On Thursday, U.S. stocks rose in the face of an uptick in bond yields, which followed hawkish comments by Federal Reserve officials and economic data pointing to persistent inflation. This rise in bond yields can reduce the present value of future cash that comprises company valuations, particularly technology companies that rely on profits in the years ahead. The 10-year Treasury yield closed at 4%, above its November level but below the 4.073% it rose to on Thursday; meanwhile, the two-year Treasury yield hit a new 52-week high of 4.902%.

The U.S. Department of Labor reported that seasonally adjusted initial jobless claims for the week ending February 25 landed at 190,000, indicating a still-resilient labor market. This was down from the 192,000 reported the previous week and below economists’ projections of 197,000. Investors are eagerly awaiting Friday’s services data release.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Earnings from retail companies continued to be in focus as Kroger and Macy’s reported their results on Thursday. On Wednesday, Salesforce experienced an 11.5% increase in stock price after posting better-than-expected fourth-quarter earnings. Additionally, several other retail earnings reports had mixed results; Lowe’s beat expectations for the fourth quarter yet its stock price dropped by 5.6%. Dollar Tree also topped estimates, but its disappointing guidance resulted in only a 1% rise in its stock price. Kohl’s saw its stock price decline by 1.7%, after reporting a significant loss in the fourth quarter and missing analysts’ estimates by a wide margin.

On Wednesday, the U.S. stock market experienced a decline prompted by hawkish comments from Minneapolis Federal Reserve President Neel Kashkari, who suggested that a more significant interest rate hike was likely. This sentiment was further compounded by the latest manufacturing data released by the Institute for Supply Management, which came in slightly worse than expected at 47.7, a slight increase from January’s reading of 47.4, but below the expectations of economists (who had forecasted 47.8). Stronger-than-expected economic data and hawkish commentary from Federal Reserve officials in the past few days have increased expectations for higher rates.

As we move forward, we can expect more volatility in the market during the first half of the year, with better-than-expected economic data making the Fed’s job harder. Despite the low unemployment rate and continued consumer spending on leisure, entertainment, and services, there are concerns about the possibility of a mild recession. Wealthy banks are already predicting negative GDP in the third and fourth quarters, which, if it comes to fruition, could cause a significant impact on the market.

Looking ahead, investors should keep an eye on various factors that could influence the market’s next move, such as upcoming earnings reports from companies like CRM, KR, and SPLK, as well as ISM data. The VIX is currently trading near the $21 level, which indicates moderate volatility. For the SPY, resistance levels are at $403 and $408, while support levels are at $395 and $390. Despite the mixed trading session, market experts predict that the markets will remain range-bound for the next two to eight weeks, suggesting that investors adopt a market-neutral approach and hedge their positions.

Lastly, it is worth noting that Europe and China have seen strong PMI data, while CPI data from Europe and South America have been worse than expected. Money market yields are close to a 5% return, leaving the average investor to ponder whether they should keep their money in market funds with zero risk or in equities with the risk of a 20-30% pullback.

With this in mind, there is one symbol I will be monitoring for an opportune time to invest in – and I believe it should be soon.

