This week, the financial markets were laser-focused on the intersection of interest rates and the quarterly earnings reports of key players such as Netflix ($NFLX) and Tesla ($TSLA). A positive development emerged with the Purchasing Managers’ Index (PMI) for both services and manufacturing surpassing expectations, reinforcing the prevailing narrative of a soft landing. A thorough review of the Personal Consumption Expenditure (PCE) data and the fourth-quarter GDP further contributed to the week’s financial discourse.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

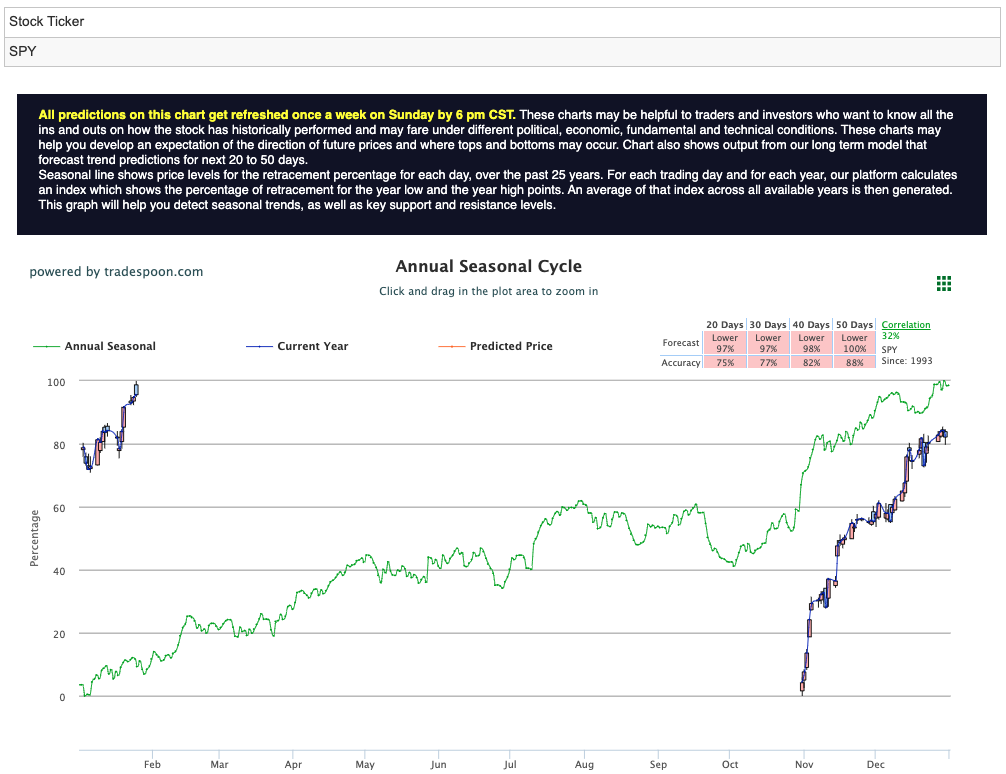

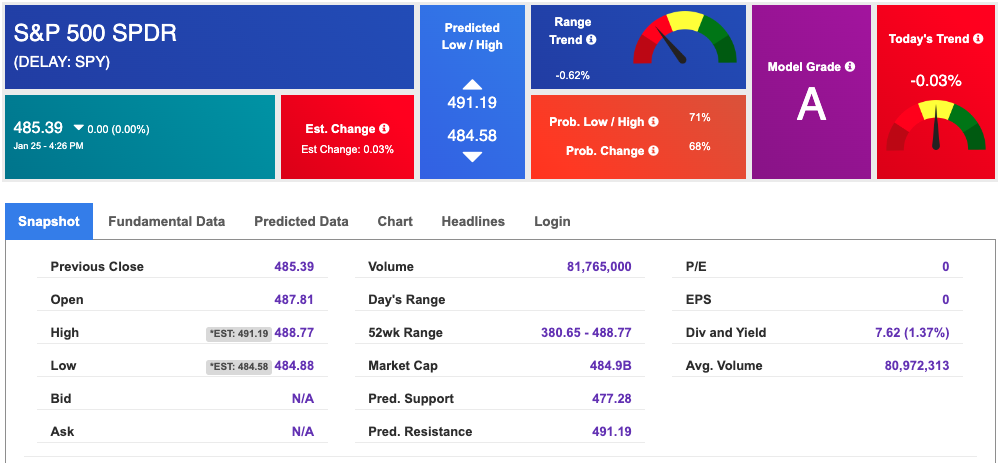

The broader markets saw a historic breakout, propelling the S&P 500 (SPY) to approach the significant 500 level. A notable trend was the ongoing rise in interest rates, attributed to the resurgence of the “high for longer” narrative. Peering into the future, market analysts foresee a potential ceiling for the $SPY rally in the $470-490 range. Short-term support is expected to materialize between $430-450 in the months ahead. To provide a visual reference, the SPY Seasonal Chart is presented below:

