RoboStreet – March 10, 2022

Alert! Best ETF To Ride Historic Gold Breakout

In light of the chaos and calamity that has embraced the stock market, there are some monumental breakouts in specific asset classes that offer up phenomenal opportunities to generate some serious portfolio gains. Let’s face it, when the Ukraine situation ends, it will either be a client state of Russia, or a nation with half of its territorial border moved into Russian control.

And then there are Iran’s nuclear ambitions to have lethal weapons that can strike Israel and other nations they wish to threaten. The New York Times reported on March 5 that Russia’s foreign secretary, Sergei V. Lavrov asked the United States for guarantees that Western sanctions imposed on Russia over the conflict did not impede trade between the two countries in future years, raising new issues.“Mr. Lavrov said he wanted a written guarantee that sanctions ‘‘launched by the U.S. will not in any way harm our right to free, fully-fledged trade and economic and investment cooperation and military-technical cooperation with Iran.” Given the sanctions on Russian oil, as well as Israel’s refusal to allow Iran to obtain a nuclear weapons capability, this is unlikely.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Moving on to China, their one-China policy to retake Taiwan was reiterated this past week, saying the island nation is “not Ukraine” and has always been an “inalienable part of China, China’s foreign ministry said on Feb. 23 (Reuters.com) This comes at a time when China is building up its military presence off the coast of Taiwan.

Adding to the elevated level of volatility, the Wall Street Journal reported on March 8 that “The Saudis have signaled that their relationship with Washington has deteriorated under the Biden administration, and they want more support for their intervention in Yemen’s civil war, help with their own civilian nuclear program as Iran’s moves ahead, and legal immunity for Prince Mohammed in the U.S.,” who currently faces multiple lawsuits, one of which goes back to the 2018 killing of journalist Jamal Khashoggi.

Lastly, the rate of annual inflation is still rising with the Fed so far behind the curve that a quarter-point hike later this month is likely to have almost no real effect in real terms for consumers and businesses coping with soaring prices for just about everything. If the Fed can’t do more to contain inflation, then the economy faces stagflation – high prices and no wage growth. Russia is in a depression, Europe is entering a recession and the U.S. is thankfully sustaining a strong enough growth rate to power through current inflation, but for how long? We live in interesting and volatile times.

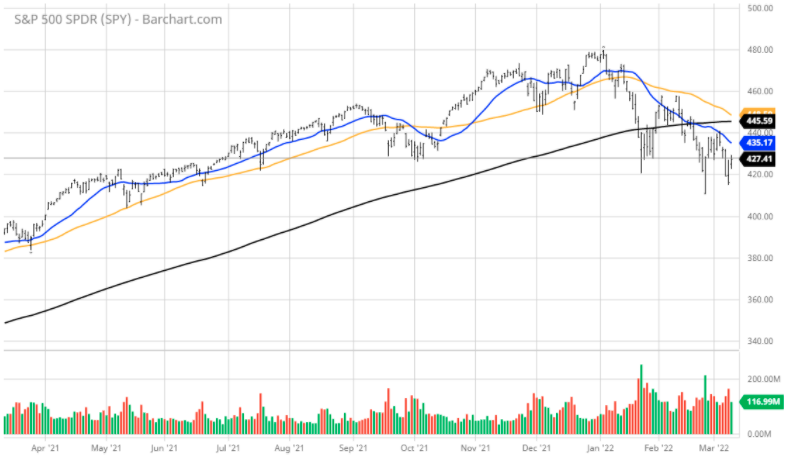

The $SPY staged an impressive rebound on Wednesday, and closed at $427, at the January lows. The $SPY was up 2.8%. The value/reflationary ($VTV) closed higher 1.5%, at $143, the midpoint between the 200 DMA and the 50 DMA. The technology sector ($QQQ) traded higher 3.5%, at $334, and closed below the 50% retracement from the recent low to high.

The $DXY closed lower, near the $98, at the June 2020 high. The $TLT closed lower 1.0% and near the recent lows. The ten-year yield closed higher near 1.95%. The $VIX traded higher near the 32 level.

The $SPY short-term support level is at $410 (key long-term support) followed by $390. The SPY overhead resistance is at $445 and then $460.

Due to the escalation of the geopolitical risks in Ukraine, one has to assume that the $SPY January lows will be re-tested again and most likely continue the downward momentum in the next couple of weeks.

I would be a seller of the high beta stocks into the rallies and have a market NEUTRAL portfolio at this time.

The earnings season continues with (ORCL, JD, and CRWD) scheduled to announce their earnings this week.