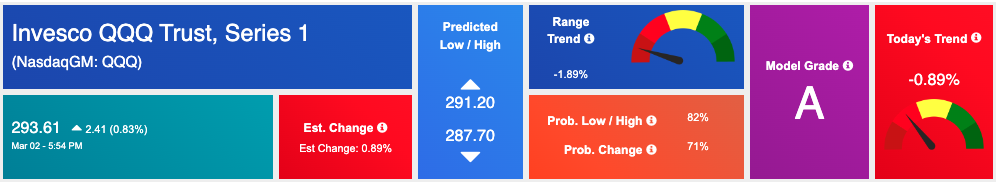

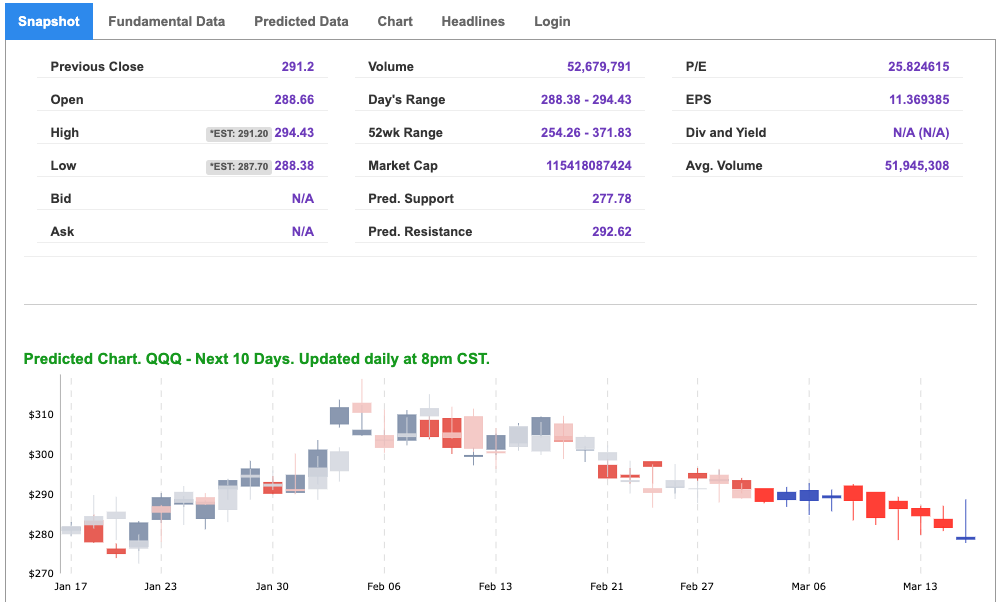

The Invesco QQQ Trust ETF (QQQ) is an exchange-traded fund that tracks the performance of the Nasdaq 100 Index, which is composed of the 100 largest non-financial companies listed on the Nasdaq stock exchange. This includes well-known technology giants such as Apple, Amazon, Google, and Facebook. The QQQ ETF is popular among investors who seek exposure to the technology sector and growth-oriented companies.

One reason why it might be a good time to buy the QQQ ETF is that the dollar is currently weak, which can benefit U.S. companies with significant international revenue streams. A weak dollar can make U.S. exports more competitive in foreign markets and increase the value of foreign earnings when they are converted back into dollars. This could provide a boost to the earnings of the companies in the Nasdaq 100 Index, which could in turn lead to higher stock prices and returns for investors in the QQQ ETF.

QQQ holds a model grade of “A,” indicating that it is in the top 10% for accuracy throughout our data universe. Furthermore, with the dollar’s weak performance, QQQ could see added value in the coming days due to its cheaper price at the moment. With a 52-week range of $254-$371, QQQ sits far closer to its 52-week low than its high, giving it plenty of room for upside.

