On Thursday, stocks rose following the release of the latest Consumer Price Index report that showed signs of slowing inflation and raised expectations for change in course from the Federal Reserve. All three major U.S. indices booked consecutive gains this week as the last CPI data provided the potential for the Fed to cease rate hikes for the time being. Q4 earnings season officially kicks off on Friday with major banks releasing data while next week, during the shortened trade week, we will see the latest Beige Book.

According to the consumer-price index, prices soared 6.5% in December compared with a year prior. The core CPI, excluding food and energy costs, recorded an increase of 5.7%, which was lower than before at 6%. This is aligned with expectations that inflation should be cooling and less than November’s result of 7.1%. This marks the sixth straight month inflation has lowered and is partially in line with the Fed’s goal of reaching 2% target inflation.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Furthermore, the bond market is now implying that the Federal Reserve’s rate-hiking phase could be coming to an end soon. The two-year Treasury yield had reached 4.2%, but after the results were released it plummeted to 4.120%. Similarly, 10-year yields dropped from 3.55% down to a mere 3.425%. These figures are an indication of market expectations about future federal funds rates and demonstrate how drastically investors reacted when faced with new economic information.

This Friday marks the official start of the fourth-quarter reporting season, and five major financial institutions—JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Wells Fargo (WFC), and BlackRock (BLK)—will be leading the way with their Q4 reports. As we enter the second half of January, I’ve spotted a sector I am looking to get involved. Keeping in my mind the current oversold nature of the market, I expect more volatility to come and this latest earnings season could be its catalyst.

Halfway through this past week, rates retreated following upbeat CPI numbers from Europe and the dollar remained stable. 10-year yields are remaining close to long-term support of 3.5%, despite drab services PMI information. Which quickly reverted following CPI data released on Thursday.

My opinion is that the bear market will remain in place during 2023. The U.S. dollar has been excessively sold off and should gain back lost ground between January and February of this year.

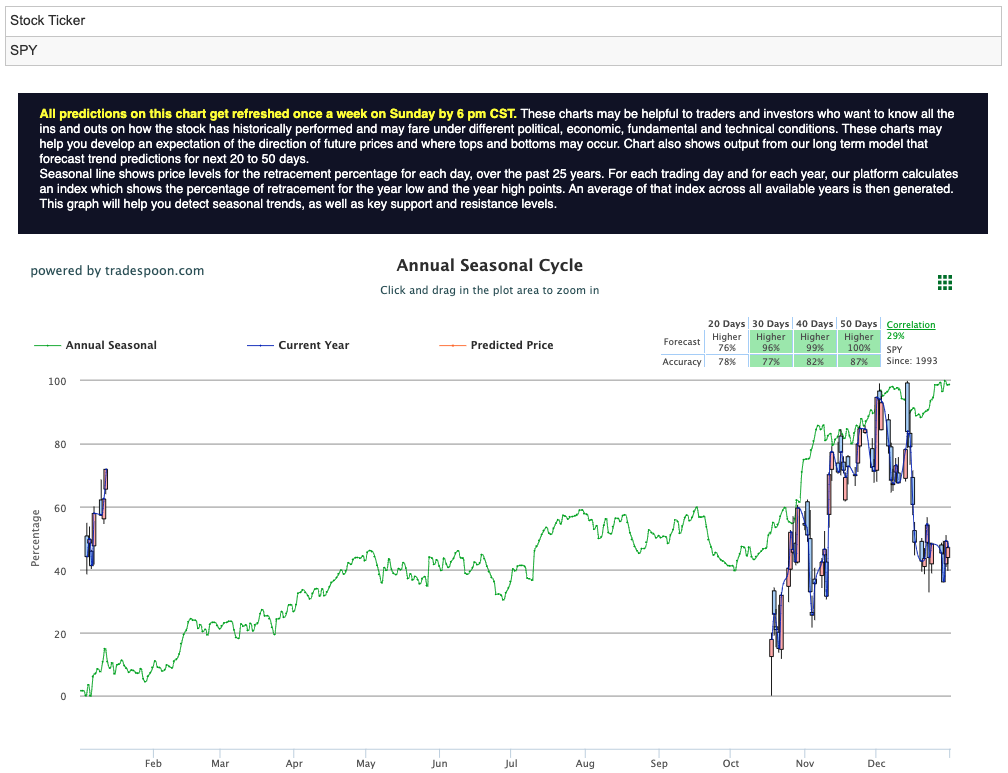

As demand continues to dwindle, oil and gas prices have plummeted toward $65 a barrel for West Texas Intermediate. Further, by looking at similar CPI data from Europe, we’ve seen an extended rally in the market. But I anticipate that growth will reach a plateau between $390 and $400 on SPY stocks. See $SPY Seasonal Chart:

Presently, the SPY’s overhead resistance levels are set at $395 and then $402. The support on the other hand lies at prices of $385 and then a lower level of $375. I am keeping an eye out for any changes in these figures over time as I expect the market to continue to make new lows for the next 2-8 weeks. I would be BEARISH ON THE MARKET at this time and encourage subscribers to hedge their positions. The $VIX has lowered throughout the week, dropping below $19 on Thursday. With this in mind, I’ve selected one symbol I’ll be looking to trade next week.

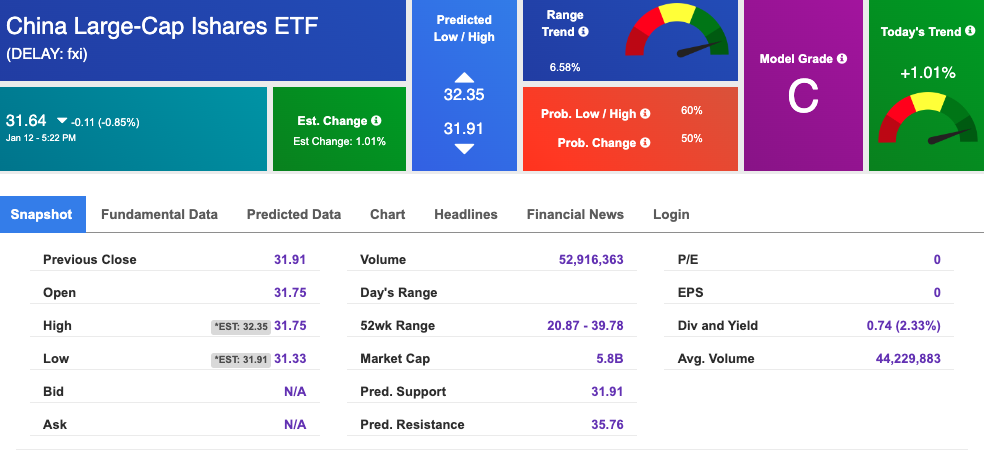

iShares China Large Cap ETF (FXI) currently trades at $31.64, near the middle of its 52-week range of $20-$39, and has slightly sold off Thursday after moving higher throughout the week. As the bear market looms, there are still promising opportunities to capitalize on. I’m particularly interested in this symbol given the potential rallies that could be occurring soon. China’s latest update to COVID policy, which opened its border, is likely to support Chinese-based business throughout 2023 and even surpass its current standing!

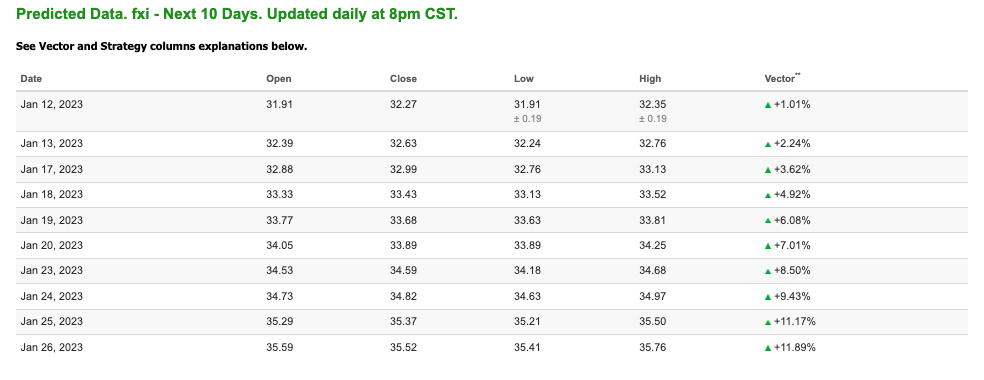

FXI carefully monitors a market-cap-weighted index of the 50 most significant Chinese stocks that are actively traded on the Hong Kong Stock Exchange. The 10-Day Stock Forecast Toolbox outlook for FXI is highly promising, indicating a strong and uninterrupted vector trend upwards. This provides confidence in my predictions, and likely decisions, involving FXI.