I would consider rebalancing portfolio at this time and have an overall market NEUTRAL portfolio. I do not expect the $SPY to post a new all-time high in the first half of this year. There is a high probability that the $SPY main long-term support at the $420 level will not hold. All eyes are on the geopolitical risk in Ukraine.

If you are trading options consider selling premium with May and June expiration dates.

Based on our models, the market (SPY) will trade in the range between $400 and $470 for the next 2-4 weeks.

With so much not working, investors can turn to the oldest asset class that has stood the test of time, outlasting the Roman and British empires, the collapse of major currencies, the long history of warring nations, and the rise and fall of financial systems over time. Gold in its various physical forms and in tradable securities that are tied to gold prices are once again proving to be a formidable hedge against geopolitical chaos, soaring sovereign debt, devaluation of fiat currencies, and overall fear of the unknown regarding financial assets.

This past week, gold traded up to $1,966/oz, moving toward its all-time high of $2,072.50 seen in August 2020. At this point, with the geopolitical world the way it is, a new high in gold prices is, in my opinion, only a matter of time. Shares of the Gold SPDR ETF (GLD) broke above technical resistance at $178 and soared to $193.30 before some short-term profit-taking set in.

In our RoboInvestor advisory service, we apply my decade’s long work in our AI-driven platform to guide us in trading all asset classes that have the profit potential of what we are now witnessing in gold. For our subscribers, I tend to gravitate towards trading the VanEck Gold Miners ETF (GDX) which historically provides higher returns versus physical gold when it rallies.

Our AI tools provide the signals we trade-off of to enter and exit positions in a timely manner that have proven to be most valuable in highly uncertain markets such as the present. The Seasonal Chart is flashing a very bullish “Higher” probability reading for GDX over the next 20, 30, 40, and 50-day periods going forward. This is a green flag to buy each dip the shares offer in the days and weeks ahead following this powerful upside breakout for the yellow metal.

RoboInvestor will invest in blue-chip stocks and ETFs of major market indexes, market sectors, sub-sectors, commodities, precious metals, currencies, interest rates, volatility, and shorting opportunities via inverse ETFs. It’s an unrestricted platform that identifies high reward/lower risk investment strategies that we put to work in the RoboInvestor portfolio that holds between 15 and 25 positions most of the time.

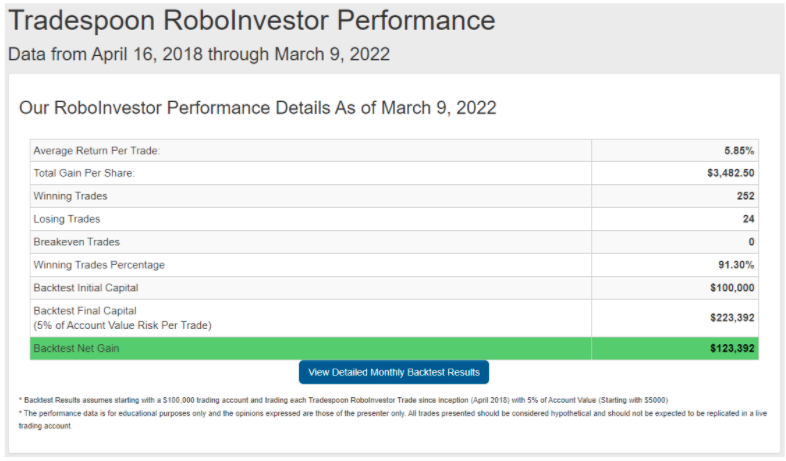

Our performance has served our members quite well, with a Winning Trades Percentage of 91.30% going back to April 2018. By most investment advisory newsletter standards, this is an incredible return on capital and is why my work of over a decade of fine-tuning an always learning AI platform can put up this kind of consistent return.

While most stocks within the S&P and Nasdaq have been sold down hard during the past two months, RoboInvestor subscribers have pocketed 10 straight profitable trades without a loss. This comes at a time when consistent gains are a real challenge.

Take me up on my offer to join our community of RoboInvestor members and let the power of AI help guide your portfolio to steady growth and long-term wealth creation. I am fully committed to this journey to the point where I invest my personal capital into every trade I recommend.

You will receive a newsletter in your inbox every two weeks, delivered over the weekend with two new trades to take action on come Monday morning. There is always a bull market somewhere or a timely shorting opportunity, and RoboInvestor is dedicated to finding those high-probability opportunities to profit from. Within the newsletter, I give my market overview, a technical outlook for the investing landscape, comment on our current holdings and provide two new recommendations in a concise format that will have you ready to execute those strategies with conviction.

Make RoboInvestor your best trade of 2022 and afford me the opportunity to welcome you aboard. Making money just doesn’t have to be that hard with a cutting-edge AI platform working 24/7 to your benefit.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!