RoboStreet – April 7, 2022

Bond Market Has Priced In Rate Hikes

The past two weeks have been dramatic in terms of movement in bond yields. The 10-yr Treasury has seen its yield spike from 1.73% to 2.65% as the Fed has telegraphed a more aggressive fiscal policy to bring inflation down. What the Fed has said they are going to do; the bond market has now adjusted in anticipation of two or more rate hikes over the next three months.

Growth stocks and consumer discretionary stocks, in particular, have endured heavy selling pressure as capital flows are rotating into consumer staples, utilities, healthcare, and fertilizer stocks. The market has gotten more narrow, experiencing a rolling correction that is likely coming to completion in the next week.

It helps to see big investors taking large stakes in companies, as it sends a clear message there is a big interest in certain stocks. Elon Musk took a 9.2% stake in Twitter Inc. (TWTR) and Warren Buffet’s Berkshire Hathaway Inc. (BRK-A) bought an 11% stake in HP Inc. (HPQ). These are timely and much-needed votes of confidence.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

As first-quarter earnings season comes into view with the big banks reporting next week, the market has likely discounted a lot of headline risk. Recent history has the market bidding up stocks in front of earnings season – akin to buying the rumor.

This time around, it’s as if the market is selling the rumor (weak earnings and lower guidance) that will be followed by buying the news (stated earnings and whatever guidance). I wouldn’t be surprised if the market just trades sideways for a while.

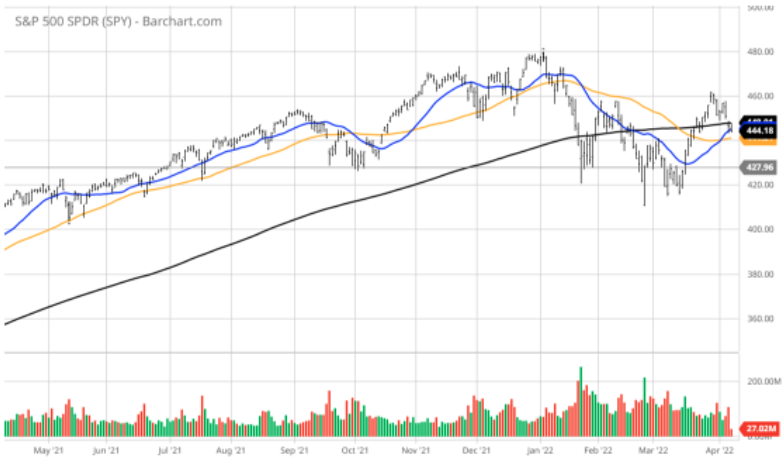

The $SPY closed lower 1.0%, at $446, below the key short-term support. The value/reflationary ($VTV) closed higher 0.3%, at $147, below the February highs. The technology sector ($QQQ) closed lower 2.2%, at $353, between the 50 DMA and the 200 DMA.

The $DXY closed higher, near the $99.5 level, at the June 2020 high. The $TLT closed lower 0.8%, at $1287, and below the 2020 lows. The ten-year yield closed flat at 2.6%. The $VIX closed higher near the 22 levels, right above the historical average.

The $SPY short-term support level is at $440 followed by $425. The SPY overhead resistance is at $451 and then $465.

Assuming the geopolitical risks in Ukraine have reached a status quo, it is reasonable to assume that the $SPY February low is set and the pattern of higher highs and higher lows will continue in the next two to six weeks. The market has reached extreme oversold levels and is due for a 2 rebound in the next few sessions.

I would be a buyer of the low beta stocks into the pullbacks and have market BULLISH portfolio at this time.

I do not expect the $SPY to post new all-time highs in the first half of this year. There is a high probability that the $SPY long-term support at $415 is now set but might be retested in the next few months.

Our proprietary AI-driven platform that guides our selection process in our RoboInvestor investment advisory service is crucial in determining when to put capital to work and when to take it off. Our current signals are indicating an extreme oversold condition for the bond market as well as for the technology sector.

In both cases, a bullish setup is in the making over the next few days, and investors want to follow our lead when our system greenlights a bullish pivot where we issue actionable advice to our members. RoboInvestor is a dynamic portfolio of between 15-25 holdings depending on market conditions. We are more concentrated during times of higher volatility, such as the present.

Our AI-driven Seasonal Chart is showing a “Higher” probability reading for the next 20 days, confirming our take on the bond market that a short-term oversold rally is about to occur. Typically, when bonds rally after such a fearful sell-off, stocks rally in tandem.

Turning to the tech-heavy Nasdaq 100, the Invesco QQQ Trust (QQQ) has retraced nearly half of its recent gains of the past two weeks and is primed for a bullish move higher as earnings season materializes. Our AI-based Forecast Toolbox has a Model Grade “A” rating for QQQ and a short-term Predicted Resistance price target of about $359 and nicely above where the Q’s trade at $350.

Within RoboInvestor, we purchase blue-chip stocks and the most widely held and traded ETFs in market indexes, sectors, sub-sectors, commodities, precious metals, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. The service is unrestricted, thereby keeping open those opportunities with the highest risk/reward probability for profits based on our AI algorithms.

Our track record is stellar, where our 91.34% Winning Percentage Trades figure is as good as I’ve seen in the industry. It’s a record I’m very proud of from years of hard work.

Take a hard look at your current system for investing. If it lacks tools to eliminate risk and measure probability, then this investment landscape will likely be very difficult to navigate. Having the power of AI at work for your portfolio is in my view – essential – and RoboInvestor is a time-tested proven system for generating wealth-building profits.

I personally put my own capital into every recommendation. We publish an online newsletter every two weeks that hits your inbox over the weekend. In each issue, I review the market landscape, address our current portfolio holdings and provide two new trades to act on when the market opens on Monday.

There are always profitable opportunities, and our data crunching, always learning AI platform is a big part of the decision-making process for RoboInvestor. Make the best trade of 2022 and join our community of members as sojourners in our quest to grow our wealth in a consistent and successful manner.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!