The week opened with the market taking a step back just as the S&P 500 came within reach of its prior record close. On Monday, the S&P 500 fell roughly 0.4%, the Dow dropped about half a percent, and the Nasdaq slipped only slightly, down around 0.1%. The headline numbers suggest a modest pullback, but the tone under the surface was much more telling.

Breadth was weak. Most stocks in the S&P 500 traded lower even as the index itself held relatively close to its highs. The reason was familiar: once again, a narrow group of technology and artificial intelligence names managed to offset broader pressure. Nvidia, Broadcom, and Oracle traded higher, and the iShares Semiconductor ETF spent much of the session in positive territory. Technology was the only S&P sector that was meaningfully green for most of the day, while many other sectors—health care, energy, materials, consumer discretionary, and communication services—were down over 1%.

Factor performance reinforced the idea that this remains a very selective tape. Momentum, growth, and risk-focused strategies, along with small caps, held up better. Low volatility, dividend, value, and quality styles generally lagged. Investors were not abandoning risk altogether; they were leaning harder into what has been working and pulling capital away from slower, more defensive corners of the market.

The bond market added another layer. The 10-year Treasury yield rose for a third straight session, moving toward 4.17%, while the 2-year yield climbed to around 3.58%. Higher yields at the long end, coming right before a Federal Reserve meeting, tend to pressure equities, particularly the more rate-sensitive areas. With the S&P 500 near its highs and policy uncertainty still in play, Monday’s action looked less like a full risk-off moment and more like investors tapping the brakes into a known catalyst.

The main scheduled event on the calendar is the Federal Open Market Committee meeting, which begins Tuesday and concludes with a policy decision on Wednesday afternoon. Futures imply very high odds of a quarter-point rate cut, with probabilities climbing into the high 80s. The rate move itself is largely expected at this point; what really matters is the forward guidance, the updated projections, and Chair Powell’s tone. Markets want to know not just whether the Fed cuts now, but how confidently it believes it can keep cutting against a backdrop of moderating growth, a softening labor market, and political uncertainty.

Against that macro backdrop, several notable stock-specific stories emerged.

First, Nvidia received an important policy “yes, but” from Washington. President Trump announced that Nvidia will be allowed to sell its H200 AI chips to approved customers in China, but subject to a 25% fee on that business. The Commerce Department will finalize the details and similar arrangements are expected for AMD and Intel. This framework effectively reopens a large end market for Nvidia’s cutting-edge hardware while reminding investors that AI semiconductors are now operating in a regulated lane. The company gets incremental revenue and demand visibility, but at the cost of a policy toll. Nvidia shares moved higher on the news, and the headline helped support the broader AI complex on an otherwise weak day for most of mega-cap tech.

Second, the media and streaming landscape has entered an aggressive consolidation phase. Warner Bros. Discovery reached a deal with Netflix for the sale of its film and TV production business plus HBO and HBO Max. The transaction is valued at $82.7 billion including debt, implying equity value of about $72 billion. Netflix will pay $27.75 per share for those assets, mostly in cash with a smaller stock component. The cable networks—TNT, TBS, CNN, Discovery and others—are being left out of the transaction and are slated to be spun off into a separate company, Discovery Global, by the third quarter of next year.

That deal did not go unchallenged. Paramount Skydance responded by taking a rival offer directly to Warner Bros. Discovery shareholders, proposing $30 per share in cash for the entire company, including the cable networks. The competing bids highlight a debate about what mix of streaming, film libraries, sports rights, and legacy cable assets will create the most value over the coming decade. Netflix is making a focused bet on content plus streaming without linear cable, while Paramount is arguing for the strategic and financial value of controlling the full stack, including traditional networks. Both approaches carry regulatory, integration, and balance-sheet risk.

Altogether, these headlines show two very different faces of this market: AI hardware, where policy shapes the ceiling but secular growth remains extraordinary, and legacy media, where strategic repositioning is happening under pressure and in public.

The mood in the market is neither euphoric nor deeply fearful. It is cautious and selective.

