This week’s financial landscape witnessed a pivotal Federal Open Market Committee (FOMC) meeting alongside a flurry of earnings reports, dictating the market’s trajectory. Despite robust corporate earnings, the specter of inflation looms large, influencing investor sentiment amidst geopolitical tensions. Let’s delve into the intricate dance between earnings, the FOMC decision, and prevailing market conditions.

Federal Reserve’s Stance: The Federal Reserve opted for continuity, maintaining its benchmark interest rate amid escalating inflationary pressures. Despite three consecutive months of higher-than-anticipated inflation, the Fed refrained from altering its current stance. This decision underscores the central bank’s cautious approach, given the uncertain trajectory of inflation and its implications for monetary policy. Federal Reserve Chair Jerome Powell emphasized the Fed’s commitment to vigilance, noting that while progress has been made in curbing inflation, sustained momentum remains elusive.

Market Response: Initially, optimism permeated the market as earnings reports showcased strength, particularly in tech behemoths like Alphabet and Microsoft. However, the sentiment quickly shifted post-FOMC meeting, exacerbated by hotter-than-expected Personal Consumption Expenditure (PCE) data. Traders pivoted, interpreting adverse economic indicators as potential catalysts for interest rate cuts, encapsulating the market’s paradoxical response to negative news. The market’s reaction underscores the delicate balance between economic data and monetary policy expectations, fueling volatility and uncertainty.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Earnings Landscape: Corporate earnings remained a focal point, with tech giants like Amazon and Google delivering promising results. Amazon’s robust performance, buoyed by strong cloud computing and e-commerce growth, exceeded expectations, signaling resilience amidst evolving market dynamics. Similarly, Google’s parent company, Alphabet, reported impressive earnings driven by robust advertising revenue. Conversely, AMD and SMCI faltered, underscoring the nuanced nature of earnings season. AMD’s weaker-than-expected performance, attributed to supply chain disruptions and competitive pressures, tempered market enthusiasm. As investors navigate through earnings reports, discerning trends and outliers is essential for informed decision-making amidst market volatility and uncertainty.

Market Volatility and Support Levels: Market volatility surged, reflected in the VIX nearing the 20 level—a threshold indicative of heightened fear and uncertainty. The erosion in support levels, notably the 50-day moving average (DMA) for major indices like SPY, QQQ, and small caps, underscores the market’s fragility. Amidst mounting geopolitical tensions and inflationary pressures, investors tread cautiously, seeking refuge in safe-haven assets while reassessing risk exposure. The challenge lies in maintaining a balanced portfolio amidst evolving market dynamics, where technical indicators and macroeconomic factors converge to shape market sentiment.

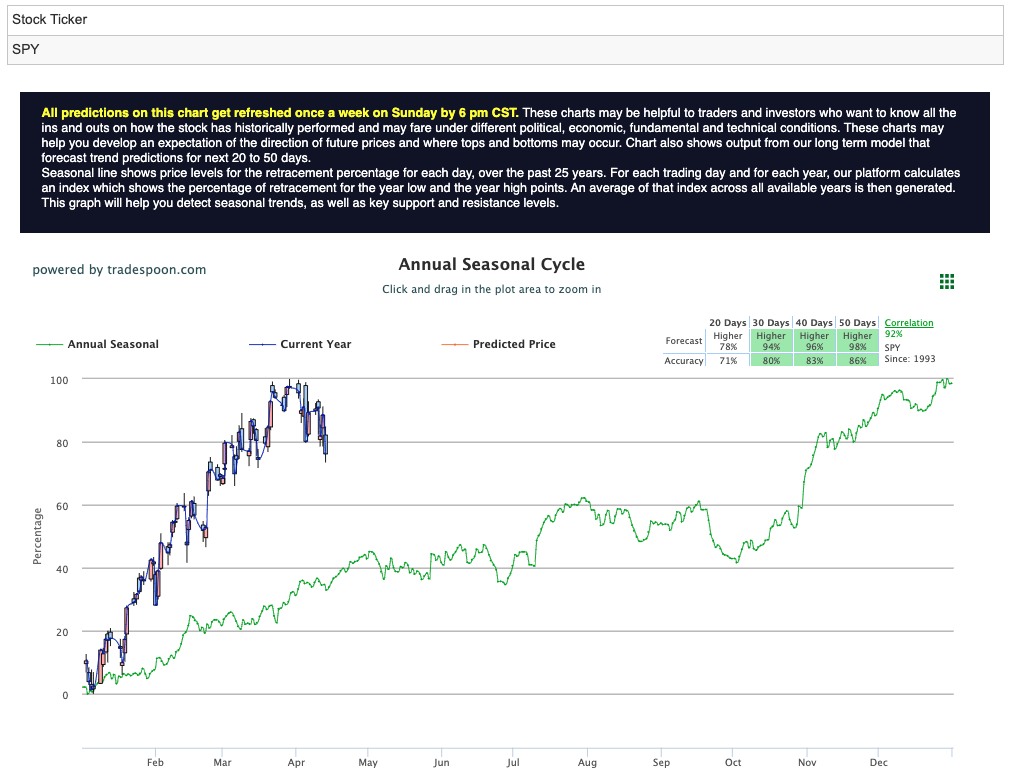

SPY Predicted Levels and Outlook: Anticipation surrounding SPY’s trajectory intensifies as market participants weigh economic fundamentals against geopolitical uncertainties. Despite recent volatility, SPY remains resilient, supported by strong earnings and cautious optimism. However, technical indicators suggest potential downside risks, with SPY hovering around the 50-day moving average. Looking at my latest forecast, SPY suggests a capped rally, likely ranging between $530 and $540, while short-term support is expected in the $480 to $500 range, indicating a turbulent market trajectory. For reference, the SPY Seasonal Chart is shown below:

