RoboStreet – January 6, 2022

Tsunami Wave Of Selling Hits Nasdaq

As the year started with so much promise in what was textbook Santa Claus Rally, the rally was cut short by the release of the Fed’s December policy statement revealing a more hawkish action plan than had been communicated by Fed Chairman Jerome Powell following the FOMC meeting. It caught Wall Street off guard as bond yields rose across the yield curve – the 10-year trading above 1.73% – its highest level since April.

Wednesday’s session ended with the Nasdaq dropping 522 points, led lower by mega-cap tech that had held up fairly well in the face of rising interest rates. But the FAANG dam plus the mighty Mr. Softie couldn’t hold and everything tech got slammed in a wave of unbridled selling that saw some downside follow-through Thursday morning before some leading tech stocks saw some buyers step in.

The worst of the selling pressure is taking place in the high price-to-sales stocks and ETFs like the ARK Innovation ETF (ARKK) where there is more downside being felt in yesterday’s session. There is a clear desire by investors to want out of these growth stocks of which most have no price-to-earnings ratios. It’s like someone yelling “fire” in a theatre and it’s hard to determine when the selling will subside.

Depending on the employment data due out this morning, it will be interesting to see how the bond market reacts and thus stocks as well. Since the ADP data was strong, it stands to reason the non-farm payrolls number will be firm as well. But the market suspects this going into the number and thus is probably reflected in bond prices.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

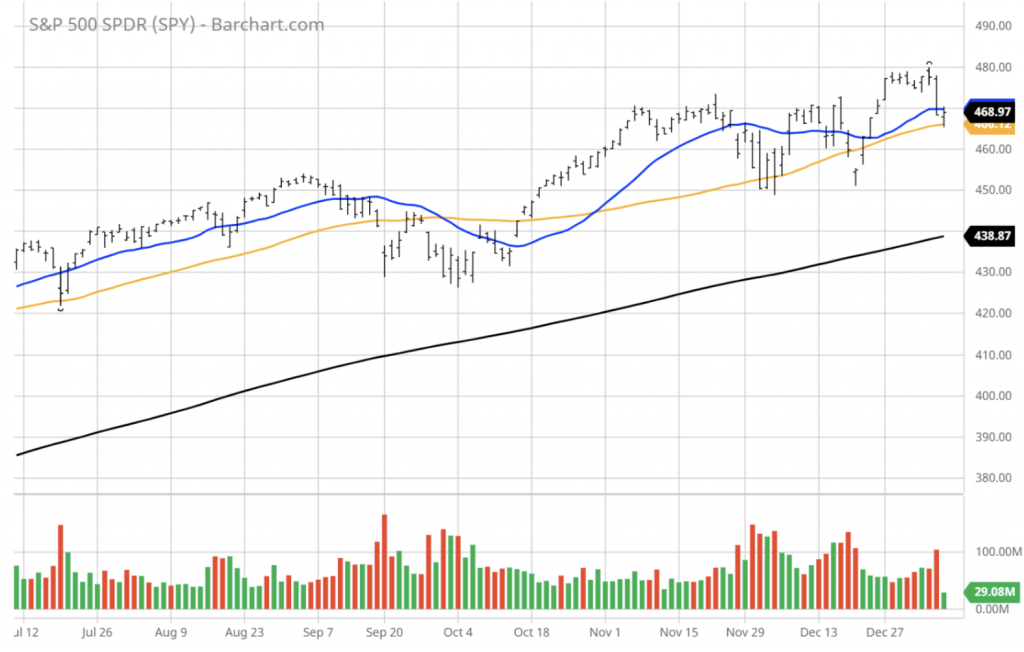

The $SPY sold on the hawkish statement from the Fed, and closed down 2.0% below key short-term support at $468, right above the 50-day moving average. The value/reflationary outperformed the $SPY and closed in the red, down 0.5% and near the all-time high. The technology sold off sharply on the steepening of the yield curve, down 3.0%, right above the key long-term support level at $380.

The $DXY was range bound and closed above $96 above the key breakout level $94.5. The $TLT continued the sell off, and closed right below the 200-day moving average. The $VIX traded higher, at 20 levels.

The $SPY short-term support level is at $462 (key short-term support) followed by $450. The SPY overhead resistance is at $480.

After the Fed’s hawkish statement, it is important to see if the $IWM and the $QQQ will maintain the key mid-term support levels, the December low for the $IWM at $210 and the $QQQ at $380. If these levels are breached there is a high probability that the $SPY has set the high at $480 for the rest of the year.

