RoboStreet – May 22, 2025

The U.S. stock market just weathered one of its most turbulent weeks in months, as Wall Street investors found themselves pulled in opposite directions by an increasingly fragile bond market, soaring cryptocurrency valuations, and mounting uncertainty over Washington’s fiscal future. After a brief rally early in May fueled by optimism around U.S.-China trade negotiations, sentiment has turned far more cautious.

On Tuesday, stocks stumbled as Treasury yields spiked in response to renewed concerns about America’s debt trajectory. A poorly received $16 billion Treasury auction on May 20 set the tone. Demand was weak, yields surged, and the ripple effect was immediate. The Dow closed down 0.3%, with the S&P 500 and Nasdaq also finishing in the red. For many investors, this marked a stark reminder that Washington’s spending habits are starting to carry consequences in capital markets.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The anxiety was amplified by Moody’s recent downgrade of the U.S. credit rating, citing the ballooning $36 trillion federal debt pile. Meanwhile, President Trump’s latest tax and spending proposal, which squeaked through a key House vote this week, could add another $4 to $5 trillion in deficit spending over the next decade. The bond market, typically a haven during uncertain times, is no longer looking so safe. Yields on the 30-year Treasury jumped above 5% on Wednesday—one of the highest levels seen since 2023—causing pain in bond-heavy portfolios. The iShares 20+ Year Treasury Bond ETF has already fallen 2.5% in 2025.

The sell-off in bonds appears to reflect more than just temporary indigestion. Investors are signaling that inflation could accelerate again, forcing the Federal Reserve to keep interest rates higher for longer. If deficits continue to expand at this pace, the government will have to issue more debt, which could overwhelm demand and push yields even higher. This backdrop has Wall Street on edge. What was once considered the safest asset in the world—U.S. government debt—is suddenly being viewed with increasing skepticism. And that shift is weighing heavily on equities.

While debt fears dominated the headlines, confusion around trade policy added to the uncertainty. Optimism that followed the U.S.-China tariff truce earlier this month faded fast, as the market waits for more concrete direction from the White House. Trump’s previous decision to pause tariffs for 90 days gave investors some breathing room, but few believe the issue is truly resolved. The lack of clarity has injected fresh volatility into sectors tied closely to global supply chains, including manufacturing and retail.

Retail earnings this week painted a mixed picture of consumer health. Target and Lowe’s reported declining revenues, echoing concerns that consumer spending is beginning to crack under inflationary pressure. Meanwhile, Urban Outfitters stunned the market with a 21% rally after posting better-than-expected earnings, and Ralph Lauren beat revenue expectations with an 8% year-over-year gain, showing that the higher-income consumer may still be spending. The sector remains divided, caught between economic uncertainty and shifting consumer behaviors.

Healthcare stocks also faced headwinds, particularly after the Centers for Medicare and Medicaid Services announced it would ramp up audits of Medicare Advantage plans. UnitedHealth, already reeling from a more than 10% drop earlier in the month after suspending its 2025 forecast and losing its CEO, continued to slide. Humana and CVS weren’t spared either, as concerns over overpayment crackdowns spooked investors.

In the midst of this cautious atmosphere, cryptocurrencies reminded the world just how uncorrelated—and unpredictable—they can be. Bitcoin smashed through its previous all-time high on Wednesday, topping out at $111,875 before pulling back slightly to trade around $111,362. The surge was driven by a combination of macro factors and growing institutional interest. Legislative developments helped as well: a Senate bill aimed at regulating stablecoins gained momentum, while a Texas bill to establish a strategic Bitcoin reserve moved closer to becoming law. The irony wasn’t lost on investors. As U.S. debt loses some of its luster, Bitcoin—the ultimate anti-establishment asset—is soaring to new heights. Ether also gained ground, climbing to $2,691, while XRP rose 4% to $2.44.

Crypto bulls are now speculating that Bitcoin could reach as high as $130,000 by year-end. Some analysts caution that a correction is overdue, noting the lack of meaningful pullbacks over the past few years. But others argue that Bitcoin’s role as both a risk-on asset and a hedge against fiscal instability is becoming more widely accepted, driving demand regardless of short-term volatility.

Tech stocks, especially those tied to artificial intelligence, continued to act as a relative safe haven. Nvidia shares rose 1% as investors await next week’s earnings report, widely expected to reaffirm surging demand for AI infrastructure. Alphabet climbed 4% on renewed enthusiasm over its AI initiatives, while Snowflake spiked more than 9% after delivering its first-ever billion-dollar revenue quarter and raising forward guidance. In contrast, Tesla slipped nearly 2% after the House bill included provisions to eliminate EV tax credits and impose new annual fees on electric and hybrid vehicles—developments that could drag on the sector if passed into law.

Another notable story came from the housing finance sector, where Fannie Mae and Freddie Mac shares each soared more than 25%. The spike followed Trump’s social media post late Wednesday, suggesting he is “giving very serious consideration” to bringing the mortgage giants public, even though analysts caution this doesn’t necessarily mean an exit from conservatorship is imminent. Regardless, the mere possibility sent their stocks soaring, revealing how sensitive these names remain to any hint of policy change.

With the week’s economic data offering few reassurances, the market remains stuck in a state of high alert. Weak retail sales expectations, sluggish consumer sentiment, and rising unemployment concerns are all starting to take a toll on risk appetite. Mortgage applications and energy inventory data released on May 21 added little relief.

