RoboStreet – October 23, 2025

Softer tariffs and bank strength lifted indexes toward records ahead of CPI—but key risks remain: higher-for-longer rates and rising unemployment.

It was a steady-risk, higher-highs kind of week—less drama, more grind. Momentum kept nudging the indexes toward records as volatility stayed tame and investors looked past the political noise to what mattered most: earnings.

With the VIX near 17 and the majors pressing their peaks, the surface story was policy, but the driver was profits. Markets opened on the back foot after renewed U.S.–China tariff threats triggered a quick de-risking across semiconductors and other China-sensitive groups. Rare-earth names spiked on supply-chain angst, but the tape found its footing as the narrative shifted toward potential negotiations rather than blanket levies. That softer tone, paired with early results that were better than feared, let dip buyers re-engage and pushed the S&P 500 and Nasdaq back toward their highs by Thursday’s close.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The most important market mover came from the banks. Money-center leaders posted sturdy third-quarter scorecards—strong enough to offset a bout of nerves from the regional cohort, where fresh write-offs and a fraud disclosure revived credit-quality questions and dragged the KBW regional index lower. The message was two-speed: fortress balance sheets and diversified fee pools can power through normalization, while smaller lenders remain under a harsher spotlight as investors comb guidance for any hint of hidden risk. That dispersion in financials shaped the week’s rhythm: enough good news to keep the Dow firm, but just enough concern to cap enthusiasm on days when policy headlines turned rough.

The government shutdown extended the “data blackout,” forcing investors to triangulate the macro picture from Fed speak, earnings calls, and high-frequency signals. The vacuum pushed capital into havens: gold ripped to a fresh all-time high above $4,000/oz before cooling into Friday, and the 10-year yield briefly pressed the bottom of its recent 3.6%–4.2% range. The absence of official prints reduced visibility and amplified the impact of anecdotes—until late in the week, when CPI was confirmed for release to meet Social Security deadlines. That single report suddenly became the fulcrum for risk appetite into the close: a benign number would endorse the retest of highs; a hot one would revive the rates scare and rotation into defensives.

Energy added a new wrinkle when fresh U.S. sanctions on Russia’s largest oil producers sent crude sharply higher and revived interest across the complex. Equity futures steadied despite a drag from a big-cap earnings stumble elsewhere, and by the afternoon cash session, breadth had improved meaningfully, with the speculative corners that were pummeled on Wednesday—quantum, crypto-adjacent, and nuclear—finding their feet again. Rates edged up from the lows (the two-year nudged toward 3.5% and the 10-year toward 4.0%), while the probability of two cuts by year-end was trimmed at the margin.

Technology told a more nuanced story. The AI-capex spine remained intact—order books, partnerships, and power-infrastructure buildouts continue to frame the secular opportunity—yet the tape also showed fatigue at the edges. Mega-cap quality mostly held firm, but high-flyers gave back part of their recent gains, reminding investors that leadership can narrow even when the index trend is up. That matters with Tesla and Netflix on the docket and Nvidia looming as the market’s single most important read-through on data-center demand, export restrictions, and supply timing. In short: the micro will drive the macro until the macro data flow normalizes.

Through it all, the market traded like it wanted to go higher but was willing to pause for confirmation. The path of least resistance remains up so long as the 10-year stays contained and earnings guidance doesn’t crack, but the tape is less forgiving of crowded positioning and soft balance sheets. For now, we keep a market-neutral stance with a constructive bias: respect the SPY road map with 680–700 as the near-term resistance band and 620–640 as tactical support. That framework acknowledges momentum’s return without ignoring the twin risks of “higher for longer” rates and a gentle creep higher in unemployment that could keep recession odds alive into year-end.

What to watch next: Friday’s CPI as the first true macro anchor in weeks; the tariff trajectory as negotiations evolve; ongoing shutdown spillovers on confidence and procurement; and, above all, the AI-capex flywheel, where order cadence and power constraints will shape multiples as much as headline growth. If CPI cooperates, expect another run at the highs with tech and quality financials doing the heavy lifting. If it doesn’t, gold’s breakout and the lower end of the yield range will likely draw fresh attention, and the market will rotate toward balance-sheet strength while it waits for the next data point.

Policy jolted the market, but earnings are setting the course for now. Barring new evidence, the long-term uptrend remains intact. Buy quality on controlled pullbacks, trim into extensions, and keep rates front and center—the 10-year is still the metronome for risk.

Meet RoboInvestor, our flagship AI-driven advisory built for exactly this kind of market. It strips out the noise and the emotion, surfaces statistically sound setups, and helps you act with precision and conviction—no matter what the headlines throw at us.

Every other weekend, you’ll get the RoboInvestor newsletter: a concise read with market context, technical outlooks, updates on open positions, and clear, actionable trade ideas designed to be ready for Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

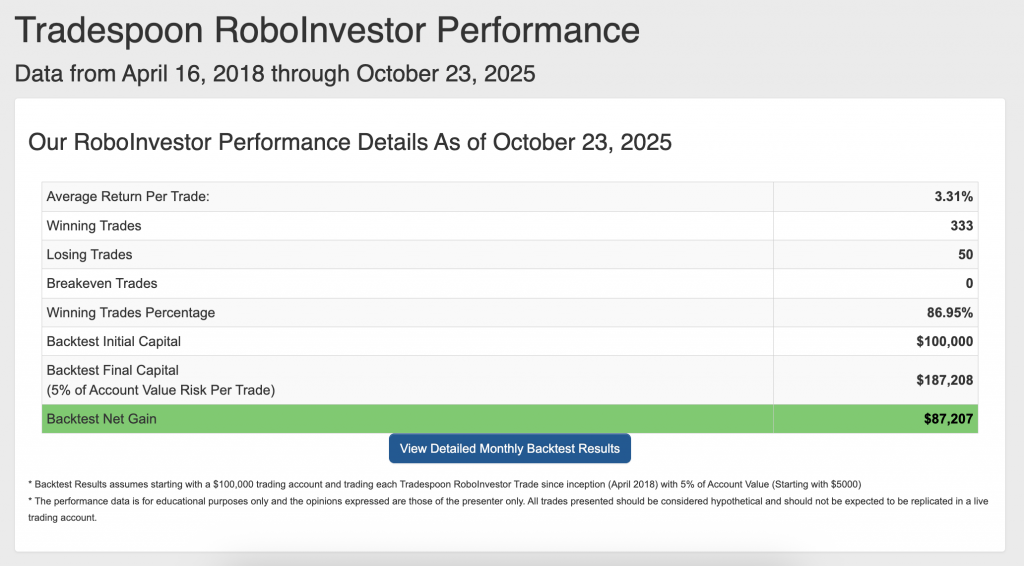

Our track record is one of the best in the retail advisory industry, with a Winning Trades Percentage of 86.95% since April 2018.

As we head into the back half of Q4 2025—with October nearly in the books—investors are navigating a market defined by renewed tariff rhetoric, an uncertain Fed path, mixed economic signals, and persistent geopolitical crosscurrents. Volatility remains contained but jumpy around headlines, while earnings and guidance are doing the heavy lifting for direction. In this backdrop, partnering with a disciplined, insight-driven framework matters more than ever to cut through noise, manage rate and labor-market risk, and position proactively for the final stretch of the year.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!