RoboStreet – February 24, 2022

Market Suffers Geopolitical Setback

Russian military forces have invaded Ukraine on several fronts in what is now a larger plan to overthrow the current democratically-elected, pro-western government and replace it with a ruling government subject to Russian oversight. Vladimir Putin’s strategy to reunite former Soviet bloc nations is playing out to the chagrin of many prominent Russian citizens that do not support these actions.

It’s not that Ukraine’s independence isn’t incredibly important, but the selling pressure in the market is more highly correlated to the rising concerns about inflation and major interruptions of key commodities (oil, wheat, etc.) and the higher prices they will command. WTI crude traded above $100/bbl before backing off to the $96-$97 range. It is a dire situation for the Ukrainian citizens and my heart and prayers go out to them.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

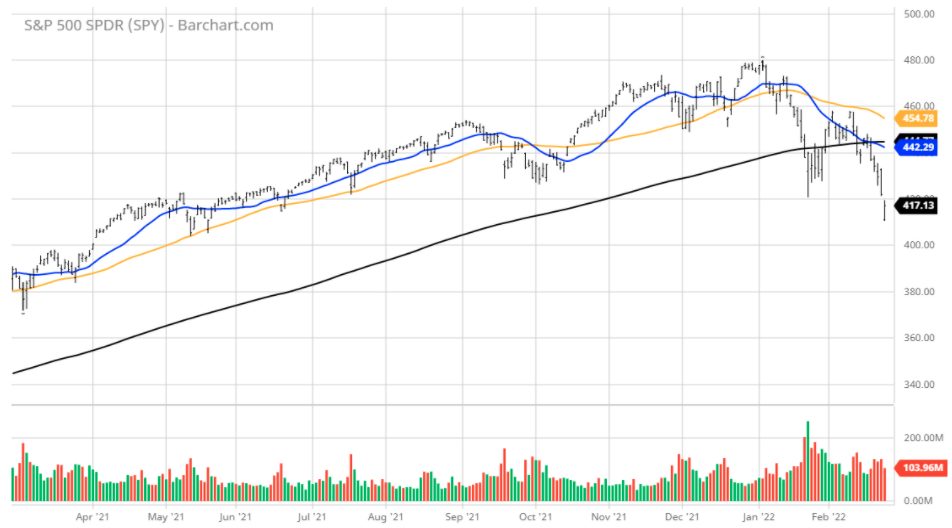

Taking out the January lows, the $SPY continued pulling back. The value/reflationary ($VTV) closed lower, down 1.3%, near the 200 DMA. The technology sector ($QQQ) closed down 2.5%, at $329, and broke through the January low.

The $DXY closed higher, at $96, below the 50 DMA while the $TLT was down 1.4% and closed near the April 2021 low. The ten-year yield closed near 1.92%. The $VIX traded higher near the 35 levels.

Short-term support level for the $SPY is at $420 (key long-term support) followed by $400. The SPY overhead resistance is at $460.

Due to the escalation of Geopolitical risks in Ukraine, one has to assume that the $SPY January lows will be broken and most likely continue the downward momentum until the uncertainty is resolved. $AAPL, $XHB, $XLY, and $ARKK started to break below major support levels and can further pressure the $SPY to the downside.

I would be a seller of the high-beta stocks into the rallies and have market BEARISH portfolio at this time.

I would consider rebalancing portfolio at this time, and have an overall market BEARISH portfolio. I do not expect the $SPY to post a new all-time high in the first half of this year. There is a high probability that the $SPY main long-term support at the $420 level will not hold. All eyes are on the geopolitical risk in Ukraine.

If you are trading options consider selling premium with April and May expiration dates.

Based on our models, the market (SPY) will trade in the range between $400 and $470 for the next 2-4 weeks.

In the near term, there will be a penchant to sell the rallies and raise cash until some of the geopolitical tension begins to lift. When that might occur is speculation now that Putin is clearly making a much bigger advance on Ukraine than thought. Hence, the crisis in Ukraine will be more lasting if and when the Russian military occupies Kyiv and other populated cities, which in turn will invite a series of sanctions on Russia.

