This week, the market continued to sell off as volume decreased into the final trading week of 2022, which, in turn, increased volatility. While volatility is expected to also kick off next year, next week all eyes will be on the latest unemployment data as well as the beginning of the next earnings season – both set to be catalysts for the next market move. With this in mind, I am keen on executing one type of trade as we wrap up 2022 and head into 2023! But more on that in a bit, first let’s review the latest market conditions.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Kicking off the week, U.S. indices endured a turbulent period as stocks dropped in value; particularly impacted were Tesla and Apple who felt the full force of bearish trading activity. On Wednesday, the stock market saw a sudden drop as investors cautiously evaluated China’s recent lifting of Covid-19 safety measures. As trading volume was lower than usual, this caused an overall decrease in prices. During the same interval, bond yields rose in tandem.

Furthermore, the considerable swell of bonds has exerted a negative impact on equities. On Tuesday, the yield on the standard 10-year US Treasury note ascended to its highest peak since mid-November and has sustained over 3.8% since that time frame as well. Next week, the economy is set to rise with more crucial economic reports and the commencement of this quarter’s earnings season.

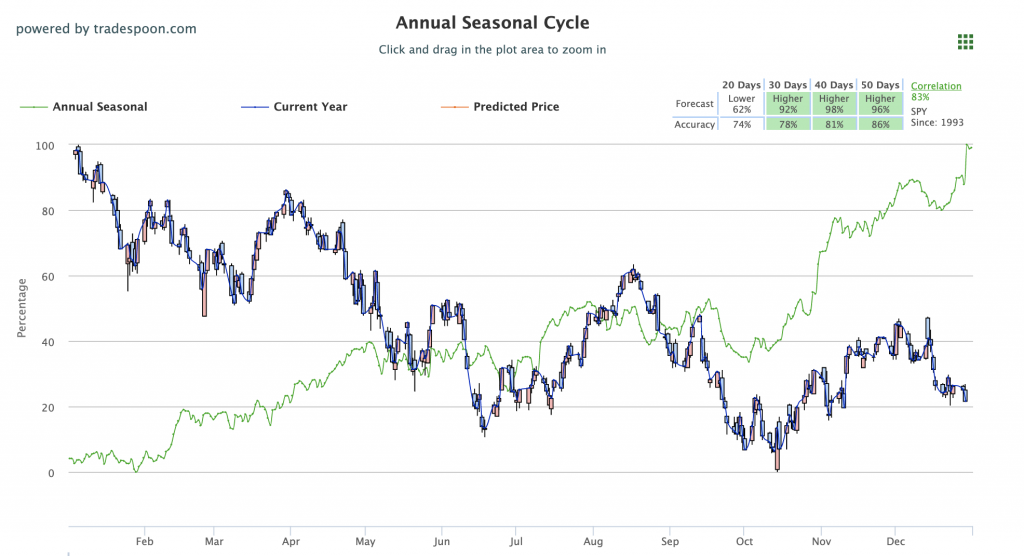

As the year concludes, next week’s taxation and unemployment data could determine which route markets will take. We are currently monitoring the resistance levels of SPY, which is currently at $390 and then again at $402. Meanwhile, the support for SPY stays put at around $380 and further down to about $370. We expect the market to continue to make new lows for the next 2-8 weeks. We would be BEARISH ON THE MARKET at this time and encourage subscribers to hedge their positions. For reference, the SPY Seasonal Chart is shown below:

Interest rates have been steadily climbing, with the 10-year yield surpassing 3.5% – a key long-term support level that could foreshadow further dollar depreciation. Predicted macro data is exceeding expectations, and thus I believe that the 10-year yield will decrease to 2.5% by the close of 2023.

We had a down year in both bond and equity markets. Historically, we had only a couple of occurrences when both bond and equity markets were down two years in a row. In the upcoming year, most likely the bond market will have positive returns due to inflation numbers reaching a plateau and showing a downward trend on a monthly and year-over-year basis.

Despite uncertainty in the equity markets, it is likely that we will reach our lowest points during the first six months of this year. The primary factor contributing to this forecasted volatility is a probable downward adjustment of S&P 500 revenue figures that are not currently taken into consideration when viewing current market performance.

With this projection in mind, I have identified several symbols I will be looking to trade and short. While I’ll be looking to short strong tech symbols that have shown weakness as of late, Apple or Meta, I will also focus on inverse ETFs meant for the short one-day market performance of a designated ETF or sector.

And when it comes to inverse ETFs there is just one ETF that I believe is suitable to outperform the market during the forecasted downtrend.

