U.S. stock indices experienced a positive turn on Thursday as President Joe Biden and House Speaker Kevin McCarthy neared a deal on the debt ceiling. The Dow Jones Industrial Average, initially in the red, managed to gain 10 points following the news, while the S&P 500 surged by 1% and the Nasdaq Composite soared 1.9%. The ongoing negotiations surrounding the debt ceiling continue to captivate market attention, with investors eagerly awaiting a resolution to this critical issue.

Meanwhile, the stock market opened on a mixed note as investors anxiously anticipated progress on the debt ceiling discussions. However, tech stocks experienced significant gains after Nvidia, a prominent semiconductor company, reported robust earnings. Investors’ excitement over the future of artificial intelligence propelled tech stocks such as Nvidia, Microsoft, Alphabet, and AMD higher, as they sought to capitalize on the AI-driven market momentum.

Nvidia’s impressive performance triggered a surge in its stock price, as the company provided a revenue outlook that surpassed analysts’ expectations. This positive development had a spillover effect, boosting other tech stocks with exposure to artificial intelligence, thereby driving the Nasdaq index higher. On the other hand, Intel faced a sharp decline in its stock price as investors sold shares due to competitive concerns following Nvidia’s strong earnings report.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

In terms of economic data, early reports on Thursday indicated a slight increase in jobless claims, which came in lighter than expected. Additionally, there was a positive revision to the first-quarter gross domestic product (GDP) growth. Jobless claims for the week ending May 20 stood at 229,000, representing a 4,000 increase from the previous week’s revised level.

The Bureau of Economic Analysis revealed an upward revision to the first-quarter GDP growth rate, indicating an increase from the initial reading of 1.1% to 1.3%. This revised figure surpassed economists’ estimates and demonstrated stronger economic performance during the period.

Beyond the U.S. markets, global counterparts experienced volatility due to concerns over the U.S. debt ceiling negotiations, which raised doubts about regional growth prospects. Asian stocks predominantly declined, reflecting the spill-over effect of the debt ceiling worries. In Europe, stock markets fluctuated as technology stocks clashed with macroeconomic gloom, particularly with Germany entering a technical recession as its GDP contracted by 0.3% in the first quarter of the year.

Looking ahead, U.S. stocks exhibited a mixed performance on Monday, as investors eagerly awaited updates on a potential deal to raise the debt ceiling. While the S&P 500 and Nasdaq seemed poised for gains, the Dow Jones lagged in negative territory. Furthermore, U.S. stock futures marginally declined, setting the stage for a crucial week in debt ceiling negotiations.

With the June 1 deadline approaching, President Biden is scheduled to meet with House Speaker McCarthy to make progress on the debt ceiling talks. The market awaits any signs of resolution to avoid a potential U.S. default, which would be a historical first. Fed President James Bullard’s announcement of two more interest rate hikes later this year added to market focus, while Treasury yields advanced in response to his hawkish remarks.

Investors are also eagerly anticipating the release of the Federal Reserve’s May meeting minutes on Wednesday, hoping to gain valuable insights into the central bank’s future course of action regarding interest rates.

