RoboStreet – March 31, 2022

It’s A Good Time To Hedge Portfolios

When it was thought that Russia was considering negotiations and a possible draw down in troops and attacks, it now appears that the Kremlin was simply buying time to rotate some military forces, reload and resupply their lines before re-engaging in more attacks on key Ukrainian cities. So, not much has changed on this front this week.

Looking at the market, the bulls have had their way for the better part of two weeks with month-end window dressing being good to growth stocks as well as value. This comes in light of the inversion of the yield curve in the bond market that is typically not a good sign for the equity market, as it tends to be a caution flag about a pending recession six to nine months out.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Companies that are reporting solid earnings are not seeing their shares respond very bullishly, another indicator that this sharp rally off the lows is running out of steam, at least in the short-term. With the earnings season coming into view in two weeks, it stands to reason that most multinational companies will be addressing inflation, the strong dollar and higher borrowing costs. It will be most interesting to see forward guidance and the risk it poses to the market if companies are overly cautious.

Commodity prices remain elevated due to ongoing supply chain constraints, Russian sanctions and strong demand from end markets. It’s been the same narrative for many months and has been exacerbated by the war in Ukraine. The ripple effect is very real and is probably going to continue to be a drag on investor sentiment going forward.

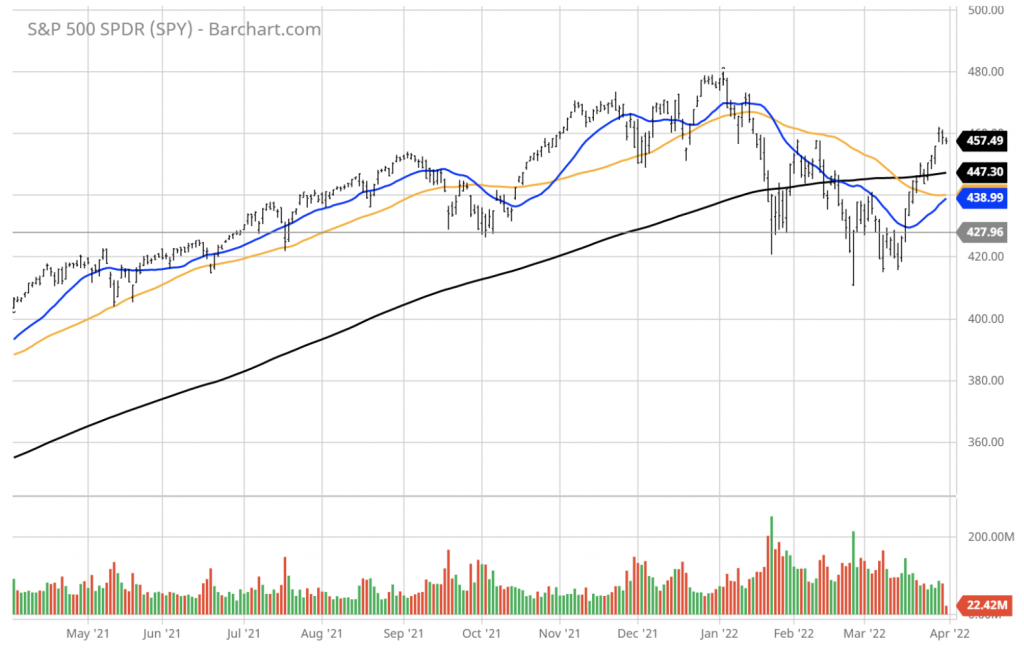

As of Wednesday, the $SPY closed lower 0.6%, at $468, above the 50 DMA and the 200 DMA. The value/reflationary ($VTV) closed lower 0.2%, at $150, at the February highs. The technology sector ($QQQ) closed lower 1.1%, at $367, above the 50 DMA and the 200 DMA.

The $DXY closed lower, near the $97.8, at the June 2020 high. The $TLT closed higher 0.8%, at $131, and below the 2020 lows. The ten-year yield closed lower at 2.33%. The $VIX closed higher near the 19 level, below the historical average.

The $SPY short-term support level is at $452 followed by $440. The SPY overhead resistance is at $465 and then $470.