I would consider rebalancing portfolio at this time, and have overall market NEUTRAL portfolio. I do expect potential sharp pullbacks (5-15%) followed by a rebound in the next 2 month.

If you are trading options consider selling premium with March and April expiration dates. Based on our models, the market (SPY) will trade in the range between $450 and $490 for the next 2-4 weeks.

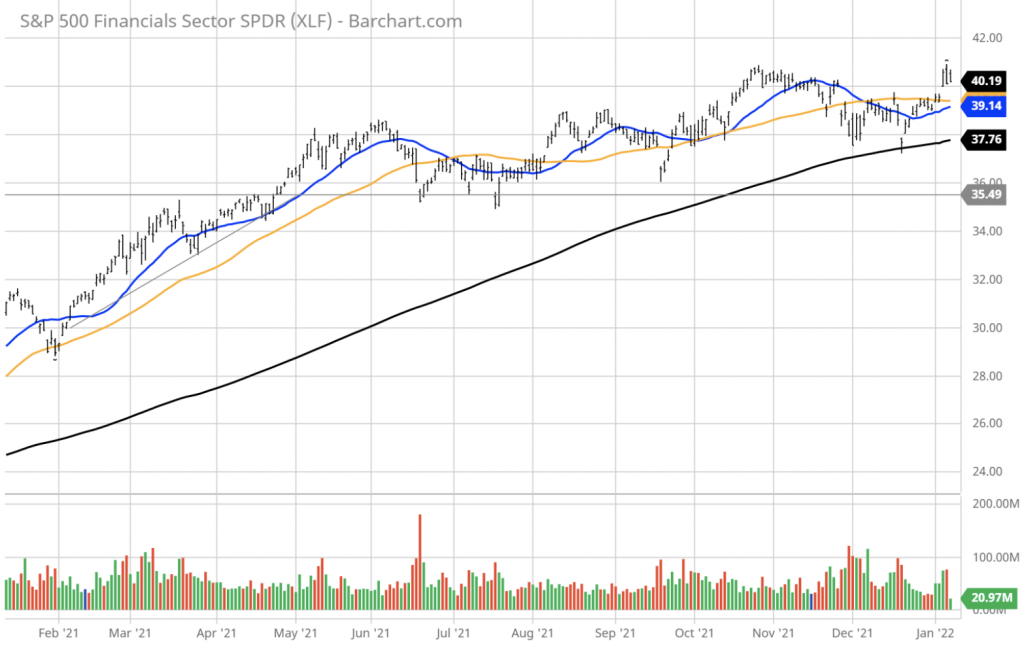

A steepening yield curve is a formula for stronger profits for the banks as they borrow short and lend long, generating rising net interest margin. This is a hugely welcome development for the banks and the market has been quick to recognize and reward the sector with a bullish move higher this week. The heavy selling within the growth stock sectors has benefited the banks where strong rotational fund flows are evident.

A rising yield curve is also bearish for iShares 20+ Year Treasury Bond ETF (TLT) where our AI-driven Seasonal Chart sees a short-term oversold bounce in the next 20 days followed by a protracted downtrend thereafter – implying TLT as a viable long-term short candidate.

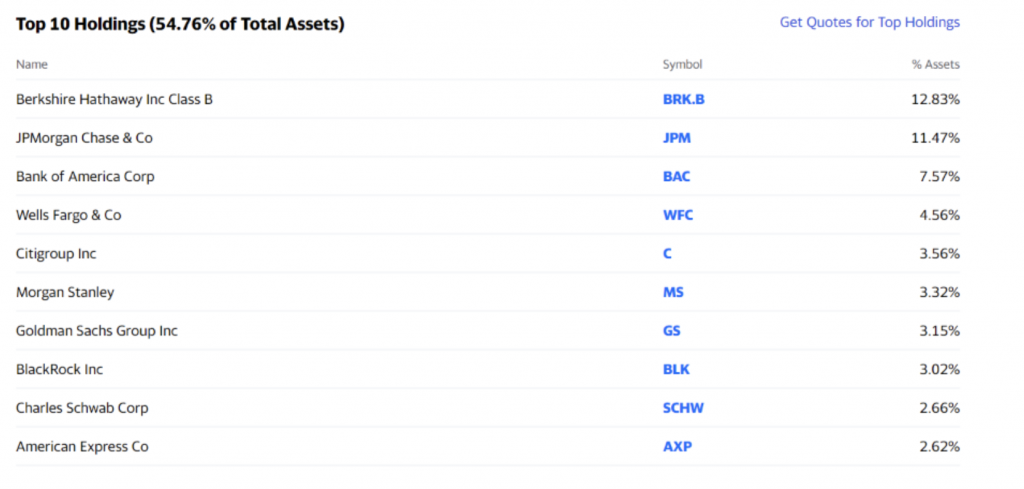

The Financial Select Sector SPDR ETF (XLF) is trading right back up to is all-time on the back of a big upside breakout in Berkshire Hathaway Cl B (BRK-B) – the top holding within the XLF assets.

