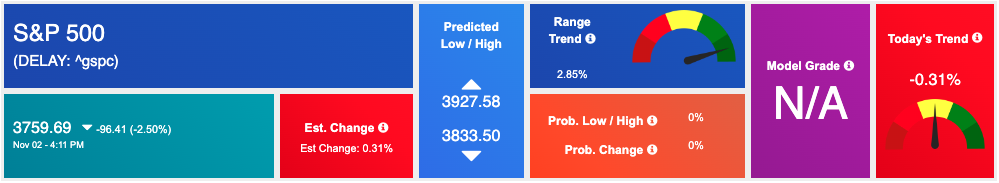

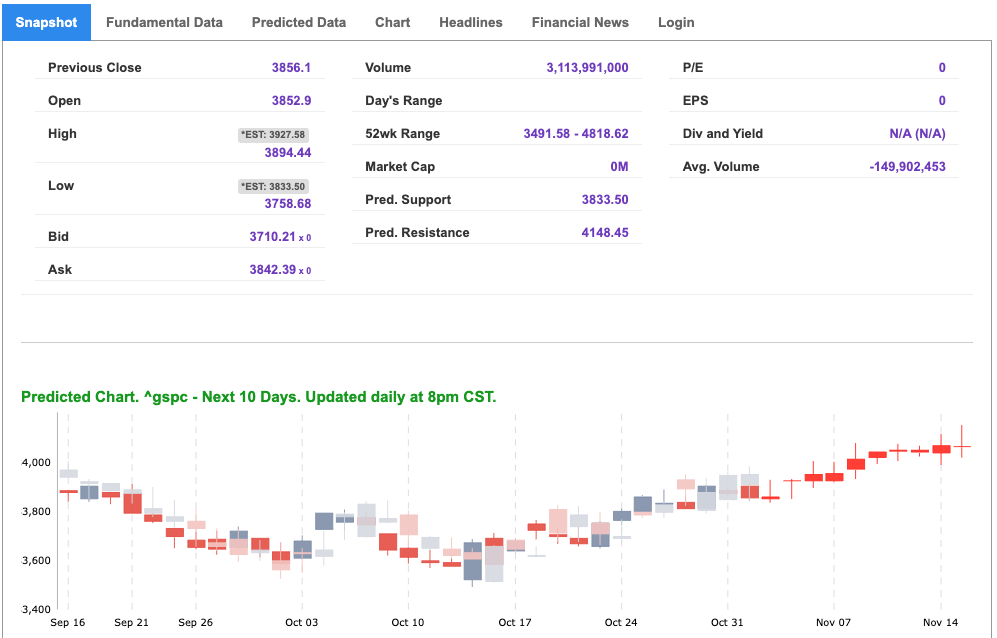

All three major U.S. indices fell today following the latest Federal Open Market Committee meeting policy update announcement. On Wednesday, Fed Chair Powell announced the fourth consecutive interest rate hike, bringing interest rates to multi-year highs. The Fed hiked its rate by 0.75 percentage points to a range of 3.75% to 4%, signaling that it would watch closely for any potential damage to the economy from this rapid pace of hikes. The latest 75 basis point hike was expected although hope for a shifting Fed stance continues to mount. Powell hinted that there could be more interest rate hikes on the horizon, although the Fed may ease up on the frequency of increases after ramping up over the past year to combat inflation. At his press conference, Powell stated that it would be “very premature” to consider pausing the rise in rates. He also said the target for increases in policy rate might be higher than what was previously expected which sent shares lower throughout the market.

Yesterday was a tough day for stocks, with the Dow Jones Industrial Average falling 80 points, the S&P 500 declining 16 points, and the Nasdaq Composite dropping 97 points- and things aren’t looking any better today, with more losses being booked. One bright spot today came from the latest ADP employment data which showed the private sector added 239,000 jobs in October, beating estimates. While the report did show pay growth decreasing, the labor market still appears to be strong after beating estimates in back-to-back months. Globally, European markets closed in the red while Asian markets finished with mixed results.

