RoboStreet – September 8, 2022

Markets Struggle for Direction Ahead of Key Inflation Data

This week, markets continued to be guided by Fed comments and sentiment as inflation remained in focus. During the shortened trade week, markets saw some movement higher behind a mixed bag of economic reporting that showed marginal relief in the economy while inflation still remained rampant. Overseas, the European Central Bank increased interest rates by 75 basis points and said that more large rate hikes would probably follow. Following the Fed comments and ECB decision, markets split, with indices trading small losses for small gains throughout Thursday. If gains hold, markets will be able to post their first positive streak in nearly two weeks.

Two weeks ago, we saw Fed Chair Jerome Powell provide remarks at the Jackson Hole economic symposium that sent shares significantly lower. Markets took some time to recover from the hawkish sentiment Powell provided, reiterating the Fed will do anything in its means to combat inflation until the job is done, but saw nice gains on Wednesday of this week.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

All three major U.S. indices were able to book gains after Federal Reserve Vice Chairman Lael Brainard said that in order to ensure inflation is target carefully, “the [Federal Open Market Committee] will need to raise rates even further and maintain rates at exceptionally high levels for an extended period of time.” While this did not veer from Powell’s comments it did provide some clarity. Likewise, the release of the latest Beige Book provided additional clarity.

The new report, published before each meeting of the Federal Open Market Committee, showed that while the U.S. economy did grow slightly by August’s end, surveyed individuals have a generally weak outlook for the coming year due to labor and supply shortages as well as rising interest rates. The study provides comprehensive statistics that can assist with and likely impact important Fed decisions.

After reaching a peak of 9.1% in June, the lift in costs from earlier in the year is now beginning to subside, according to the Beige Book, but inflation is still “considerable.” According to nine of the 12 Federal Reserve districts around the country, prices climbed at a “slower” rate during this time period, although they rose overall.

The United States economy expanded slightly in the reported period, however, the future for the next year is grim due to rising interest rates and an insufficient labor supply that does not match industry demands. Although the economy is not as fragile, labor and resource shortages still caused problems. The labor market is just as tight, according to the Fed, which is driving salaries higher as businesses compete for employees.

There was some good news, though — consumer spending remained constant despite Americans’ increased expenditures on leisure and hospitality pursuits.

Looking ahead, Core CPI data, which will be a key component of market direction next week, is set to release on Tuesday, September 13th. The following week, the latest FOMC meeting is due to take place, September 20th-21st.

At the moment, I am watching the overhead resistance levels in the SPY, which are presently at $396 and then $404. The $SPY support is at $390 and then $380. I still expect the market to continue the current pullback for the next 2-8 weeks and I would be a seller into any further rallies. Chasing the market at this time would not be wise. See the $SPY Seasonal Chart below:

