The U.S. financial markets have witnessed a turbulent week, with a mix of challenges and opportunities setting the tone for the second half of the year. Here’s a comprehensive overview of the events that unfolded.

U.S. markets have been navigating a rough patch, with the S&P 500 trading below its 200-day moving average for the past six sessions. This trend has raised concerns about increased market volatility in the second half of the year. Investors are closely eyeing the ongoing earnings season to see if robust corporate performance can pull the market out of its recent malaise.

The week began with mixed results in the U.S. financial markets, but tech stocks showed resilience, rebounding from earlier losses as bond yields retreated from recent highs. This rebound was particularly notable as tech giants like Microsoft, Alphabet, Meta Platforms, and Amazon prepared to release their earnings reports.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Monday’s trading session started with a significant milestone as the 10-year Treasury yield briefly surpassed the 5% mark for the first time since the 2007 financial crisis. This development sent shockwaves through the market, causing stocks to open on a slightly lower note. Investors are bracing for a week filled with earnings reports and closely watching how the market responds to these developments.

On the global stage, the ongoing Israel-Hamas conflict took center stage, impacting not only the Middle East but also global financial markets. The decision by Israel to hold back from a ground invasion of Gaza temporarily eased tensions, causing a dip in oil and gold prices. However, the persistent Middle East crisis continues to cast a shadow over the financial world, with concerns about potential disruptions to oil supplies leading to a rise in assets like gold.

The CBOE Volatility Index (VIX), often referred to as the “fear gauge,” experienced a spike. This increase in volatility was largely attributed to the uncertainty surrounding the Israel-Hamas conflict and domestic political dysfunction. Although the VIX initially reached 23.08, it slightly retreated to 21.37 shortly after the market opened on Monday.

Despite a challenging week marked by multiple selloffs, the U.S. stock market had some positive news. The U.S. economy demonstrated resilience, with a remarkable 4.9% annual growth rate in the third quarter, driven by surging consumer spending and residential construction.

Meta Platforms, the parent company of Facebook, Instagram, WhatsApp, and Threads, posted better-than-expected quarterly results. For the quarter ending on September 30, they reported revenue of $34.2 billion, surpassing Wall Street consensus forecasts. Profit also saw a substantial increase, rising by 168% from the previous year.

However, Meta Platforms stock experienced a setback when the company’s CFO warned about weaker advertising demand in the fourth quarter. The stock declined by 4.6% the morning after the earnings report.

The week also saw notable developments on the economic front. Treasury yields plummeted, hinting at signs of a global economic cooldown. The European Central Bank (ECB) decided to keep eurozone interest rates unchanged, while the Federal Reserve is expected to follow suit in its upcoming meeting.

Several major companies reported their earnings this week as well, and the responses were mixed. International Business Machines (IBM) outperformed Wall Street estimates, with the company’s CEO highlighting the positive impact of their investments in artificial intelligence.

However, United Parcel Service faced a 5.9% drop in stock value after its third-quarter revenue missed analysts’ estimates. Comcast saw its stock fall by 8.4%, despite third-quarter earnings beating expectations, due to a decline in domestic broadband customers and video subscribers.

Whirlpool fell by 16% as concerns about margins outweighed a quarterly earnings beat. Mattel reported better-than-expected third-quarter earnings but warned of slowing demand as the holiday season approaches, leading to a 7.6% drop in its stock.