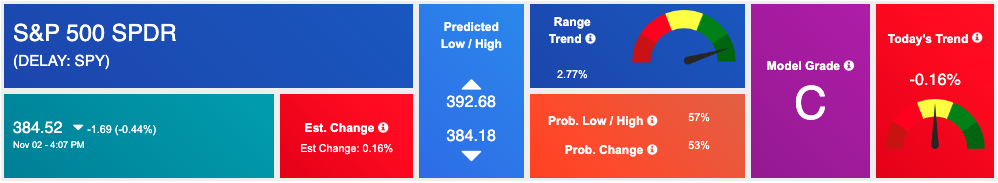

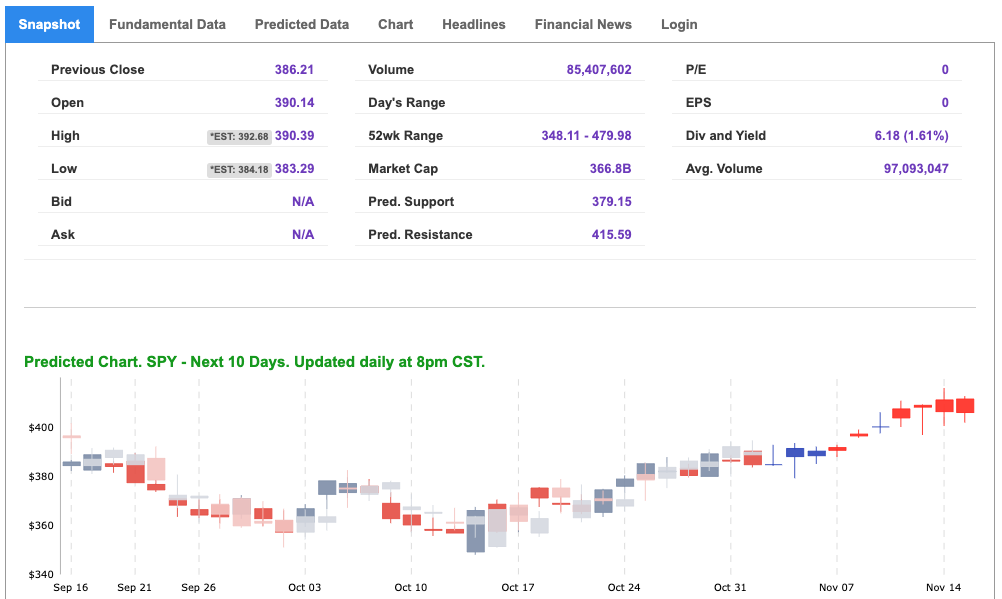

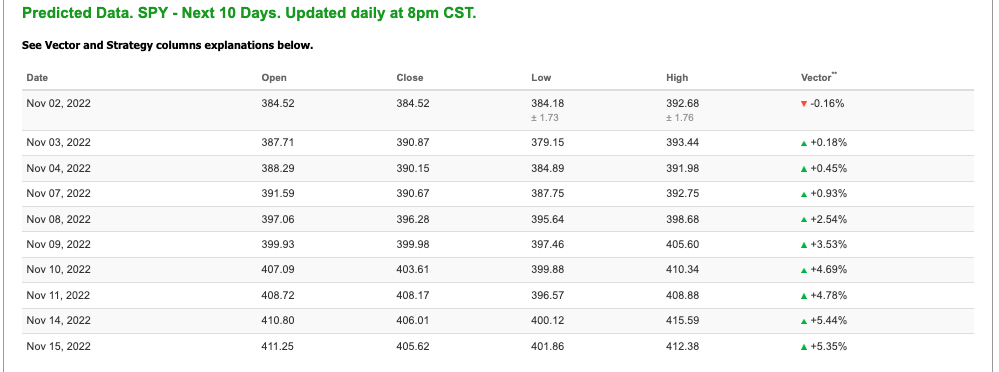

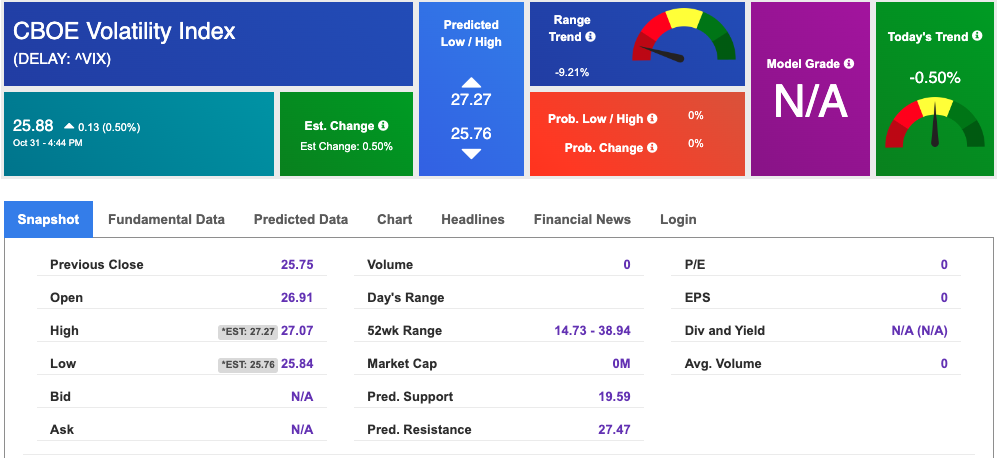

With the latest news in mind, we are watching the $VIX which is currently trading near the $28 level. This week’s earnings reports from eBay, Qualcomm, and Robinhood – as well as the Federal Reserve’s monetary policy decision and unemployment data – could affect where the market goes next. The $SPY support is at $374 and then $367, with overhead resistance presently observed at levels of $390 and then $400. We expect the market to continue the current rally for the next 4-8 weeks. The short-term market is overbought and can pull back. We would be a buyer into any further sell-offs and encourages subscribers not to chase the market to the downside or upside. Market commentary readers should maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, SPY. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

