On Wednesday, stocks retreated as the minutes from the Federal Reserve’s most recent meeting revealed that officials are anticipating multiple-rate hikes this year. Several other economic reports have impacted markets this week including employment and manufacturing data. Several stocks saw increased action today as crypto-broker Coinbase boomed after agreeing to a settlement while Salesforce stocks increased following their reported downsizing.

Today’s marquee report was last month’s FOMC minutes which revealed Federal members still view inflation as an “unacceptable” level. The Federal Reserve appears poised to continue raising interest rates in an effort to stifle inflation and decrease economic demand. Investors are hopeful that the Fed will not only reduce its current rate of hikes but ultimately pause this process altogether. The minutes exposed statements that could trouble stock and bond traders. The release emphatically showed that the Fed is still not convinced that increased interest rates are successfully driving inflation meaningfully down.

The most recent data suggests that inflation has fallen drastically since its peak of 9% in 2022, with the current rate now below 7%. With higher levels of inflation historically leading to stifled economic activity, it’s quite possible that attaining the Federal Reserve’s goal of a 2% target may be closer than anticipated. Another key report today was the ISM index, which showed manufacturing activity experienced a further decline in December.

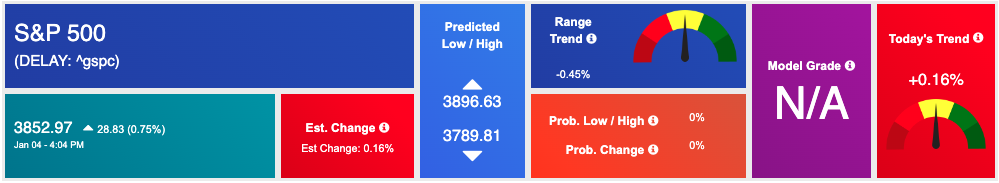

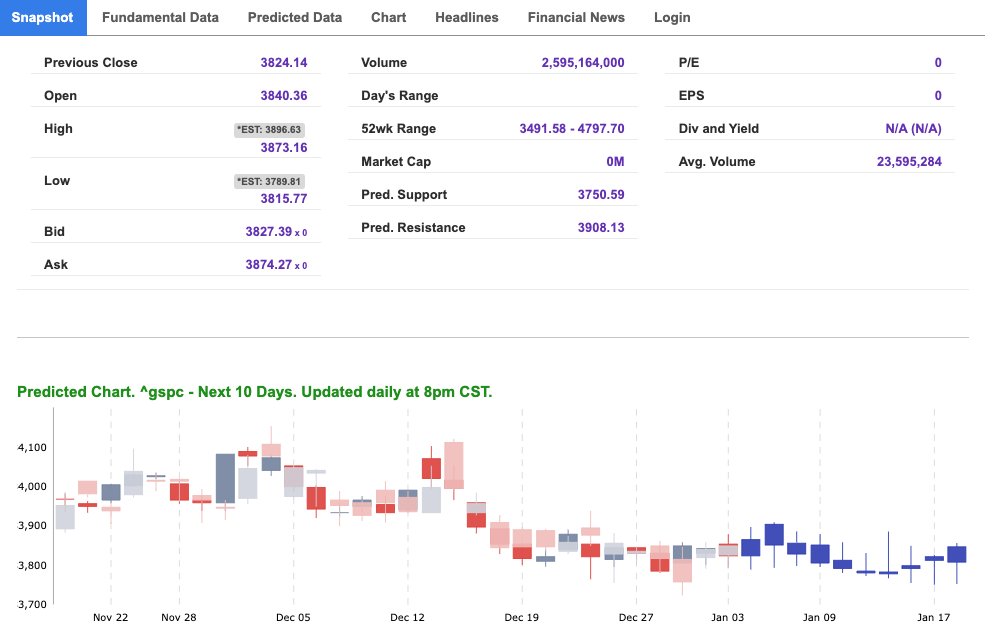

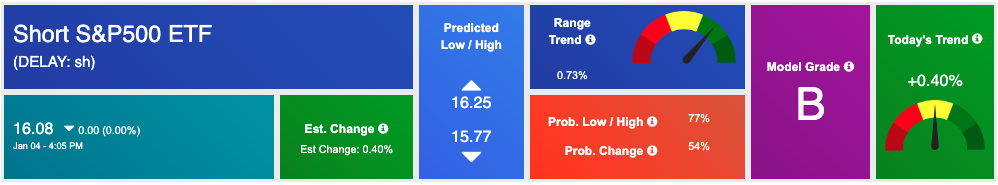

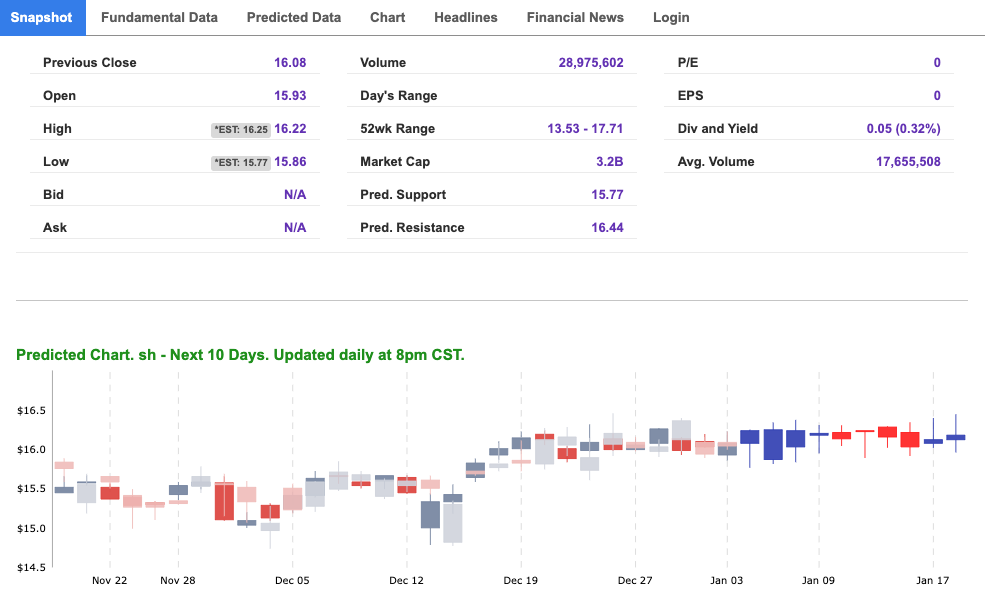

This week, $CAG and $STZ will both make their earnings announcements. In addition, the upcoming release of unemployment figures this week combined with Consumer Price Index data next week could have a major effect on the market’s trajectory moving forward. We are watching the overhead resistance levels in the SPY, which are presently at $390 and then $402. The $SPY support is at $376 and then $370. We expect the market to continue to make new lows for the next 2-8 weeks. We would be BEARISH ON THE MARKET at this time and encourage subscribers to hedge their positions. Globally, both Asian markets traded with mixed results while European markets finished in the green. Market commentary readers should maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

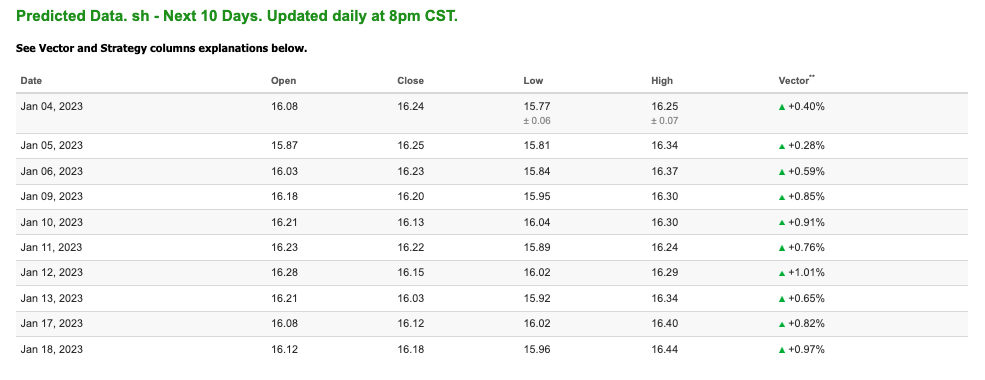

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, SH. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

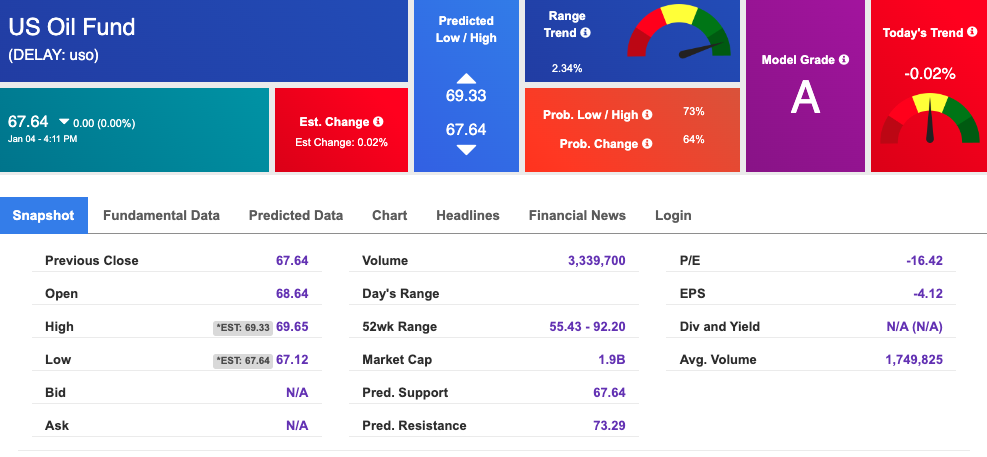

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $ 73.22 per barrel, down 4.82%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $67.64 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