On the one hand, the indices are still close to highs and investors continue to reward companies that sit at the center of the AI narrative or have clear, idiosyncratic catalysts like strategic deals. Nvidia and a small group of similar names remain key leaders. The outperformance of momentum and growth factors, along with higher-beta segments such as certain small caps, suggests there is still a meaningful appetite for risk as long as it is concentrated in perceived winners.

On the other hand, the breadth of the rally has weakened. When the S&P 500 can trade near a record while most of its components are red on the day, it signals a market increasingly dependent on a narrow leadership group. That narrowing is taking place just as long yields creep higher, the Fed prepares to speak, and investors grapple with the possibility that policy may not be as supportive as current pricing implies. The underperformance of defensives, value, and income-oriented strategies on a weak tape also suggests that investors are not yet rushing to hide; they are simply more reluctant to push capital into areas without clear narratives or catalysts.

In that environment, each macro headline takes on outsized importance. A slightly more hawkish dot plot or a less confident Powell press conference could be enough to pressure high-multiple growth stocks and long-duration assets at the same time. A cleanly dovish message, by contrast, could fuel another leg higher in the narrow set of leaders while leaving the rest of the market struggling to catch up.

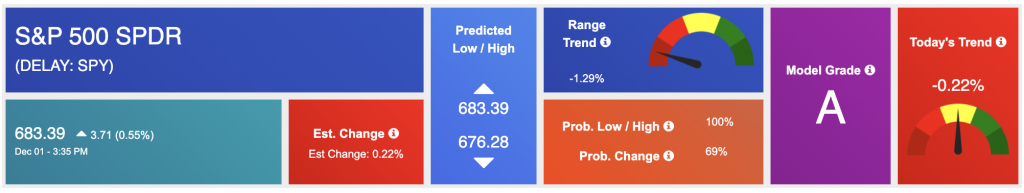

At the index level, I remain market-neutral. The late-year surge improved momentum off the lows, but the advance has turned choppier and more fragile than the smoother rally we saw earlier in the cycle. My working assumption is that the S&P 500, via SPY, trades within a broad range over the coming months, with support in the 620 to 640 zone and room on the upside toward 680 to 700. The longer-term uptrend remains intact, but the easy phase of that trend is behind us.

The main macro risk is straightforward. If interest rates stay restrictive for longer at the same time unemployment drifts higher and manufacturing stays weak, valuations in the parts of the market that have been priced for perfection will come under pressure. That risk does not necessarily imply an immediate bear market, but it does argue against assuming a straight-line move higher from here.

In practical terms, this leads me to prioritize discipline over direction. I do not feel compelled to chase the broad indices at current levels with a Fed decision imminent and leadership so narrow. Instead, I want to come into the meeting with a clear playbook. Suppose the market trades lower toward the bottom of my expected range on macro headlines rather than on a genuine deterioration in earnings or credit conditions. In that case, I want a prepared shopping list of high-quality, cash-generative businesses with durable competitive advantages, especially in areas like AI infrastructure and enablement. If, instead, the market breaks higher in a way that further narrows leadership and stretches valuations, I will look to trim into strength rather than add.

Within equities, I continue to favor select exposure under the surface rather than broad, indiscriminate beta. In AI and semiconductors, I prefer the strongest balance sheets and franchises, sized with the expectation that policy and export headlines will remain a recurring source of volatility. In media and communications, the Netflix–Warner–Paramount triangle is interesting as a tactical theme rather than a core allocation; the outcome will be shaped not only by shareholder votes and board decisions but also by regulators, and that introduces timing and deal risk that has to be respected.

On the rates side, the recent move higher in the 10-year yield is a reminder that long-duration assets can struggle together when the policy path is questioned. I remain cautious about loading up on long duration—whether in bonds or in the highest-multiple parts of the equity market—until we see how the Fed balances its growth and inflation mandates in this meeting and in its forward guidance.