JP Morgan Chase & Co. (JPM), Bank of America Corp. (BAC), Goldman Sachs Group Inc. (GS) and Wells Fargo & Co. (WFC) lead off earnings season as of January 13-14 and will set the tone for the sector going forward. Currently, the momentum is clearly there to take the sector higher if bond yields continue upward.

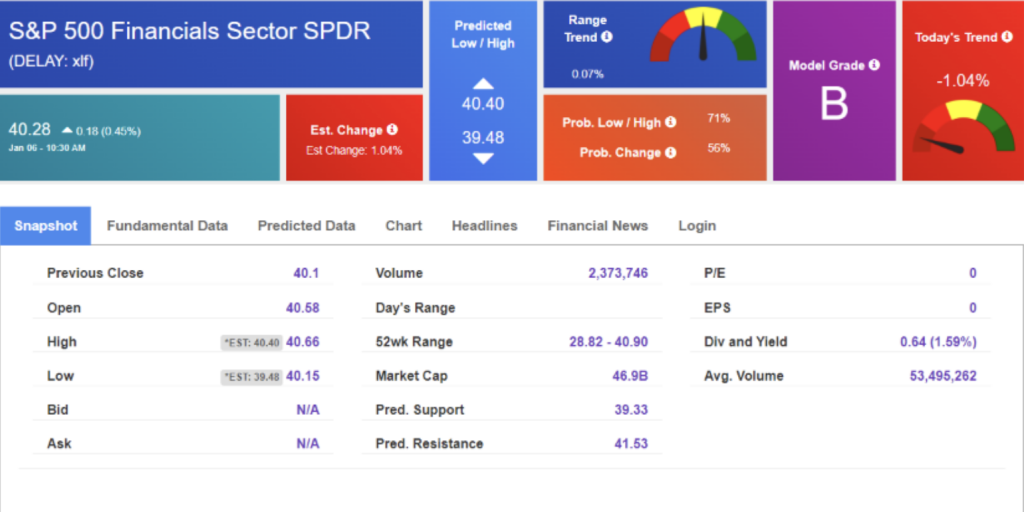

When we apply our AI-based Forecast Toolbox to XLF, we get a continuation of the current upside move over the next 10 trading days that portends of a new all-time high in the making, where an extended uptrend would commence.

