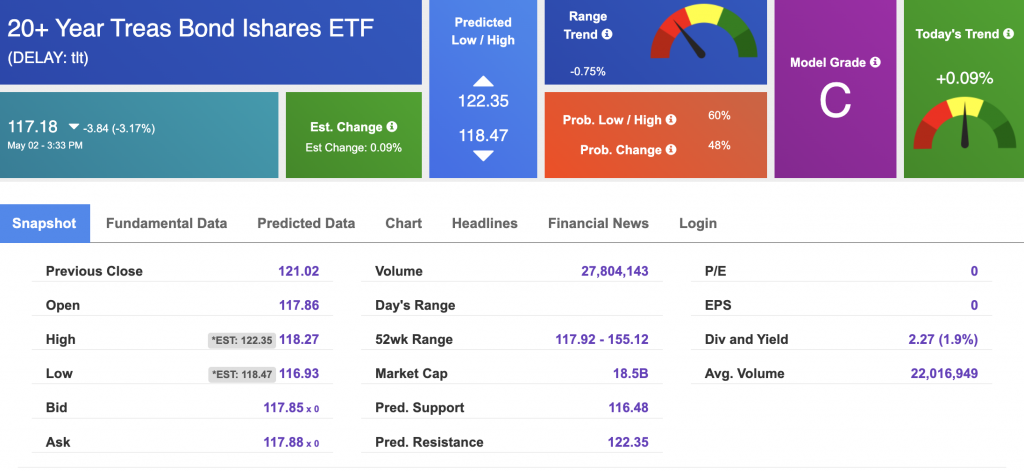

The yield on the 10-year Treasury note is down, at 2.963% at the time of publication.

The yield on the 30-year Treasury note is down, at 3.006% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is $32.34 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!