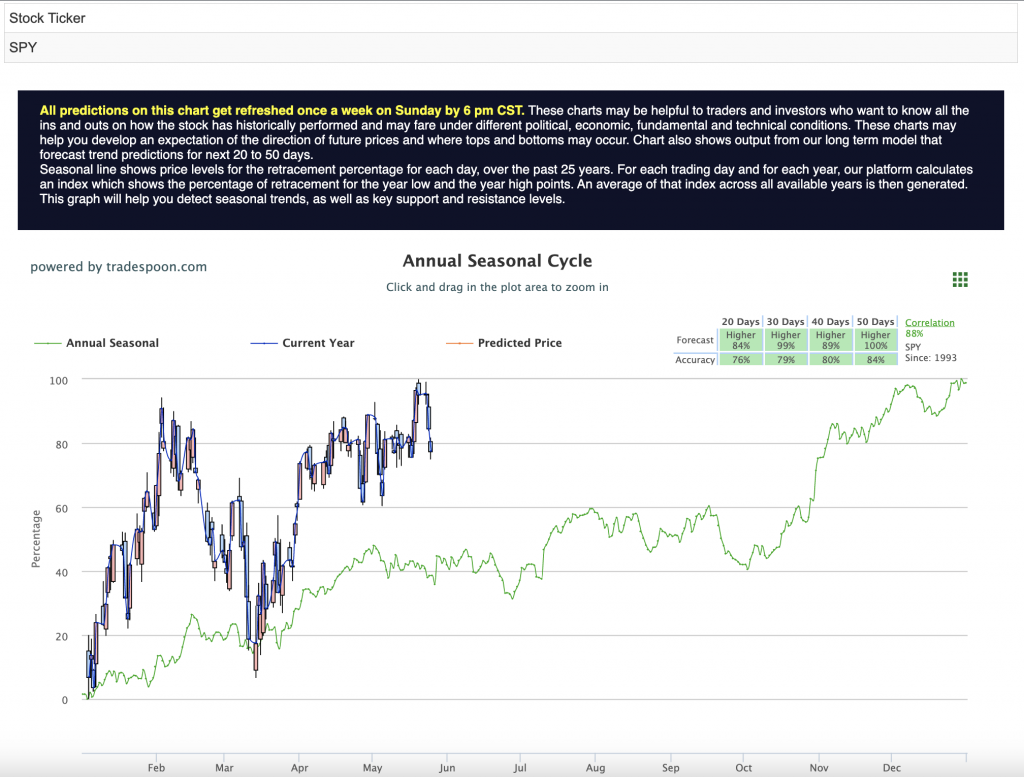

As market conditions are closely monitored, it is worth noting that the VIX, known as the “fear index,” is trading near the $18 level. Key factors influencing market sentiment this week include earnings reports from Lowe’s Companies Inc., Zoom Video Communications Inc., and Nvidia Corporation, as well as the release of the Fed meeting minutes. Furthermore, overhead resistance levels in the SPDR S&P 500 ETF are being closely watched, with support levels also identified. As the market may exhibit a sideways trading pattern in the coming weeks, a cautious outlook is recommended, and subscribers are encouraged to hedge their positions accordingly. See $SPY Seasonal Chart:

Amidst this market activity, retail data showed moderate improvement, though still high. Notably, companies such as KSS and URBN exceeded expectations due to effective inventory management. Additionally, the office real estate investment trust (REIT) sector witnessed a fire sale, while weak data from China and declining commodities, attributed to the strengthening DXY, added to global market concerns. LVMH’s fire sale of luxury goods retail stores further contributed to the landscape.

While the narrative of a soft landing remains prevalent due to China’s reopening, the AI market surge, low unemployment rates, and strong consumer sentiment, uncertainties persist. FXI, an exchange-traded fund tracking Chinese stocks, exhibited weakness, raising doubts about the pace of reopening in the region. Office REITs continued to face challenges, leading to fire sales. As volatility begins to rise, it is expected to continue its upward trajectory as the summer season approaches.

In summary, U.S. stock indices witnessed gains as progress was made in the debt ceiling negotiations. Tech stocks surged on the back of Nvidia’s strong earnings report, propelling the Nasdaq higher. Economic data showed a slight increase in jobless claims and an upward revision to first-quarter GDP growth. However, global markets experienced volatility due to concerns over the U.S. debt ceiling and other economic factors. Investors await further developments in debt ceiling negotiations, the release of the Fed’s meeting minutes, and key earnings reports to guide their investment decisions.

With this in mind, I have identified my next move in the market.