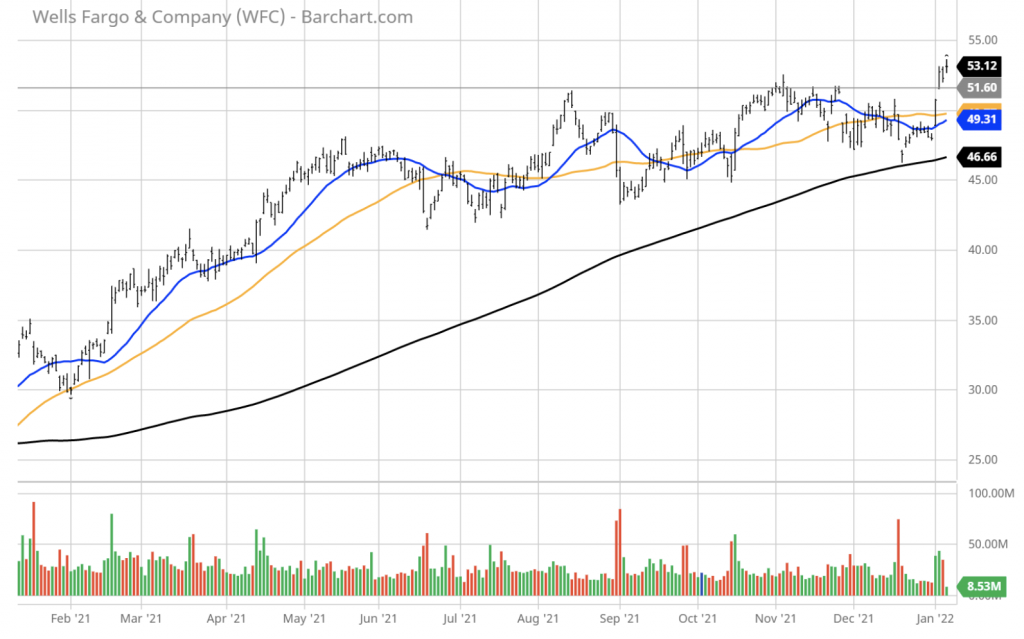

Of the bank stocks that post up best on the charts, and the potential for the sector to break out is Wells Fargo & Co. (WFC). New CEO Charlie Sharpe is engineering a major turnaround for the formerly scandal-plagued bank and has the best potential for beating earnings forecast for the fourth quarter.

The one-year chart of WFC shows a clean breakout above $51.60 that makes for a prime candidate for being added to our RoboInvestor Portfolio in the coming days. As these opportunities arise, we screen each ETF and stock through our AI platform and determine from a number of factors if I want to recommend it to our members. In the case of Wells Fargo, it has all the components of what we’re looking for, and will likely add this name on the first technical pull back that provides a perfect entry point.

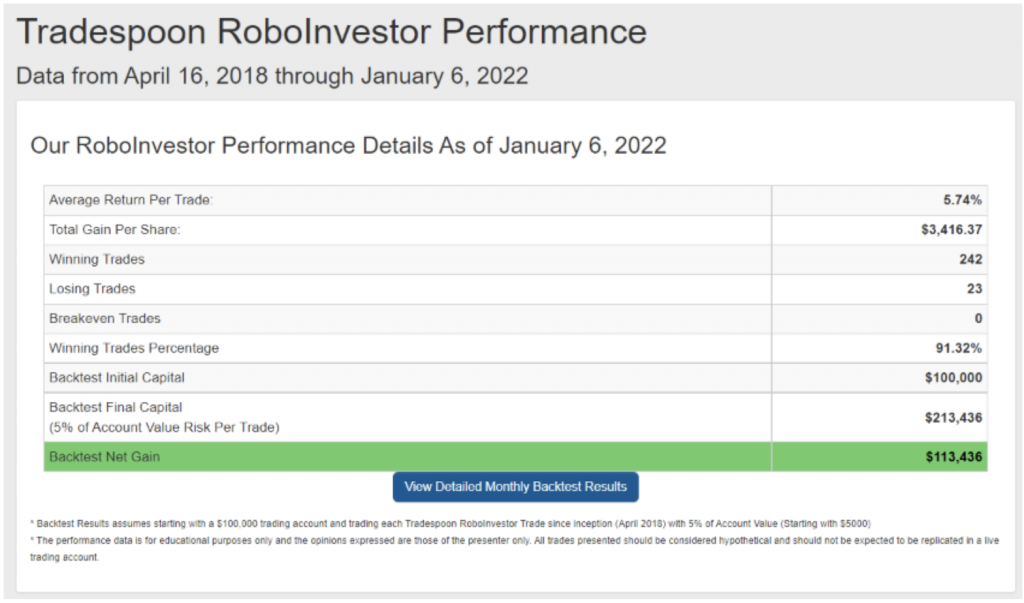

Within the RoboInvestor advisory service, our AI models identify blue-chip stocks and ETFs that represent indexes, all 11 major market sectors, sub-sectors, commodities, currencies, interest rates, volatility and shorting opportunities via inverse ETFs. The performance of RoboInvestor since being launched in early 2018 has proven to be a real wealth creation machine for our community.

We publish the RoboInvestor online newsletter every other week that arrives in your inbox over the weekend, where we highlight the investing landscape, review our current holdings and provide two new recommendations that you can act on Monday morning.

The service boasts a Winning Trades Percentage of 91.32% that to my knowledge is not matched by any investor advisory service. We’ve worked very hard to accomplish this track record and will continue to pursue an even better performance going forward.

With the market definitely showing a more volatile investing landscape is in store for 2022, I really want to encourage everyone reading this column to give RoboIvestor a place in your stable of portfolio management tools. I believe you will be very happy you did come this time next year. My personal capital is committed to every trade I recommend, so I’m with you every step of the way on this journey to grow our net worth in a substantial manner over this year and the years to come. Thank you for your interest, stay healthy and good investing.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!