Assuming the geopolitical risks in Ukraine have reached status quo, it is reasonable to assume that the $SPY February low is set and the pattern of higher highs and higher lows will continue in the next two to six weeks. Market has reached extreme overbought levels and is due for a 2-5% pull back in the next 10 days.

I would be a buyer of the low beta stocks into the pullbacks and have a market BULLISH portfolio at this time.

I do not expect the $SPY to post new all-time highs in the first half of this year. There is a high probability that the $SPY main long-term support at $415 is now set but might be retested in the next few months.

If you are trading options consider selling premium with May and June expiration dates.

Based on our models, the market (SPY) will trade in the range between $415 and $470 for the next 2-4 weeks.

Against this backdrop of still higher inflation, geopolitical tensions, an overbought equity market, a bond market in decline with yields moving higher and the Fed about to add risk to the market if they turn more hawkish at the next FOMC meeting, it argues well for investors to consider putting into place some selective portfolio hedges.

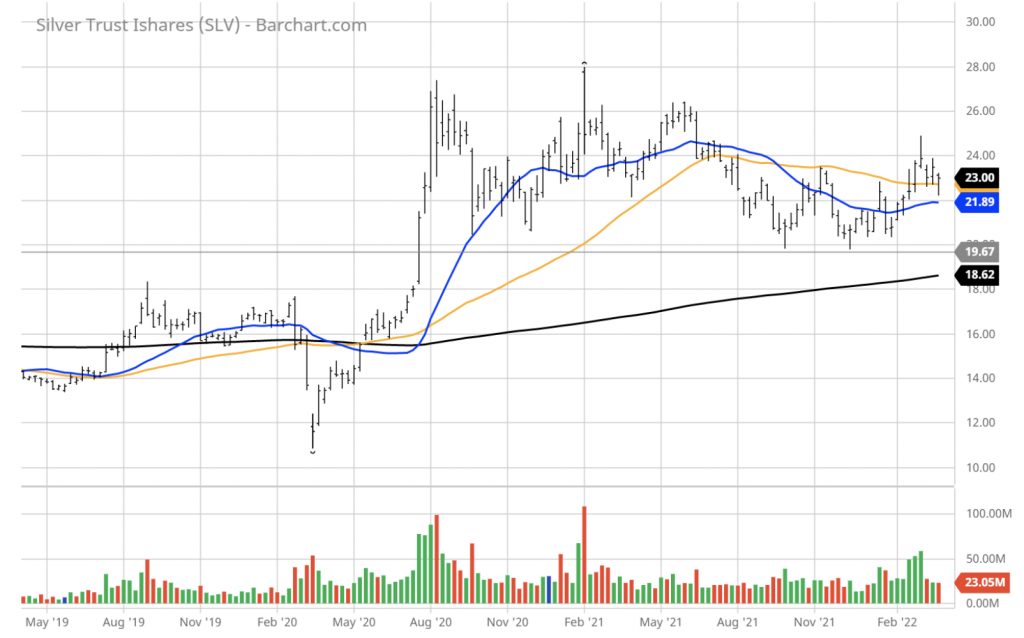

One hedge that has a good history of responding well to the noted risks above is physical silver and silver mining stocks. While gold tends to get most of the attention in the world of precious metals, silver has widespread industrial application and is also an excellent storehouse of wealth.

Physical silver prices have been trading in a fairly tight trading range after a substantial upside breakout back in August 2020. Since that time, shares of the iShares Silver Trust ETF (SLV) have been consolidating in a four-point channel, and now appear to be setting up for a new move higher with interest rates increasing and global fiat currencies under pressure.