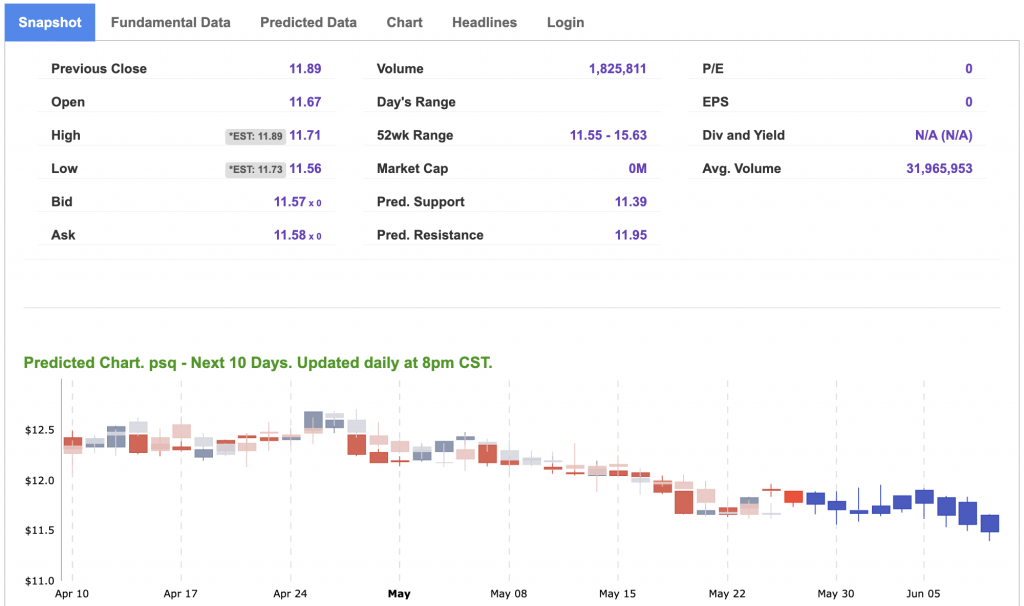

ProShares Short QQQ (PSQ) aims to provide investors with an inverse return to the daily performance of the Nasdaq-100 Index. The Nasdaq-100 Index includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market, representing a wide range of industries such as technology, healthcare, consumer services, and more.

In times of market uncertainty, investors often seek strategies to mitigate potential losses and protect their portfolios. One approach that investors may consider is utilizing the ProShares Short QQQ (PSQ) exchange-traded fund (ETF) as a potential hedge.

PSQ is specifically designed to provide an inverse return to the daily performance of the Nasdaq-100 Index, which comprises large-cap non-financial companies listed on the Nasdaq Stock Market. By employing short-selling techniques and derivative instruments, PSQ aims to deliver returns that move in the opposite direction of the Nasdaq-100 Index.

During periods of market volatility or when there are concerns about the technology sector, which the Nasdaq-100 Index heavily represents, holding PSQ can potentially offset losses or provide gains when the index declines. This inverse relationship allows investors to profit from a bearish stance on the technology market without directly shorting individual stocks.

One advantage of using PSQ as a hedge is its simplicity and accessibility. As an ETF, it offers investors the ability to gain exposure to an inverse position on the Nasdaq-100 Index without the need for complex derivatives or short-selling individual stocks. It provides a convenient way to implement a hedging strategy, particularly for those who may not have the resources or expertise to engage in direct short-selling.

When reviewing our A.I. data, I am seeing several encouraging signs for PSQ, specifically as a hedge in the upcoming market. The symbol is shown to have momentum towards the upside and with the latest rise in the market, there is room for the Nasdaq to dip.

PSQ offers investors an opportunity to hedge against potential losses in the technology sector and the broader market during times of uncertainty. By providing an inverse return to the Nasdaq-100 Index, it allows investors to potentially offset losses or benefit from a bearish market outlook. Nevertheless, investors should be aware of the risks associated with inverse ETFs and seek professional advice when incorporating PSQ into their investment strategy.

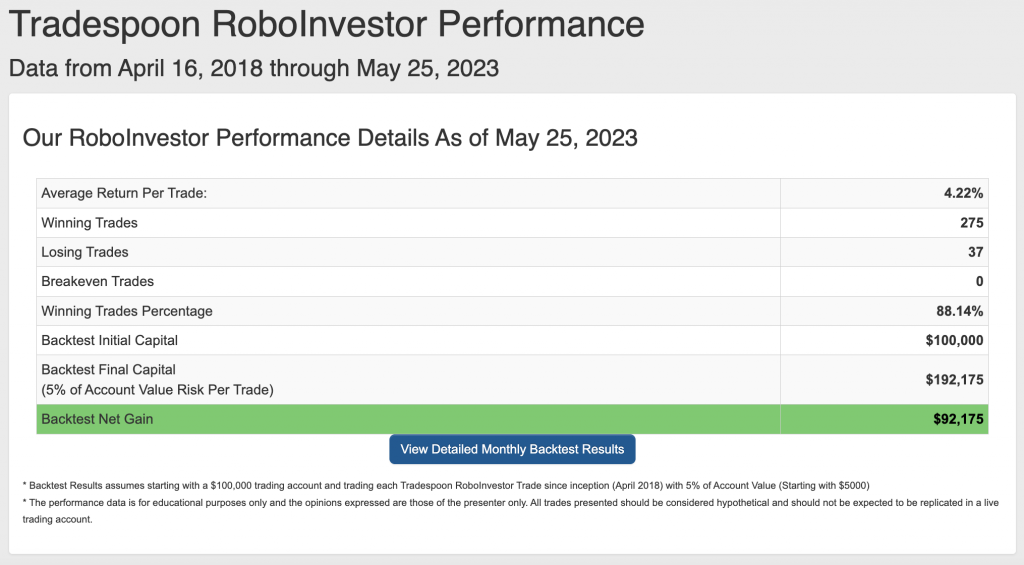

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.14% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!