Market Outlook and Uncertainties

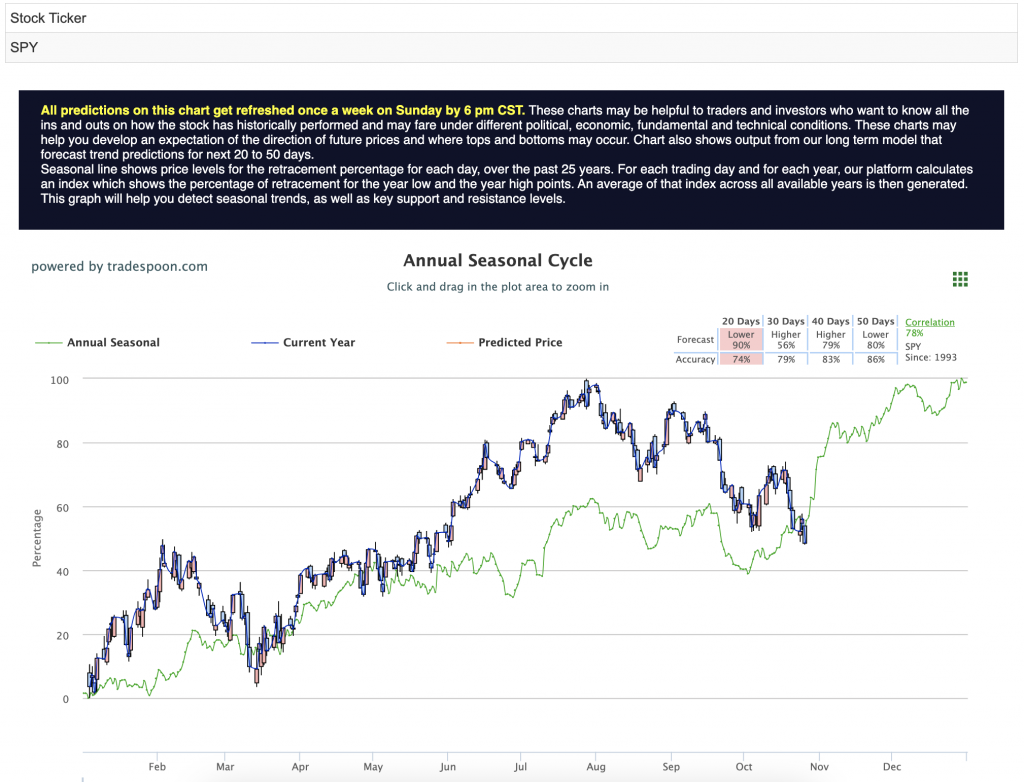

As for the market outlook, there’s a prevailing belief that the SPY rally may be capped at levels between $450 and $470, with short-term support in the range of $400 to $430. The markets appear to be on a downward trajectory, and a break of August lows is already in progress. For reference, the SPY Seasonal Chart is shown below:

In the energy sector, initial spikes related to geopolitical risks subsided as long as there were no signs of escalation in the Middle East. Concerns over slowing global demand have led to a recent decline in energy prices.

Interest rates have been a hot topic, with longer-dated treasuries experiencing a significant rally and retesting October’s yield highs. The 10-year Treasury yield reached levels not seen since the Global Financial Crisis (GFC). Some market participants anticipate lower yields in the first half of 2024, but if this doesn’t materialize, it could mean prolonged higher inflation and delayed interest rate reductions, factors that may not be fully factored into current market evaluations.

Moreover, as demand for U.S. treasuries weakens, interest rates may continue to rise, with reduced demand from Japan and China impacting treasuries’ prices, thereby pushing yields higher and creating pressure on equity valuations.

The Utilities Sector: A Safe Haven in Volatile Markets

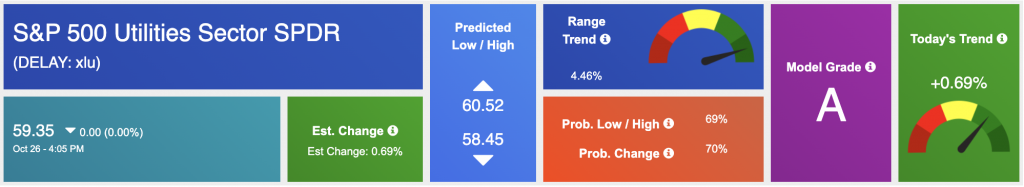

Amid the turbulence and uncertainty that has recently characterized the financial markets, investors often seek refuge in sectors that are known for their stability and resilience. The utilities sector, represented by the Utilities Select Sector SPDR Fund ($XLU), has long been considered a safe haven during times of market volatility.

The Utilities Select Sector SPDR Fund ($XLU) is an exchange-traded fund (ETF) that tracks the performance of the utilities sector within the S&P 500 Index. XLU comprises a diversified portfolio of companies engaged in providing essential services such as electricity, water, and natural gas to households and businesses. These companies typically operate in regulated environments, which can provide a certain level of predictability and stability.

XLU’s holdings include well-established utility giants such as NextEra Energy, Duke Energy, Dominion Energy, and Southern Company. These companies are known for their dependable cash flows, essential services, and historically robust dividend payments. It’s these qualities that often make the utilities sector an attractive option for investors seeking a reliable income stream and a hedge against market volatility.

In the current market conditions, with concerns about rising bond yields, geopolitical tensions, and the potential for a broader market pullback, XLU has become an increasingly appealing investment choice.

The utilities sector is renowned for its resilience. In uncertain times, investors tend to favor companies that provide essential services, and XLU fits the bill. These companies often demonstrate consistent cash flows and relatively low sensitivity to economic downturns.

Utilities companies are known for their dividend payments. In a low-interest-rate environment, the sector’s dividend yields can be particularly attractive. With the Federal Reserve holding interest rates steady, XLU’s dividend payouts could be a dependable source of income for investors.