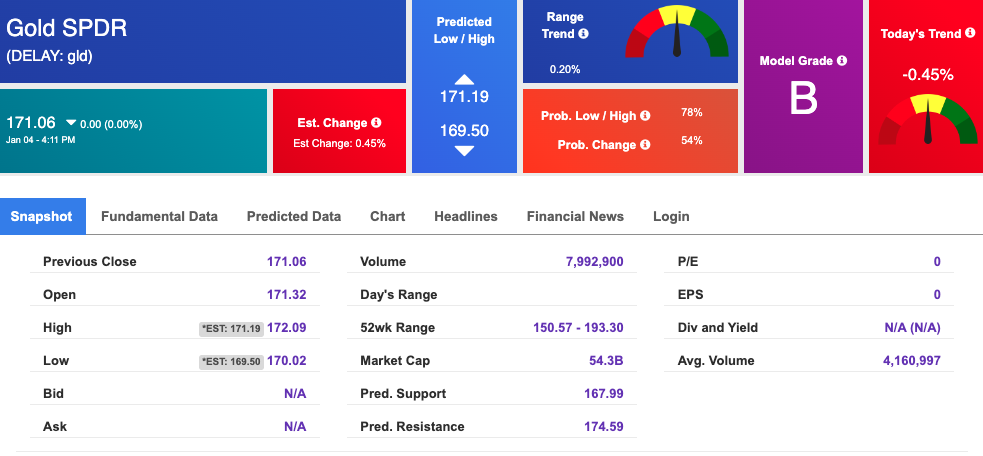

The price for the Gold Continuous Contract (GC00) is up 0.79% at $1860.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $171.06 at the time of publication. Vector signals show -0.45% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

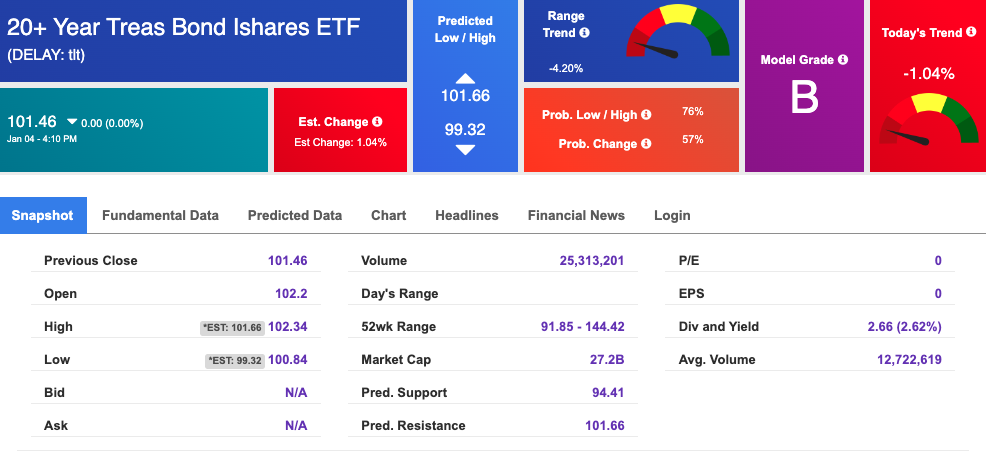

The yield on the 10-year Treasury note is down at 3.687% at the time of publication.

The yield on the 30-year Treasury note is down at 3.800% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

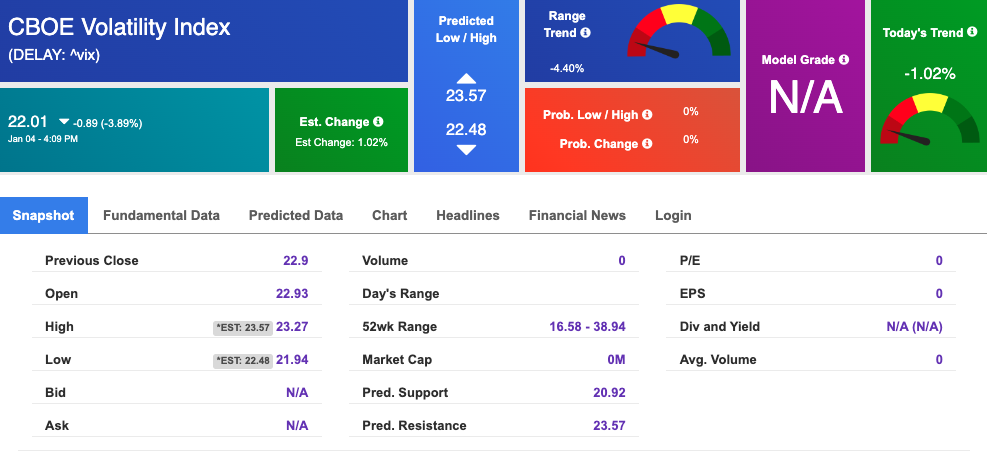

The CBOE Volatility Index (^VIX) is $22.14 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!