Amid a backdrop of cautious optimism, U.S. stocks held their ground on Monday, displaying minor fluctuations across the three major indices. As investors brace for a packed schedule of corporate earnings releases and a pivotal Federal Reserve monetary policy decision later this week, the market remains in a state of heightened anticipation.

On Wednesday, the Federal Open Market Committee is poised to announce its interest-rate decision, widely expected to maintain the Fed funds target rate at 5.25%-5.50%. However, the focal point for traders will be the nuanced messages conveyed during the meeting, with keen attention on whether the tone is sufficiently dovish to spark expectations of an impending rate cut, potentially as early as March.

Monday witnessed the spotlight on tech giants Microsoft and Apple, contributing to a positive market sentiment. While the S&P 500 initially reflected gains, its equal-weighted counterpart experienced marginal losses. The upcoming week promises a flurry of earnings releases, notably from five major tech players, collectively constituting 28% of the S&P 500 index, as reported by Dow Jones indices.

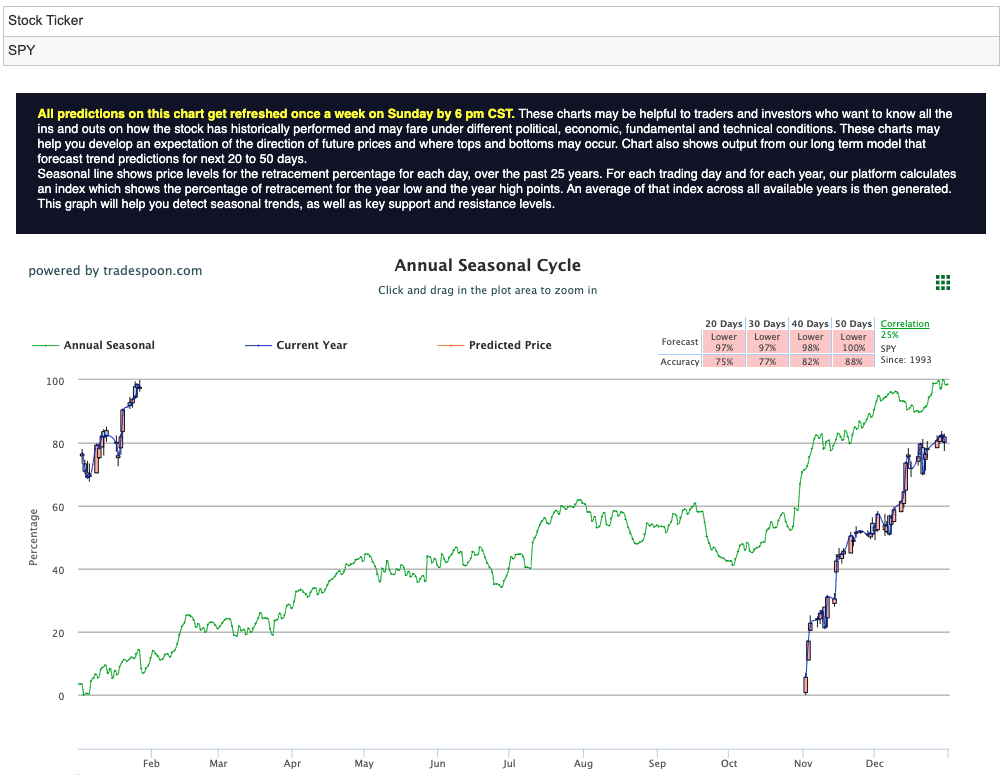

The broader market landscape has witnessed a historical breakout, steering the S&P 500 toward the significant 500 level. Yet, amid this upward momentum, concerns linger regarding the resurgence of the “high for longer” narrative and the implications of rising interest rates. Market analysts project a potential ceiling for the S&P 500 rally in the $470-490 range, with short-term support anticipated between $430-450 in the coming months. For reference, the SPY Seasonal Chart is shown below:

Juggling the ascent of interest rates with the ongoing breakout in the QQQ index poses a delicate challenge for the market, especially considering the downward pressure exerted by the rebound of the 10-year yield and the U.S. Dollar Index ($DXY) from oversold conditions across various segments.

The earnings season unfolds with significant players such as AMD, Google-parent Alphabet, and Microsoft scheduled to report on Tuesday, followed by Apple and Amazon on Thursday. Simultaneously, the Treasury Department’s announcement on Wednesday regarding the quantity of long- and medium-term securities to be offered could potentially influence yields if the supply surpasses expectations.