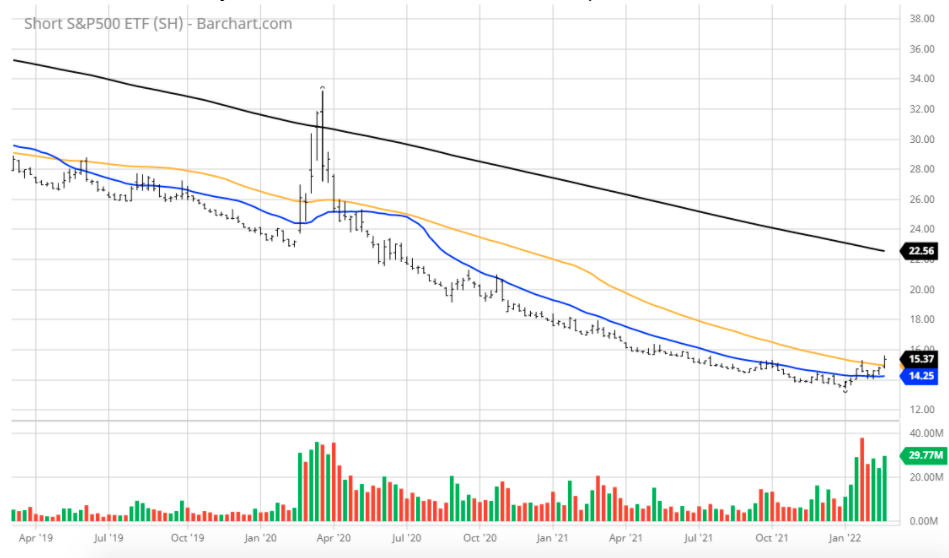

Under this premise, investors should consider hedging portfolios with an inverse ETF on the S&P with the ProShares Short S&P ETF (SH). This is not a leveraged ETF, but rather a (-1x) ETF that is suitable for almost every kind of investment account. Many brokerage firms do not permit the ownership of leveraged ETFs, so for this reason, I want to provide a hedge that accommodates our universe of subscribers.

SH is a highly liquid ETF, with about $1.24 billion in assets, and the bid/ask spread is very tight, usually no more than 3 cents. So, in a fast market, this security trades like water, where the spread widens out like the majority of ETFs witness in volatile markets. I would be layering on SH on rallies depending on one’s market exposure and composition of portfolios. The higher the beta of holdings, the greater amount of SH should be considered for purchase.

When emotions are running high, having a powerful AI platform to guide your decisions is, in my view, paramount. The proprietary AI tools that I apply to our RoboInvestor advisory service are indispensable for stock and ETF selection. Our AI models are always thinking and crunching data 24/7-365, making for a highly dynamic set of data points that are crucial to my work in fast markets such as the present.

