RoboStreet – July 7, 2022

All Eyes on Employment Data Following FOMC Minutes

Ahead of today’s labor reports, U.S. markets traded exceptionally higher throughout the week, posting four consecutive sessions of gains in the wake of receiving fresh inflation and corporate earnings data. Markets responded favorably to a number of new economic readings as well as expectations for upcoming earnings reports and Federal Reserve decisions. Still, the potential for an elongated bear market lingers on the upcoming earnings season as well as the central bank’s response.

On Wednesday, the Federal Open Market Committee released last month’s meeting’s minutes which showed a Fed that was ready to issue another large interest rate hike in the coming meetings in an effort to combat inflation while also supporting markets. A 75 basis point rate hike could be seen again in this month’s FOMC while a 50-point hike could be featured in September. Thursday’s weekly jobs review showed a slight uptick in unemployment, however, the market focus remains on Friday’s marquee June labor reports: unemployment rate, average hourly earnings, and labor force.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside the next 3 months, so my weekly updates are timely enough for you to act.

Next week, Q2 corporate earnings season is set to begin with several key releases, including major banks and airlines, which will guide market direction in the coming weeks.

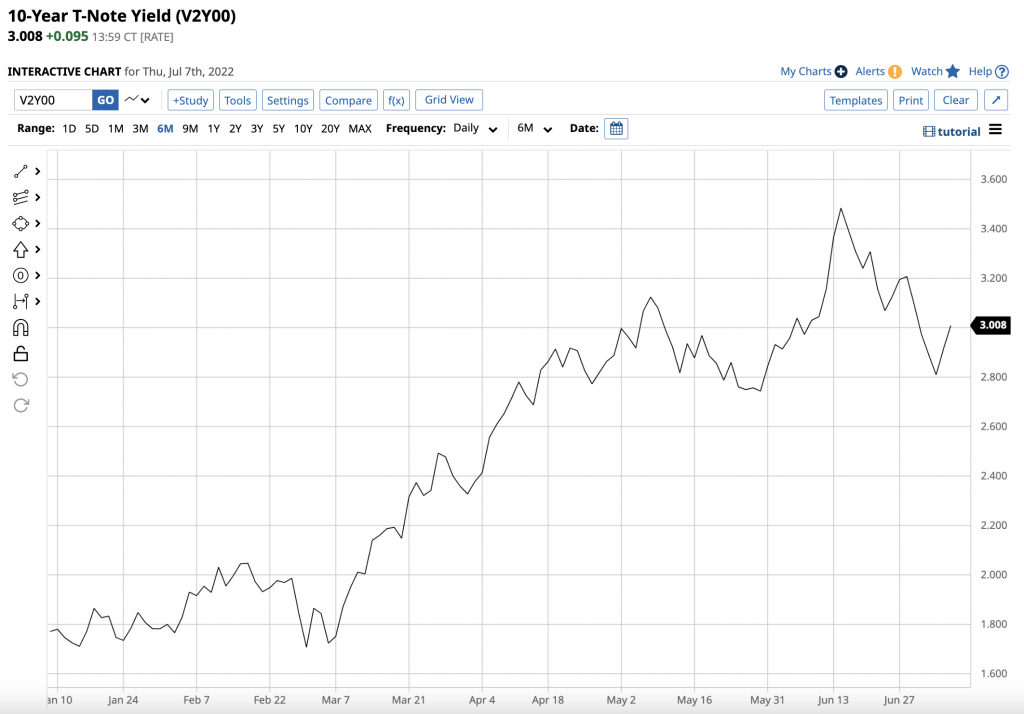

The volatility index, $VIX, continues to trade near the $30 level and is a point of interest along with long-term treasury notes. The 10-year note and 30-year note rose marginally, at 3.008% and 3.201% respectively. With the 2-year note, the 10-year note, and the 30-year note, all rising this week, yields inverted as the 2-year yield rose above the 10-year yield.