SoFi Technologies surged by an impressive 17% after announcing its inaugural quarterly profit, reporting revenue of $594.25 million, exceeding analyst predictions for break-even fourth-quarter earnings of $572 million. Simultaneously, Tesla experienced a 2.7% uptick, revealing plans to invest $10 billion in new plants and equipment for 2024, equivalent to approximately 8.9% of the projected 2024 sales.

A diverse range of companies is expected to release reports in the coming days, including Microsoft, Apple, Amazon.com, Alphabet, Meta Platforms, Advanced Micro Devices, Boeing, Pfizer, Merck, Exxon Mobil, Chevron, United Parcel Service, General Motors, Starbucks, Novo Nordisk, Bristol Myers Squibb, Mastercard, Qualcomm, Honeywell, Altria, and Royal Caribbean.

In the cryptocurrency realm, Bitcoin and other digital assets exhibited relative stability on Monday, maintaining recent gains. Despite a more positive sentiment, market participants remain cautious about potential volatility in the week ahead, closely monitoring price movements and developments in the crypto space.

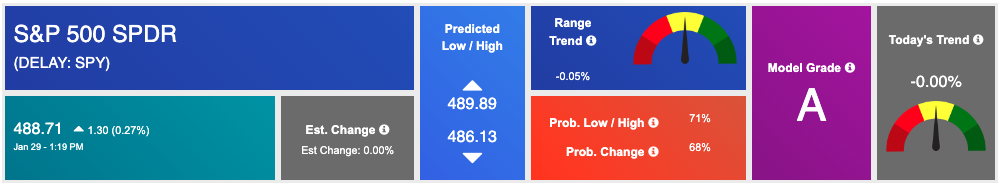

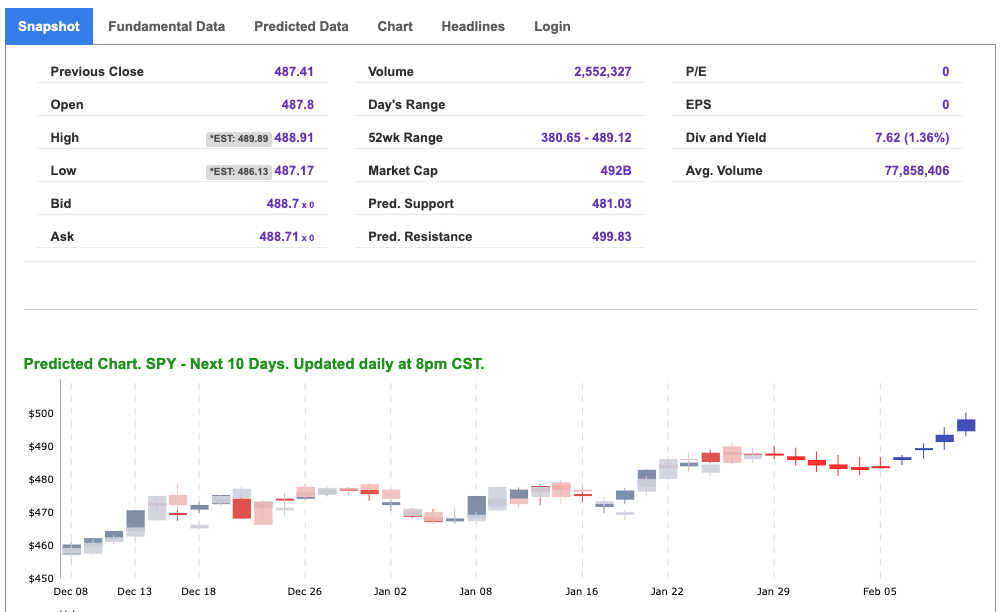

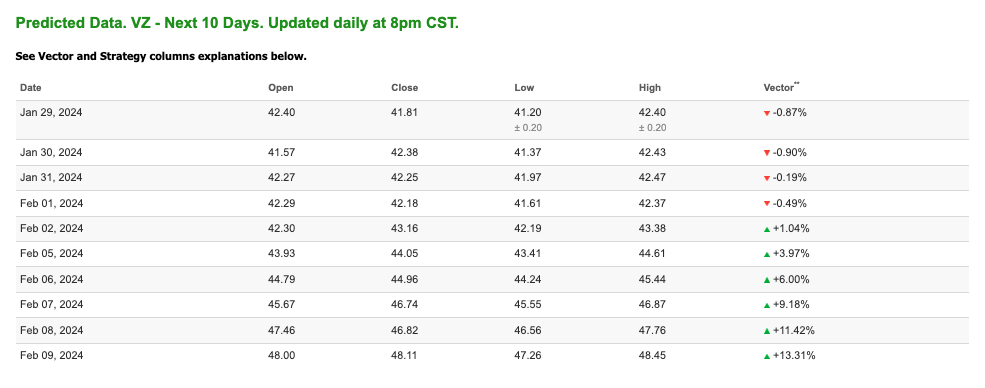

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

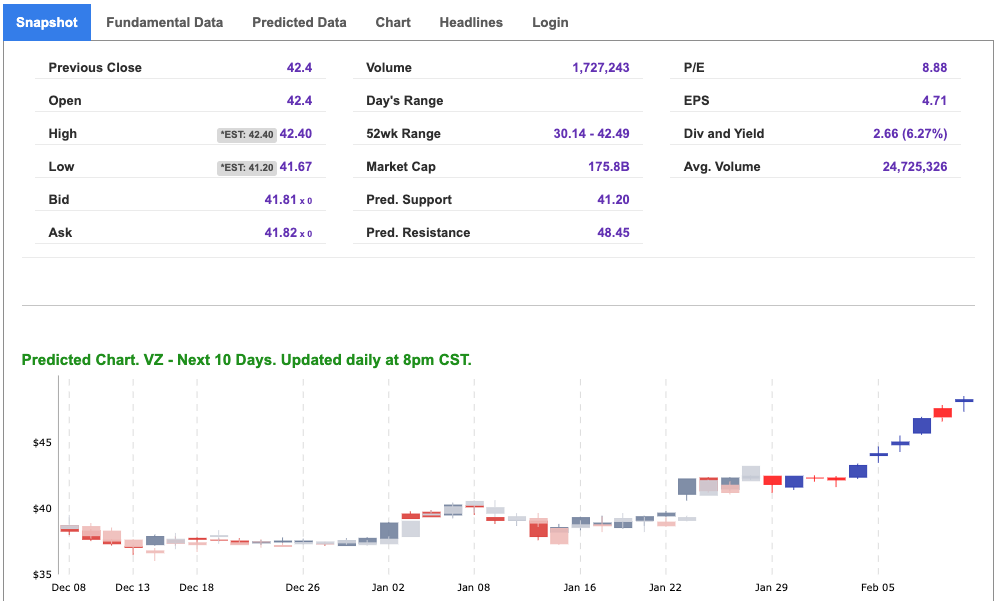

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, VZ. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

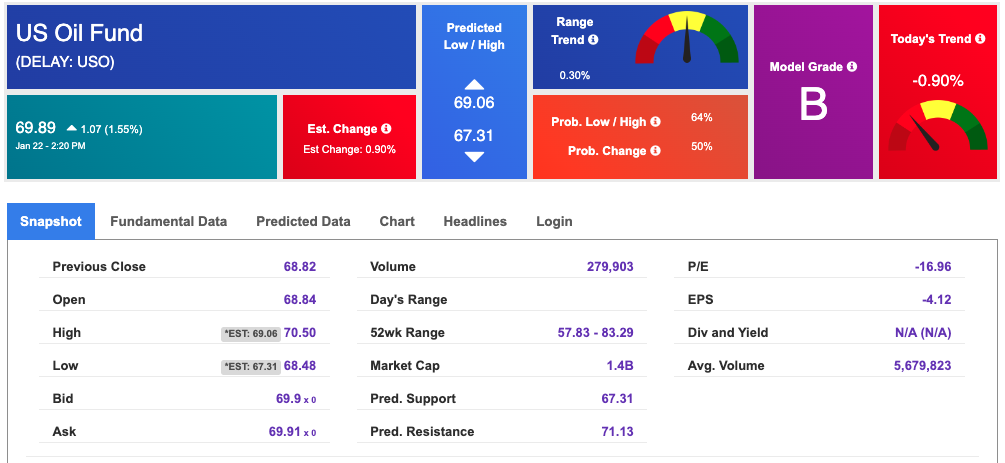

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $76.80 per barrel, down 1.55%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.86 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

