U.S. stock markets took a dip on Thursday as a string of corporate earnings reports underwhelmed investors and raised concerns about the strength of the economy. The Dow dropped by 0.3%, the S&P 500 fell by 0.6%, and the Nasdaq Composite declined by 0.8%. Several large companies, including Tesla, AT&T, and American Express, missed their respective earnings expectations, leading to drops in their stock prices.

Tesla’s stock fell sharply by 9.8% due to the first-quarter automotive gross profit margins, which did not meet Wall Street’s expectations. Additionally, AT&T stock declined by 10% because of a decrease in subscriber growth for its postpaid phone plans. American Express stock also dropped by 1% as they missed earnings expectations and are anticipating defaults. Netflix’s second-quarter outlook was disappointing, which resulted in a 3.2% drop in its stock. Likewise, Morgan Stanley experienced a drop in both earnings and revenue, whereas IBM had a mixed quarter.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The markets were also concerned due to the latest release of labor data. The Labor Department reported that the number of first-time unemployment claims filed by Americans increased to 245,000 last week; this suggests that the labor market might be softening. Furthermore, concerns about inflation are escalating. If not addressed, this could lead to more interest rate hikes, potentially pushing the economy into a recession.

Apart from earnings season, investors are also closely monitoring the future of monetary policy. The Federal Reserve’s latest Beige Book report on economic activity showed that overall economic activity had little changed in recent weeks, employment growth had moderated slightly, and overall price levels had risen moderately.

Looking ahead, we are anticipating a pullback in the next two to four weeks as corporate earnings and forward-looking guidance are assessed. The VIX is currently trading near the $17 level. We are watching the overhead resistance levels in the SPY, which are presently at $414 and then $418. The SPY support is at $406 and then $402. We expect the market to trade sideways for the next two to eight weeks. We would be market neutral at this time and encourage subscribers to hedge their positions. See $SPY Seasonal Chart:

Although the market is experiencing turbulence, there is some optimism as global government bond yields rise due to the UK reporting higher-than-anticipated inflation. Investors will be keeping a close eye on economic data and corporate earnings reports to gauge the market’s performance in the upcoming weeks.

With this in mind, we have identified a specific sector and several symbols within that should prosper in the current and upcoming economic landscape.

The financial sector has shown resilience amidst the recent market turbulence, with several major banks reporting strong earnings results. JPMorgan Chase & Co. reported a first-quarter net income increase from a year earlier. Bank of America Corporation also posted better-than-expected earnings results, and Wells Fargo & Co. exceeded earnings expectations.

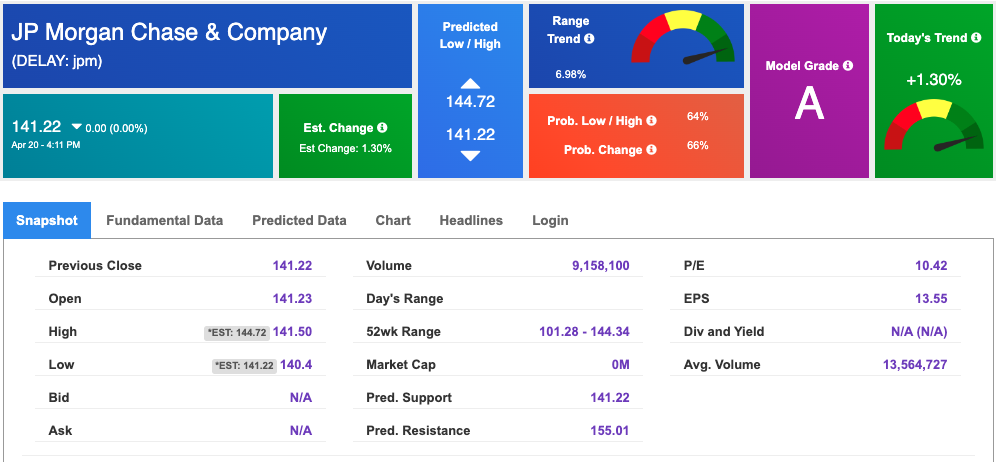

Investors looking to capitalize on this trend should consider major bank stocks such as $JPM, $BAC, and $WFC. These stocks have shown strength and stability in the face of economic uncertainty, and they are well-positioned to capitalize on the current economic landscape. Reviewing our A.I. data, we are seeing similar results!

