RoboStreet – February 10, 2020

Stocks Rally On Improving Covid Trends

In the third wave of Covid-19, Omicron is showing rapid progress of winding down as caseload, hospitalizations, and fatalities numbers are dropping fast. Several related restrictions are being lifted, sending a strong message to the market and the reopening sectors that the third time trying to rally out of the pandemic funk is the charm. Shares of hotels, casinos, restaurants, airlines, cruise lines, and travel booking companies are all finding fresh and heavy interest being they are truly lagging coming into 2022.

The bullishness is also spilling over into cyclical sectors that sense a freeing up of the gridlock within the global supply chains is within sight of broadly materializing as Covid protocols are gradually removed. This week represents a bit of an epiphany for the post-Covid narrative, but seeing schools begin to remove mask restrictions is a real breath of fresh air for the national mood and the market at large.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Wednesday’s rally saw 10 of the 11 market sectors rally, with the Consumer Staples closing down only -0.09%. For most of 2021 and part of 2020, the market see-sawed between growth and value, reinflation versus stay-at-home/remote work sectors. It has been an exhausting tug-o-war where meme stocks made a huge splash, cryptocurrencies exploded onto the scene and high price-to-sales stocks crashed after the Fed stated they would launch aggressive measures to tackle runaway inflation.

Though the first six weeks of 2022, the market swooned and has collected itself on the back of a surprisingly strong fourth-quarter earnings reporting season where some 80% or more of companies posting their sales and earnings are topping estimates. Economic conditions look to be improving, the bond market has priced in the expectation of a tighter Fed and the job market is showing signs of rebounding in both new hires and better wages. This all comes as the market will try to shake off sticky inflation data.

CURRENT MARKET LANDSCAPE

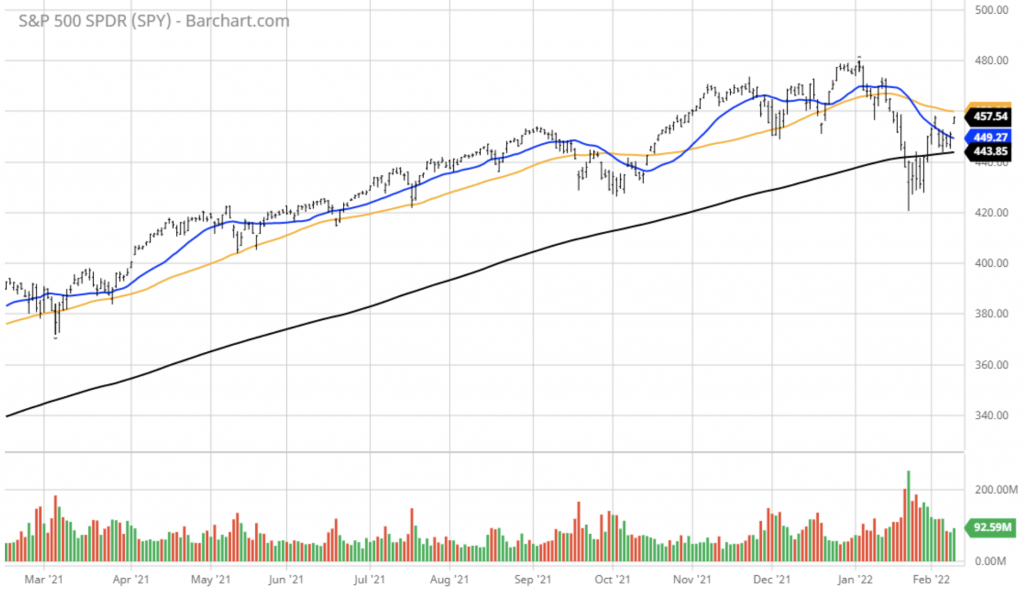

The $SPY continued to trade higher, broke out from the short-term range, and closed at $457. The $SPY was up 1.6% and closed at the 62% retracement from 2022 low to high, key medium-term resistance. The value/reflationary ($VTV) closed higher, up 1.0%, within striking distance from the all-time high. The technology sector ($QQQ) closed higher, up 2.1% at $367, near the 50% retracement from the 2022 low to high range.