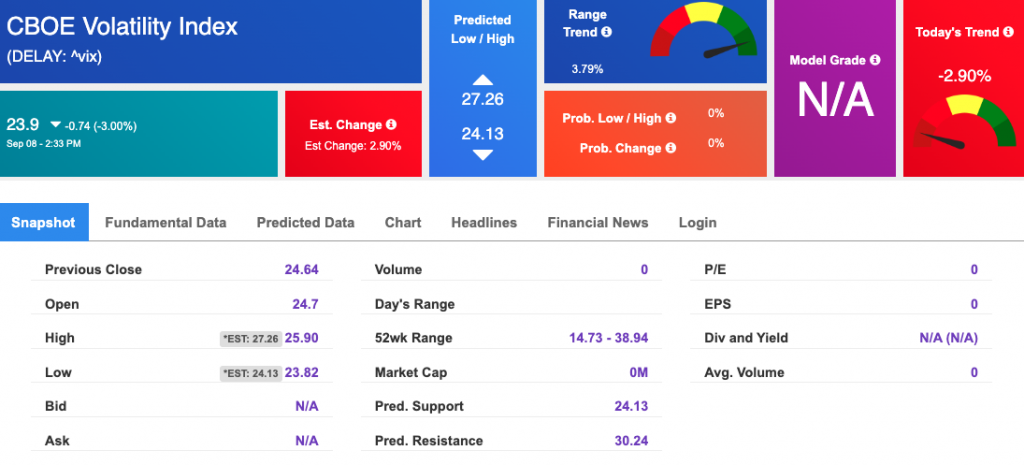

As stocks have given up much of their mid-August gains and Federal Reserve officials suggest that they are unlikely to reverse course on higher interest rates this year or next, I am seeing some increased volatility to come. Just this week, the VIX hit a high of $28, before returning to trade in the $23-$25 level.

As the market continues to shape up ahead of the upcoming FOMC, I am going to be hedging my portfolio with one key symbol I, and my A.I. system, believe will prosper.

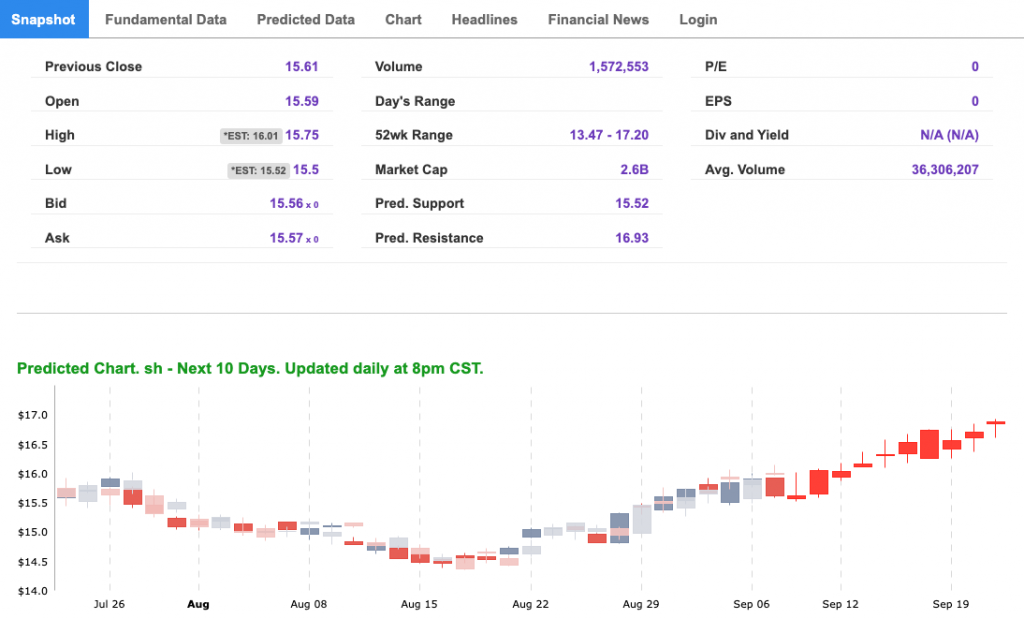

ProShares Short S&P 500 (SH) is an ETF intended for shorting the S&P 500, which consists of large-cap U.S. stocks. Currently managing over $2.5 billion in assets, this ETF has been trading in the $15 range, below its 52-week high of $17.20. The inverse ETF, which saw movement higher last week, dropped off on Wednesday and Thursday- bringing its five-day total to down 1.64%