Looking ahead, the next few days will be shaped by three intertwined questions. The first is whether Powell confirms or challenges the market’s optimistic path for rate cuts. The second is whether breadth improves or deteriorates after the meeting; a healthier rally would see participation broaden beyond a handful of mega-cap tech and AI names. The third is how policy and regulatory frameworks evolve around AI exports and media consolidation, both of which are now central to the investment case in those sectors.

Until there is more clarity, my stance remains simple and consistent: neutral on the broad indices, constructive but selective on high-quality growth and AI, and opportunistic rather than aggressive in complex special situations. Volatility around the Fed decision is not something to fear. It is an opportunity to upgrade portfolios—provided you come prepared with a plan, not a reaction.

Using the “SPY” symbol to analyze the S&P 500, our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

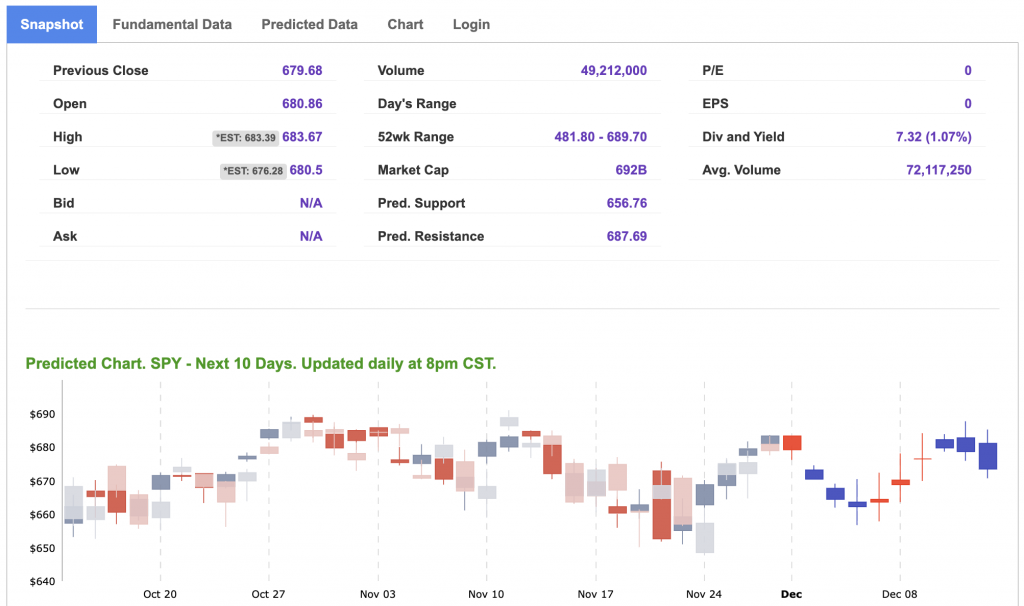

Our featured symbol for Tuesday is MS. Morgan Stanley (MS) is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $176.83 with a vector of +0.26% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication, Vlad Karpel does have a position in the featured symbol, MS. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

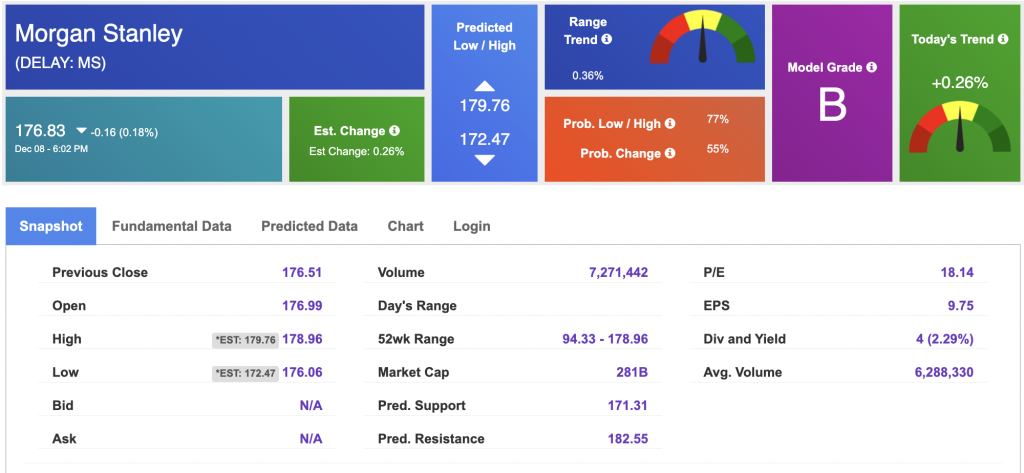

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $59.50 per barrel, up 1.62%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.07 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