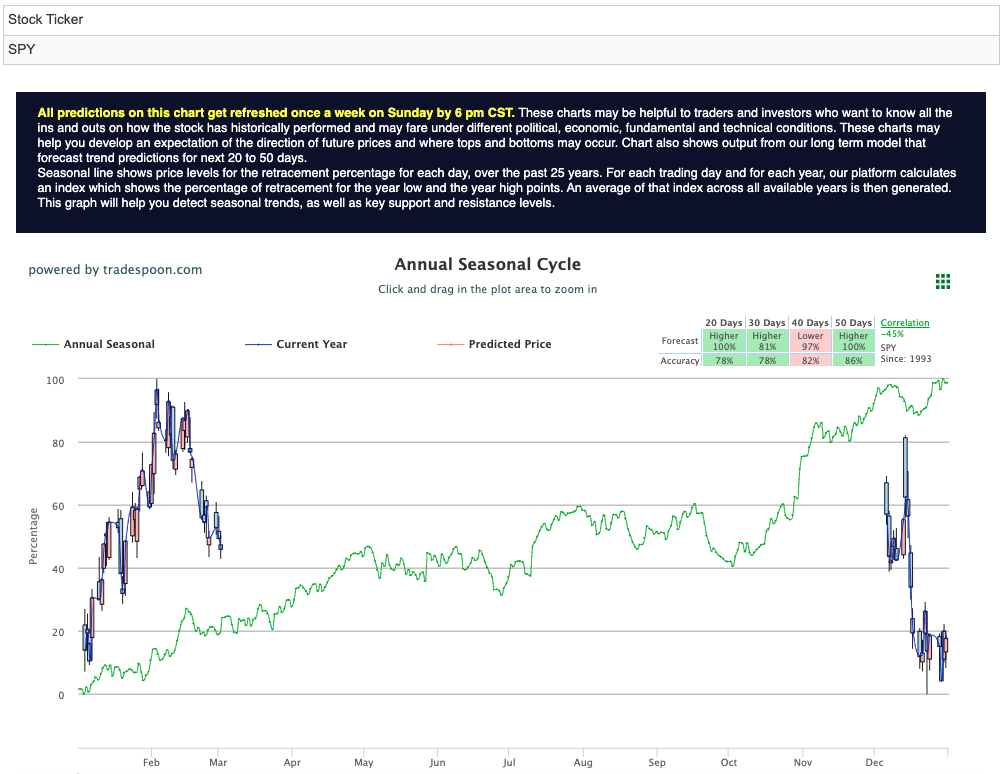

Additionally, when reviewing our seasonal chart for QQQ, primed for long-range forecasts, the symbol is showing several positive signs. With two out of the four-time ranges showing higher forecasts and a wide gap within the actual chart, QQQ is positioned for a decent rally if markets see a bounce back in the coming days. See QQQ Seasonal Chart:

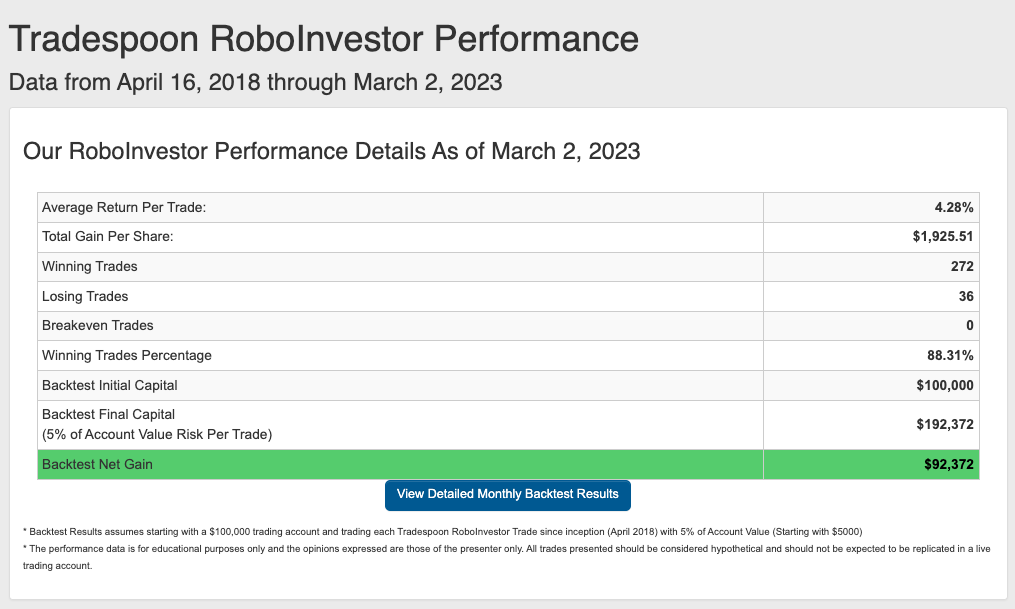

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

The interplay between inflation, Fed policies, geopolitical tensions, and the ongoing conflict in Ukraine is making waves in the financial markets, making 2023 an eventful year for investors. To navigate this complex landscape, it is important to have a partner whom you can trust. RoboInvestor offers the expertise and tools you need to confidently manage your portfolio and seize opportunities in today’s fast-moving market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!