Based on these levels, I am seeing a narrow trading range in the near term, with support levels tested amidst prevailing headwinds. As investors brace for a period of heightened volatility, prudent risk management and strategic asset allocation are imperative for navigating uncertain market conditions.

Inflationary Concerns and Geopolitical Risks: Rising inflationary pressures coupled with geopolitical uncertainties underscore the market’s cautious sentiment. As inflation surpasses expectations and geopolitical tensions persist, investors adopt a wait-and-see approach, anticipating the Federal Reserve’s forthcoming decisions. The confluence of inflationary pressures, supply chain disruptions, and geopolitical tensions amplifies market volatility, necessitating a nimble and adaptive investment approach.

Founded by Jeff Bezos in 1994 as an online marketplace for books, Amazon has since transformed into a global behemoth, dominating e-commerce, cloud computing, digital streaming, and artificial intelligence. With a relentless focus on innovation and customer-centricity, Amazon has revolutionized retail and technology landscapes, reshaping consumer behavior and industry dynamics.

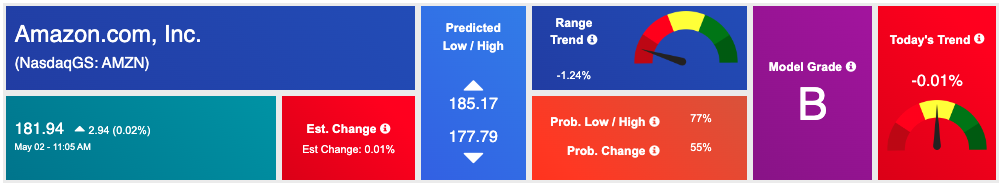

Despite recent market turbulence, Amazon (AMZN) stands out as a compelling investment opportunity amidst evolving market conditions. Several factors contribute to Amazon’s resilience and growth potential:

AI Insights: A Positive Outlook for Amazon (AMZN)

Our AI analysis corroborates bullish sentiments surrounding Amazon (AMZN), citing strong fundamentals, favorable market dynamics, and innovative initiatives as key drivers of future growth. By leveraging advanced predictive modeling and sentiment analysis, our AI platform identifies Amazon as a top pick within the technology and consumer sectors, signaling long-term upside potential for investors.

Capitalizing on Amazon’s Potential

In conclusion, Amazon (AMZN) presents an enticing investment opportunity amidst current market conditions. With its unparalleled market position, resilient business model, and relentless pursuit of innovation, Amazon is well-positioned to navigate challenges and capitalize on emerging opportunities in the digital economy. Investors seeking exposure to e-commerce, cloud computing, and artificial intelligence sectors should consider Amazon as a cornerstone of their investment portfolio.

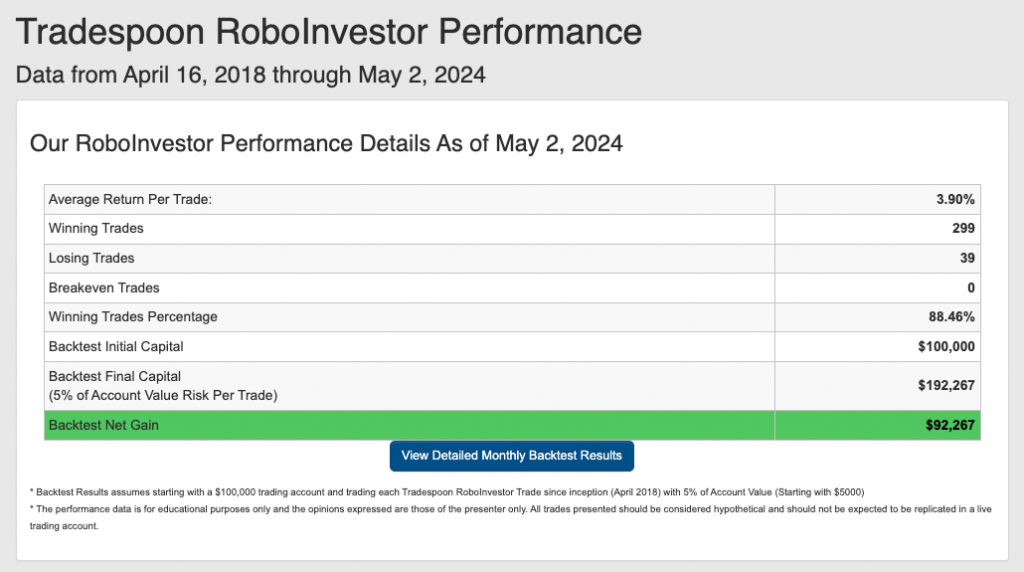

That is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.46% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!