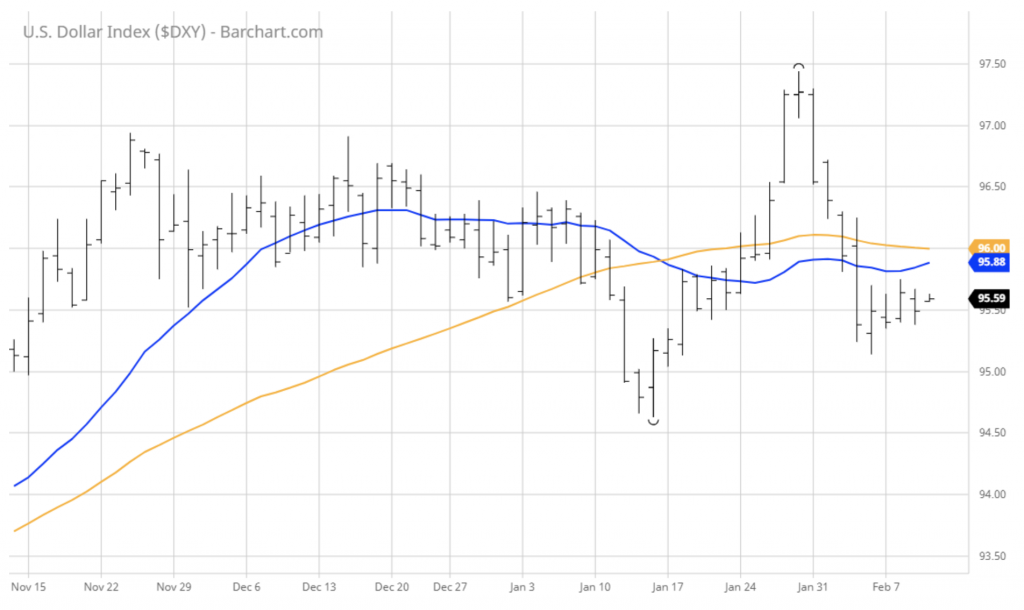

The $DXY closed higher, at $95.5, below the 50 DMA. The $TLT closed flat and closed below the 200 DMA. The ten-year yield is approaching 2.0%. The $VIX traded lower at the 20 level. The $SPY short-term support level is at $450 (key long-term support) followed by $440. The SPY overhead resistance is at $460.

I do expect volatility to persist, but the pattern of higher lows and higher highs should continue to emerge. I would be a seller of the high beta stocks into the rallies and continue rotating the portfolio into the value stocks ($XLE, $XLI, $XME, and $XLF).

I would consider rebalancing portfolio at this time and have an overall market BULLISH portfolio. I do expect the $SPY’s rebound to continue for the next 1-2 months. I do not expect the $SPY to post a new all-time high in the first half of this year. Based on our models, the market (SPY) will trade in the range between $430 and $470 for the next 2-4 weeks.