However, the small-cap index IWM exhibited underperformance during this period. All eyes are now keenly fixed on the Federal Reserve’s forthcoming rate decision scheduled for next Wednesday. The market faces the imperative task of reconciling the upward trajectory of interest rates with the ongoing breakout in the QQQ index. The 10-year yield and the U.S. Dollar Index ($DXY) rebounded from previously oversold conditions, exerting downward pressure on various market segments.

In the realm of geopolitics, oil experienced a notable rebound owing to heightened geopolitical risks in the Red Sea, involving Houthi rebels. It’s worth noting that 10-15% of global oil shipping traverses through this region. Despite this, the overall trajectory of oil prices continued to trend downwards due to a concurrent decrease in global demand. Further analysis delved into the earnings of Kinder Morgan (KMI), revealing significant market dynamics at play.

The cryptocurrency landscape witnessed a substantial reversal in Bitcoin, signaling a potential culmination of the risk-on trade. Concurrently, the precious metal Gold (GLD) altered its course in response to a rebound in the dollar.

Market sentiment has coalesced around the belief that the Federal Reserve is likely done with rate hikes for the current year and the next. There’s a prevailing expectation of a high probability of the Fed commencing a cycle of lowering interest rates in the first half of 2024. This overarching narrative is generally perceived as bullish for the market. However, a palpable risk looms in the form of the Fed potentially deviating from this projected path, refraining from lowering interest rates in the initially stipulated timeframe. Such an outcome could trigger a market selloff, particularly impacting the so-called “magnificent 7” stocks.

While short-term pullbacks are anticipated, the broader pattern of higher highs and higher lows is projected to persist into the upcoming year. The market is seen as needing a catalyst to propel it to higher levels. The caveat is that, as long as there are no discernible signs of an impending recession, the prevailing sentiment suggests that the market will continue its upward grind.

Retracing to the week’s beginning, the market sustained its positive momentum, witnessing a 0.2% increase on Monday. Of particular note was the performance of the S&P 500 equal-weighted index, which surged to new highs, driven by the continued outperformance of tech stocks buoyed by optimism regarding artificial intelligence demand.

The week’s opening saw stocks starting higher, with the S&P 500 extending its record highs. The Dow Jones Industrial Average experienced a significant surge on Monday, driven by gains in technology and financial stocks. This surge, amounting to nearly 200 points or 0.5%, resulted in a new intraday record. The Federal Reserve’s quiet period before its impending monetary policy decision shifted the market’s focus to influential quarterly earnings and key economic indicators, including the release of fourth-quarter U.S. GDP data and Personal Consumption Expenditure (PCE).

The 10-year U.S. Treasury yield’s dip below 4.1% provided additional support to risk sentiment. Market expectations for the initial interest-rate cut by the Fed shifted from March to May, reflecting recent data indicating an economy still grappling with potential inflation risks.

Looking to the international scene, the iShares MSCI China exchange-traded fund experienced a 3.05% decline on Monday. This came after the People’s Bank of China opted to leave interest rates unchanged, compounded by pressure from a stronger dollar, a slump in property sales, and the ongoing crackdown on Chinese technology companies in the U.S.

Spirit Airlines faced a setback in its merger plans but saw a notable rise in its shares. Notably, JetBlue also experienced a 1.5% increase. Anticipation for influential earnings reports, including those from United Airlines and Logitech, heightened during the week.

Mid-week earnings reports showcased General Electric beating expectations, while Johnson & Johnson and Verizon met expectations. AT&T reported fiscal fourth-quarter earnings below Wall Street expectations but boasted revenue exceeding consensus estimates. Despite this mixed earnings picture, AT&T’s wireless services division saw a 3.9% increase in revenue from the prior year, while business wireline sales dropped by 10.3%.

Netflix, a streaming giant, presented a stellar performance in its quarterly report. The company exceeded expectations with better-than-anticipated revenue and a substantial beat in subscriber growth for the fourth quarter. Netflix added a remarkable 13.1 million net new subscribers during this period, surpassing its own earlier forecast. This achievement marked the company’s best-ever fourth quarter for subscriber additions. The positive reception of Netflix’s earnings report was evident in the stock’s significant surge of up to 8.5% in after-hours trading.

