RoboStreet – December 22, 2022

Markets Slump Ahead of PCE Reports

This week, U.S. shares have been experiencing a general decline with the exception of a Wednesday surge – leading to an expected weekly negative outcome in all three major U.S. indices. As we approach the upcoming, shortened holiday week, investors have been reviewing several key economic reports, including building permits and housing starts figures, the Consumer Confidence Index report, third-quarter GDP numbers, and November personal consumption expenditure data. To finish off the week, all eyes will be on Friday’s personal consumption expenditure data release which will provide one of the last gauges of inflation for 2022.

Just last week, investors were sent on a roller coaster of emotions as stocks initially rose with the news that inflation was easing – only for them to tumble drastically after hearing the Federal Reserve’s monetary policy statement. Although the central bank’s rate hike of 50 basis points was not as drastic as previous increases, it still sent panic and shockwave through the market as the Fed picked up a more hawkish tone. Analysts are now predicting that interest rates will be higher than anticipated to limit inflation and prevent a recession – a concern that is becoming more pronounced with time.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This week, trading activity remained below average as the holiday season approached, sparking investor trepidation and causing share prices to plunge on Monday. Heightened fears of further Federal Reserve intervention and an impending recession also contributed significantly to this market shift.

The Bank of Japan astounded global markets on Tuesday by announcing an unexpected adjustment to its bond yield controls, permitting long-term interest rates to increase noticeably. The action was taken with the intention of abating some of the expenses associated with maintaining extended monetary stimulus. As predicted, the Bank of Japan decided to hold steady its yield curve control (YCC) objectives – a short-term interest rate of -0.1% and an approximate zero 10-year bond yield – at their two-day policy meeting that concluded on Tuesday. Shares plummeted, while the yen and bond yields skyrocketed as a result of the decision which also pressured the U.S. dollar.

On Wednesday, stocks surged as the U.S. markets concluded its four-day slump with an uptick of investor sentiment spurred by new consumer confidence figures and quarterly earnings reports from FedEx and Nike. Despite FedEx experiencing a dip in package volumes, they reported earnings that exceeded expectations – causing their stock to surge by 3.4%. Similarly, Nike also saw success as they revealed high quarterly sales accompanied by strong margins – despite an accumulation of inventories. As a result of this news, the company’s stocks rose 12.2% on Wednesday! The response to these reports appeared to cool inflation concerns for the time being.

As investors geared up for the weekend, trading volume was lower on Thursday, prompting a heightened level of volatility. Adding to the day’s action, the GDP’s third-quarter growth rate was revised upward to a 3.2% annual rate from its initial projection of 2.9%, significantly surpassing economists’ assumptions that it would remain constant at 2.9%.

Following the initial two-quarter decline in GDP, which caused market participants to worry that a recession might occur soon, the third quarter now shows signs of growth. Although this is promising news for investors and traders alike, fears remain that an overly aggressive Federal Reserve may cause interest rates to spike too high. Additionally, on Thursday, the latest unemployment report showed a less-than-expected spike in the application which, when the Fed is looking at slowing the economy and inflation, is not a welcome diagnosis for the market.

On Friday, we will be presented with the week’s most significant economic event – the personal consumption expenditures index. This is seen as a crucial indicator of inflation by the Federal Reserve and will likely be our last market trigger until December 27th when investors return after markets have been closed due to Christmas celebrations on Monday. With this in mind, I’ve got a specific symbol I am interested in for the upcoming shortened holiday week, but before we reveal that let’s review the current market conditions.

Presently, the SPY has overhead resistance at $390 and then again at $402. Support for the same lies at $380 followed by a lower level of support at around $370. I anticipate that in the next 2-8 weeks this market will experience new lows, leading me to remain BEARISH ON THE MARKET right now and advising my subscribers to hedge their positions as well.

One way I enjoy hedging is with one of my go-to short ETFs. Perfect for this time of year when action is low and volatility could remain high.