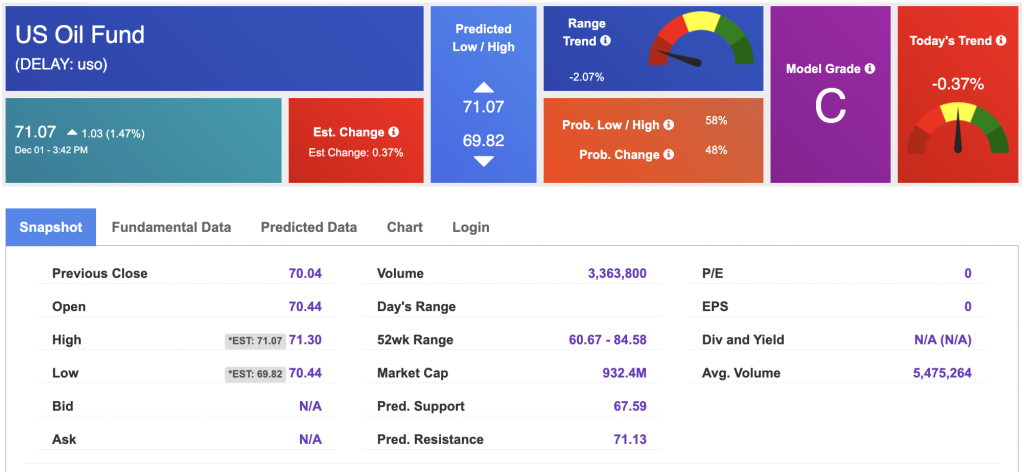

The price for the Gold Continuous Contract (GC00) is up 0.28% at $4,267.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $387.88 at the time of publication. Vector signals show +0.68% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is up at 4.094% at the time of publication.

The yield on the 30-year Treasury note is up at 4.742% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

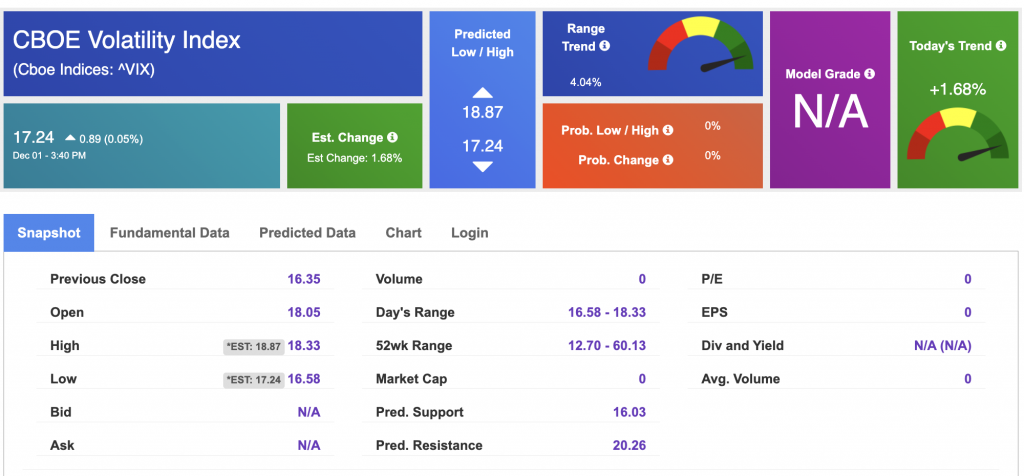

The CBOE Volatility Index (^VIX) is priced at $17.24 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!