On the other hand, Tesla, the electric vehicle industry pioneer, faced a more challenging scenario. Tesla’s financial results for the fourth quarter fell slightly short of Wall Street expectations. The company reported earnings of 71 cents a share, just below the anticipated 73 cents. More significantly, Tesla’s announcement that its vehicle volume growth “may be notably lower than the growth rate achieved in 2023” stirred concerns among investors. This revelation led to a pronounced 12% decline in Tesla’s stock price.

Investor sentiment surrounding Tesla was further influenced by the company’s earnings call, which did not provide substantial clarity on the implications of lower projected growth rates for unit sales. The market, accustomed to Tesla’s ambitious growth trajectory, reacted with caution and uncertainty, contributing to the decline in the stock’s value.

As a result, both Netflix and Tesla, as influential components of the market, played pivotal roles in shaping investor sentiment during the week. While Netflix’s robust subscriber growth and strong financial performance contributed to positive market sentiment, Tesla’s challenges and the lack of clarity in its growth outlook prompted a more cautious stance among investors. These contrasting dynamics underscored the nuanced nature of the market, where individual company performance can significantly impact broader market trends and investor confidence.

Microsoft, on the other hand, experienced a stock advance following its announcement of plans to reduce its gaming workforce by 1,900, including roles at Activision Blizzard.

Thursday’s gains followed a robust reading on the U.S. economy, with GDP growing at a 3.3% annual rate in the fourth quarter, according to the Commerce Department. Interestingly, yields fell while the dollar strengthened, diverging from their usual correlation. The GDP data showcased the economy’s resilience, even after the Federal Reserve’s historical pace of rate hikes. Despite the strong economy, an inflation gauge within the GDP data revealed stable price gains at 2%, aligning with the Fed’s goals.

Also, on Thursday, the FTC directed its focus to the AI sector, specifically examining investments made by Microsoft, Alphabet, and Amazon. The regulatory body issued orders to five companies, including Microsoft and OpenAI, Alphabet, and Amazon, seeking details on recent AI investments and partnerships. Anthropic, an AI software company with investments from both Alphabet and Amazon, is among the entities under scrutiny.

With earnings season in full swing and the current $SPY levels in mind, there is one symbol that has caught my and my AI’s attention.

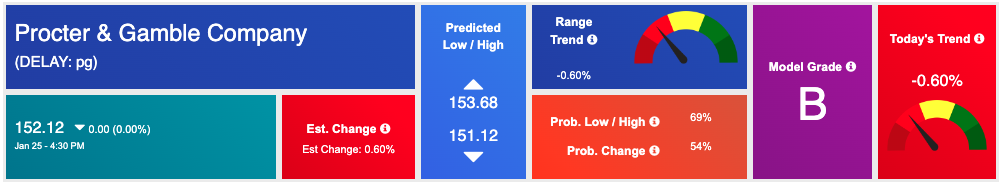

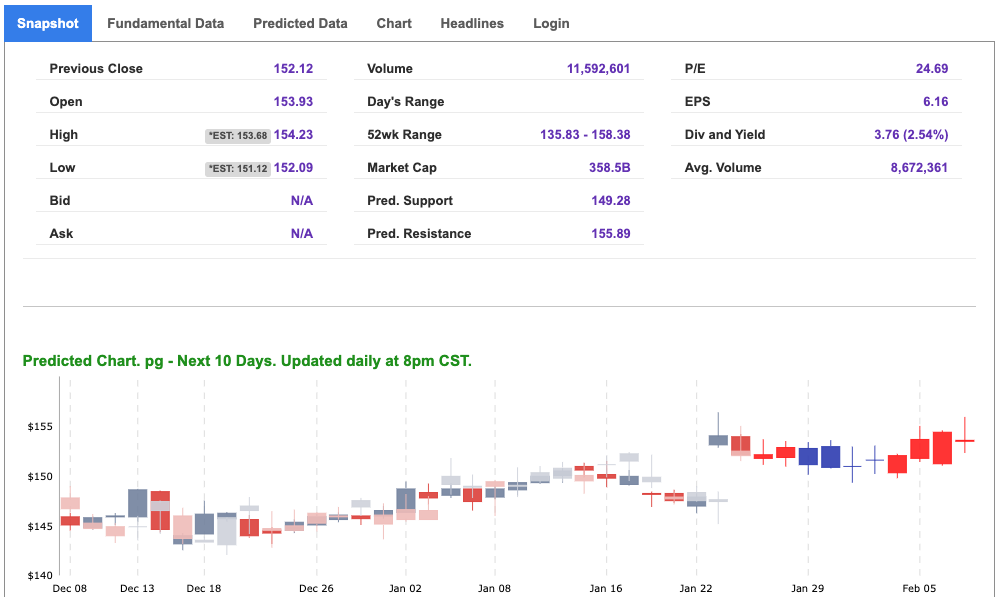

Procter & Gamble ($PG), a stalwart in the consumer goods industry, stands out as an attractive investment option and now could be an opportune time to consider buying its shares. Founded in 1837, Procter & Gamble has established itself as a global consumer goods powerhouse, boasting a diverse portfolio of well-known brands across categories such as beauty, grooming, healthcare, and household products.