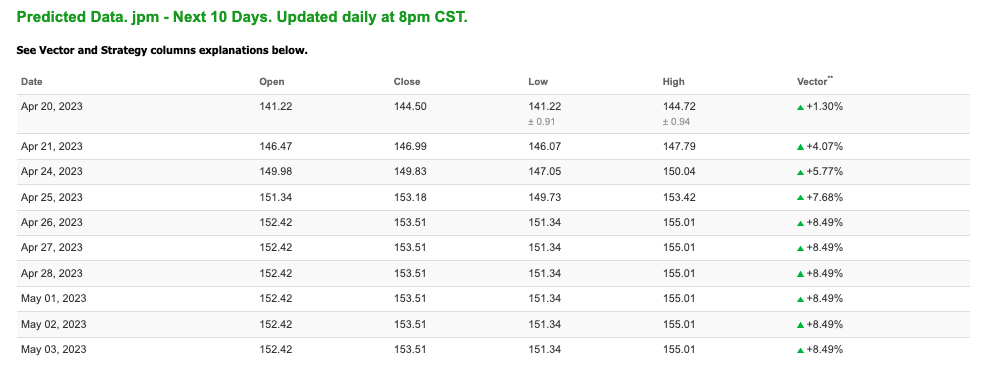

JPMorgan Chase & Co. (JPM) is showing a model grade of “A” with a positive vector score as well as an upward vector trend within the 10-day predicted data:

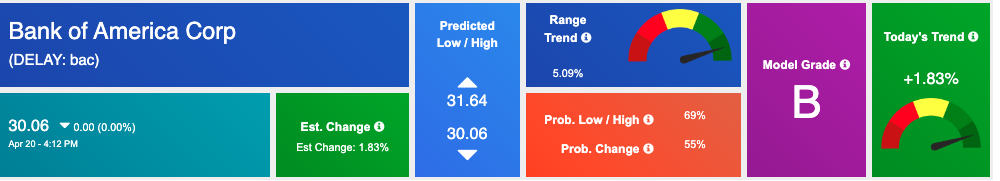

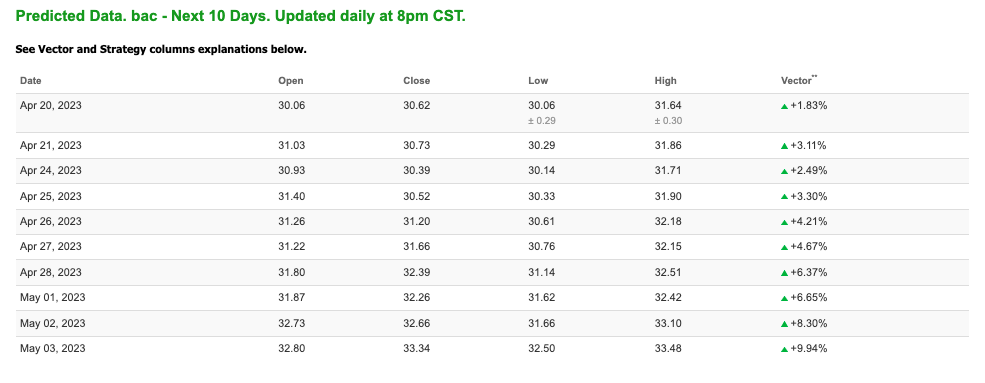

Looking at Bank of America (BAC) we see a similar vector score and trend which is the ideal forecast when looking for a bullish symbol.

BAC’s 10-day predicted data via the Stock Forecast Toolbox shows a positive vector score within each day that accelerates and is one directional towards the positive side.