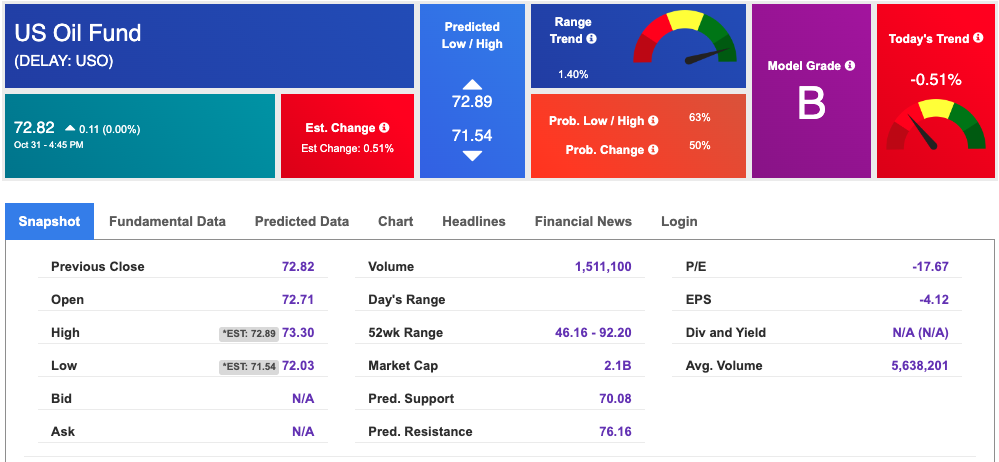

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $89.35 per barrel, up 1.11%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $72.82 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

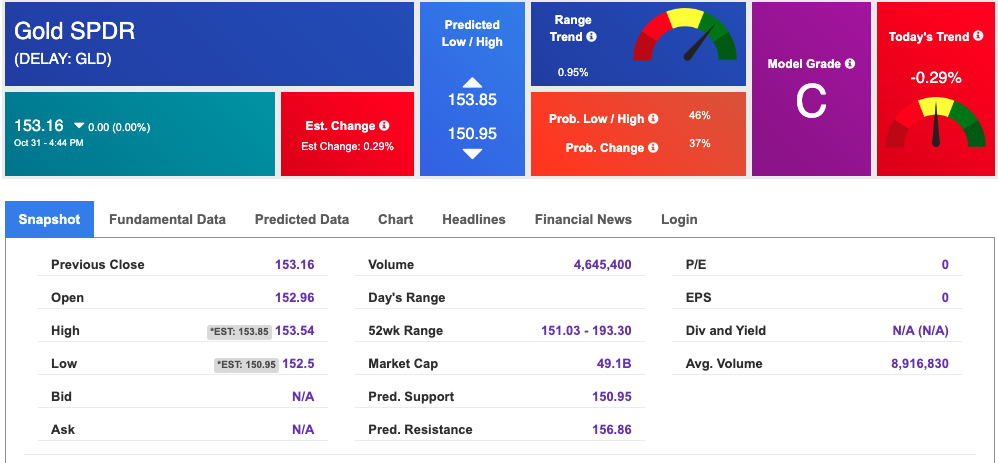

The price for the Gold Continuous Contract (GC00) is down 0.72% at $1637.80 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $153.16 at the time of publication. Vector signals show -0.29% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

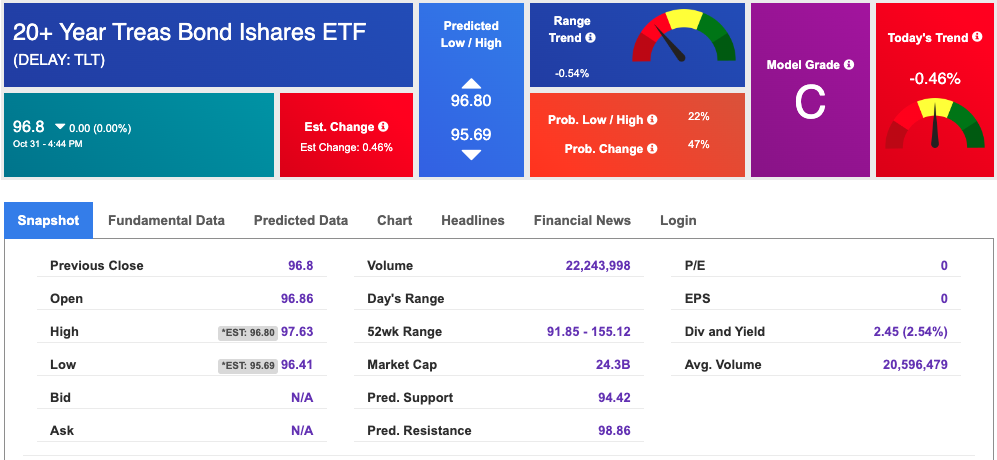

The yield on the 10-year Treasury note is up at 4.105% at the time of publication.

The yield on the 30-year Treasury note is up at 4.140% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is $25.88 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!