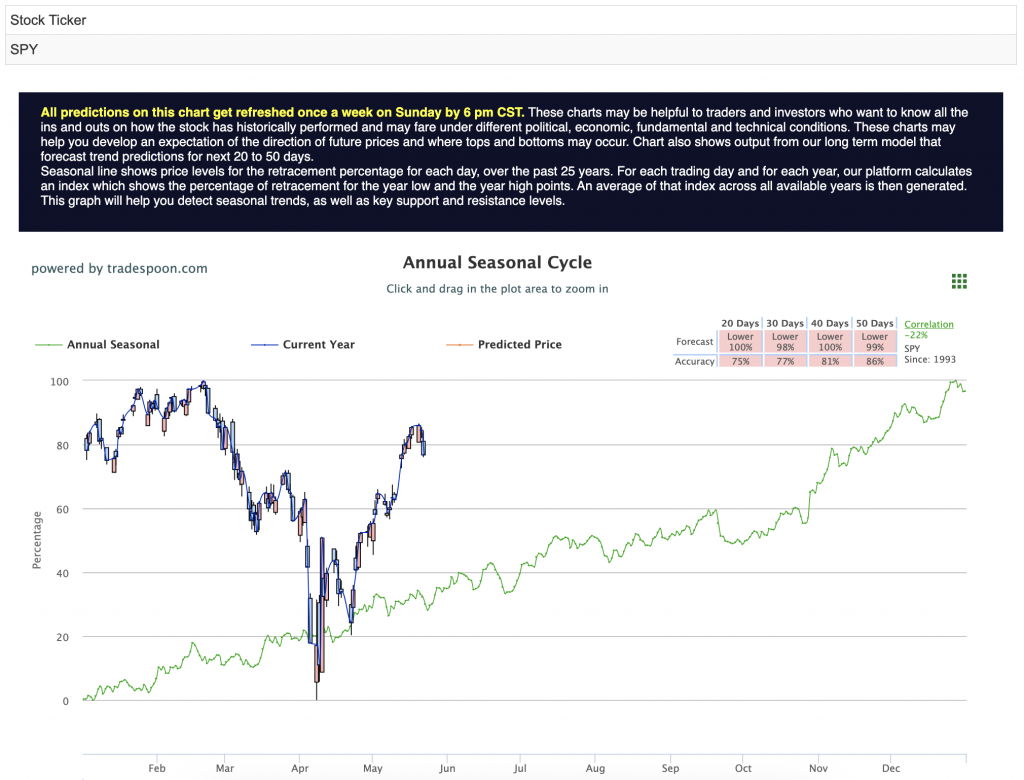

All of this keeps the broader market in a neutral holding pattern. The S&P 500 continues to trade in a sideways range, with strong support between 540 and 550 and potential resistance near 600–620 if momentum improves. But right now, the risks remain tilted to the downside. The Fed appears unlikely to cut rates before autumn, if at all in 2025, and headline-driven volatility remains the name of the game. For reference, the SPY Seasonal Chart is shown below:

This is not a panicked market, but it is one that’s being forced to readjust. Investors are coming to terms with the idea that easy money is gone, fiscal discipline is fading, and the path forward for both bonds and equities is anything but certain. For now, the best strategy may be staying neutral, staying nimble, and being ready for anything.

Navigating this landscape requires more than just optimism. A well-balanced, diversified strategy is essential. Agility is your edge—identify emerging opportunities while staying protected from sudden downturns. Staying informed throughout earnings season and tracking macroeconomic shifts will position you to act decisively and with confidence.

Despite the headwinds, this environment still offers meaningful opportunities for growth. With discipline and a focus on key indicators, investors can adapt to changing conditions and position themselves for long-term success.

That’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

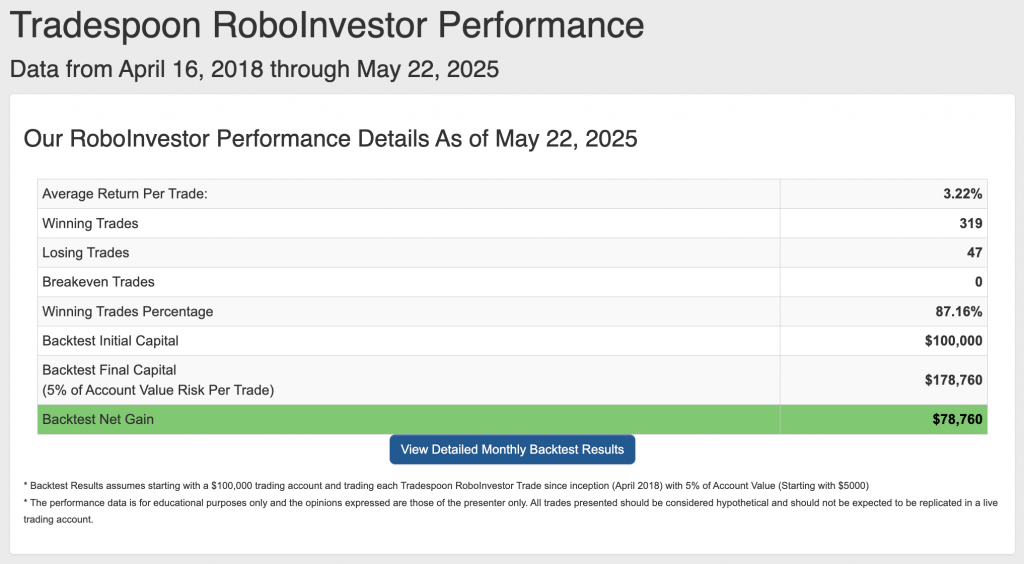

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.18% going back to April 2018.

As we progress through Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!