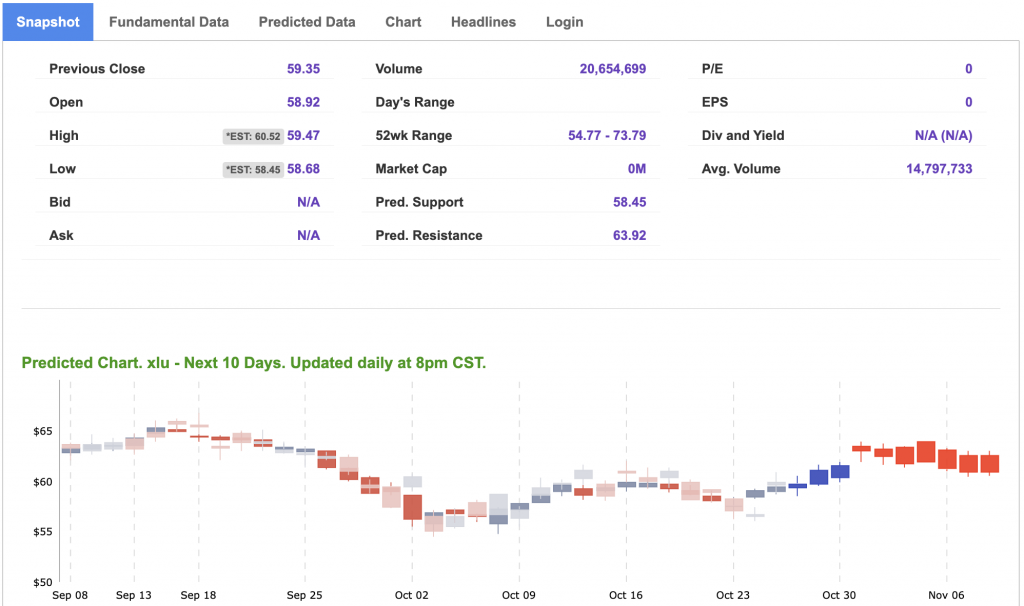

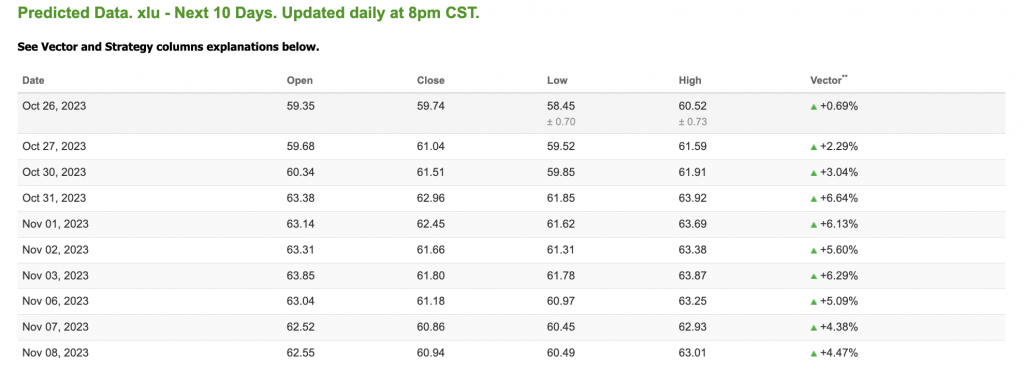

Utilities tend to have a low correlation with broader market movements. When equities face headwinds, utilities can act as a hedge against potential losses, helping to protect and stabilize a portfolio. And my A.I. agrees! Just take a look at the 10-day predicted data for XLU:

Given the prevailing market conditions marked by rising bond yields, geopolitical tensions, and uncertainties about the future direction of the economy, the utilities sector, as represented by the Utilities Select Sector SPDR Fund ($XLU), offers an appealing investment opportunity. Its reputation for stability, dividend income potential, and ability to provide a hedge against market volatility make it an asset worth considering in your investment strategy. As always, it’s advisable to consult with a financial advisor or conduct your own research before making investment decisions.

Looking Ahead

While the week has been tumultuous and challenging, expectations for the remainder of the year suggest potential market stability due to anticipated better-than-expected earnings and end-of-year seasonality, which should create a floor for the market near its 200-day moving average.

In summary, the financial markets have had a roller-coaster ride this week, with a mix of earnings reports, geopolitical tensions, economic indicators, and interest rate concerns shaping the landscape. Investors are left to watch and react as the markets continue to navigate uncertainty and challenges.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!