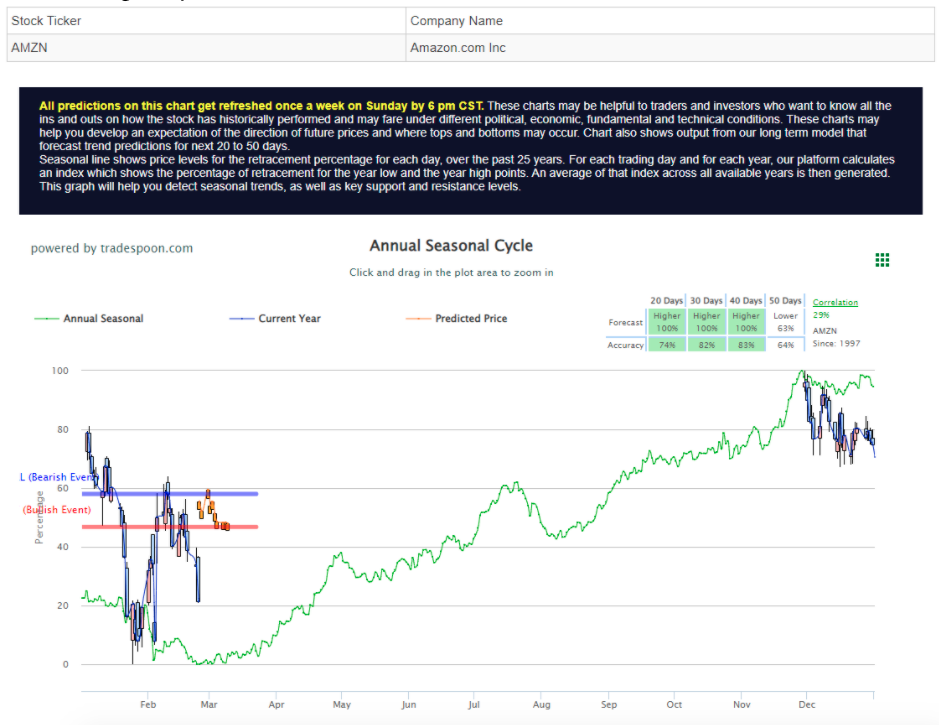

Even during a big selloff such as what the market is currently enduring, our AI platform will guide us as to whether to maintain or exit certain positions. In the case of Amazon.com (AMZN) that we are currently long, our AI-driven Seasonal Chart is signaling “Higher” probability readings for the next 20, 30, and 40-day periods.

This set of readings indicates the market for AMZN is due for an oversold rally in the near-to-intermediate term to where we can either exit the position again or put on a market hedge to pare our downside risk.

Our AI tools guided our RoboInvestor members to book profits during the first half of February and raise cash that is going to be precious powder when we start buying again once our indicators flash a buy signal for us.

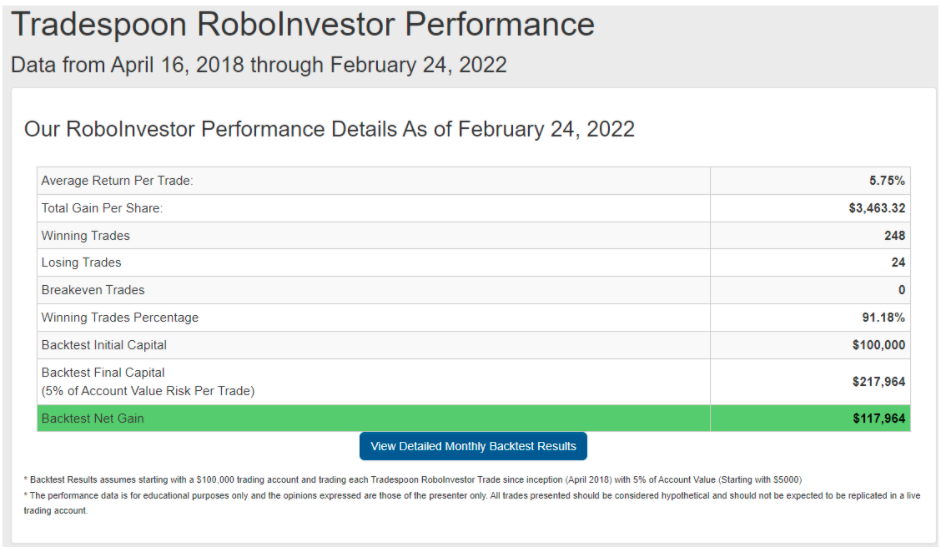

Our performance speaks for itself. Going back to April 2018 when we launched RoboInvestor, we’ve put together a fantastic track record where the Winning Trades Percentage is an amazing 91.18%. To my knowledge, I don’t think there is another advisory service available to the retail investor that can match this return.

RoboInvestor lends itself to finding opportunities wherever they exist in the entire marketplace. Our AI models will identify trades with high probability for profits in blue-chip stocks and ETFs in major indexes, all 11 market sectors, sub-sectors, commodities, precious metals, currencies, interest rates, volatility and shorting opportunities via inverse ETFs such as the SH trade discussed within.

After the market has taken investors through the wash, rinse and spin cycle these past few weeks, I can express how meaningful it has been to have the power of AI working for our RoboInvestor portfolio and our members. We are all aware that stocks take the escalator up and the elevator down. Protecting profits and growing principle consistently is how we get it done at RoboInvestor. Come join our community of AI investors and let’s have a prosperous 2022 together!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!