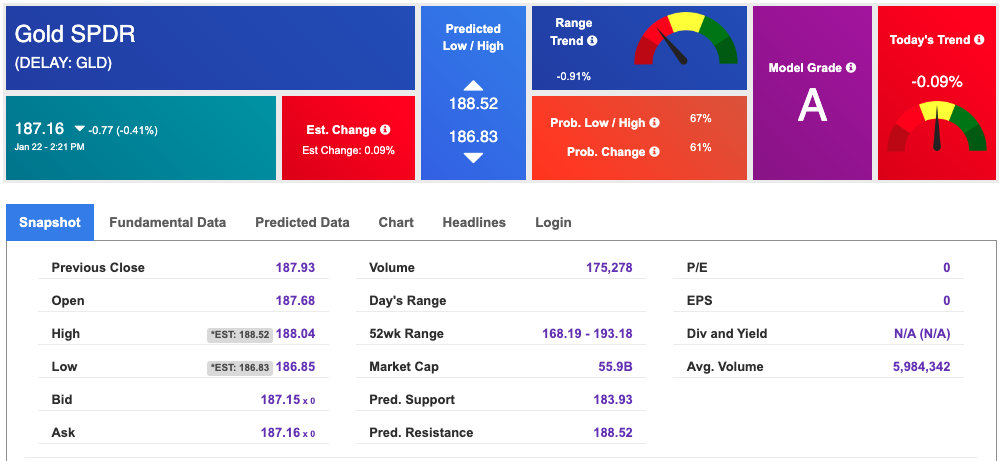

The price for the Gold Continuous Contract (GC00) is up 0.40% at $2025.30 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $187.72 at the time of publication. Vector signals show -0.20% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

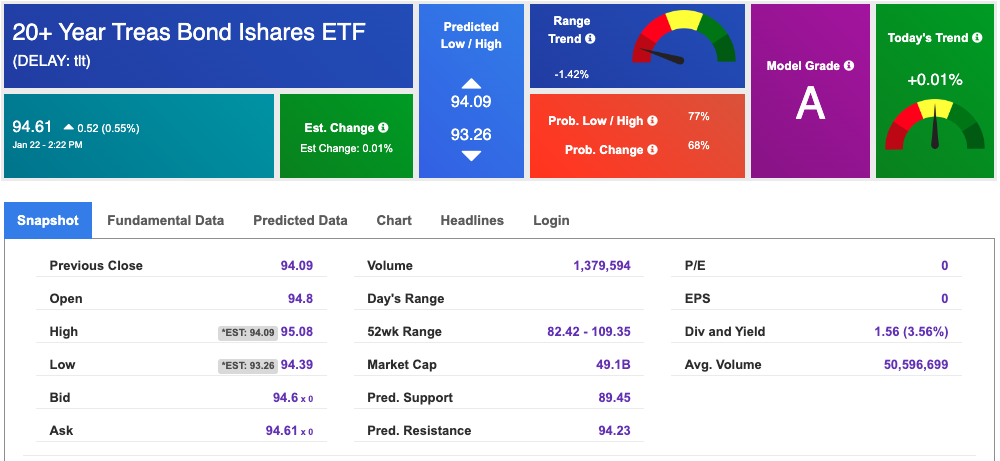

The yield on the 10-year Treasury note is down at 4.092% at the time of publication.

The yield on the 30-year Treasury note is down at 4.336% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

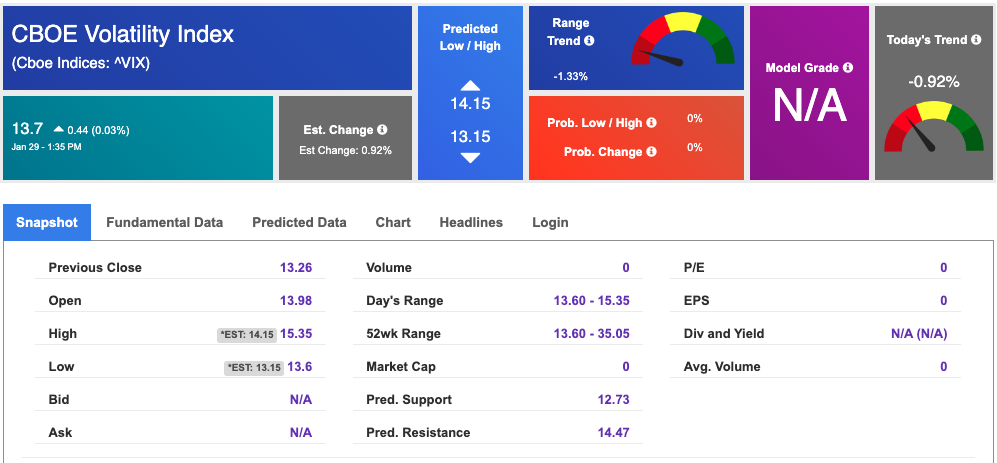

The CBOE Volatility Index (^VIX) is priced at $13.7 up 0.03% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!