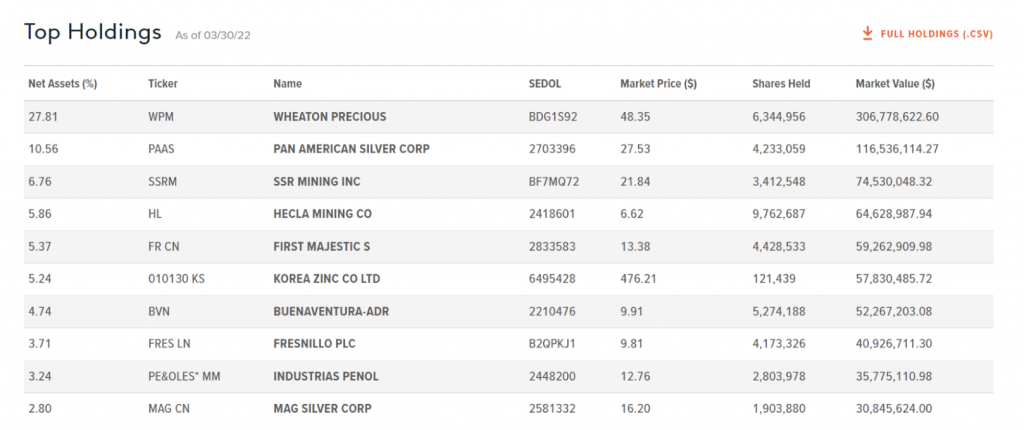

Historically, investors can get more total return by owning the stocks of mining companies that are engaged in the exploration, production and sale of silver to the marketplace. The Global X Silver Miners ETF (SIL) is one such instrument to own and trade. With total assets of $1.1 billion and 41 current holdings, SIL is an excellent way to cast a net over the silver mining sector and own a liquid hedge with good liquidity.

The top ten holdings account for just over 75% of total assets.

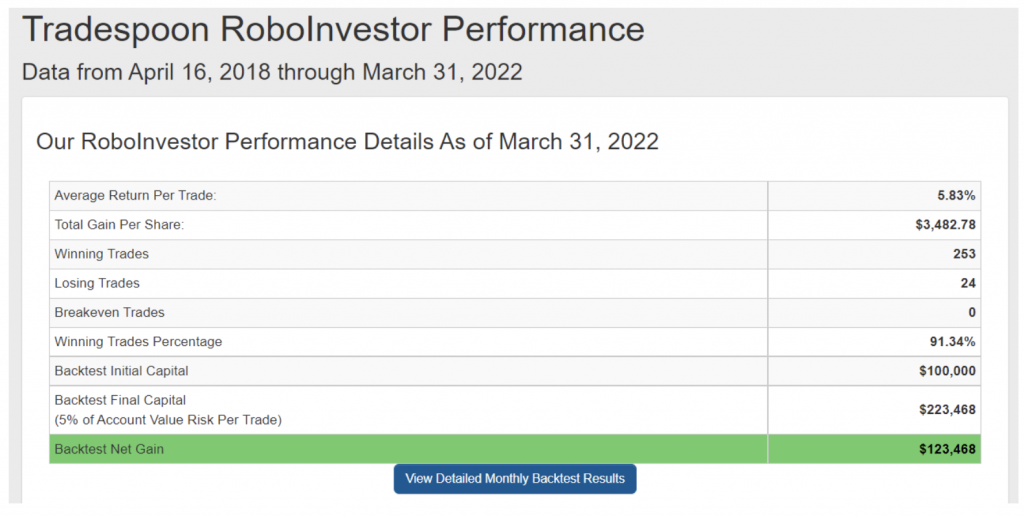

For our RoboInvestor advisory service, this is the kind of asset our AI-driven platform will identify for us to put to work as an offset to our long market exposure in equities. When our indicators tell us the market is too frothy on a short-term basis, we deploy ETFs that target capital preservation when volatility is on the rise or about to spike.

RoboInvestor is an unrestricted advisory service that holds a portfolio of between 15-25 positions. They can be blue-chip stocks or ETFs in market indexes, sectors, sub-sectors, commodities, precious metals, interest rates, currencies, volatility and shorting opportunities using inverse ETFs.

I’ve spent over a decade fine-tuning the algorithms that drive our AI platform and it continues to always be learning, always delivering a steady stream of winning trades. In fact, our Winning Trades Percentage for RoboInvestor is 91.34%.

To my knowledge, investors will find it difficult to locate another advisory service with a track record that rivals our performance. Members of RoboInvestor receive an online newsletter every other week that is delivered over the weekend with two new recommendations to act on come Monday morning when the market opens. I review the market landscape, go over our current portfolio of holdings and detail our two new picks.

Join me and our RoboInvestor community and make a decision to put the power of AI to work in your portfolio today. The market is more challenging and uncertain than at any time in recent months and having the right set of tools is how to sustain a winning wealth-building formula. I look forward to welcoming you aboard and let’s grow our nest eggs in 2022 with confidence!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!