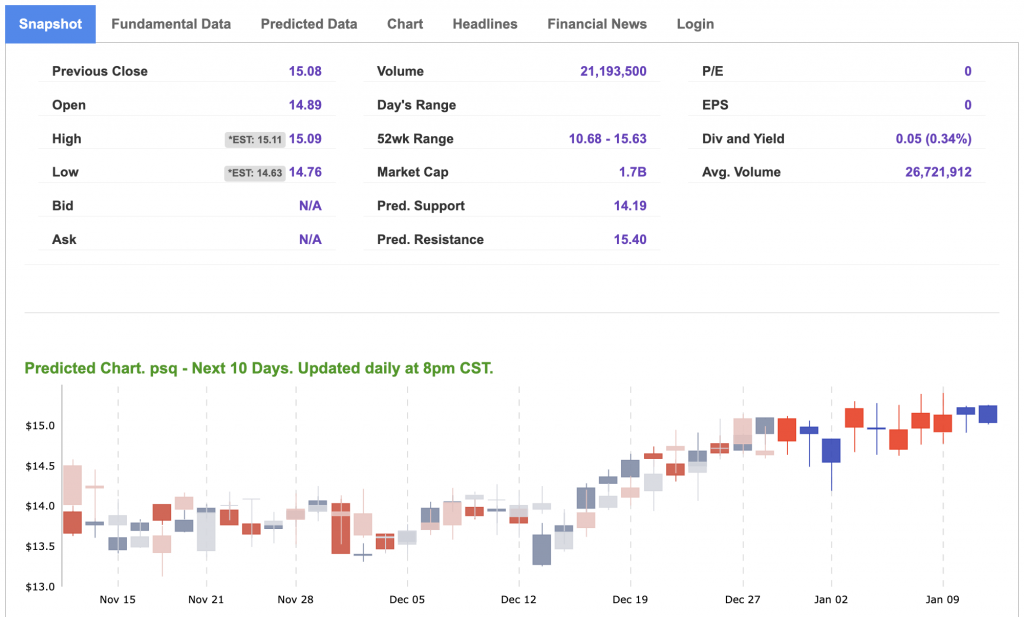

ProShares Short QQQ (PSQ) is the ideal avenue for traders to capitalize on the current state of the Nasdaq 100. With this inverse ETF, it’s never been easier to take advantage of sell-offs as the ETF offers traders an easy way to short the tech sector. Trading just near $15 the symbol has begun to retreat after nearing its 52-week high.

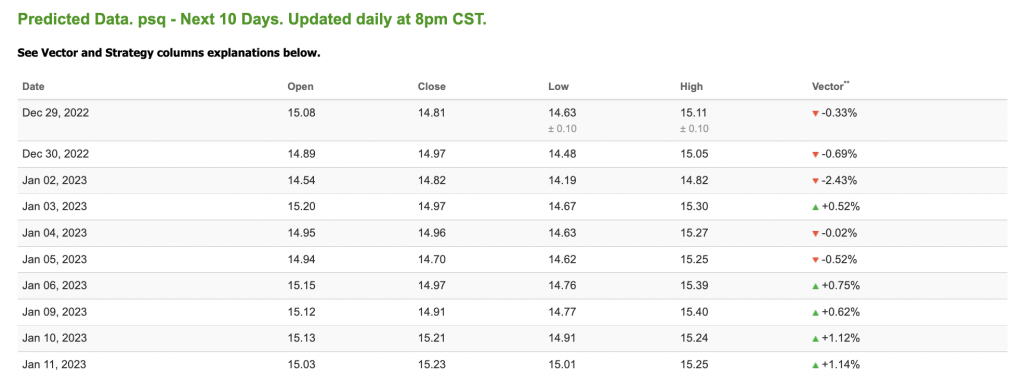

When we apply PSQ to our AI-driven Forecast Toolbox for the near term, we get a Model Grade “B” rating with a Predicted Resistance price target of $14.63 which is decently higher than where PSQ currently trades. At $15.08, PSQ is trading in the upper range of its 52-week range of $10.68-$15.63 – but sold off drastically on Thursday.

Looking at the symbols forecasted data, we see an encouraging vector trend that turns steady and positive after an initial batch of up and down sessions. With a strong, positive trend defined within a few days, we could see PSQ booking gains as early as next week!

As the risk of a bear market continues to grow, now is an opportune moment for us to invest in $PSQ. After thoroughly examining data from diverse markets as well as consulting with my artificial intelligence toolset, I am confident that PSQ will see an uptrend as we head into, and to start off, 2023!

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

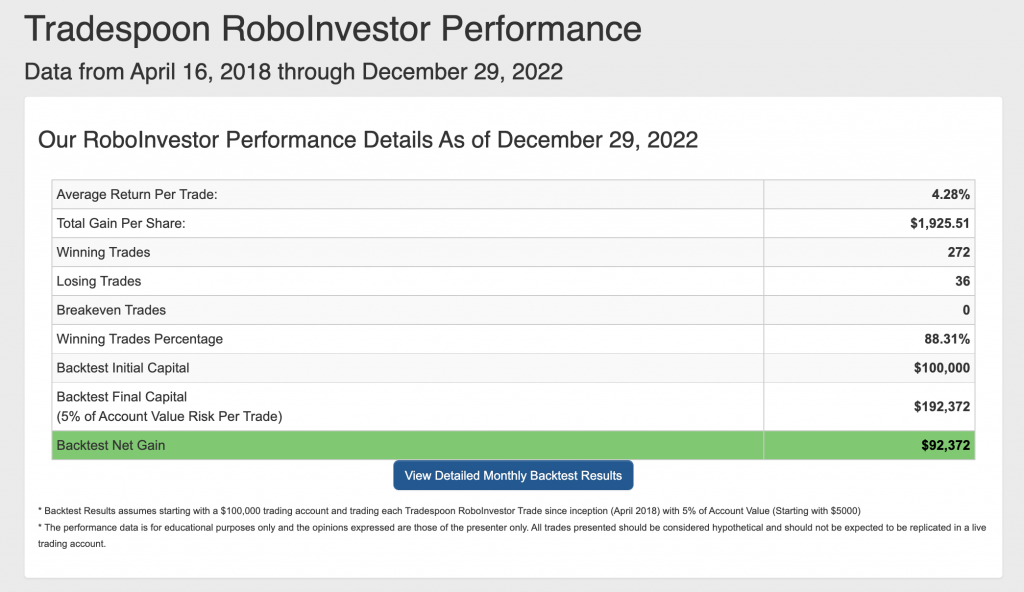

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!