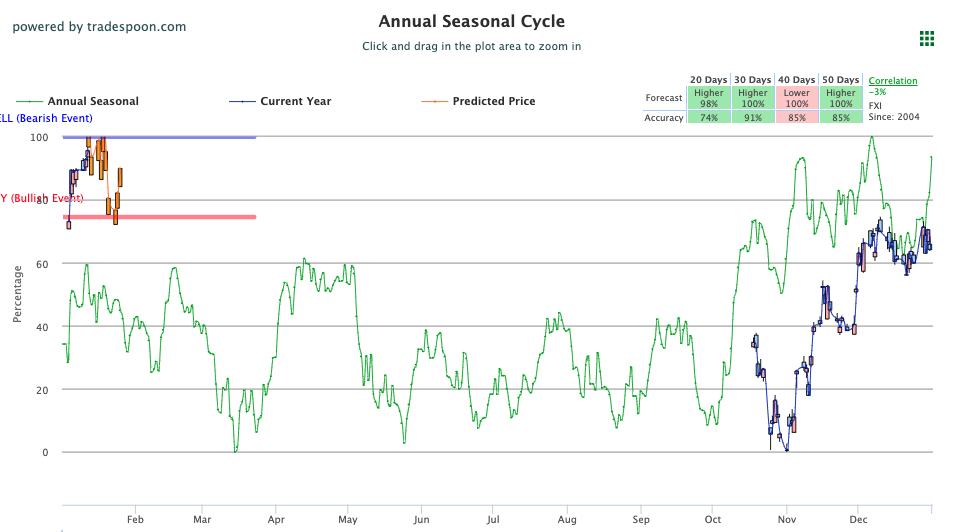

Not only is the chart pattern indicating potential, but our AI platform has also given us a ‘buy’ signal. Our seasonal chart readings are proving to be incredibly accurate in three of the four-time frames studied—20 days, 30 days, and 50 days—which is an excellent indication that this stock could yield strong results! See FXI seasonal chart below:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

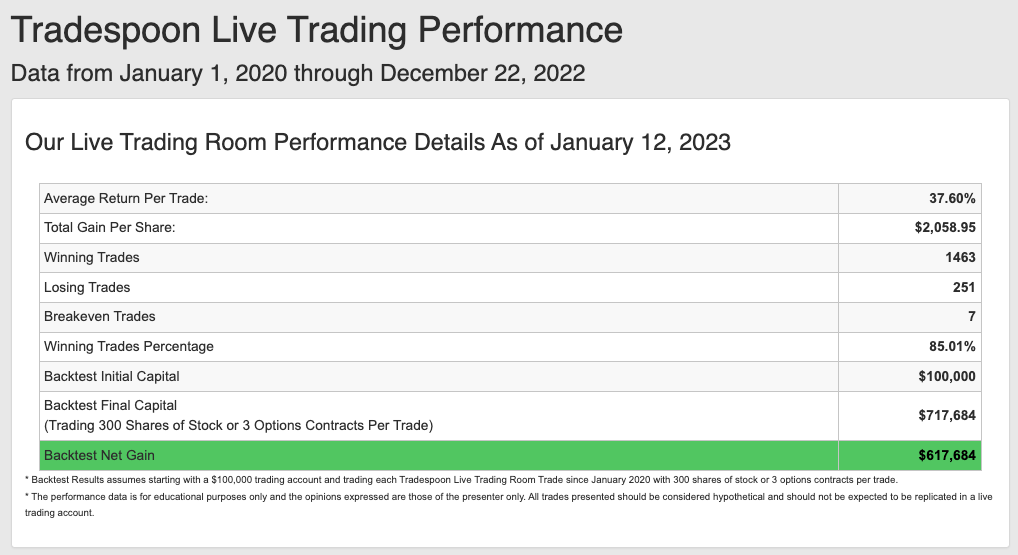

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 85.01% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!