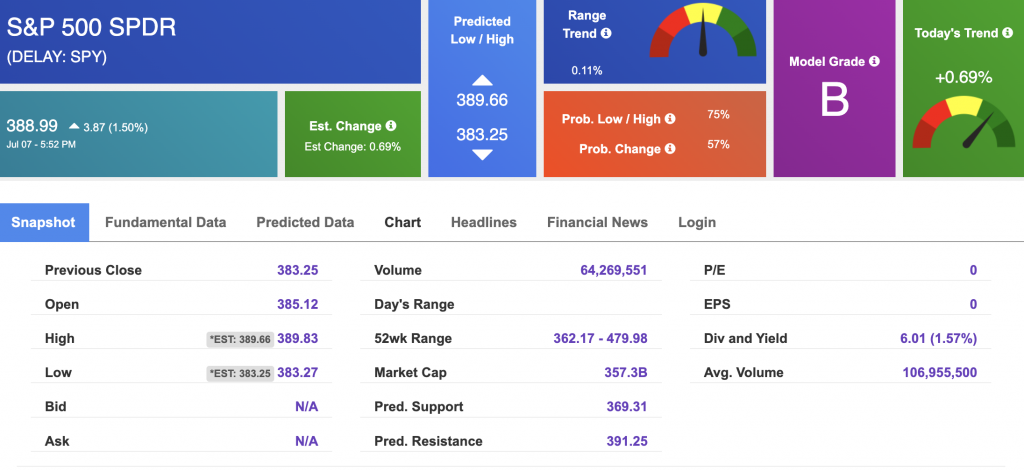

As of Thursday, the $SPY was trading 3% higher, near $389, above the key long-term support – $380. The technology sector ($QQQ) also closed higher, up 5% over the last five trading sessions, at $295, impressively above its 50 DMA.

Looking at the data, I would be a seller into the rally and have a NEUTRAL portfolio at this time. Short term the market is oversold and undergoing the bottoming process.

If you are trading options consider selling premium with November and December expiration dates.