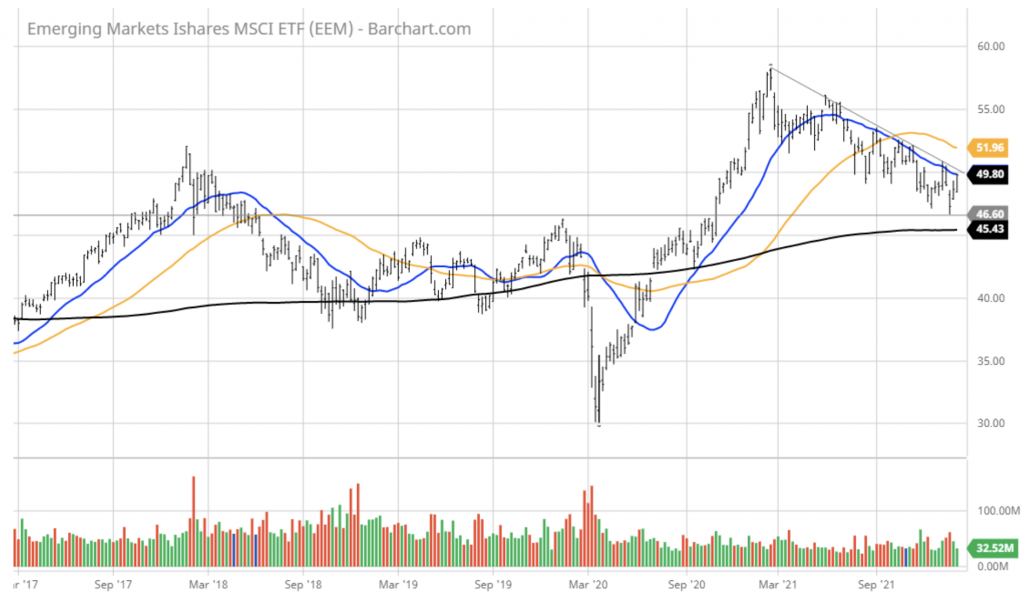

One specific area of opportunity I see shaping up for what looks to be an extended uptrend involves emerging markets. There are some catalysts that are in a position to light a fire under what has been a sorely lagging global sector, where a new leg higher is on the cusp of being established. Following a huge upside breakout back in February 2021, the iShares MSCI Emerging Markets ETF (EEM) has done a textbook job of retracing 50% of the heady gains of the pandemic low.

Emerging markets are highly sensitive to the direction of the U.S. dollar. A strong dollar puts downward pressure on the currencies of emerging economies, thereby shrinking the buying power of those currencies to buy imported goods. What the charts are showing is a major downside reversal in the dollar this past couple of weeks, where if the U.S. Dollar Index (DXY) breaks 94.50, a new downtrend will be in place.

Another catalyst is China’s central bank, the People’s Bank of China (PBOC) has embarked on a plan to increase quantitative easing to reduce the impact of its recent debt crisis and stimulate an economy that has been slowed by several large Covid outbreaks. China’s economy grew only 4% in the fourth quarter, marking the slowest rate in nearly two years, hampered by declining property values and softer consumer spending.

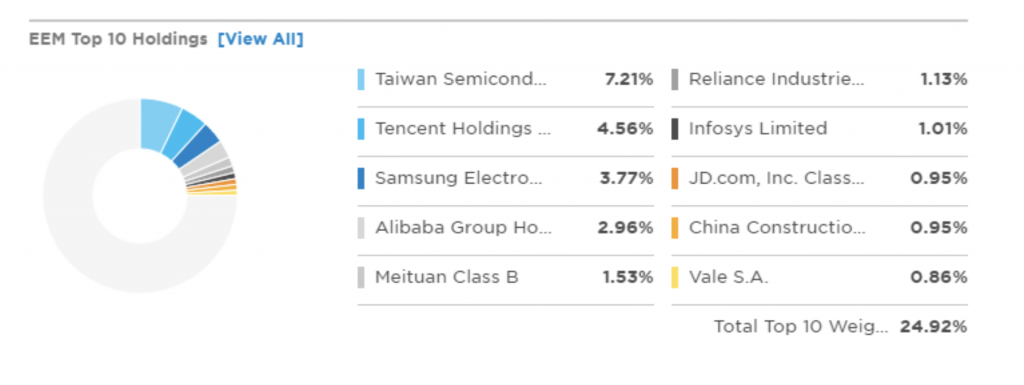

Even as the U.S. and other economies begin to tighten monetary policies, it is thought that China will continue to ease for the foreseeable future until there’s solid evidence of an upturn in GDP becoming evident. As such, Chinese stocks should perform much better going forward as would be emerging market ETFs where many top holdings are Chinese ADRs. The top 10 holdings in EEM have strong Asian exposure.

The emerging-market investment proposition takes on a more convincing tone when we apply our Tradespoon proprietary AI-driven tools to the EEM trade. Our Seasonal Chart shows “Higher” probability readings for the next 20, 30, 40, and 50-day periods, where we will likely recommend this trade to our RoboInvestor advisory service when our short-term signals indicate to do so.