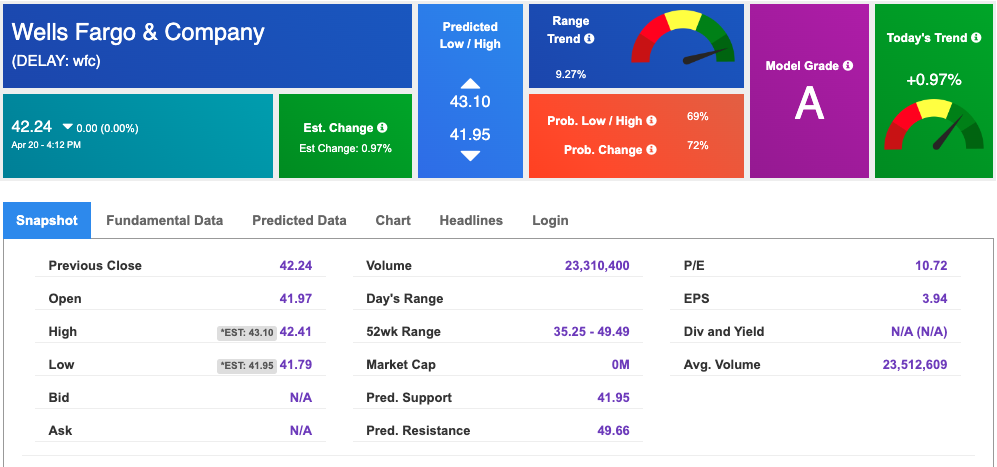

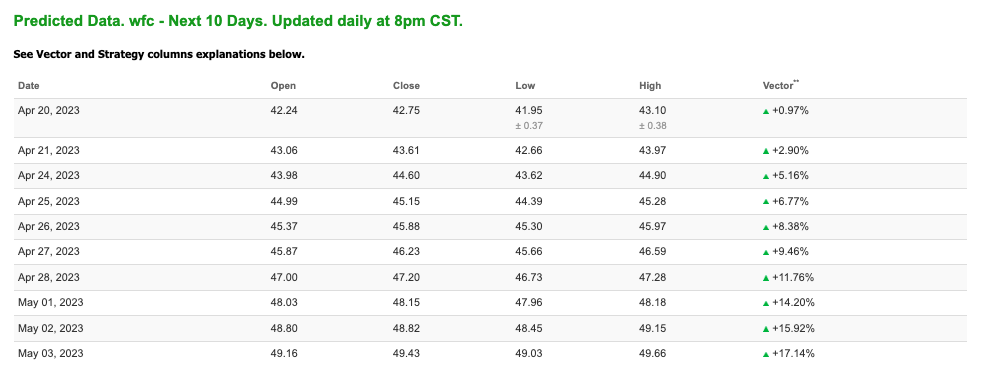

Wells Fargo & Co. (WFC) is no different and also shows a high accuracy model grade of “A,” indicating it is within the top 10% of our data universe. WFC rides the very same vector trend towards the upside, and with the current market landscape, we believe this is a great entry spot.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

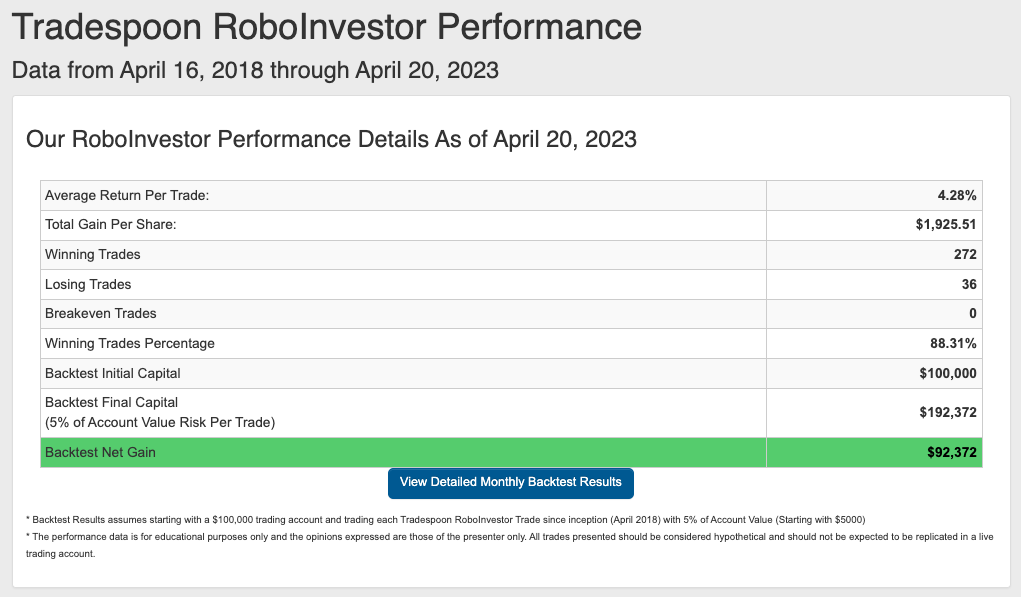

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!