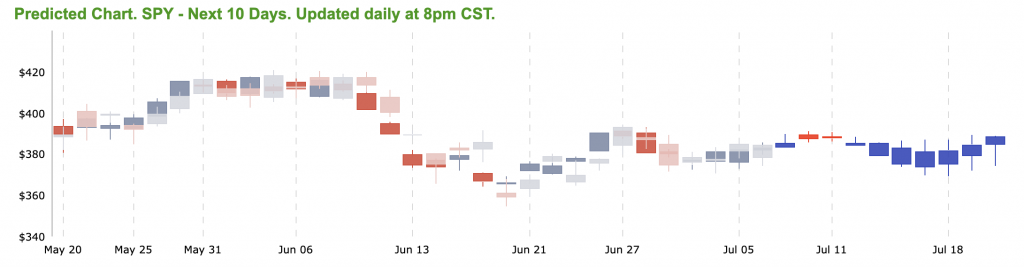

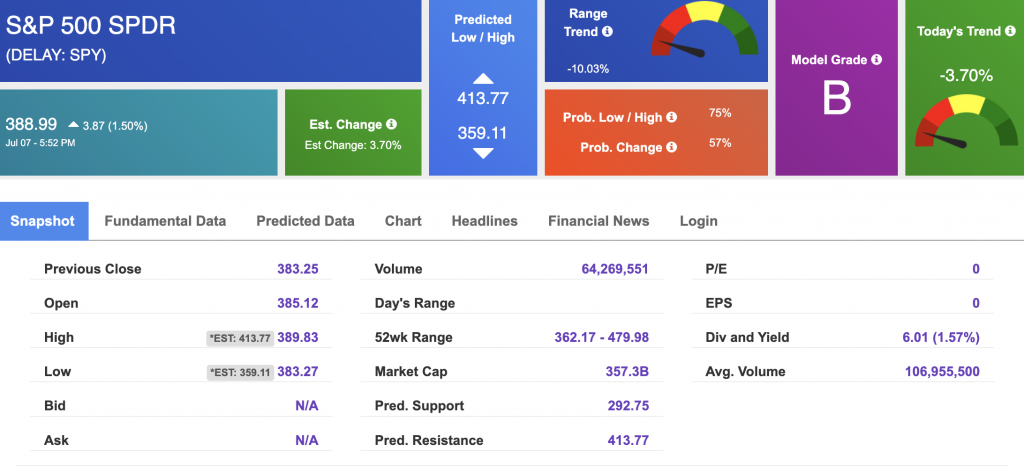

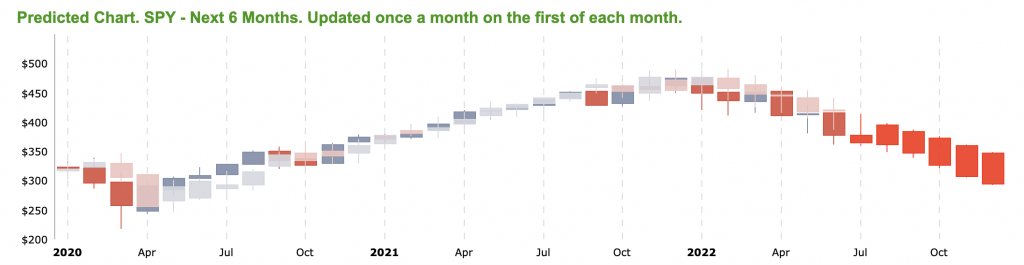

As seen above, our Stock Forecast Toolbox is predicting an upward trend in the next few sessions, with a range of $389 to $383. Similarly, the 6-month forecast, seen below, captures a trend that is moving higher in the near term while trending down thereafter. The 6-month support and resistance levels are a bit more spread out but forecast some higher highs with lower lows.

I am keeping an eye on big-name earnings, such as $JPM, $DAL, and $PEP next week, as well as the June unemployment data, released today. SPY overhead resistance is currently at $396 and $409, and I am monitoring support levels at $380 and $362. With this in mind, I expect the market to continue the short-term rally for the next couple of weeks.

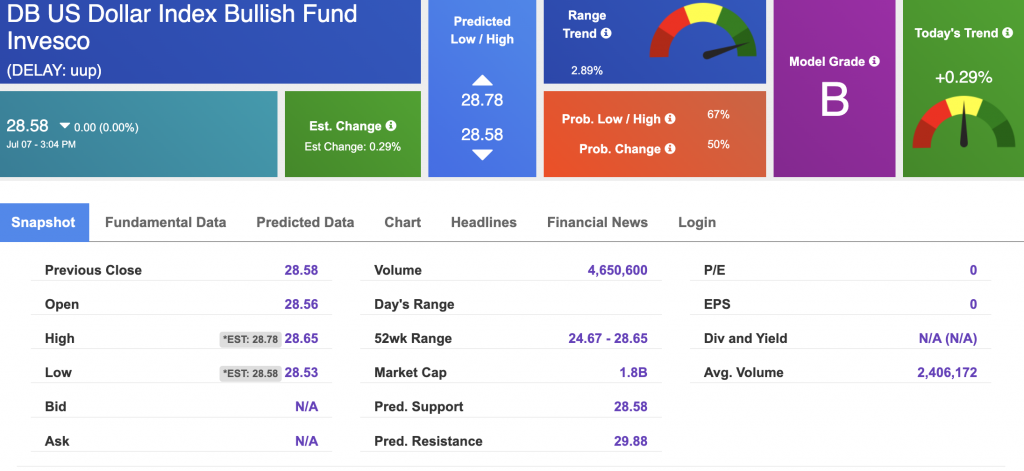

Likewise, the $DXY traded higher, near the $107 level this week. The $TLT saw a choppy week, trading near the $114 level, and could be facing the key long-term resistance. However, something like UUP, a bullish Dollar fund, is something to keep in mind. Along with $TLT, these symbols have recently caught my attention and could be considered long-term plays.

The narrative for a slower growth economy continues to build momentum, with the FOMC declaring a similar sentiment, and I expect interest rates to top out with a rotation back into big-cap growth sectors. Beyond tech, which has shown recent strength, I am keeping an eye on $TLT and looking to go long on the Dollar. In the current short-term, I believe the market is overbought but is heading higher long-term.