The upcoming earnings report for Procter & Gamble is anticipated to be a key catalyst for potential investors. Against the backdrop of a dynamic market influenced by interest rates, geopolitical tensions, and the performances of major players like Netflix and Tesla, Procter & Gamble’s steadfastness in the consumer goods sector presents a stable and reliable investment opportunity.

The consumer goods giant has historically demonstrated resilience in the face of economic fluctuations, making it an appealing choice for investors seeking stability. As market participants scrutinize various sectors for reliable and consistent performers, Procter & Gamble’s defensive position becomes particularly attractive.

Analyzing the broader market conditions, Procter & Gamble’s diversified product portfolio, including household staples and personal care items, positions the company well in times of economic uncertainty. Consumer goods tend to exhibit stability, as these are products that consumers consistently purchase regardless of market volatility.

With positive economic indicators and robust U.S. GDP growth, as highlighted in recent reports, Procter & Gamble stands to benefit. A strong economy typically leads to increased consumer spending on everyday essentials, a category where Procter & Gamble holds significant influence.

Amidst the focus on the “magnificent 7” stocks and the market’s anticipation of potential Federal Reserve rate cuts, the significance of defensive stocks, such as Procter & Gamble, is underscored. In an environment where investors seek refuge in reliable and dividend-paying companies, Procter & Gamble’s consistent track record of delivering shareholder value through dividends further enhances its appeal.

Procter & Gamble emerges as an attractive investment option, offering stability and reliability in a market characterized by various uncertainties. The upcoming earnings report presents an opportunity for investors to gain insights into the company’s performance and future outlook. As the market navigates through fluctuations, Procter & Gamble’s defensive positioning and resilient consumer goods portfolio make it a compelling choice for those looking for stability and long-term growth.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

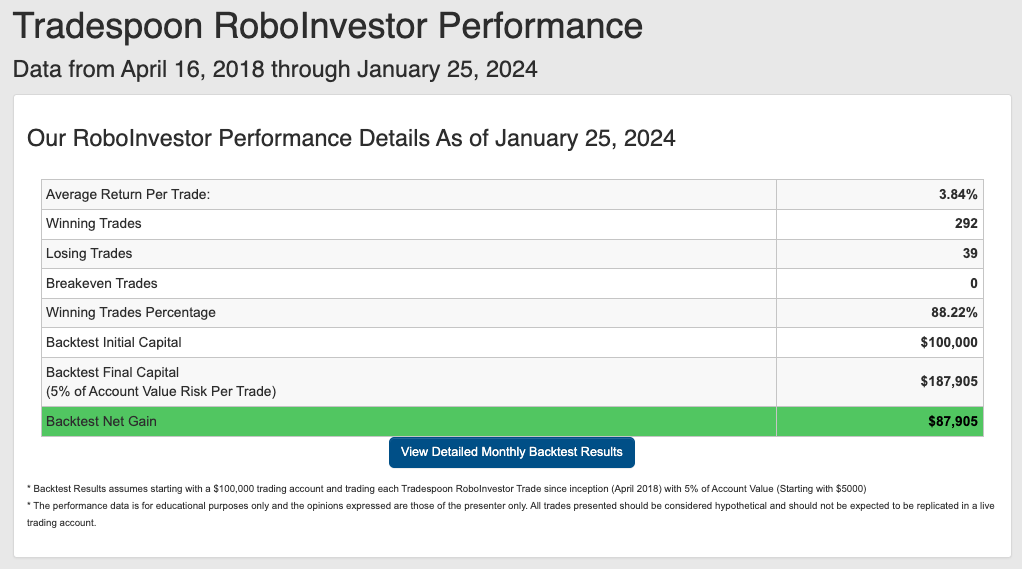

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we step into 2024, investors are confronted with a complex market scenario shaped by elements like inflationary forces, evolving Federal policies, and persistent geopolitical tensions, such as the ongoing conflict in Ukraine. Successfully maneuvering through this intricate landscape demands a dependable and well-informed investment platform. This is where RoboInvestor proves its worth, acting as a reliable ally by providing a spectrum of invaluable resources and expert guidance. With RoboInvestor at your service, you can adeptly oversee your portfolio and capitalize on lucrative opportunities within the dynamic and fast-paced market environment.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!