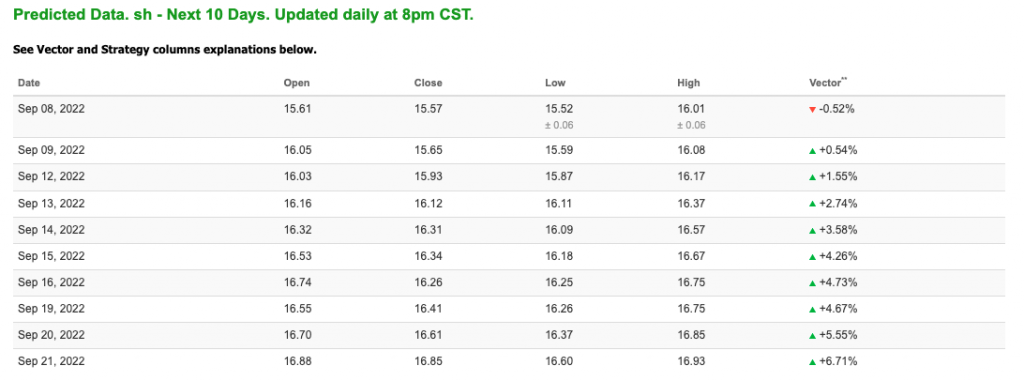

While the market currently presents an oversold nature, I am banking on the S&P to see continued struggles in the next few sessions, specifically as core CPI data is unveiled. We’ve seen weakness in the tech sector previously and even saw market-wide pressure following Jackson Hole. As we approach the next key reading of inflation, I believe the market could see some momentum lower. But let’s review the A.I. data to concur.

Reviewing the $SH Seasonal Chart, seen above, we see that the annual season price, marked in green, has dipped below the current year price, marked in blue. A back and forth is presented which signals volatility, something that is key for an inverse ETF. The symbol is showing potential to go higher in the next 30, 40, and 50-day ranges with a growing accuracy percentage- something I could see arriving even sooner.

Using the Stock Forecast Toolbox, SH is signaling a continuous trend upward in its 10-day forecast. The symbol is trading below its 52-week and monthly highs and has potential for the upside. SH was trading around $17 just this July signaling that this symbol path of least resistance is up and our A.I. tools are showing just the same!

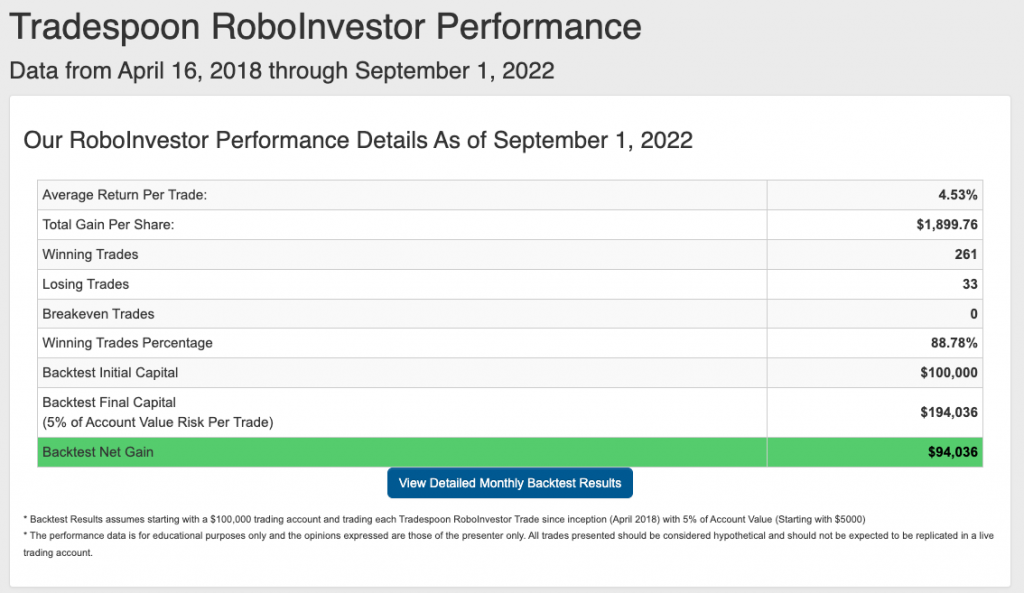

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior. We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.78% going back to April 2018.

The market is still very unpredictable, and we still have an entire quarter left in 2022. Inflation, Fed decisions, geopolitical tension, and the Ukraine war are all influencing how money is being gained and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!