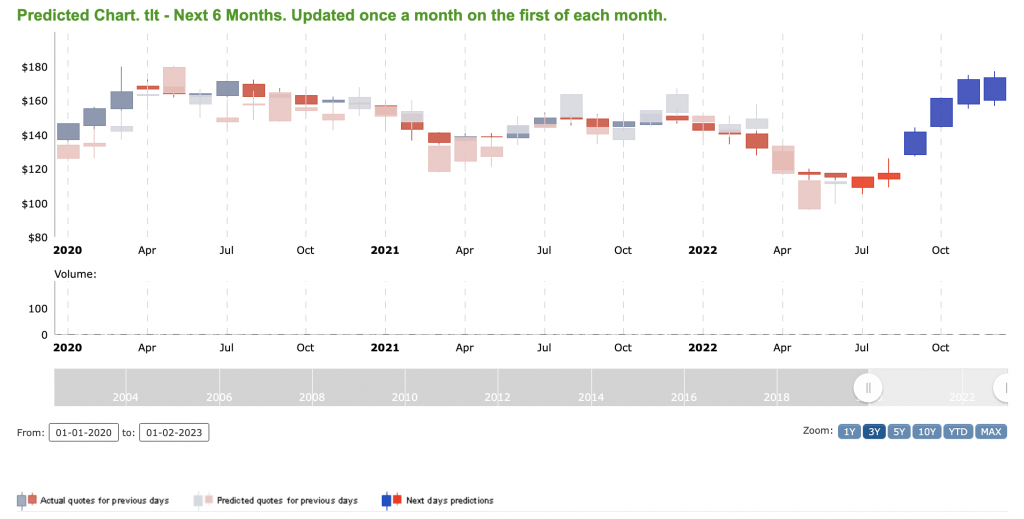

$TLT could also be another long play as going long-term dollar and $TLT go hand in hand. Our Seasonal Chart tool, best used for long-term trend identification, shows a wide gap from the current year, marked in the blue line above, as compared to the annual seasonal data, marked in the green line.

When we apply our AI-powered Stock Forecast Toolbox to TLT, we get very bullish reading looking at the next few months.

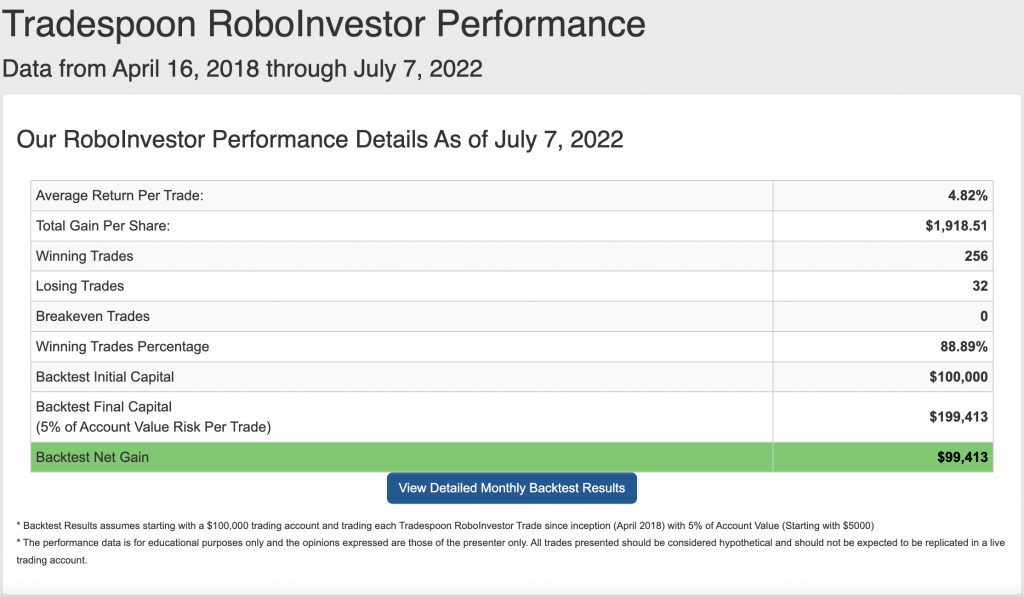

This is what the power of AI does for us and for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior. We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

To my knowledge, our track record of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.89% going back to April 2018.

The market is shaping up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020. Inflation, upcoming Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!