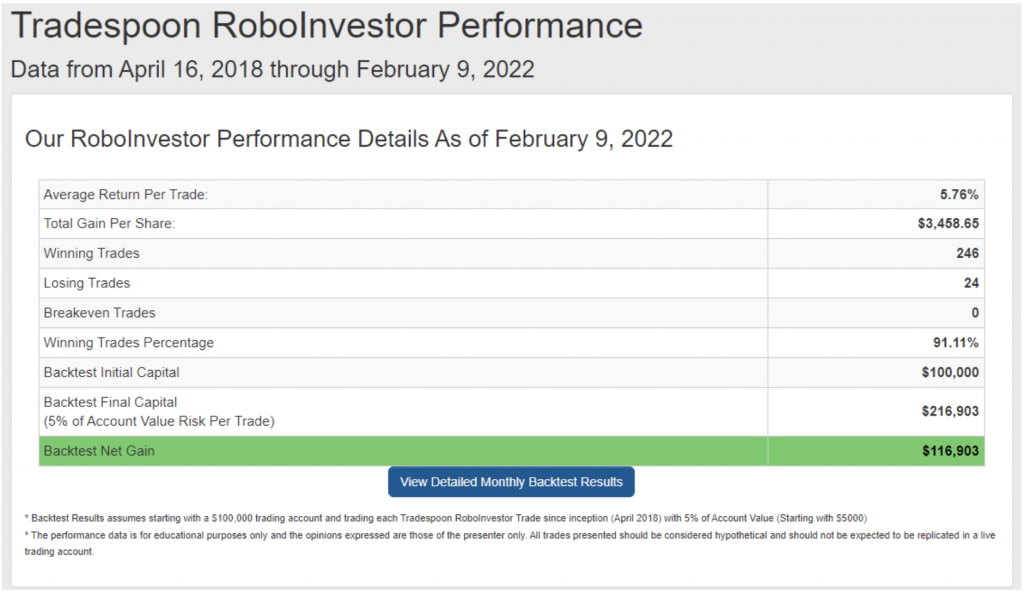

RoboInvestor is a dynamic AI-based portfolio of blue-chip stocks and ETFs that I personally invest in alongside our members. My algorithms sift through thousands of bits of data to formulate investible trades with exceptional risk/reward profiles where the probability of booking profits is better than 90% of the time capital is put to work. From the table below, going back to April 2018, our Winning Trades Percentage is 91.11%.

We achieve this torrid track record from having the flexibility to invest in an unrestricted manner, using blue-chip stocks and ETFs that represent the eleven market sectors, all the various sub-sectors, commodities, precious metals, currencies, interest rates, volatility, and shorting opportunities by way of utilizing inverse ETFs. There isn’t a day or week that goes by that we can’t find trades to consider for potential profits.

Every other week, we email out the RoboInvestor newsletter over the weekend with two new trade recommendations to act on Monday morning when the market opens. Just this week, we closed out four profitable trades we put on recently when the market was exhibiting elevated volatility. When investors were running for the exits in January, our unemotional and agnostic AI platform was telling us to buy Marathon Petroleum Corp. (MPC) and Wells Fargo & Co. (WFC).

In a market where headlines trigger stunning moves and high-frequency trading firms dominate the investing landscape, having the power of AI is an essential set of resources to navigate through the noise, wild price swings, and emotions that can make the business of investing extremely challenging. AI removes many elements of risk where human emotions can result in hasty and bad decisions.

This market has a lot of moving parts working simultaneously for both the bullish and bearish camps. The best approach is don’t take sides, just trade for profits in those stocks and ETFs where the data represents the highest probability of winning. With RoboInvestor, there is always a compelling strategy that hits our screens to take full advantage of.

I look forward to welcoming aboard all readers of this column to join our RoboInvestor community of wealth-building members that are on our collective journey to grow our portfolios in an unemotional and intelligent manner for years to come.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!