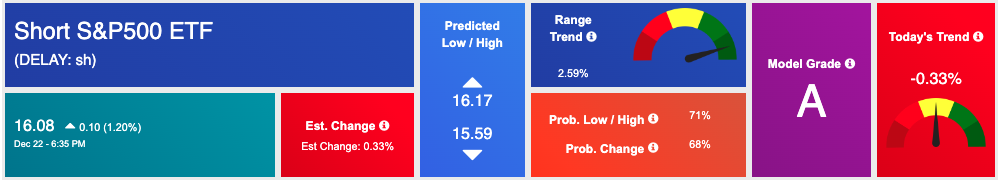

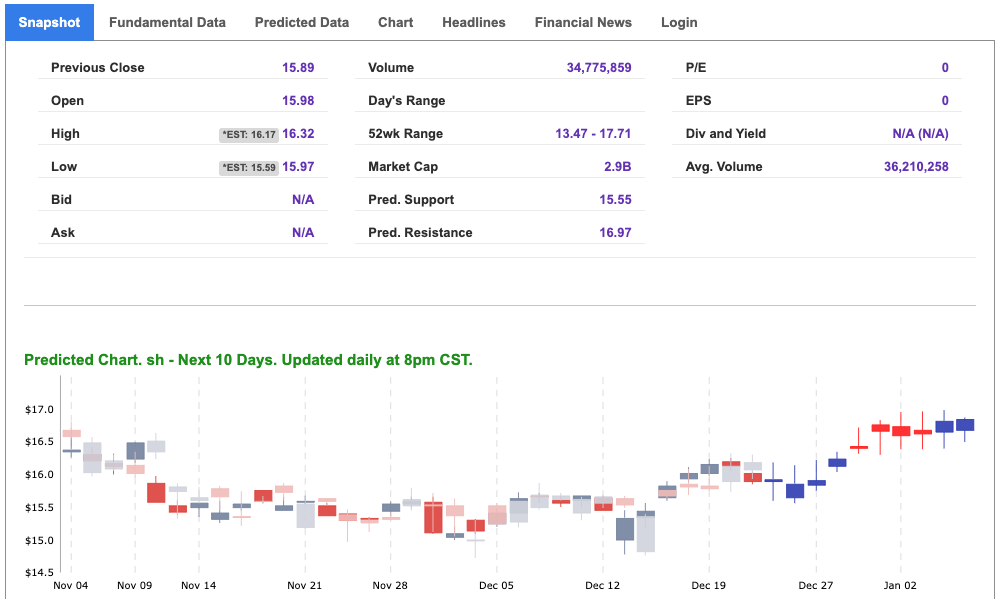

Short S&P 500 ETF (SH) is a short ETF that I am going to be looking to use to hedge as the market breaks below its latest support levels. The ETF shorts S&P performance. When it comes to shorting the market, SH is always my top choice. With the current tech sector instability, I plan on revisiting SH this season for some profitable opportunities. The symbol is trading just above $15 and right in the middle of its 52-week range of $13-$17. Having recently broken above our forecasted resistance, SH offers a unique opportunity if the market continues as projected above.

Similarly, the symbol sports a model grade of “A” indicating it is in the top 10% of accuracy for the Tradespoon data universe.

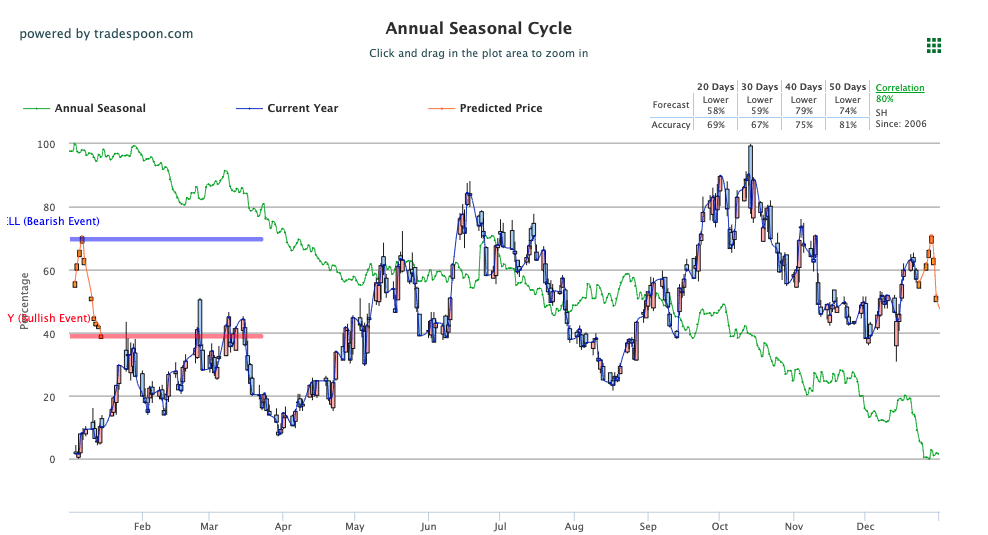

After we merged SH data into the Seasonal Chart, our model for predicting long-term trends showed us several worthwhile benefits. Currently, there’s a large gap between the symbol’s current rate and its regularly expected yearly price — suggesting that prices could sharply increase in the near future. See SH Seasonal Chart below:

With the probability of a bear market looming, now is an ideal time for us to add $SH. After reviewing extensive data from various markets and consulting my A.I. toolset, I will be watching for SH’s continued success moving forward.

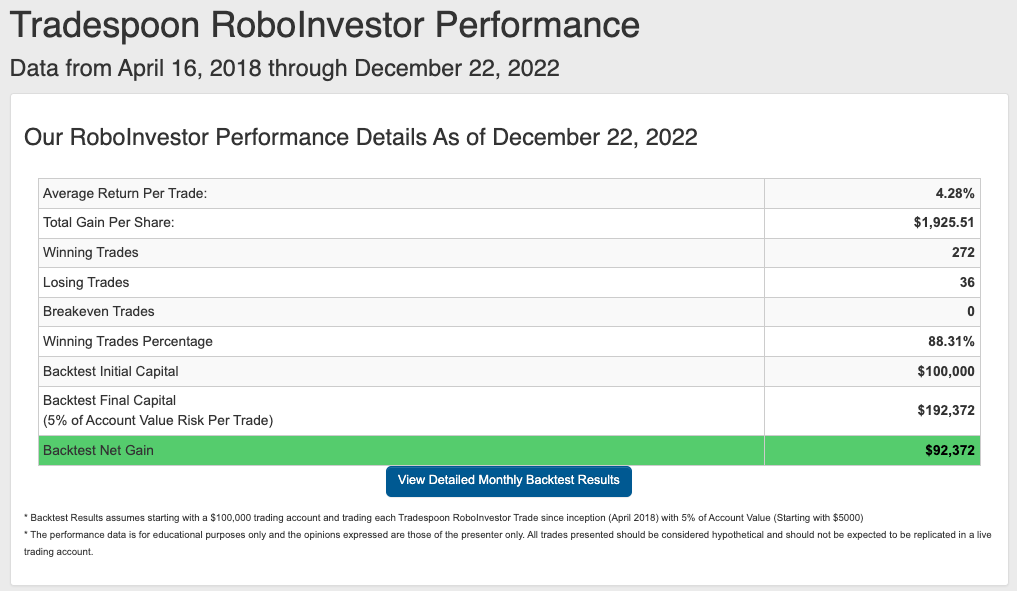

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!